Whether you’re starting a new job, preparing for retirement, or looking to simplify your financial landscape, understanding how to roll over your 401(k) can significantly impact your financial future. At XOA TAX, we’re committed to helping you navigate this process with confidence. This guide breaks down everything you need to know about 401(k) rollovers in 2024, empowering you to make informed decisions about your retirement savings.

Quick Overview

- What Is a 401(k) Rollover?: Transferring your retirement savings from your old employer’s plan to a new retirement account.

- Ways to Roll Over: Direct and indirect rollovers, each with specific rules and implications.

- Why Roll Over?: Simplify account management, access more investment options, gain greater control, and potentially enjoy tax benefits.

- Tax Implications: Understanding tax rules is crucial for a smooth and cost-effective rollover.

- Key Changes for 2024: Updated contribution limits, catch-up contributions, and legislative changes impacting retirement accounts.

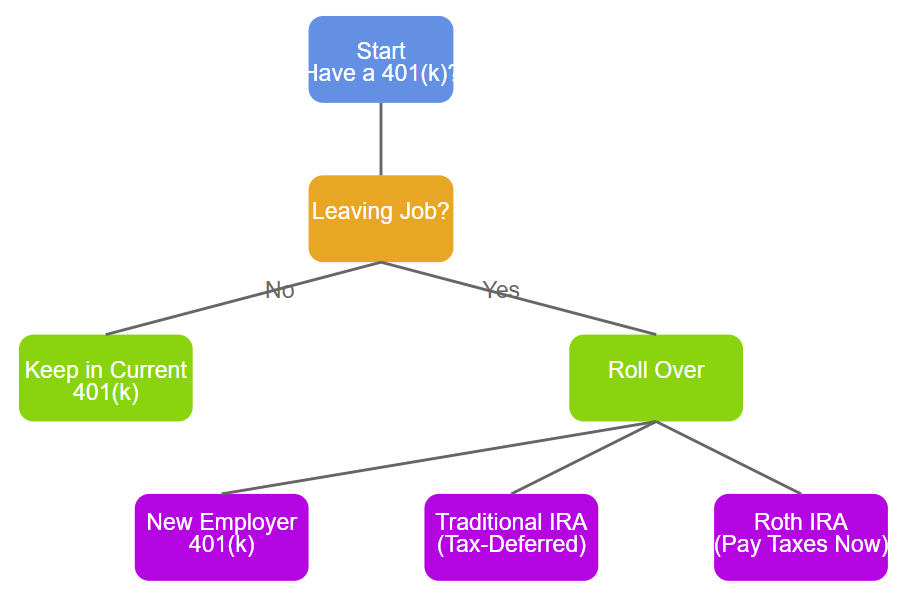

1. What Is a 401(k) Rollover?

A 401(k) rollover allows you to transfer your retirement savings from your old employer’s plan to another retirement account. Common destinations include:

- Traditional IRA: Offers a broad range of investment options with tax-deferred growth.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

- Your New Employer’s 401(k): Consolidate your retirement savings under one plan with your current employer.

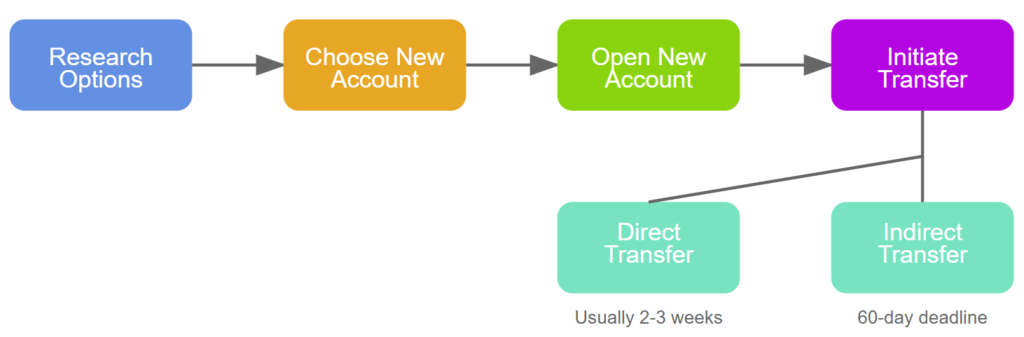

2. Ways to Roll Over Your 401(k)

There are two primary methods:

Direct Rollover

Your funds are transferred directly from your old 401(k) to your new retirement account.

- No Tax Withholding: Avoids the mandatory 20% federal tax withholding.

- Simplicity: Less paperwork and lower risk of errors.

- No Penalties: Bypasses early withdrawal penalties.

Indirect Rollover

You receive the funds from your old 401(k) and are responsible for depositing them into your new account within 60 days.

- Tax Withholding: 20% is withheld for federal taxes, which you must replace from other sources to avoid penalties.

- Risk of Penalties: Missing the 60-day deadline can result in taxes and early withdrawal penalties.

- When to Use: Typically only advisable if you need short-term access to funds.

3. Reasons to Consider a 401(k) Rollover

- Simplify Your Finances: Managing multiple retirement accounts can be complicated.

- More Investment Choices: IRAs often offer a wider array of investment options compared to employer plans.

- Control Over Fees: IRAs may have lower fees and greater transparency.

- Tax Planning Opportunities: Rolling over to a Roth IRA can provide tax-free income in retirement, although taxes are due at conversion.

- Beneficiary Designations: Easier management of beneficiaries and estate planning.

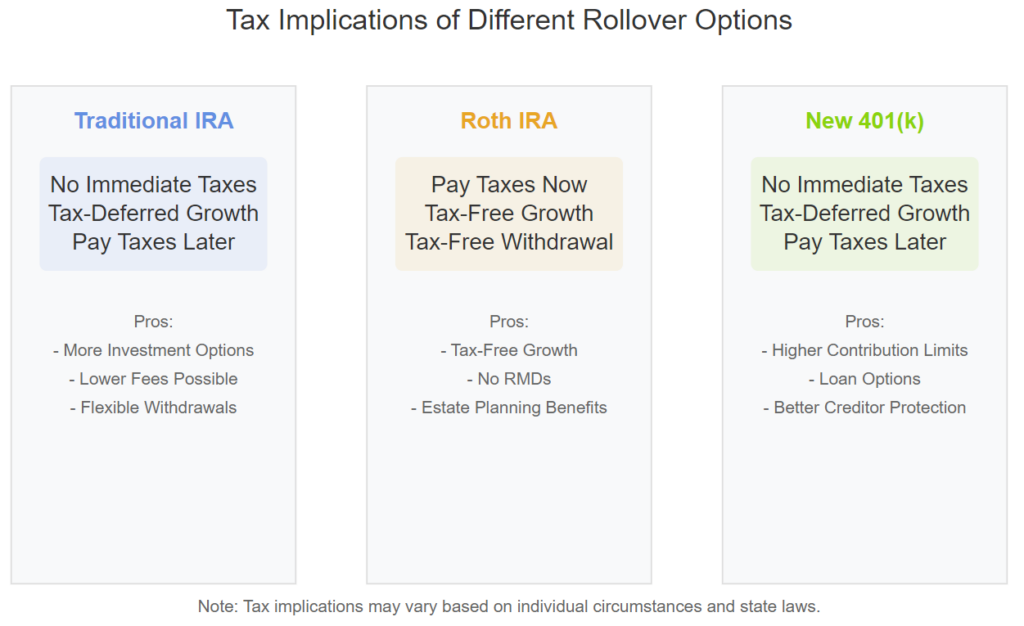

4. Tax Implications of Rollovers

Understanding the tax consequences is essential for making informed decisions.

Traditional 401(k) to Traditional IRA or New 401(k)

- Tax-Neutral Event: No immediate tax liability.

- Continued Tax-Deferred Growth: Taxes are due upon withdrawal during retirement.

Traditional 401(k) to Roth IRA

- Taxable Event: The rolled-over amount is added to your taxable income for the year.

- Strategic Consideration: Beneficial if you expect to be in a higher tax bracket in retirement or want tax-free withdrawals.

- Consult a Professional: Important to assess the impact on your overall tax situation.

5. Important Updates for 2024

Contribution Limits

- Employee Contribution Limit: Increased to $23,000 for 2024.

- Catch-Up Contributions:

- Age 50 and Over: Additional $7,500.

- Age 60 to 63 (Starting in 2025): Under the SECURE Act 2.0, catch-up contributions will increase to the greater of $10,000 or 150% of the regular catch-up amount, adjusted for inflation.

- Overall Limit (Including Employer Contributions): The total contribution limit (employee plus employer contributions) is $69,000 for 2024.

Changes to Required Minimum Distributions (RMDs)

- Roth 401(k)s Exempt from RMDs: Starting in 2024, Roth 401(k)s are no longer subject to RMDs, offering more flexibility in retirement planning.

Qualified Disaster Distributions

- Eligibility: Available to those affected by federally declared disasters.

- Distribution Limit: Up to $22,000 can be withdrawn without the 10% early withdrawal penalty.

- Repayment Option: You can repay the distribution within three years to avoid taxes.

- Taxation: Income from the distribution can be spread over three years, easing the immediate tax burden.

6. Exceptions to Early Withdrawal Penalties

You can avoid the 10% penalty in certain situations:

- Disability: Permanent disability allows for penalty-free withdrawals.

- High Medical Expenses: If unreimbursed medical expenses exceed 7.5% of your adjusted gross income.

- First-Time Home Purchase (IRAs Only): Up to $10,000 can be used penalty-free.

- Higher Education Expenses (IRAs Only): For qualified education costs like tuition and books.

- Health Insurance Premiums While Unemployed (IRAs Only): If you’ve lost your job and are receiving unemployment compensation.

- Qualified Disaster Distributions: As detailed in the previous section.

7. Advanced Strategies and Considerations

Inherited IRAs

Spouse Beneficiaries

- Options:

- Roll Over into Your Own IRA: Treat the inherited IRA as your own, following your own RMD schedule.

- Inherited IRA Account: Maintain the account as an inherited IRA, which can be beneficial if you’re under 59½ and need access to funds without penalties.

Non-Spouse Beneficiaries

- 10-Year Rule: Generally must withdraw all funds within 10 years of the original owner’s death.

- Stretch IRA: Certain eligible beneficiaries may stretch distributions over their life expectancy (e.g., minor children, disabled individuals).

Net Unrealized Appreciation (NUA) for Company Stock

- What Is NUA?: The difference between the cost basis of company stock and its current market value.

- Tax Advantage: Pay long-term capital gains tax on the appreciation instead of ordinary income tax.

- When to Consider: If you have highly appreciated company stock in your 401(k).

- Important Note: Complex rules apply; consult a tax professional.

The Pro-Rata Rule for Roth Conversions

- Applies When: You have both pre-tax and after-tax funds in IRAs.

- How It Works: Determines the taxable portion of a Roth conversion based on the ratio of pre-tax to after-tax assets.

- Planning Tip: Consider strategies like “backdoor” Roth conversions carefully to avoid unintended tax consequences.

Protecting Your Retirement Savings from Creditors

- 401(k)s: Generally have strong protection under federal law (ERISA) from creditors.

- IRAs: Protection varies by state.

- States with Strong Protection: Texas, Florida.

- States with Limited Protection: California.

- Consideration: If creditor protection is a concern, you might opt to keep funds in a 401(k).

Electronic Transfers

- Types of Transfers:

- Automated Clearing House (ACH) Transfers: Free or low-cost, but may take several days.

- Wire Transfers: Faster, usually same-day, but may incur fees.

- Electronic Funds Transfer (EFT): Similar to ACH but can be quicker.

- Benefits:

- Speed and Efficiency: Faster access to funds.

- Security: Reduces risk of lost or stolen checks.

- Convenience: Simplifies the transfer process with less paperwork.

Timing Considerations

- Market Volatility:

- Avoid Selling at a Low: Monitor market conditions to potentially maximize your investment value.

- Stay Invested: Direct rollovers often keep you invested throughout the process.

- Tax Implications:

- Tax Bracket Management: Large Roth conversions can push you into a higher tax bracket.

- Multi-Year Conversions: Spreading conversions over multiple years can mitigate tax impacts.

- Year-End Deadlines:

- RMDs: Complete rollovers involving RMDs by December 31.

- Contribution Deadlines: Traditional and Roth IRA contributions for a tax year can be made until the tax filing deadline (usually April 15 of the following year).

8. Practical Steps and Checklist

Printable Checklist for a Successful 401(k) Rollover

- Gather Necessary Documents:

- Open a New Retirement Account:

- Consult Professionals:

- Initiate the Rollover:

- Confirm Transfer Method:

- Monitor the Transfer:

- Update Beneficiary Information:

- Adjust Investment Options:

- Tax Reporting:

Common Mistakes to Avoid

- Missing the 60-Day Deadline (Indirect Rollovers): Leads to taxes and penalties.

- Incorrect Tax Reporting: Can result in IRS audits or penalties.

- Not Replacing Withheld Taxes: Failing to replace the 20% withheld can cause part of your rollover to be taxable.

- Ignoring Plan Restrictions: Some plans have specific rules about rollovers.

9. Common Questions

1. Can I roll over my 401(k) while still employed?

- In-Service Distributions: Some plans allow you to roll over funds after reaching a certain age (often 59½).

- Action Step: Check your plan’s Summary Plan Description or consult HR.

2. What happens if I have a loan on my 401(k)?

- Options:

- Repay the Loan: Before initiating the rollover.

- Loan Offset: The outstanding loan balance may be considered a taxable distribution.

- SECURE Act 2.0 Update: Extended the loan repayment period until the tax filing deadline, including extensions.

3. Are there fees involved in rolling over a 401(k)?

- Possible Fees:

- Termination Fees: From your old plan.

- Account Opening Fees: At the new institution.

- Mitigation:

- Compare Custodians: Look for low-fee options.

- Ask for Fee Waivers: Some institutions may waive fees to earn your business.

4. How long does a direct rollover take?

- Typical Timeline: 2 to 4 weeks.

- Variables: Processing times depend on the institutions involved.

- Tip: Stay in communication to expedite the process.

5. Can I roll over my 401(k) to a Roth IRA without paying taxes?

- Taxable Event: Rolling over from a traditional 401(k) to a Roth IRA triggers income taxes on the amount converted.

- Strategy: Consider partial conversions over several years to manage tax liability.

10. Additional Resources

Online Rollover Calculators

These tools provide estimates but should not replace professional advice.

IRS Forms You Might Need

- Form 1099-R: Reports distributions from retirement accounts.

- Form 5498: Reports IRA contributions and rollovers.

- Form 5329: For reporting additional taxes on early distributions.

Find these forms at the IRS Forms & Instructions page.

11. Glossary of Terms

- 401(k)

- Employer-sponsored retirement savings plan.

- IRA (Individual Retirement Account)

- Personal retirement account with tax advantages.

- Direct Rollover

- Funds are transferred directly between retirement accounts without you handling the money.

- Indirect Rollover

- Funds are distributed to you, and you have 60 days to redeposit them into a retirement account.

- Roth IRA

- Retirement account funded with after-tax dollars; qualified withdrawals are tax-free.

- Pro-Rata Rule

- IRS rule determining the taxable portion of a Roth conversion when both pre-tax and after-tax funds are involved.

- Net Unrealized Appreciation (NUA)

- The increase in value of employer securities held in a retirement plan.

- Required Minimum Distribution (RMD)

- The minimum amount you must withdraw from your account each year starting at a certain age.

- SECURE Act 2.0

- Legislation that introduced significant changes to retirement plan rules.

12. Examples to Illustrate

NUA Example

John has $50,000 in company stock within his 401(k), purchased for $10,000. The Net Unrealized Appreciation (NUA) is $40,000.

- Option 1: Roll over to an IRA.

- Tax Implication: Pays ordinary income tax on withdrawals of the full $50,000 during retirement.

- Option 2: Utilize NUA strategy.

- Immediate Tax: Pays ordinary income tax on the $10,000 cost basis.

- Future Tax: Pays long-term capital gains tax on the $40,000 NUA when selling the stock.

- Benefit: Potential tax savings due to lower capital gains tax rates.

Pro-Rata Rule Example

Mary has:

- Total IRA Balance: $100,000.

- Pre-Tax Funds: $80,000.

- After-Tax Funds: $20,000.

She wants to convert $50,000 to a Roth IRA.

- Calculation:

- Percentage of After-Tax Funds: $20,000 / $100,000 = 20%.

- Tax-Free Portion: 20% of $50,000 = $10,000.

- Taxable Portion: $50,000 – $10,000 = $40,000.

- Implication: Mary will owe income tax on $40,000 for the conversion.

Rollover Deadlines and Important Dates

| Rollover Type | Deadline |

|---|---|

| Direct Rollover | No specific deadline; timing based on institutions |

| Indirect Rollover | 60 days from receipt of funds |

| Inherited IRA (Non-Spouse Beneficiary) | Generally 10 years from original owner’s death |

| RMDs (If Applicable) | By December 31 each year |

| Repayment of Qualified Disaster Distribution | Within 3 years of distribution date |

13. Need Help? Contact XOA TAX

Navigating a 401(k) rollover involves understanding tax implications, evaluating investment options, and aligning with your personal financial goals. By utilizing this guide and seeking professional advice when necessary, you can make informed decisions that will enhance your long-term financial well-being.

At XOA TAX, we’re here to assist you every step of the way. If you’re ready to take the next step or have questions, our team is ready to help:

- Website: www.xoatax.com

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: www.xoatax.com/contact-us/

Disclaimer: This information is intended for general purposes and does not constitute legal, tax, or financial advice. Laws and regulations can change and vary by state. For advice tailored to your situation, please consult a professional advisor.

anywhere

anywhere  anytime

anytime