Hi everyone,

It’s Hoang from XOA TAX, here to break down a core accounting principle that often causes confusion: accrual accounting. While the term might sound a bit technical, trust me, it’s not as complex as you might think. In fact, once you understand it, you’ll see how it can give you a much clearer picture of your business’s financial health.

Key Takeaways

- Accrual accounting records revenue when it’s earned and expenses when they’re incurred, regardless of when cash actually changes hands.

- This method provides a more accurate view of your business’s profitability compared to cash-basis accounting.

- Accrual accounting is generally required for larger businesses and those seeking external financing.

What is Accrual Accounting?

Simply put, accrual accounting recognizes revenue when you’ve earned it, not necessarily when you receive payment. Similarly, you record expenses when you incur them, not just when you pay for them. This aligns with the matching principle, which emphasizes pairing revenues with the expenses incurred to generate them, providing a more accurate view of profitability in a given period.

Imagine you’re a consultant who provides online business coaching. Let’s say you complete a series of coaching sessions for a client in December. They’re happy with the results and agree to pay you in January. Under accrual accounting, you’d record the revenue from those sessions in December, even though you haven’t received the cash yet. Why? Because you’ve completed the service and earned the income.

To illustrate further, let’s say you also incurred $500 in expenses for online advertising in December to promote your coaching services, but your advertising platform bills you at the end of the month. You would record this expense in December, the same month you record the revenue from the coaching sessions, even though the cash payment for the advertising won’t go out until January.

Accrual Accounting vs. Cash Accounting

This differs from cash accounting, which only records transactions when cash is received or paid out. Sticking with our coaching example, under cash accounting, you’d record the revenue in January when the client actually pays you, and the advertising expense in January when you pay the platform.

While cash accounting seems simpler, accrual accounting paints a more accurate picture of your business’s financial performance over time, especially if you offer credit to customers or have significant operating expenses.

Benefits of Accrual Accounting

- Improved Financial Reporting: By matching revenues and expenses, accrual accounting provides a more accurate snapshot of your business’s profitability.

- Better Financial Planning: It allows you to track outstanding invoices (accounts receivable) and upcoming bills (accounts payable), helping you manage cash flow more effectively.

- Easier Access to Financing: Lenders and investors generally prefer accrual accounting as it provides a more comprehensive view of a company’s financial health.

Accrual vs. Cash Accounting: Online Coaching Business Example

| Business Scenario | Accrual Method | Cash Method |

|---|---|---|

| December 2023: Completed 10 coaching sessions ($2,000) | Record $2,000 revenue in December 2023 | No entry until payment received |

| January 2024: Client pays for December sessions | Record cash receipt only (already recorded revenue) | Record $2,000 revenue in January 2024 |

| December 2023: Digital advertising costs ($500) | Record $500 expense in December 2023 | No entry until payment made |

| January 2024: Pay advertising bill | Record payment only (already recorded expense) | Record $500 expense in January 2024 |

| December 2023 Totals | Revenue: $2,000 Expenses: ($500) Net Income: $1,500 | Revenue: $0 Expenses: $0 Net Income: $0 |

| January 2024 Totals | Revenue: $0 Expenses: $0 Net Income: $0 | Revenue: $2,000 Expenses: ($500) Net Income: $1,500 |

Key Insights:

- Accrual method shows profit in December when work was performed

- Cash method shows profit in January when payment was received

- Accrual method better matches revenue with related expenses

- Cash method simpler but may not reflect true business performance timing

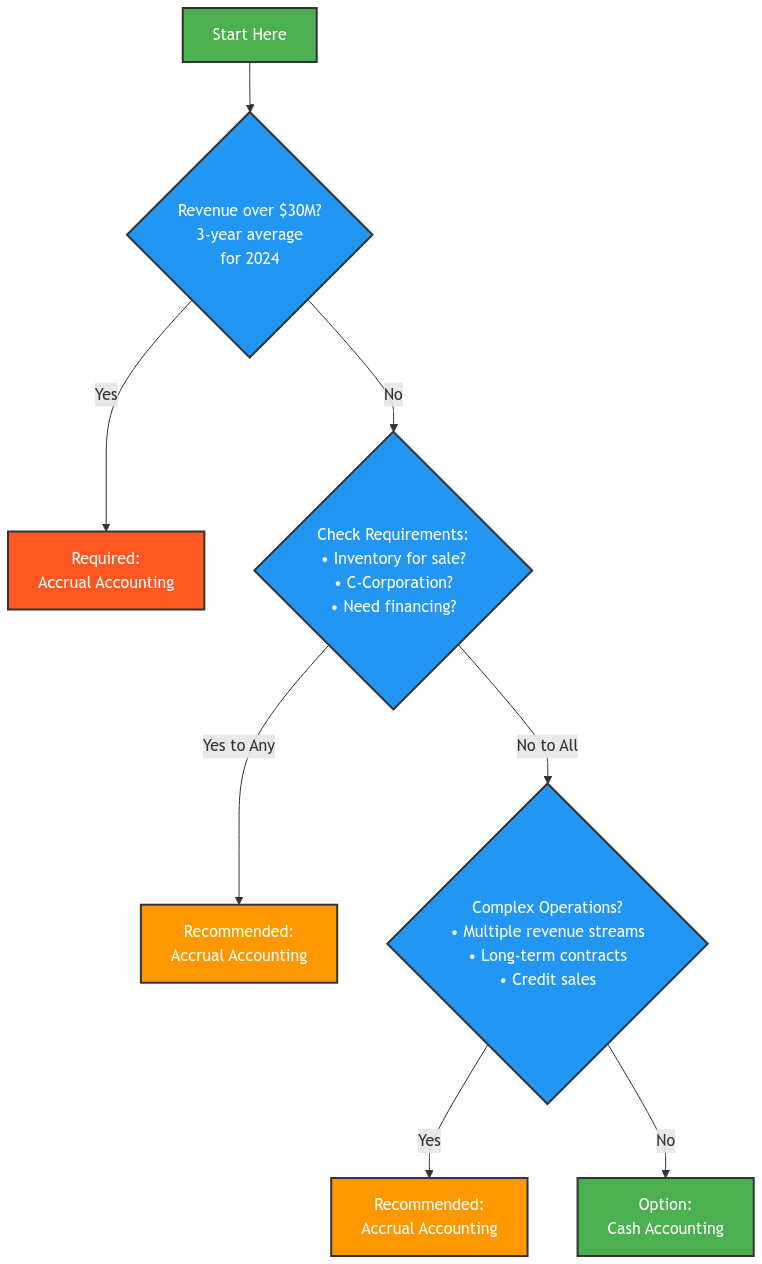

Is Accrual Accounting Right for Your Business?

While accrual accounting offers many advantages, it might not be the best fit for every business. Factors to consider include the size and complexity of your business, your industry, and whether you need to comply with Generally Accepted Accounting Principles (GAAP).

For 2024, the IRS generally requires businesses with average annual gross receipts exceeding $30 million (based on the prior three-tax-year period) to use accrual accounting. This threshold is adjusted annually for inflation (up from $29 million in 2023). Businesses below this threshold may qualify to use the cash method, though other factors like business structure or industry may still require accrual accounting.

For many businesses, especially larger ones or those seeking financing, accrual accounting is the preferred method. However, if you’re a small business owner with straightforward transactions, cash accounting might suffice.

It’s always a good idea to discuss your specific needs with a tax professional to determine the most appropriate accounting method for your business.

Record-Keeping for Accrual Accounting in the Digital Age

Maintaining detailed and accurate records is crucial for accrual accounting. The IRS has recently updated its guidelines regarding digital record-keeping, emphasizing the importance of secure and accessible electronic storage. Here’s what you need to know:

- Digital Records: The IRS now accepts most financial records in electronic format, including invoices, bills, bank statements, and general ledger entries.

- Software Compliance: Ensure your accounting software complies with IRS requirements for digital record-keeping.

- Cloud Storage: Cloud-based storage solutions can offer secure backups and easy access to your financial data.

- Data Security: Implement strong cybersecurity measures to protect your sensitive financial information.

Leverage Technology for Efficient Accrual Accounting

Modern accounting software can significantly streamline your accrual accounting processes. Popular options like QuickBooks Online, Xero, and Zoho Books offer features such as:

- Automated Invoicing: Generate and send invoices automatically, track due dates, and send payment reminders.

- Expense Tracking: Capture and categorize expenses digitally, including those paid with credit cards or digital payment systems.

- Bank Reconciliation: Reconcile bank transactions automatically, reducing manual effort and errors.

- Financial Reporting: Generate customized financial reports to track key performance indicators (KPIs).

- Integration with Other Systems: Connect your accounting software with CRM, inventory management, and other business systems for a more comprehensive view of your operations.

Industry-Specific Considerations

Accrual accounting can be particularly important in industries with significant credit transactions or delayed payments. Here are some examples in today’s business landscape:

- E-commerce: Online retailers often have to account for pre-orders, returns, and chargebacks, making accrual accounting essential for accurate revenue recognition.

- SaaS (Software as a Service): SaaS businesses typically operate on a subscription model, requiring the recognition of revenue over the subscription period, even if payment is received upfront.

- Digital Marketing Agencies: Agencies often bill clients based on project milestones or deliverables, requiring accrual accounting to match revenue with the completion of services.

- Remote/Hybrid Businesses: Businesses with remote or hybrid work models need to adapt their accounting practices to track expenses related to remote work arrangements and ensure compliance with tax regulations in multiple locations.

Emerging Trends in Accrual Accounting

The world of accounting is constantly evolving. Here are some emerging trends to keep in mind:

- Cryptocurrency Accounting: The rise of cryptocurrencies presents unique accounting challenges. It’s essential to stay informed about the tax implications and best practices for recording cryptocurrency transactions.

- ESG Reporting: Environmental, Social, and Governance (ESG) reporting is becoming increasingly important for businesses. Accrual accounting can help track and report on sustainability initiatives and social impact.

- International Business Transactions: Businesses operating globally must navigate complex accounting rules related to foreign currency exchange, transfer pricing, and international tax regulations.

- Digital Payment Systems: The widespread use of digital payment systems like PayPal and Stripe requires careful accounting for transaction fees and reconciliation with bank statements.

FAQs about Accrual Accounting

Is accrual accounting required by law?

While not always legally required, accrual accounting is often mandated for larger businesses (over $30 million in average annual gross receipts for 2024) or those that sell stock. Additionally, GAAP generally requires accrual accounting.

What are some examples of accrued expenses?

Accrued expenses are those you’ve incurred but haven’t yet paid. Examples include salaries payable, interest payable, and utilities payable.

How do I switch from cash accounting to accrual accounting?

Switching accounting methods can be complex. It requires filing Form 3115 with the IRS and ensuring a smooth transition and accurate record-keeping. It’s crucial to consult with a CPA to navigate this process correctly.

Need Help with Your Business Accounting?

Understanding and implementing the right accounting method is crucial for your business’s success. If you have questions about accrual accounting or need assistance with your business finances, don’t hesitate to reach out to us at XOA TAX. We’re here to help!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime