Launching and growing a successful business requires more than just a great idea—it demands a solid plan. When entrepreneurs first hear the term “business plan,” they often think of it as a blueprint to kickstart their venture. While this is true, business plans come in various forms, each serving different purposes and benefiting stakeholders at different stages of a company’s development. Understanding these types can empower you to strategically navigate your business journey.

Whether you’re starting a new company or aiming to expand an established one, laying out your objectives and strategies is crucial. Additionally, a well-crafted business plan can attract investors and make your business eligible for specific funding opportunities. Below, we explore the six most commonly used types of business plans and how each can contribute to your company’s success.

1. Startup Plan

A Startup Business Plan is essential for new companies preparing to go public, seeking outside investment, or securing startup financing. This plan typically emphasizes the company’s financial projections, the products or services offered, and comprehensive market analysis.

Key Components:

- Executive Summary

- Company Overview

- Management Background

- Marketing Plan

- Competitive Analysis

- Financial Projections

Example: A tech startup seeking venture capital might focus on its innovative product, market potential, and revenue forecasts to attract investors.

Common Pitfall to Avoid: Overlooking detailed financial projections can make it difficult to secure investment or loans.

2. One-Page Business Plan

A One-Page Business Plan serves as a concise synopsis of your company’s key aspects, ideal for presenting to prospective lenders, investors, partners, and vendors. This streamlined format highlights your business’s most critical elements without overwhelming the reader.

Key Components:

- Company’s Products and Services

- Target Market

- Revenue Projections

- Significant Milestones

Example: A freelance graphic designer might use a one-page plan to outline services offered, target clients, and income goals when meeting with potential partners.

Common Pitfall to Avoid: Being too vague can leave readers uncertain about your business’s potential and direction.

3. Strategic Plan

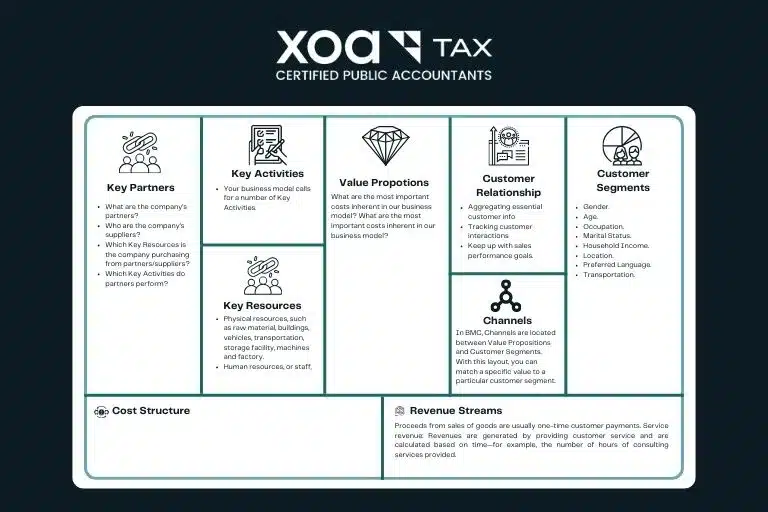

A Strategic Business Plan outlines a high-level approach to achieving significant business goals. It often begins with a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify areas for improvement and growth.

Key Components:

- Mission Statement

- Business Vision

- Key Success Factors

- Strategies for Achieving Objectives

- Implementation Schedule

Example: An established retail chain might develop a strategic plan to expand into new markets, focusing on enhancing online presence and customer experience.

Common Pitfall to Avoid: Failing to align strategies with the company’s mission and vision can lead to inconsistent efforts and missed goals.

4. Feasibility Plan

A Feasibility Plan assesses the viability of entering a new market or launching a new product or service. It answers critical questions about market demand, startup costs, potential sales, and expected profits.

Key Questions:

- Is there a market for your new product or service?

- How much capital is needed to start?

- Will the market purchase your offerings?

- What are the projected earnings?

Example: A restaurant planning to introduce a new cuisine might use a feasibility plan to analyze market interest, costs, and revenue potential before launching.

Common Pitfall to Avoid: Skipping thorough market research can result in launching a product with insufficient demand.

5. Growth Plan

A Growth Plan—also known as an expansion strategy—helps businesses identify the steps needed to scale, enter new markets, or increase their product offerings. This plan is crucial for securing additional funding to support growth initiatives.

Key Components:

- Company Description

- Overview of Products and Services

- Management Background

- Market Research

- Financial Reports

- Financial Projections

- Funding Request

Example: A manufacturing company aiming to increase production capacity might outline the necessary investments, market opportunities, and financial forecasts in its growth plan.

Common Pitfall to Avoid: Underestimating the resources required for expansion can strain finances and operational capabilities.

6. Operations Plan

An Operations Plan, also known as an annual plan, details the day-to-day tasks and responsibilities necessary to run the business effectively. It ensures that all team members are aligned and working towards common objectives.

Key Components:

- Business Objectives

- List of Required Activities

- Resources Needed

- Staffing Requirements

- Deadlines

- Progress Tracking

Example: A marketing agency might use an operations plan to outline campaign timelines, resource allocation, and performance metrics for the upcoming year.

Common Pitfall to Avoid: Neglecting to update the operations plan regularly can lead to missed deadlines and uncoordinated efforts.

Next Steps

Before drafting your business plan, ask yourself some crucial questions:

- What is the primary objective of the plan? Are you seeking investment, planning for growth, or assessing a new market?

- Who is the intended audience? Understanding who will read the plan helps tailor its content and tone.

Creating a business plan is not just a formality; it’s a strategic tool that ensures your business stays on track and meets its goals. Whether you’re aiming to secure funding or streamline operations, the right business plan can make all the difference.

Take Action Today: Navigating the complexities of business planning and financial management can be challenging. If you need expert assistance, consider consulting with XOA TAX. Visit our website at https://www.xoatax.com/, call us at +1 (714) 594-6986, or email us at [email protected]. You can also reach out through our contact page to learn how we can support your business’s financial and strategic needs.

anywhere

anywhere  anytime

anytime