Imagine opening your mailbox in January and finding a stack of 1099 forms. Do you know what to do with them? As a freelancer or independent contractor, these forms are essential for understanding your tax obligations. At XOA TAX, we often hear from clients who are unsure about how to handle their 1099s. This comprehensive guide will walk you through everything you need to know.

Key Takeaways

- 1099 forms track various income sources outside of traditional employment, keeping you and the IRS informed.

- Most 1099s arrive by January 31st, but some have later deadlines. It’s crucial to stay organized and know what to expect.

- If you haven’t received all your forms, contact the payer promptly. Accurate reporting is vital, even without the form itself.

- Maintaining detailed records throughout the year simplifies tax preparation and ensures accuracy.

What is an IRS 1099 Form?

An IRS 1099 form is like a receipt for income earned outside a typical employer-employee relationship. Clients, companies, or other entities paying you for services issue these forms. They send copies to both you and the IRS, ensuring transparency and proper tax reporting.

Think of it this way: if you’re a freelance graphic designer and a client pays you $600 or more for a project, they’ll issue a 1099-NEC to report that payment. This form helps categorize your income, ensuring it’s reported correctly on your tax return.

Types of 1099 Forms

There’s a whole family of 1099 forms, each tailored to a specific type of income. Here are a few common examples:

- 1099-NEC: Reports non-employee compensation (common for freelancers and independent contractors). Payments generally must be $600 or more to trigger this form.

- 1099-INT: Tracks interest earned on savings accounts or other investments. Banks will issue this form if you’ve earned $10 or more in interest.

- 1099-DIV: Details dividends received from stocks or mutual funds. Like 1099-INT, this form is typically issued if dividends exceed $10.

- 1099-MISC: Covers miscellaneous income like rents, royalties, or prizes. The threshold for this form varies depending on the type of income.

1099 Deadlines: A Quick Reference

- Recipients: Most 1099s should arrive by January 31st of the year following the tax year. However, some forms, like the 1099-B for brokerage transactions, have a February 15th deadline.

- Payers: Generally, payers must send 1099s to recipients by January 31st and file them with the IRS by February 28th (paper filing) or March 31st (electronic filing). For tax year 2024, electronic filing is required for businesses submitting 10 or more forms. Form 1099-NEC is due to the IRS by January 31st regardless of filing method.

Important Note: Always verify the specific deadlines for each form type, as they can vary. The IRS website (www.irs.gov) is your best resource for up-to-date information. State filing requirements may vary. Some states require separate 1099 filing or have different thresholds.

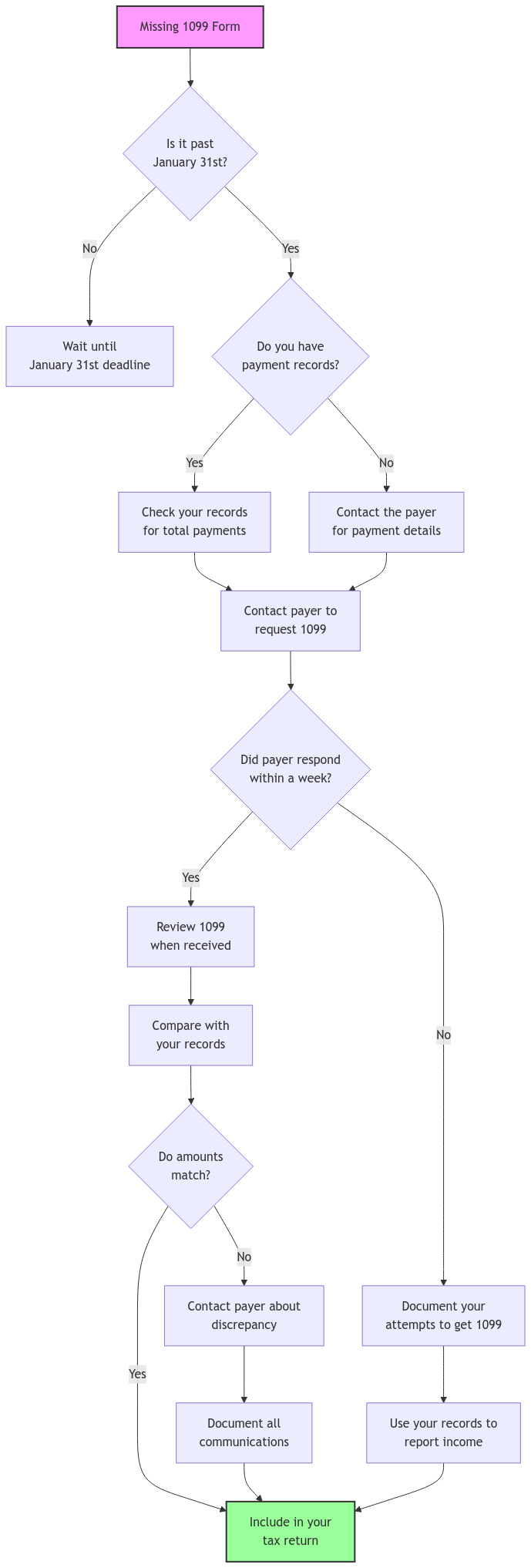

What if My 1099 is Missing?

- Contact the Payer: Reach out to the client or company that should have issued the form. A simple email or phone call is usually enough to get a copy.

- Report the Income Anyway: Even without the form, you’re still responsible for reporting all income on your tax return. Use your records to estimate the amount and categorize it correctly.

- Utilize IRS Resources: The IRS offers online tools to track your tax forms and provides guidance on reporting income.

Digital Delivery of 1099s

In today’s digital age, many businesses opt to deliver 1099s electronically. This method is often faster and more secure than traditional mail. Be sure to provide your payers with a valid email address and consent to receive electronic documents. XOA TAX utilizes a secure digital document management system to facilitate efficient and confidential delivery of tax documents.

Don’t Forget Form W-9

Before starting work with a new client, it’s essential to complete Form W-9. This form provides your taxpayer identification number and certification information to the payer, enabling them to accurately prepare your 1099.

Record-Keeping is Key

Accurate record-keeping is essential for freelancers and independent contractors. Maintaining detailed records of income and expenses not only simplifies tax preparation but also helps you identify potential deductions and avoid audits. XOA TAX offers comprehensive record-keeping services and can guide you on best practices for organizing your financial documents.

Don’t Forget Estimated Taxes

As an independent contractor, you’re generally required to make quarterly estimated tax payments to the IRS. These payments help you avoid penalties for underpayment of taxes. We can help you calculate your estimated tax obligations and ensure you meet the deadlines.

Important Dates for 2024

| Date | Event |

|---|---|

| January 31, 2024 | Most 1099s due to recipients |

| April 15, 2024 | First quarterly estimated tax payment due |

| June 15, 2024 | Second quarterly payment |

| September 15, 2024 | Third quarterly payment |

| January 15, 2025 | Fourth quarterly payment |

New 1099-K Reporting Changes for 2024

Be aware of significant changes to 1099-K reporting for the 2024 tax year. Previously, this form was issued to taxpayers receiving over 200 transactions totaling over $20,000 through third-party payment networks. The threshold has been lowered significantly, and you may receive a 1099-K if you have just one transaction exceeding $600.

Penalties for Late Filing or Non-Filing

Failing to file your tax return on time or neglecting to report all your income can result in penalties from the IRS. These penalties can include late filing fees, accuracy-related penalties, and even interest charges on unpaid taxes. It’s crucial to meet all deadlines and accurately report your income to avoid these costly consequences.

Corrected 1099s

If you receive a corrected 1099 form (Form 1099-C), it means the payer has made changes to the original information reported. It’s important to review the corrected form carefully and ensure you use the updated information when filing your tax return. If you’ve already filed and need to make changes, you may need to file an amended return.

Documentation Retention Requirements

Maintaining proper documentation is crucial for tax purposes. The IRS generally recommends keeping records for at least three years from the date you filed your return or the date the tax was paid, whichever is later. However, certain records, such as those related to property ownership, should be kept for longer periods.

Digital Backup Recommendations

In today’s digital world, it’s essential to back up your important tax records electronically. Cloud storage services, external hard drives, and secure online platforms can help you safeguard your data from loss or damage. XOA TAX offers secure digital storage solutions for our clients’ convenience.

Common Filing Errors to Avoid

Even small errors on your tax return can lead to delays, penalties, or even audits. Common mistakes include misreporting income, claiming ineligible deductions, or using an incorrect filing status. XOA TAX can help you avoid these errors and ensure your tax return is accurate and complete.

Frequently Asked Questions (FAQs)

What does “1099” stand for?

“1099” simply refers to the IRS form number for reporting various types of income other than wages earned as an employee.

How do I get a 1099 form?

Payers are responsible for providing 1099 forms to both recipients and the IRS. If you haven’t received yours, contact the payer directly.

Which tax form do I use with my 1099s?

Most taxpayers will report 1099 income on Form 1040. If you’re self-employed, you’ll also need Schedule C to calculate your business profit or loss and Schedule SE to calculate your self-employment tax.

Navigating 1099s with XOA TAX

At XOA TAX, we understand that tax season can be overwhelming, especially for freelancers and independent contractors juggling multiple income sources. Our team of experienced CPAs can help you:

- Organize and categorize your 1099 forms.

- Ensure accurate income reporting on your tax return, including Schedules C and SE.

- Identify potential deductions and credits to minimize your tax liability.

- Address any IRS notices or inquiries related to your 1099s.

We’re here to provide personalized guidance and support every step of the way. Contact us today for a consultation and let us help you make tax season a breeze!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime