Hey there, future scholars and savvy savers! Planning for education expenses can feel overwhelming, but it doesn’t have to be. One popular tool that often comes up is the 529 plan. Think of it as a special savings account designed to help you put aside money for education expenses, with some nifty tax advantages to boot.

In this post, we’ll break down the ins and outs of 529 plans, exploring the good, the bad, and everything in between. By the end, you’ll have the knowledge to decide if a 529 plan is the right fit for your financial goals.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan sponsored by states, state agencies, or educational institutions. These plans are designed to encourage saving for future education costs.

There are two main types of 529 plans:

- Prepaid tuition plans: Allow you to pre-pay tuition at today’s rates for future enrollment at participating colleges or universities.

- Education savings plans: Offer more flexibility, allowing you to invest your contributions in various investment options, similar to a 401(k) or IRA. Earnings grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

Education Savings Options Comparison

Education Savings Options Comparison

| Features | 529 Plans | Coverdell ESA | Roth IRA | UGMA/UTMA |

|---|---|---|---|---|

| Contribution Limits | $235,000-$550,000 aggregate (varies by state) | $2,000 annual limit | $7,000 annual (2024, if under 50) | No limit, but gift tax may apply |

| Tax Benefits | Tax-free growth and withdrawals for qualified education expenses. Possible state tax deductions. | Tax-free growth and withdrawals for qualified education expenses | Tax-free withdrawals of contributions anytime; earnings may be subject to taxes/penalties | First $1,250 of earnings tax-free, next $1,250 at child’s rate |

| Flexibility | Can be used for K-12, college, apprenticeships, student loans. Beneficiary can be changed. | Can be used for K-12 and college expenses | Can be used for education or retirement | Can be used for any purpose, not just education |

| Financial Aid Impact | Minimal (5.64% assessment rate as parent asset) | Counted as parent asset (5.64% assessment) | Not counted for financial aid if untouched | Counted as student asset (20% assessment) |

| Age Restrictions | None | Must be used by age 30, contributions stop at 18 | Must have earned income to contribute | Child gains control at age of majority (18-21) |

Pros of 529 Plans

- Tax Advantages: This is a big one! Earnings in a 529 plan grow tax-free, and withdrawals are tax-free at the federal level (and often at the state level too) when used for qualified expenses. This can result in significant savings over time.

- Flexibility: While primarily for college, 529 funds can be used for K-12 tuition, apprenticeship programs, and even student loan repayments (up to a lifetime limit of $10,000).

- High Contribution Limits: 529 plans have high contribution limits, which vary by state. This allows you to save a substantial amount for future education costs. The aggregate contribution limit for these plans typically ranges from $235,000 to $550,000, depending on the state.

- Control and Beneficiary Changes: The account owner (usually a parent or grandparent) retains control of the account, even after the beneficiary reaches adulthood. You can also change the beneficiary to another family member if needed.

- Financial Aid Eligibility: 529 plans have a minimal impact on financial aid eligibility, as they are considered parental assets.

Cons of 529 Plans

- Limited Investment Options: Investment choices are typically restricted to the options offered within the specific 529 plan, often including age-based portfolios. These portfolios automatically adjust from more aggressive to more conservative investments as your beneficiary approaches college age, helping to protect your savings when you'll need them most. Keep in mind that you can typically only make changes to your investment allocations twice per calendar year.

- Penalties for Non-Qualified Withdrawals: If withdrawals are used for non-qualified expenses, the earnings portion is subject to income tax and a 10% federal penalty.

- State Tax Benefits May Vary: While federal tax benefits are consistent, state tax benefits and deductions for 529 plan contributions vary. Some states offer no benefits at all.

529 Plans and Your 2024 Taxes

It's important to understand how 529 plans might affect your tax situation for the upcoming tax year. Here are some key points to keep in mind:

- State Tax Deductions: If you contribute to your state's 529 plan, you might be eligible for a state income tax deduction or credit. Some states even offer tax benefits for contributing to any 529 plan, not just your home state's plan, so it's worth researching options across different states. Check your state's specific rules.

- Gift Tax Considerations: Contributions to a 529 plan are considered gifts for federal gift tax purposes. However, you can contribute up to $18,000 per beneficiary in 2024 ($36,000 for married couples filing jointly) without incurring any gift tax. You can even make five years' worth of contributions at once! This means you can contribute up to $90,000 per beneficiary in 2024 without incurring gift tax, provided no other gifts are made to the same beneficiary during that period.

- Impact on Financial Aid: Remember that 529 plan assets are considered parental assets for federal financial aid calculations. 529 plans owned by parents are assessed at a maximum 5.64% rate in financial aid calculations, versus 20% for student-owned assets. Starting with the 2024-2025 FAFSA, grandparent-owned 529 plans will no longer impact financial aid eligibility.

New for 2024: Rollover to Roth IRA

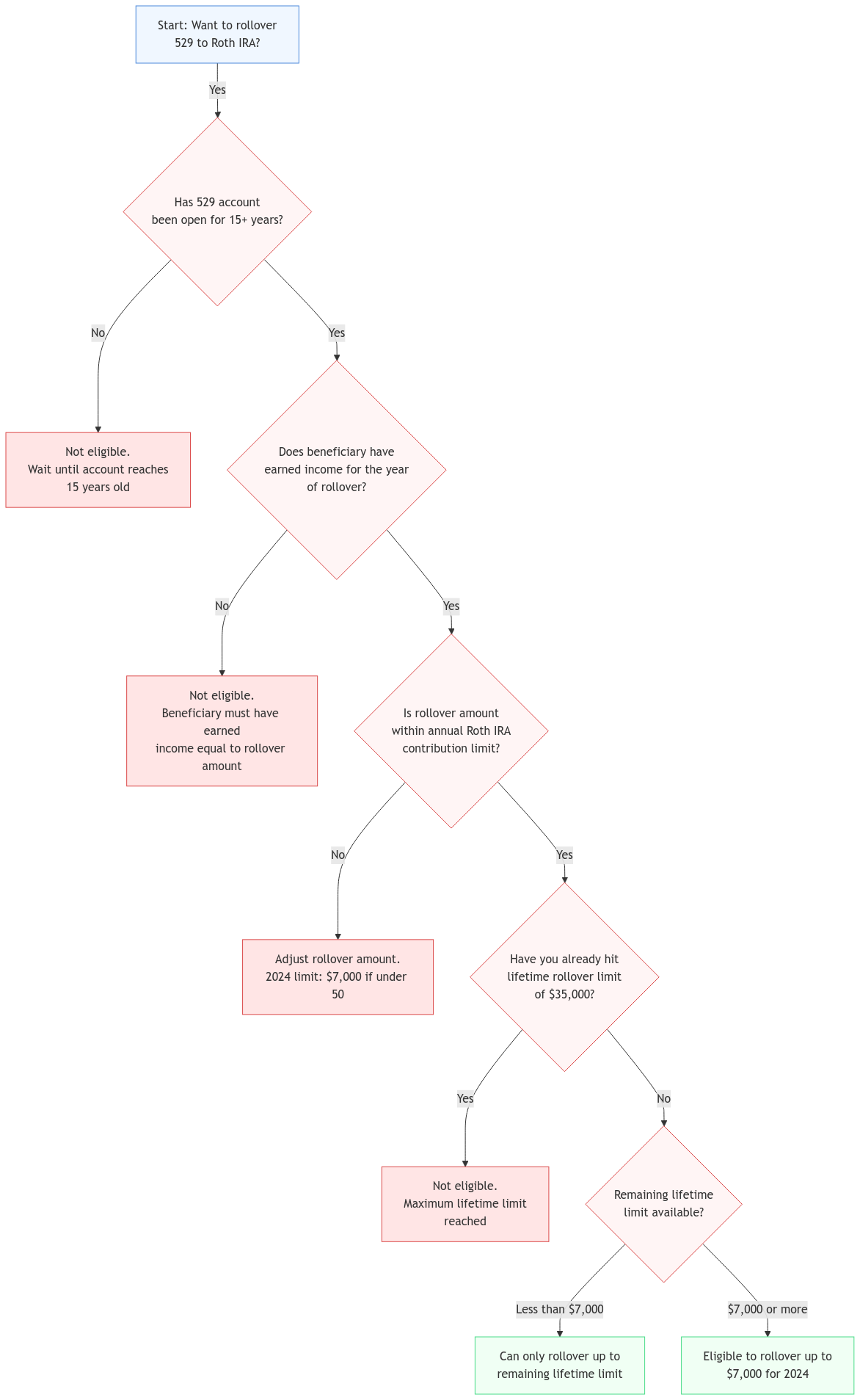

Thanks to the SECURE 2.0 Act, starting in 2024, you have a new option for unused 529 plan funds. You can now roll over up to $35,000 from a 529 account to a Roth IRA for the same beneficiary. Keep in mind that rollovers count towards the beneficiary's annual Roth IRA contribution limit ($7,000 for 2024 if under age 50).

Here are some important things to know about this new rollover option:

- Account Age: The 529 account must have been open for at least 15 years.

- Contribution Limits: Rollovers are subject to annual Roth IRA contribution limits.

- Beneficiary's Earned Income: The beneficiary must have earned income at least equal to the amount rolled over.

This new provision offers greater flexibility for 529 plan beneficiaries, allowing them to use funds for retirement if not needed for education expenses.

Is a 529 Plan Right for You?

Deciding if a 529 plan is the right choice depends on your individual circumstances and financial goals. Consider factors such as:

- Your Savings Goals: How much do you need to save for education expenses?

- Your Time Horizon: When will you need the funds?

- Your Risk Tolerance: What level of investment risk are you comfortable with?

- Your State's Tax Benefits: Does your state offer tax advantages for 529 plan contributions?

FAQs

What are qualified education expenses?

Qualified education expenses include tuition, fees, books, supplies, required equipment, and room and board. They also include computer equipment and internet access required for coursework, certain expenses for students with special needs, and costs associated with registered apprenticeship programs (fees, books, supplies, equipment).

* Room and Board: For students living on campus, the actual amount charged by the school qualifies. For off-campus housing, qualified expenses are limited to the allowance published by the school for room and board.

Can I use a 529 plan for more than one child?

Yes, you can change the beneficiary of a 529 plan to another family member, such as a sibling, child, or even yourself.

What happens to the money in a 529 plan if the beneficiary doesn't go to college?

You can withdraw the money, but the earnings portion will be subject to income tax and a 10% federal penalty. Alternatively, you can change the beneficiary to another eligible family member.

Can I contribute to a 529 plan and a Roth IRA for the same child?

Absolutely! Both 529 plans and Roth IRAs offer valuable tax advantages for education savings. A Roth IRA provides more flexibility since it can be used for retirement if not needed for education.

What is the difference between a 529 plan and a Coverdell Education Savings Account (ESA)?

While both offer tax advantages for education savings, 529 plans have higher contribution limits and no income limitations. Coverdell ESAs have a $2,000 annual contribution limit and income restrictions. Also, contributions to Coverdell ESAs must stop when the beneficiary reaches age 18, and funds must be used by age 30.

Connecting with XOA TAX

Navigating the world of 529 plans can be tricky, but we're here to help! XOA TAX can provide personalized guidance based on your specific financial situation and education savings goals. Contact us today for a consultation to discuss your options and create a plan that sets you up for success.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime