At XOA TAX, we’re committed to providing our clients with in-depth knowledge and guidance on all aspects of tax planning. One area that often requires careful consideration is the Additional Medicare Tax. This tax can significantly impact high earners, and understanding its intricacies is essential for making informed financial decisions. Let’s delve into the details and explore how it might affect you.

What is the Additional Medicare Tax?

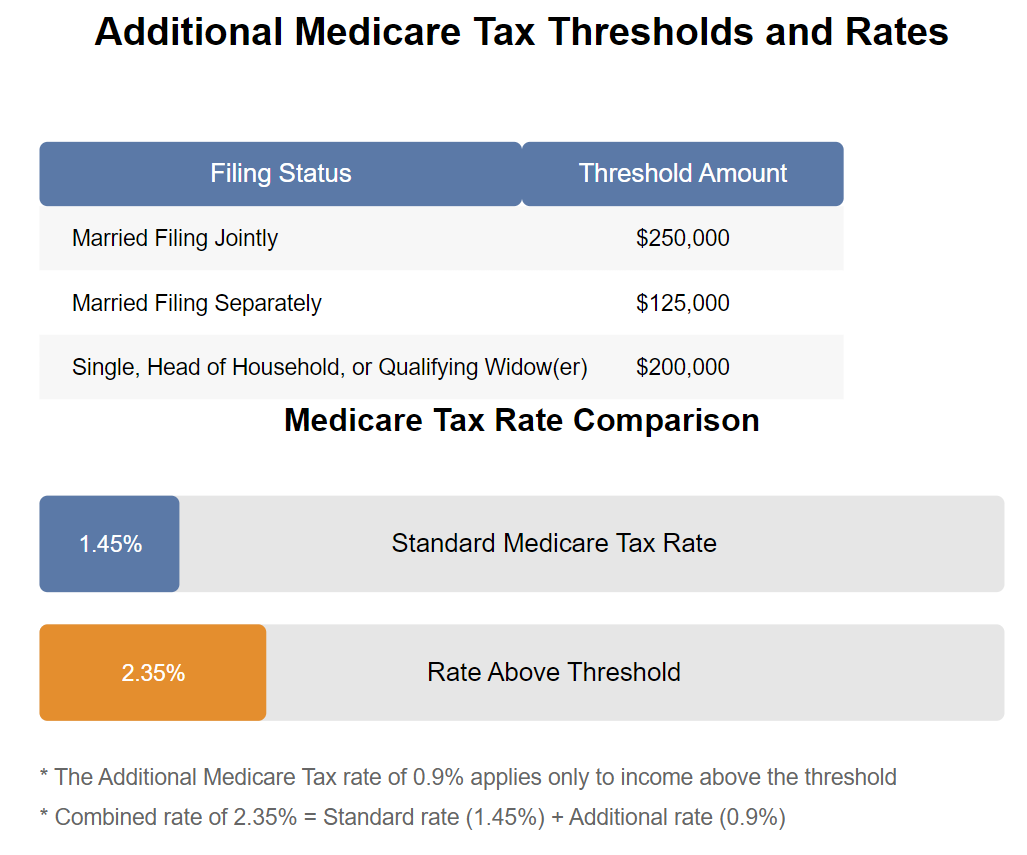

The Additional Medicare Tax is a 0.9% tax on earned income that exceeds certain thresholds. Enacted in 2013 as part of the Affordable Care Act, it helps ensure the long-term sustainability of Medicare, a crucial program providing health insurance coverage to millions of Americans.

Who Pays the Additional Medicare Tax?

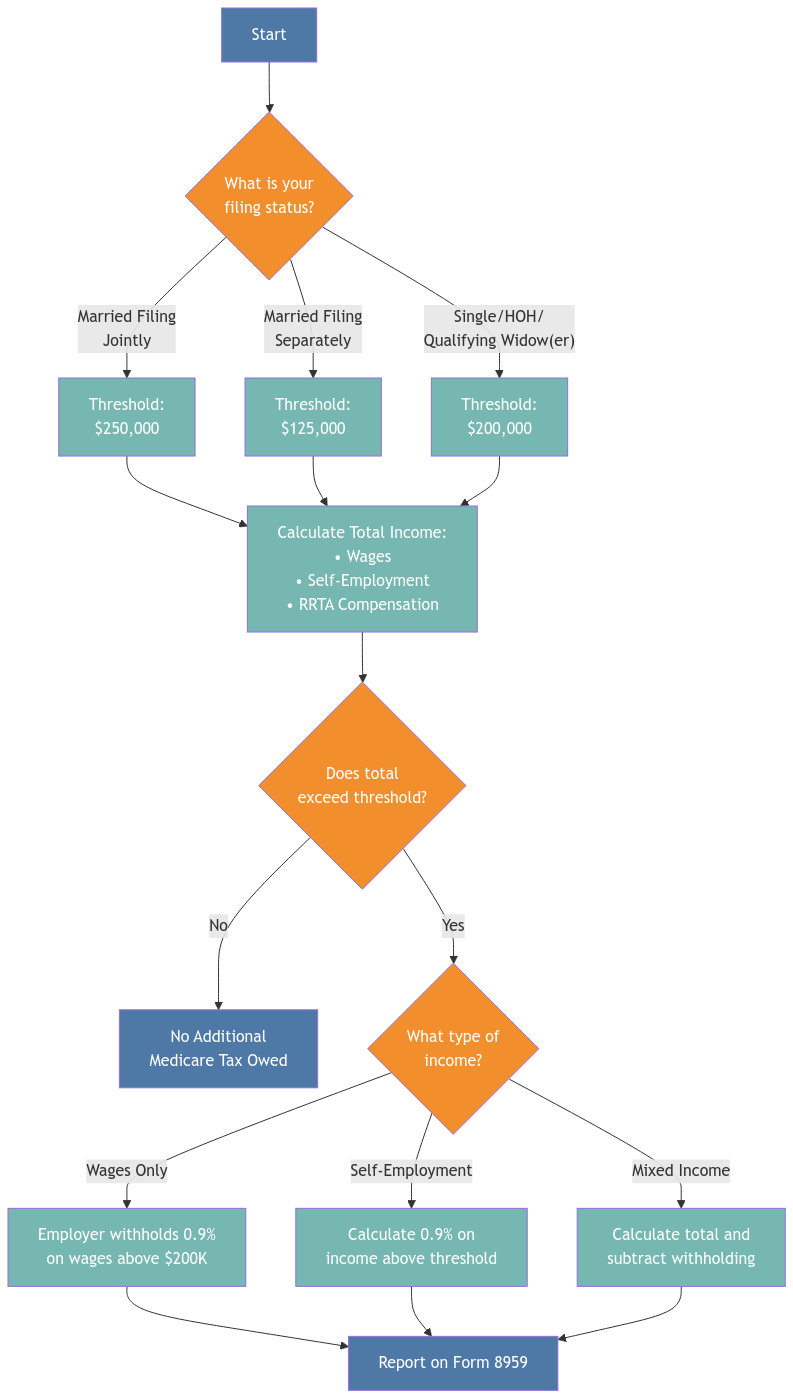

For the 2024 tax year, the Additional Medicare Tax applies to individuals with income surpassing the following thresholds:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- All other taxpayers (single, head of household, etc.): $200,000

Understanding the Mechanics of the Additional Medicare Tax

Employer Withholding: If your wages exceed $200,000 in a calendar year, your employer is legally obligated to withhold the Additional Medicare Tax, irrespective of your ultimate filing status. This means you might have it withheld even if your total income doesn’t exceed the threshold for your filing status. Any over-withholding will be reconciled when you file your tax return.

Self-Employment Income: If you’re self-employed, the responsibility for calculating and paying the Additional Medicare Tax falls squarely on your shoulders. It’s crucial to factor this into your estimated tax payments throughout the year to avoid any surprises come tax season. This 0.9% tax applies in addition to the self-employment tax you already pay on your net earnings (which includes the standard 1.45% for Medicare). For self-employed individuals, the Additional Medicare Tax applies to the Medicare portion of self-employment tax after the deduction of 50% of self-employment tax.

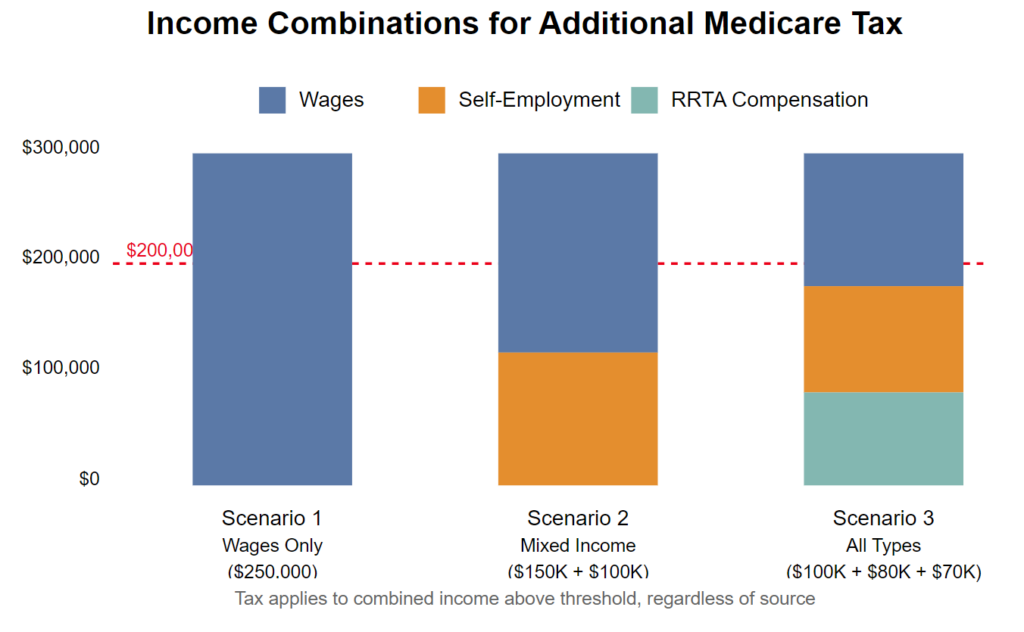

The Additional Medicare Tax applies to your combined employment and self-employment income. If you have both types of income, the threshold applies to the combined amount, but you get credit for any Additional Medicare Tax withheld by your employer.

Railroad Retirement (RRTA) Compensation: The Additional Medicare Tax also applies to any Railroad Retirement (RRTA) compensation that exceeds $200,000 in a calendar year.

No Income Cap: It’s important to note that there is no income cap for the Additional Medicare Tax. This means the 0.9% rate applies to every dollar of earned income above the threshold, regardless of how high your income climbs.

Reporting: If you owe the Additional Medicare Tax, you’ll need to file Form 8959, “Additional Medicare Tax,” along with your annual tax return (Form 1040). This form helps you calculate and report the precise amount due.

Illustrative Examples

Scenario 1: Married couple filing jointly with one spouse earning $175,000 and the other earning $100,000. In this case, their combined income is $275,000, exceeding the $250,000 threshold for married couples filing jointly. They would owe the Additional Medicare Tax on the $25,000 exceeding the threshold. The calculation would be: $25,000 x 0.9% = $225 in Additional Medicare Tax.

Note that even if neither spouse individually exceeds $200,000, their employer(s) won’t withhold the Additional Medicare Tax. The couple should plan for this tax liability through estimated tax payments or additional withholding.

Scenario 2: Single individual with $150,000 in salary and $75,000 in self-employment income. This individual’s total earned income is $225,000, surpassing the $200,000 threshold for single filers. They would owe the Additional Medicare Tax on the $25,000 exceeding the threshold. The calculation would be: $25,000 x 0.9% = $225.

Scenario 3: Individual earning $190,000 in salary and receiving a $20,000 bonus in December. The bonus pushes their total income to $210,000, exceeding the $200,000 threshold. Additional Medicare Tax withholding would begin with the paycheck that includes the bonus payment. The tax would apply only to the portion of the bonus that pushes the individual over the $200,000 threshold ($10,000). The calculation would be: $10,000 x 0.9% = $90.

Scenario 4: Retired individual receiving $150,000 in Railroad Retirement benefits. Since this individual receives $150,000 in Railroad Retirement benefits, which is below the $200,000 threshold, they would not owe Additional Medicare Tax on these benefits. However, if their RRTA compensation exceeded $200,000, the Additional Medicare Tax would apply to the excess amount.

Common Misconceptions and FAQs

Does the Additional Medicare Tax apply to investment income?

No. The Additional Medicare Tax applies only to earned income, such as wages, salaries, and self-employment income. Investment income like interest, dividends, and capital gains are not subject to it. However, high-income earners might be subject to the Net Investment Income Tax (NIIT), which is a separate tax.

Can I adjust my withholding to account for the Additional Medicare Tax?

While you can’t specifically request Additional Medicare Tax withholding, you can increase your overall income tax withholding using Form W-4. This can help ensure you have enough withheld to cover your total tax liability, including the Additional Medicare Tax.

What happens if my employer didn’t withhold enough Additional Medicare Tax?

If you owe more than was withheld, you’ll need to pay the difference when you file your tax return. In some cases, you might be subject to penalties for underpayment.

Proactive Tax Planning Strategies

At XOA TAX, we believe in proactive tax planning. Here are a few strategies to consider if you anticipate owing the Additional Medicare Tax:

- Maximize Retirement Contributions: Contributing to pre-tax retirement accounts, like a 401(k) or traditional IRA, can reduce your taxable income and potentially lower your liability.

- Tax-Loss Harvesting: If you have investments, consider selling losing positions to offset gains. This can help reduce your overall tax burden.

- Income Deferral: Explore opportunities to defer income to a later tax year. This might involve delaying bonus payments or utilizing deferred compensation plans.

State-Specific Considerations

While the Additional Medicare Tax is a federal tax, it’s important to be aware of any state-specific rules or regulations that might apply. For example:

- California: Imposes a Mental Health Services Tax (MHST) on high earners, which functions similarly to the Additional Medicare Tax.

- New Jersey: Has a “millionaire’s tax,” which is an additional income tax rate on those with incomes exceeding certain thresholds.

- New York: Has its own set of income tax brackets that can result in higher taxes for high earners.

Always consult with a tax professional in your state to understand the specific rules and regulations that apply to your situation.

XOA TAX: Your Partner in Navigating the Additional Medicare Tax

Tax laws can be intricate, and the Additional Medicare Tax is no exception. At XOA TAX, we’re dedicated to providing personalized guidance and support to help you navigate the complexities of the tax code. Our team of experienced CPAs can help you understand your liability, develop tax planning strategies, and ensure you remain compliant with all applicable regulations.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Business Hours: Monday-Friday, 9:00 AM – 5:00 PM Pacific Time

For more information, see IRS Publication 15 (Circular E) and Publication 505, Tax Withholding and Estimated Tax.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime