Are you eagerly waiting for your tax refund? Do you want to know when you will receive your hard-earned money? The Internal Revenue Service (IRS) has a unique code for that, and it’s called Tax Topic 152. Tax Topic 152 is your key to understanding the status of your tax refund.

So, what can you do while waiting for your refund? You can plan some activities with your refund money once it arrives. Maybe you can take a vacation, pay off some debt, or save for a rainy day. Whatever you choose, it’s always good to have a plan.

Key Takeaways

- Taxpayers who have filed their tax returns and are waiting for their refunds will receive a notice titled “Tax Topic 152” from the IRS.

- The IRS issues most refunds within 21 days of the e-filed return or six weeks for paper returns. However, if you receive an audit letter or owe any taxes, it may take longer to receive your refund.

- Assuming there are no complications with your tax returns and you’ve opted for direct deposit, the IRS anticipates that refunds related to the Earned Income Tax Credit and Additional Child Tax Credit should be accessible in your bank account or debit card by February 28th.

- If you receive a refund that is less than expected, it could be due to unpaid debts or errors on your tax return. If you receive a notice from the IRS explaining why your refund is less than expected, read it carefully and follow any instructions provided.

Why Do I Receive A Notice “Tax Topic 152” from IRS?

If you receive a notice from the IRS titled “Tax Topic 152“, don’t worry; it’s not bad. It simply means that the IRS processes your tax return, and you will receive a refund.

Taxpayers who have filed their tax returns and are waiting for their refunds will receive a notice. It’s a way for the IRS to inform taxpayers that their tax returns have been accepted and are being processed.

Understanding Tax Topic 152

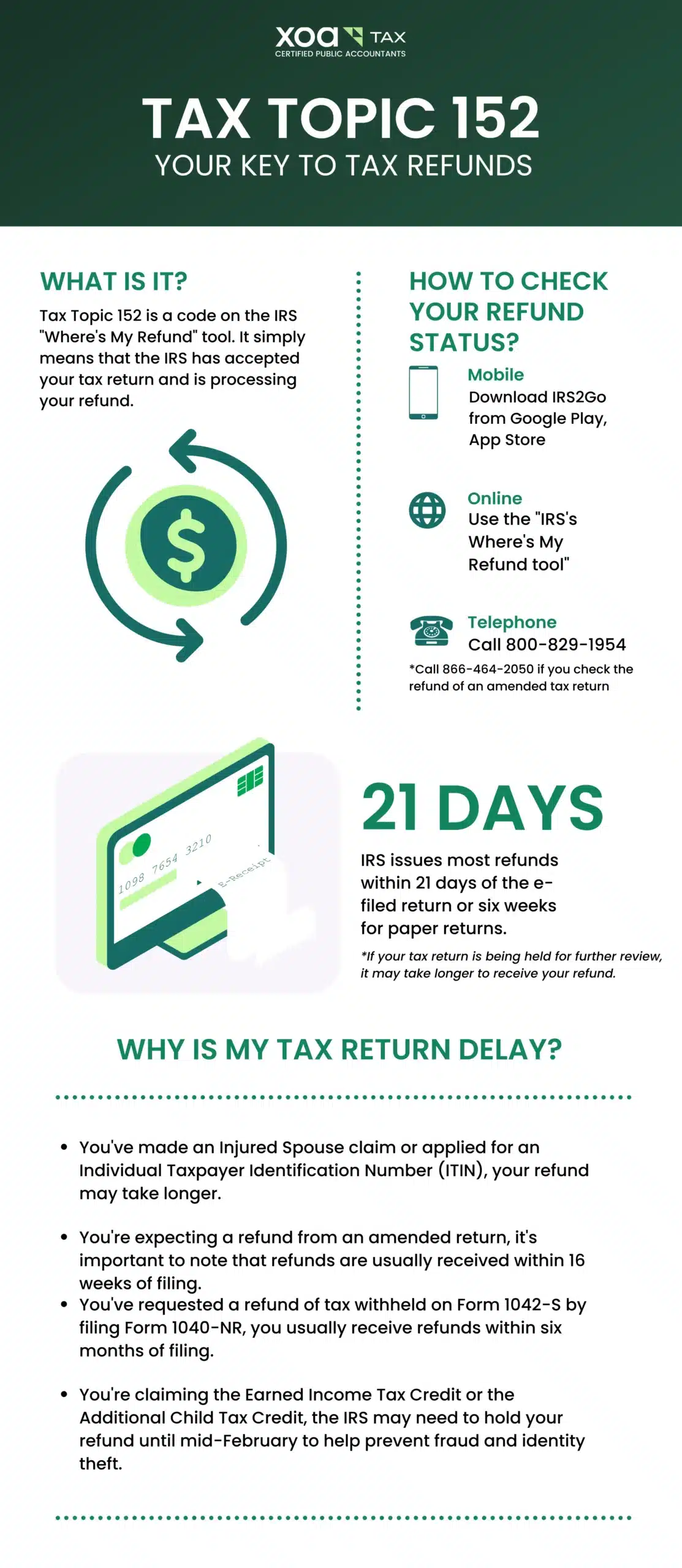

Tax Topic 152 is a code on the IRS “Where’s My Refund” tool. It simply means that the IRS has accepted your tax return and is processing your refund.

Taxpayers with an Individual Taxpayer Identification Number (ITIN) or an Injured Spouse Claim may experience longer refund processing times.

How Long Does Tax Topic 152 Take?

The processing time for tax refunds varies, but IRS issues most refunds within 21 days of the e-filed return or six weeks for paper returns. However, if your tax return is being held for further review, it may take longer to receive your refund.

Why is My Tax Return Delay?

Are you wondering why your tax return is processing longer than expected? There are several reasons why your tax return may be delayed.

- If you’ve made an Injured Spouse claim or applied for an Individual Taxpayer Identification Number (ITIN), your refund may take longer.

- If you’re expecting a refund from an amended return, it’s important to note that refunds are usually received within 16 weeks of filing.

- If you’ve requested a refund of tax withheld on Form 1042-S by filing Form 1040-NR, you usually receive refunds up to six months after filing.

- If you’re claiming the Earned Income Tax Credit or the Additional Child Tax Credit, the IRS may need to hold your refund until mid-February to help prevent fraud and identity theft.

- If you have not received your refund within the expected timeframe, you can check your refund status on the website or by calling the IRS on your tax transcript.

How to Check Your Refund Status

If you’re eagerly awaiting your tax refund, you can check your refund status on the IRS website or by calling the IRS.

When can you check the status of the refund? Here’s what you need to know:

- If you e-filed a tax year 2022 return, you can start checking on the status of your refund within 24 hours.

- If you e-filed a tax year 2020 or 2021 return, you can start checking on the status of your refund within 3 or 4 days.

- If you filed a paper return, you can start checking on the status of your refund within four weeks.

To check your refund status on the website, you must provide your Social Security number or Individual Taxpayer Identification Number (ITIN), filing status, and refund amount. There are a few ways to check on its status. Here are three easy options:

Mobile

The IRS has a mobile app called IRS2Go that you can download from Google Play, the Apple App Store, or Amazon. This app allows you to check your refund status, make payments, access tax help, and sign up for alerts.

People also read: California Property Taxes: Complete Guide

Online

You can check your refund status online using the Where’s My Refund tool. Simply access this tool through a browser on your phone, laptop, or computer and enter your filing status, Social Security Number, and the refund amount.

Telephone

If you don’t have access to the internet, you can check your refund status over the phone. Call 800-829-1954 to check on the status of most tax refunds. If you’re checking on the status of a refund from an amended tax return, call 866-464-2050.

If you can’t contact the IRS, contact your local Taxpayer Advocate for help. Each state has at least one Taxpayer Advocate Service separate from the local IRS office and can provide personalized support to help you resolve any tax-related issues.

The IRS’s refund status has three stages: received, approved, and sent. Keep an eye out for updates, and don’t hesitate to contact the IRS with any questions or concerns.

If I Receive a Refund Less than Expected

If you receive a refund that is less than expected, there could be several reasons for this. One reason could be that the IRS used your refund to pay off if you owe money, such as back taxes or student loans. Another reason could be that you made an error on your tax return, such as miscalculating the amount of tax withheld.

If you receive a notice from the IRS explaining why your refund is less than expected, it’s essential to read it carefully and follow any instructions provided. If you believe there is an error on your tax return, you can file an amended return to correct it.

Read more: The IRS offers a solar tax credit for homeowners who install solar panels, but how does IRS verify solar credit?

Bonus Content: Tax Code 303

While Tax Topic 152 is your key to tax refunds, there’s another tax code that you should be aware of: Tax Code 303.

These tax codes may appear if there are errors in the information entered on your return. Here are a few common errors that can trigger the Tax Topic 303 message and further review of your return:

- Incorrect or illegible name, ITIN, address, or ZIP code

- Incorrect filing status or dependent information

- Missing names or ITINs for those listed on the return

- Information entered on the wrong lines or missing schedules (attachments)

- Incorrect calculations for deductions or credits

- Incorrect tax tables used for figuring income tax

- Missing signature or date

- Missing or incorrect Identity Protection PIN (IP PIN)

- Wrong banking or routing number given for direct deposit refunds

If you receive a notice from the IRS with Tax Topic 303, it’s essential to read it carefully and follow any instructions provided. You can contact the local IRS office to dispute any errors you believe exist.

Remember, Tax Topic 303 is another reference code you may see when tracking your refund.

4 Simple Tips to Avoid Refund Delays

Now that you understand Tax Topic 152, nobody likes to wait for their tax refund. Here are four simple tips to help you avoid refund delays:

Tip 1: Keep income-related forms you receive, such as W-2s or any 1099s

Keep all income-related forms you receive, such as W-2s or any 1099s. These forms provide essential information you need to file your tax return accurately.

Tip 2: Other Necessary Forms, such as Form 1095

If you got health insurance through the marketplace, don’t forget to include Form 1095 with your tax return. And if you’re eligible for a health savings account (HSA) or Coverdell Education Savings Account, make sure to include any necessary forms with your return too.

Tip 3: Keep your previous income tax return and your taxpayer identification number (ITIN)

Keeping your previous income tax return and taxpayer identification number (ITIN) can help you file your tax return accurately and avoid processing delays.

Your last tax return can also serve as a reference for any changes or updates that need to be made.

Tip 4: Note all personal information for yourself, your spouse, and any dependents

Double-checking your tax return for accuracy can help avoid any errors or issues that could cause delays in processing. Review all information, including your Social Security number or ITIN, filing status, and deductions.

People also read: How to Conduct Market Research for a New Small Business

In Conclusion

Tax Topic 152 is an integral part of the tax refund process. It provides information on the status of your refund and what to expect during processing.

By understanding Tax Topic 152 and following the tips provided, you can help ensure that your tax return is processed accurately and efficiently and that you receive your refund as quickly as possible.

Remember to keep all necessary forms and documents, double-check your tax return for accuracy, and check your refund status regularly.

If you’re feeling overwhelmed or unsure about your tax return, we strongly encourage you to contact a tax professional for assistance. The tax expert team from XOA can provide personalized guidance from tax attorneys and help ensure your tax situation is accurate and complete.

Frequently Asked Questions (FAQs)

How long can the IRS hold your refund for processing?

The processing time for Tax Topic 152 can vary, but generally, you can expect your refund in normal time frame – 21 days if you e-filed your return and chose direct deposit. However, if your return is flagged for further review or if there are errors or discrepancies, the IRS may hold your refund for a more extended period.

Do you get your refund on the deposit date?

If you received your refund via direct deposit, you should receive it on the date you selected when you filed your return. However, delays or discrepancies may cause your refund to be delayed or held.

>>You may also like:

- How Much Is the Average Tax Refund and When Will I Get Mine?

- Simplify bank reconciliation with our expert guide, learn the process, identify common errors, and ensure your finances are accurate and flawless.

3 Responses

Your quick guide on Tax Topic 152 was just what I needed. The tips to avoid delays are going to be a big help. Thanks for making tax season a bit easier.

Dealing with taxes for the first time on my own. Your guide on Tax Topic 152 made it so much easier to understand.

As a small business owner, I’m always juggling a million things, and tax time adds to the chaos. Your breakdown of Tax Topic 152 helped me plan better.