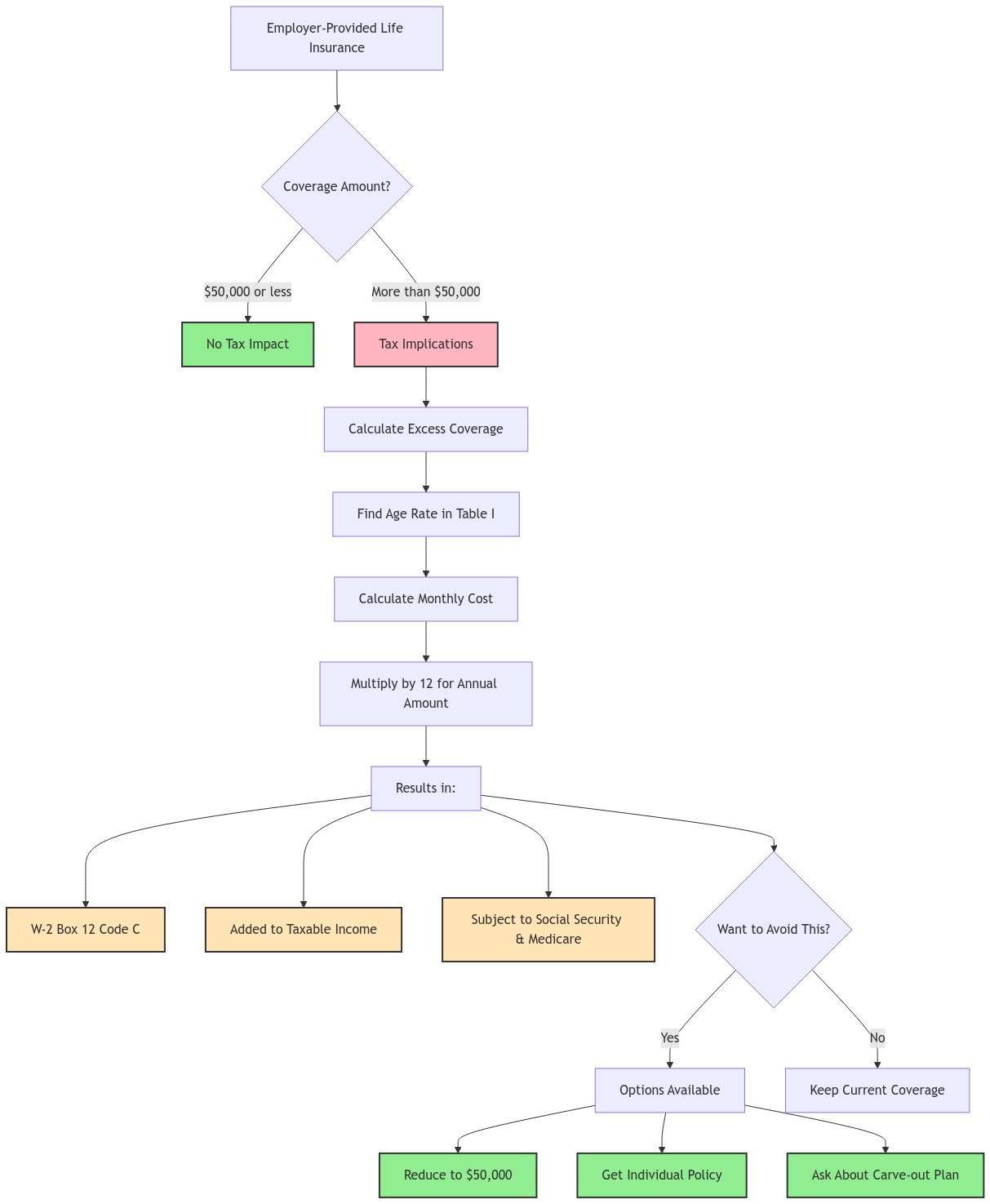

Hey there, fellow tax adventurers! It’s your friendly neighborhood CPA firm, XOA TAX, here to help you navigate the twists and turns of the tax world. Today, we’re diving into a topic that might surprise you: employer-paid life insurance and how it can affect your taxes.

You see, many companies offer life insurance as a perk to their employees. It’s a great way to protect your loved ones if something unexpected happens. But here’s the thing: if your life insurance benefit is too high, you might end up with a bigger tax bill than you expected.

Don’t worry, though! We’re here to break it all down for you in simple terms, just like we’d explain it to a friend or a student. By the end of this post, you’ll know exactly how employer-paid life insurance works and what you can do to avoid any tax surprises.

Key Takeaways

- The first $50,000 of your life insurance benefit is usually tax-free.

- Anything above $50,000 might be considered “imputed income” and taxed.

- You can adjust your coverage or get your own policy to avoid extra taxes.

- Always check your W-2 for any surprises in Box 12 with Code “C”.

- Don’t hesitate to reach out to us if you have any questions! We’re always happy to help.

What’s the Deal with Employer-Paid Life Insurance?

Imagine your employer offers you a life insurance policy that’s worth twice your salary. That’s pretty common! It’s like a safety net for your family, so they’ll be taken care of if something happens to you. This is called Group Term Life Insurance:

Group Term Life Insurance: A type of life insurance policy offered by employers to their employees. It pays a death benefit to your loved ones if you pass away while you’re covered by the policy.

But why do employers even offer this? Well, it’s a win-win for everyone!

- It’s cheaper for them to get a group policy for all employees.

- It’s easier for you to get coverage, even without a medical exam.

- It’s a nice perk that can make you happier at work.

The $50,000 Sweet Spot

Now, here’s where things get interesting. The IRS, the tax guys, say that the first $50,000 of your life insurance benefit is tax-free. That means you don’t have to pay any taxes on it!

Think of it like this: If your company gives you $50,000 worth of life insurance, it’s like getting a free gift! No strings attached.

Uh Oh! When Your Benefit Goes Over $50,000

But what if your benefit is more than $50,000? Let’s say it’s $100,000. In this case, the extra $50,000 above the limit might be considered “imputed income.”

Imputed Income: This is when you have to pay taxes on something you get as a benefit, even if you didn’t get it in cash. It’s like getting a free gym membership at work – you didn’t pay for it, but you might have to pay taxes on its value.

The IRS has a special table (Uniform Premium Table I) that they use to figure out how much you might owe in taxes. This table looks at your age and how much your benefit is over $50,000.

IRS Table I Rates (Cost per $1,000 of coverage)

| Age | Monthly Rate |

|---|---|

| Under age 25 | $0.05 |

| 25-29 | $0.06 |

| 30-34 | $0.08 |

| 35-39 | $0.09 |

| 40-44 | $0.10 |

| 45-49 | $0.15 |

| 50-54 | $0.23 |

| 55-59 | $0.43 |

| 60-64 | $0.66 |

| 65-69 | $1.27 |

| 70 and above | $2.06 |

Crunching the Numbers: Let’s See an Example

Let’s say you’re 40 years old and your employer-provided life insurance is $150,000. Here’s how we’d figure out the taxable amount:

- Excess Coverage: $150,000 (total coverage) – $50,000 (tax-free amount) = $100,000

- Monthly Rate (from Table I): $0.09 per $1,000 of coverage

- Monthly Imputed Income: $0.09 x 100 = $9.00

- Annual Imputed Income: $9.00 x 12 = $108

This $108 would be added to your taxable income for the year. And don’t forget, this extra income is also subject to Social Security and Medicare taxes!

Decoding Your W-2: Where to Find the Tax Surprise

When tax season rolls around, keep an eye out for Box 12 with Code “C” on your W-2 form. That’s where you’ll find the amount of imputed income from your life insurance benefit.

If you see something there, don’t panic! It just means you might owe a bit more in taxes. But hey, at least you’re aware of it, right?

How to Avoid the Tax Trap

The good news is that there are ways to avoid this tax surprise! Here are a few things you can do:

- Reduce your employer-provided coverage to $50,000. This way, you’ll stay under the tax-free limit.

- Get your own individual life insurance policy. This gives you more control and flexibility.

- Talk to your HR department about a “carve-out plan.” Carve-out plan (sometimes called a split-dollar arrangement): This lets certain employees, like those with higher salaries, choose to not take the extra life insurance coverage over $50,000. Sometimes they might even get a bonus to buy their own policy instead! This might allow you to opt out of the extra coverage and get a cash bonus instead.

Keep in mind that you might need to make these changes during your company’s open enrollment period, so plan ahead!

State Taxes: What’s the Deal?

While the $50,000 tax-free rule applies at the federal level, some states might have their own rules about taxing employer-provided life insurance. It’s always a good idea to check with your state’s tax department or a tax professional to see how this applies to you.

Special Note for High Earners

If you’re considered a “highly compensated employee” by the IRS, there might be some extra rules and limits on your employer-provided life insurance. Highly compensated employee: For 2024, the IRS defines this as someone who earned more than $155,000 in compensation from their employer during the previous year. This designation is mainly used for retirement plan rules, but it can also affect other benefits. It’s best to chat with a tax advisor to make sure you’re following all the guidelines.

What About Supplemental Life Insurance?

Some employers also offer “supplemental” life insurance, which you can buy on top of your basic coverage. Supplemental Life Insurance: This is extra life insurance you can get on top of your basic coverage, usually through your employer. This usually works a bit differently, and the premiums might be taxable. Again, it’s always a good idea to check with a tax pro to see how this fits into your overall tax picture.

Need More Help? We’re Here for You!

We know that taxes can be confusing, especially when it comes to things like life insurance. But that’s what we’re here for!

If you have any questions or need help figuring out your situation, don’t hesitate to reach out to us. We’re always happy to chat and guide you through it.

Website: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.