Planning for retirement as a self-employed individual or small business owner can be straightforward with the right tools. A Solo 401(k) is a powerful option that offers high contribution limits and flexibility. Let’s walk through the essential details for 2024 and 2025, helping you make the most of your retirement savings.

Solo 401(k) vs SEP IRA Comparison

Understanding Solo 401(k) Contributions

A Solo 401(k) allows you to contribute both as an employee and an employer, potentially maximizing your retirement savings. Here’s what you need to know about the contribution limits, deadlines, and strategies to optimize your Solo 401(k).

Contribution Limits for 2024 and 2025

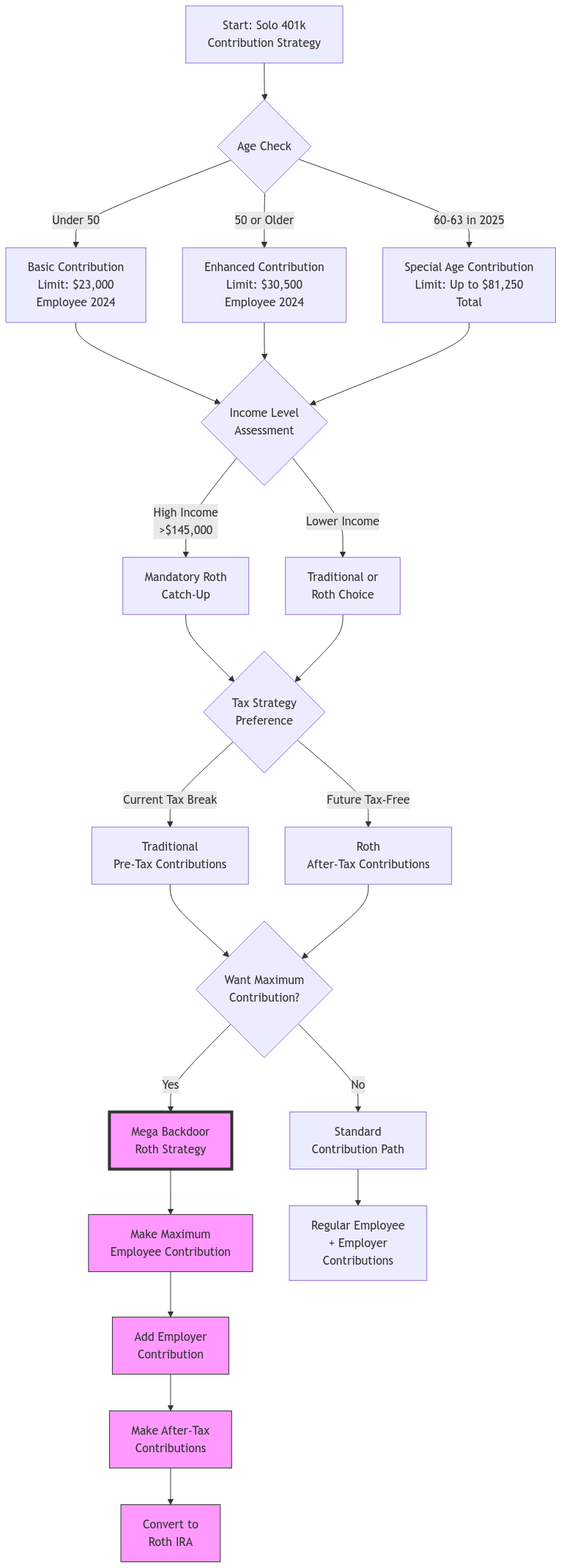

The IRS sets annual contribution limits for Solo 401(k) plans. These limits vary based on your age:

For 2024:

- Under Age 50:

- Employee Contribution: Up to $23,000

- Total Contribution (Employee + Employer): Up to $69,000

- Age 50 and Older:

- Employee Contribution: Up to $30,500 (including a $7,500 catch-up)

- Total Contribution: Up to $76,500

For 2025:

- Under Age 50:

- Employee Contribution: Up to $23,500

- Total Contribution (Employee + Employer): Up to $70,000

- Age 50 and Older:

- Employee Contribution: Up to $31,000 (including a $7,500 catch-up)

- Total Contribution: Up to $77,500

- Age 60-63:

- Total Contribution: Up to $81,250 due to higher catch-up limits (effective in 2025)

Note: These figures allow you to maximize both your personal contributions and the contributions your business can make on your behalf.

Key Contribution Deadlines

Meeting contribution deadlines is crucial to take full advantage of your Solo 401(k). Here’s what you need to remember:

- Employee Contributions: Must be elected by December 31 of the tax year. However, you can make the actual contributions up until the tax filing deadline, typically April 15 of the following year. If you file for an extension, this deadline can extend to October 15.

- Employer Contributions: These can be made up until your business’s tax filing deadline, including any extensions. For example:

- Sole Proprietorships and Single-Member LLCs: Generally, April 15 or October 15 with an extension.

- S-Corps and Partnerships: Typically March 15 or September 15 with an extension.

Strategies to Maximize Your Solo 401(k)

Maximizing your Solo 401(k) involves more than just hitting the contribution limits. Here are some effective strategies:

- Automate Your Contributions

Setting up automatic contributions ensures you consistently save throughout the year without having to remember each deposit. This approach not only simplifies the process but also takes advantage of dollar-cost averaging, potentially reducing the impact of market volatility.

How to Automate:

- Bank Transfers: Set up regular transfers from your business account to your Solo 401(k).

- Payroll Deductions: If you pay yourself a salary, arrange for automatic deductions to your retirement account.

- Optimize Employer Contributions

Review your business’s financial performance periodically. If your business does well, consider increasing your employer contributions. This flexibility allows you to adjust based on your income and ensures you’re maximizing tax benefits.

Steps to Optimize:

- Assess Profitability: Regularly evaluate your business’s earnings.

- Adjust Contributions: Contribute a lump sum based on profitability to maximize your retirement savings and reduce taxable income.

- Take Advantage of Catch-Up Contributions

If you’re 50 or older, you can contribute an additional $7,500. This catch-up contribution can significantly boost your retirement savings, helping you prepare more effectively for retirement.Additional Note for 2024 and Beyond: Starting in 2024, participants with wages over $145,000 must make catch-up contributions as Roth contributions, providing tax diversification benefits.

- Explore Roth Contributions

Some Solo 401(k) plans offer Roth options, which allow you to contribute after-tax dollars. While you don’t get a tax break upfront, your withdrawals in retirement can be tax-free, providing valuable tax diversification.

Consider After-Tax Contributions

If you’ve maxed out your employee and employer contributions but still want to save more, check if your plan allows after-tax contributions. These can be rolled over into a Roth IRA later, offering potential tax-free growth.Mega Backdoor Roth Strategy:

The Mega Backdoor Roth is an advanced strategy that allows you to contribute significantly more after-tax dollars to your Solo 401(k) and then convert them to a Roth IRA. This approach can be beneficial for high-income earners looking to maximize tax-free retirement growth.

Contribution Limits for Mega Backdoor Roth:

The after-tax contribution limit is the lesser of $69,000 (for 2024) or 100% of your compensation minus other contributions.

In-Service Distribution Requirements:

To fully utilize the Mega Backdoor Roth strategy, your Solo 401(k) plan must allow for in-service distributions or in-plan Roth conversions. This means you can move after-tax contributions to a Roth IRA or convert them within the Solo 401(k) while still employed.

Clarity on Employer Contribution Calculations

Employer contributions are a crucial part of maximizing your Solo 401(k). Here’s how they are calculated based on your business structure:

- For Corporations (e.g., S-Corps, C-Corps): Employer contributions are limited to 25% of your compensation.

- For Sole Proprietorships and Single-Member LLCs: Employer contributions are limited to 20% of your net self-employment income after deducting half of your self-employment tax.

Understanding these calculations ensures you optimize your contributions without exceeding IRS limits.

Calculate Your Solo 401(k) Employer Contribution

Maximum Employer Contribution

Maximum Employer Contribution

Comparing Solo 401(k) and SEP IRA

Choosing between a Solo 401(k) and a SEP IRA depends on your specific needs and retirement goals. Here’s a quick comparison to help you decide:

Solo 401(k) Advantages:

- Higher Contribution Limits: Allows both employee and employer contributions, permitting up to $76,500 for those 50 and older.

- Tax Options: Offers both Traditional (pre-tax) and Roth (post-tax) contributions.

- Flexibility: More control over how much you contribute each year.

SEP IRA Advantages:

- Simplicity: Easier to set up with minimal paperwork.

- Employer Contributions Only: Suitable if you prefer not to make employee contributions.

- Flexible Contributions: Adjust based on business profits without strict deadlines.

Which to Choose? If you want higher contribution limits and more flexibility, a Solo 401(k) is likely the better choice. If you prefer simplicity and ease of setup, a SEP IRA might be more suitable.

Impact of SECURE 2.0 on Solo 401(k) Plans

The SECURE 2.0 Act brings several improvements to Solo 401(k) plans, enhancing their benefits:

- Extended Deadlines: Greater flexibility in establishing and contributing to your Solo 401(k) up to the tax filing deadline.

- Increased Catch-Up Contributions: Starting in 2025, catch-up contributions will adjust for inflation, allowing you to save more as you near retirement.

- Enhanced Roth Options: More opportunities for after-tax contributions, providing better tax planning options.

- Roth Employer Contributions: New provisions allow employer contributions to be designated as Roth contributions, offering additional tax diversification.

These changes make Solo 401(k) plans even more attractive, offering greater opportunities to optimize your retirement savings.

Additional Considerations

Required Minimum Distributions (RMDs)

Starting at age 73, rising to 75 by 2033, you must begin taking required minimum distributions from your Solo 401(k). Proper planning ensures you comply with IRS rules and manage your tax liabilities effectively.

Solo 401(k) Loan Provisions

Some Solo 401(k) plans allow you to take loans from your account. You can borrow up to the lesser of $50,000 or 50% of your account balance. This can be a flexible way to access funds for emergencies or investments, but it’s essential to understand the repayment terms to avoid penalties.

Loan Repayment Requirements:

- Repayment Period: Loans must be repaid within five years.

- Interest Payments: Typically, interest is paid quarterly, ensuring the loan is paid back promptly and maintaining the growth potential of your retirement funds.

Self-Employed Income Calculation

Accurately calculating your self-employed income is vital for determining your contribution limits. For sole proprietors and single-member LLCs, this involves deducting business expenses and half of your self-employment tax from your gross income.

Form 5500-EZ Filing Requirements

If your Solo 401(k) plan assets exceed $250,000, you must file Form 5500-EZ annually with the IRS. This filing ensures compliance with regulatory requirements and helps maintain the plan’s tax-advantaged status.

Frequently Asked Questions (FAQ)

How does SECURE 2.0 benefit Solo 401(k) participants?

SECURE 2.0 provides more flexibility with contribution deadlines, increased catch-up limits, enhanced Roth options, and the ability to designate employer contributions as Roth. These changes allow for better tax planning and higher savings.

Can I automate my Solo 401(k) contributions?

Yes! Automating contributions through bank transfers or payroll deductions ensures consistent saving and maximizes growth without manual effort.

What if my business operates on a non-calendar fiscal year?

Coordinate with your 401(k) provider to align contribution deadlines with your fiscal year. Consulting a financial advisor can help tailor your plan to fit your business cycle.

How can I maximize my Solo 401(k) contributions?

Contribute the maximum employee deferral, utilize catch-up contributions if eligible, optimize employer profit-sharing based on your business income, and automate your savings to ensure consistency.

Can I contribute to a Solo 401(k) alongside other retirement plans?

Yes, you can contribute to multiple retirement plans. Just ensure your total contributions across all plans comply with IRS limits to avoid penalties.

What happens to my Solo 401(k) if I close my business?

You have several options:

- Leave the Account: Continue managing it independently.

- Roll Over: Transfer funds to another retirement account.

- Withdraw Funds: Be aware of potential taxes and penalties if you’re under 59½.

Take Action Today

Maximizing your Solo 401(k) involves understanding the rules, staying on top of deadlines, and implementing smart strategies. Here’s how to get started:

- Consult a Professional: Speak with a financial advisor or tax expert to tailor your retirement plan to your needs.

- Set Up Automated Contributions: Ensure consistent saving by automating your deposits.

- Stay Informed: Keep up with legislative changes to make the most of your Solo 401(k).

Need Help with Your Solo 401(k) or Other Tax Planning Needs? Contact XOA TAX Today!

Website: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230 and relevant state resources. Please consult a professional advisor for advice specific to your situation.