Introduction

As a successful small business owner, you face unique financial challenges and opportunities. Effective tax planning is not just about compliance—it’s a strategic tool to preserve wealth, fuel growth, and gain a competitive edge. While standard tax strategies provide baseline benefits, exploring advanced options can unlock significant savings and operational efficiencies. This comprehensive guide for 2024 delves into sophisticated tax strategies, enriched with practical examples, implementation timelines, state-specific information, and industry-specific considerations to help you make informed decisions.

Key Takeaways

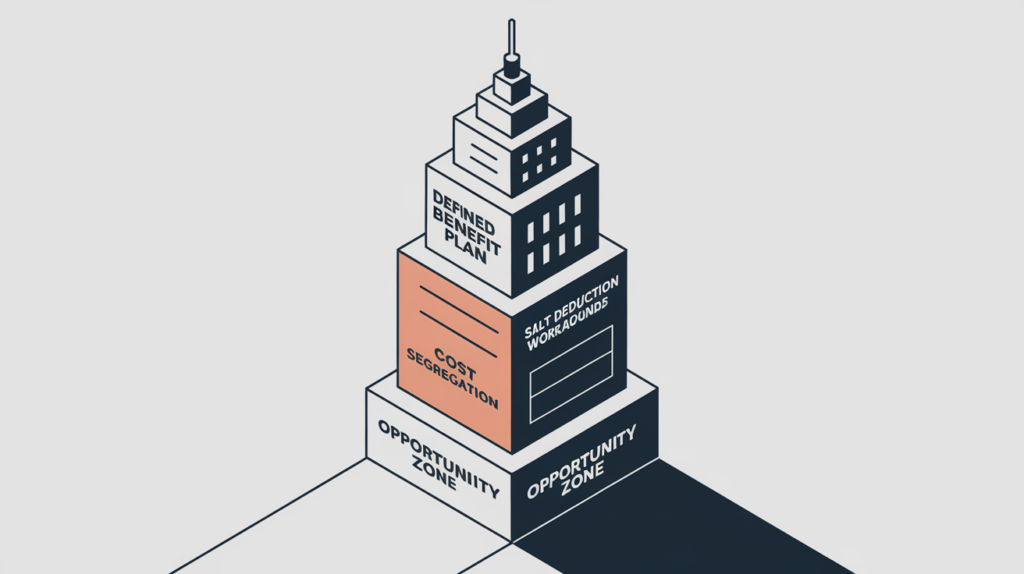

- Elevate Retirement Contributions: Learn how Defined Benefit and Cash Balance Plans can dramatically increase your retirement savings, with practical timelines and cost analyses.

- Leverage COVID-Related Tax Provisions: Discover how recent legislation impacts your tax planning, including bonus depreciation and PPP loan forgiveness.

- Accelerate Depreciation Deductions: See how Cost Segregation Studies can provide immediate tax relief, backed by real-world examples.

- Optimize Your Business Structure: Understand the tax implications of different entities and how they apply to your industry, including recent legal developments.

- Navigate International Tax Complexities: Get detailed insights into GILTI calculations, FDII deductions, and compliance requirements.

- Stay Informed with Recent Legal Developments: Learn how recent court cases and IRS notices may affect your tax strategies.

- Implement with Confidence: Access estimated timelines, cost ranges, and maintenance requirements for each strategy.

1. Defined Benefit Plans

Overview

Defined Benefit Plans promise a specified retirement benefit, calculated based on factors like salary history and years of service. These plans allow for significantly higher annual contributions compared to traditional retirement plans, making them particularly advantageous for high-income earners nearing retirement.

Benefits

- Substantial Tax Deductions: Contributions are generally tax-deductible, reducing your taxable income.

- Accelerated Retirement Savings: Ideal for catching up on retirement savings if you started late.

- Predictable Retirement Income: Provides a guaranteed benefit upon retirement.

Considerations and Risks

- Funding Obligations: Requires consistent annual contributions, which can be a significant financial commitment.

- Complex Compliance Requirements: Must adhere to IRS Code §412 and ERISA standards, including annual actuarial certifications.

- Potential Audit Triggers: High contribution amounts may attract IRS scrutiny. Proper documentation and compliance are essential.

- Professional Guidance Needed: Consult with a qualified actuary and tax professional to ensure compliance and optimize benefits.

Qualification Requirements

- Eligibility: Must be established for the exclusive benefit of employees and their beneficiaries.

- Nondiscrimination Rules: Must comply with IRS Code §401(a)(4) to ensure benefits don’t favor highly compensated employees.

- Plan Document: Requires a formal written plan detailing the benefits and operations.

- Reporting: Annual Form 5500 filing is mandatory.

Implementation Details

- Setup Timeline: Approximately 3-6 months.

- Professional Costs: Setup fees range from $5,000 to $10,000; annual maintenance costs between $2,000 and $5,000.

- Maintenance Requirements: Annual actuarial valuations, compliance testing, and participant disclosures.

Practical Example

Case Study: A 55-year-old dentist wants to maximize retirement savings.

- Contribution Potential: Up to $200,000 annually.

- Tax Savings: At a 35% tax rate, potential tax savings of $70,000 per year.

- Cost-Benefit Analysis:

- Costs: $10,000 setup + $3,000 annual maintenance.

- Net Tax Benefit: $70,000 tax savings – $3,000 maintenance = $67,000 net benefit annually.

Recent Court Case

Thole v. U.S. Bank N.A. (2020): This case dealt with a law called ERISA, which protects people’s retirement savings. The court looked at whether people in a “defined-benefit plan” (where you get a fixed amount of money after you retire) could sue the company managing their plan even if they weren’t losing any money.

In simpler words: Imagine a company promises to pay you a set amount every month after you retire. Some people thought the company wasn’t managing the money well, but they were still getting all the payments they were promised. They sued the company anyway.

The Supreme Court said they couldn’t sue because they weren’t actually harmed. This means it’s harder for people with these types of retirement plans to sue unless they can prove the company’s actions are causing them to lose money.

Industry-Specific Considerations

- Medical Practices: Highly beneficial for doctors with high income and minimal staff.

- Legal Firms: Partners can maximize contributions due to high earnings.

2. Cash Balance Plans

Overview

Cash Balance Plans are hybrid retirement plans combining features of Defined Benefit and Defined Contribution Plans. They offer the security of a traditional pension with the flexibility of a 401(k), allowing for high contribution limits that increase with age.

Benefits

- High Contribution Limits: Depending on age and income, contributions can exceed $300,000 annually.

- Tax Efficiency: Contributions are tax-deductible, reducing current taxable income.

- Employee Attraction and Retention: Attractive benefit for key employees.

Considerations and Risks

- Complex Administration: Requires annual actuarial valuations and compliance testing.

- Regulatory Compliance: Must adhere to IRS Code §411 and ERISA requirements.

- Documentation Requirements: Detailed records and annual reports are mandatory.

- Potential Audit Triggers: Large deductions may attract IRS attention. Ensure all filings are accurate and timely.

- Professional Assistance Essential: Engage experienced actuaries and tax advisors.

Qualification Requirements

- Eligibility: Must cover eligible employees and comply with nondiscrimination rules under IRS Code §401(a)(4)

- Plan Document: Requires a formal written plan.

- Reporting: Annual Form 5500 filing and participant disclosures.

Implementation Details

- Setup Timeline: 3-6 months.

- Professional Costs: Setup fees between $8,000 and $12,000; annual administration costs from $3,000 to $6,000.

- Maintenance Requirements: Annual actuarial certifications and compliance testing.

Practical Example

Case Study: A 60-year-old owner of an architecture firm wants to maximize tax deductions.

- Contribution Potential: Up to $280,000 annually.

- Tax Savings: At a 37% tax rate, potential savings of $103,600 per year.

- Implementation Schedule:

- Month 1-2: Consult with actuaries and tax advisors.

- Month 3: Draft plan documents.

- Month 4: Implement the plan and begin contributions.

Recent Legal Update

SECURE Act 2.0 (Proposed Legislation): Potential changes to retirement plan provisions, affecting contribution limits and compliance requirements.

Industry-Specific Considerations

- Professional Services: Ideal for firms with high-income owners and few employees.

- Manufacturing Companies: Can be structured to benefit key personnel.

3. Cost Segregation Studies

Overview

Cost Segregation Studies accelerate depreciation deductions on commercial properties by reclassifying assets to shorter recovery periods under IRS guidelines.

Benefits

- Immediate Tax Savings: Increases depreciation deductions in the early years of property ownership.

- Improved Cash Flow: Reduces current tax liability, freeing up capital.

- Compliance with COVID-Related Tax Changes: Leverage 100% bonus depreciation on Qualified Improvement Property (QIP) as per the CARES Act (2020).

Considerations and Risks

- Professional Expertise Required: Must be conducted by qualified engineers or specialists.

- Detailed Documentation: Maintain thorough records to support asset classifications.

- Potential Audit Risks: Misclassification can lead to penalties and interest.

- Investment in Study Costs: Upfront costs can be significant.

Implementation Details

- Setup Timeline: 1-3 months.

- Professional Costs: Studies typically cost between $5,000 and $15,000.

- Maintenance Requirements: Update depreciation schedules annually.

Practical Example

Case Study: A hotel owner invests $5 million in a new property.

- Standard Depreciation: Straight-line over 39 years.

- With Cost Segregation:

- Reclassify 20% ($1 million) to 5-year property.

- First-year depreciation increases significantly due to 100% bonus depreciation.

- Tax Savings: Potential immediate deduction of $1 million, saving $370,000 at a 37% tax rate.

Recent Court Case

AmeriSouth XXXII, Ltd. v. Commissioner (2021): Affirmed the importance of proper documentation in cost segregation studies.

In simpler words: This is a case that reminds us how important it is to have really good records when it comes to taxes, especially for people who own buildings. The case was about a company that tried to lower its taxes by using a strategy called “cost segregation.” This strategy lets building owners divide their property into different parts and speed up how fast they can deduct the cost of those parts, which can save them money.

However, the company didn’t keep detailed enough records to back up their claims. They didn’t have enough proof to show why they were dividing the building the way they did. Because of this, the court sided with the IRS and said the company couldn’t take many of the deductions they were trying to claim.

This case is a warning for anyone using cost segregation. It shows how crucial it is to have thorough and accurate documentation to support your tax strategy. Things like photos, blueprints, and reports from experts can help prove you’re doing things correctly and avoid problems with the IRS.

Industry-Specific Considerations

- Hospitality: Hotels can benefit greatly due to specialized assets.

- Retail: Stores with significant leasehold improvements can accelerate deductions.

4. Captive Insurance Companies

Overview

Establishing a Captive Insurance Company involves creating a licensed insurance entity to insure your business’s specific risks, potentially reducing insurance costs and gaining tax benefits under IRS Code §831(b).

Benefits

- Customized Risk Management: Tailor coverage to unique business needs.

- Potential Tax Advantages: Premiums may be deductible; underwriting profits can accumulate tax-deferred.

- Cost Savings: Potential reduction in insurance premiums over time.

Considerations and Risks

- Regulatory Compliance: Must adhere to IRS and state insurance laws.

- High Setup and Maintenance Costs: Initial setup can be costly; ongoing administration required.

- IRS Scrutiny: Certain arrangements are “transactions of interest” per IRS Notice 2016-66.

- Audit Triggers: Non-compliance can lead to penalties.

Qualification Requirements

- Legitimate Insurance Activity: Must involve risk shifting and risk distribution.

- Licensing: Obtain proper licensing in the domicile jurisdiction.

- Operational Independence: The captive must operate as a separate entity.

Implementation Details

- Setup Timeline: 6-12 months.

- Professional Costs: Initial setup ranges from $75,000 to $150,000; annual costs between $50,000 and $100,000.

- Maintenance Requirements: Compliance with insurance regulations, annual audits.

Practical Example

Case Study: A construction company faces $500,000 in annual insurance premiums.

- Strategy: Establish a captive insurance company.

- Financial Impact:

- Premiums Paid to Captive: $500,000 (deductible).

- Underwriting Profits: Retained within the captive.

- Cost-Benefit Analysis:

- Costs: $100,000 setup + $75,000 annual maintenance.

- Potential Savings: Significant over time, depending on claims.

Recent Court Case

Reserve Mechanical Corp. v. Commissioner (2018): Highlighted the importance of genuine risk distribution and proper structuring.

In simpler words: In this case, Reserve Mechanical created a captive insurance company. However, the court found that it wasn’t set up correctly. It didn’t truly spread the risk around enough, and it looked more like a way to simply shift money around to avoid taxes. The court said that to be a real insurance arrangement, there has to be genuine risk distribution and the captive needs to be structured properly.

This case is important because it shows that the IRS is paying close attention to microcaptive insurance arrangements. Companies need to be careful to follow the rules and make sure their captive insurance companies are set up for legitimate risk management purposes, not just tax avoidance.

Industry-Specific Considerations

- Construction: High-risk profiles make captives advantageous.

- Healthcare: Medical practices can manage malpractice risks.

5. Optimizing Business Structure

Overview

Selecting the appropriate legal entity affects tax obligations, liability protection, and operational flexibility. Common structures include S Corporations, C Corporations, and LLCs.

Benefits

- Tax Efficiency: Entities like S Corporations offer pass-through taxation.

- Liability Protection: Corporations and LLCs shield personal assets.

- Flexibility: LLCs offer operational flexibility and choice of taxation.

Considerations and Risks

- Compliance Requirements: Vary by entity type; include documentation and reporting.

- Tax Reporting: Accurate filings are essential to avoid penalties.

- Potential Audit Triggers: Misclassification of expenses can attract IRS attention.

- State-Specific Regulations: Different states have varying laws affecting entities.

Implementation Details

- Setup Timeline: 1-2 months for restructuring.

- Professional Costs: Legal and accounting fees ranging from $2,000 to $5,000.

- Maintenance Requirements: Annual reports, meetings, and tax filings.

Practical Example

Case Study: A freelance consultant shifts from sole proprietorship to an S Corporation.

- Tax Savings: By paying a reasonable salary and taking distributions, the consultant saves on self-employment taxes.

- Cost-Benefit Analysis:

- Costs: $3,000 in professional fees.

- Savings: Potentially saves $10,000 annually in taxes.

Recent Legal Development

TCJA (2017): Introduced a 20% Qualified Business Income (QBI) deduction for pass-through entities under IRS Code §199A.

State-Specific Information

- California: S Corporations pay a 1.5% franchise tax on net income.

- Texas: No personal income tax; businesses pay a franchise tax.

Industry-Specific Considerations

- Real Estate: LLCs preferred for holding properties due to flexibility.

- Technology Startups: C Corporations favored for attracting investors.

6. Tax Loss Harvesting

Overview

Tax Loss Harvesting involves selling underperforming investments at a loss to offset capital gains, reducing taxable income as per IRS Code §1211.

Benefits

- Reduce Taxable Income: Offsets capital gains and up to $3,000 of ordinary income annually.

- Portfolio Rebalancing: Opportunity to adjust investment strategy.

Considerations and Risks

- Wash-Sale Rule Compliance: Cannot repurchase the same or substantially identical security within 30 days before or after the sale under IRS Code §1091.

- Market Risks: Selling assets may impact future returns.

- Documentation Requirements: Maintain records of transactions.

Implementation Details

- Implementation Timeline: Can be executed quickly, often at year-end.

- Professional Costs: Advisor fees typically 0.5% to 1% of assets.

- Maintenance Requirements: Ongoing portfolio monitoring.

Practical Example

Case Study: An investor has $100,000 in capital gains.

- Strategy: Sell underperforming stocks with $40,000 in losses.

- Tax Savings: Reduces taxable gains to $60,000, saving approximately $9,520 at a 23.8% capital gains tax rate.

Industry-Specific Considerations

- Venture Capitalists: Can offset gains from successful exits.

- Day Traders: Frequent trading provides opportunities for loss harvesting.

7. Charitable Trusts

Overview

Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) offer tax benefits while supporting philanthropic goals under IRS Code §664.

Benefits

- Immediate Tax Deductions: Based on the present value of future charitable gifts.

- Income Stream: CRTs provide income to the donor or beneficiaries.

- Estate Tax Reduction: CLTs can reduce taxable estates.

Considerations and Risks

- Irrevocable Commitment: Assets are permanently transferred.

- Complex Administration: Requires ongoing management.

- Strict Compliance: Must adhere to IRS regulations to maintain benefits.

Implementation Details

- Setup Timeline: 2-4 months.

- Professional Costs: Legal fees ranging from $5,000 to $15,000.

- Maintenance Requirements: Annual filings and trust administration.

Practical Example

Case Study: A business owner sells appreciated stock worth $2 million.

- Strategy: Transfer stock to a CRT.

- Benefits:

- Avoid Immediate Capital Gains Tax: Defers taxation.

- Receive Annual Income: Payments from the trust.

- Charitable Deduction: Potential deduction of $200,000.

Recent Court Case

Atkinson v. Commissioner (2000): Emphasized strict adherence to trust requirements to obtain tax benefits.

In simpler words: This is a tax case that centers around the very specific rules that need to be followed when setting up a special kind of trust called a “charitable remainder trust.” These trusts are designed to provide income to someone for a period of time, with the remaining assets eventually going to a charity. They can offer tax benefits, but only if they are set up exactly according to the law.

In this case, Mrs. Atkinson created a charitable remainder trust, but unfortunately, it didn’t perfectly follow all the technical requirements. Specifically, she didn’t cash two of the annual payments she was supposed to receive from the trust. This seemingly small oversight had significant consequences.

The court ruled that because the trust didn’t strictly adhere to all the rules, Mrs. Atkinson’s estate couldn’t claim the tax benefits associated with charitable remainder trusts. This case serves as a strong reminder that when dealing with these types of trusts, precision and attention to detail are critical. Even minor deviations from the rules can jeopardize the intended tax benefits.

Industry-Specific Considerations

- Art Collectors: Can donate appreciated artwork.

- Real Estate Developers: Use CRTs to manage highly appreciated property sales.

8. Opportunity Zone Investments

Overview

Investing in Qualified Opportunity Zones (QOZs) allows deferral and potential reduction of capital gains taxes under IRS Code §1400Z-2.

Benefits

- Tax Deferral: Defer capital gains tax until December 31, 2026.

- Tax Reduction: Potential 10% exclusion if held for five years.

- Tax-Free Appreciation: No tax on gains if investment held for at least 10 years.

Considerations and Risks

- Investment Risk: Projects in economically distressed areas.

- Complex Compliance: Must meet specific requirements.

- Documentation and Reporting: Requires filing Form 8996.

Implementation Details

- Investment Timeline: Must invest capital gains within 180 days.

- Professional Costs: Legal and advisory fees between $5,000 and $20,000.

- Maintenance Requirements: Annual reporting and compliance checks.

Practical Example

Case Study: An investor sells a business for a $1 million gain.

- Strategy: Invest $1 million into a QOF.

- Tax Benefits:

- Deferral: Postpone capital gains tax.

- Reduction: 10% basis step-up after five years.

- Exclusion: No tax on appreciation after 10 years.

Recent Legal Update

IRS Final Regulations (2020): Clarified operational rules for QOFs.

State-Specific Information

- Conformity States: States like New York conform to federal Opportunity Zone benefits.

- Non-Conformity States: California does not conform; state taxes are still due.

Industry-Specific Considerations

- Real Estate Development: Opportunities for building in underserved areas.

- Renewable Energy: Investments in solar or wind projects within QOZs.

9. Family Limited Partnerships (FLPs)

Overview

FLPs facilitate the transfer of assets to family members at discounted values, aiding in estate planning and tax reduction under IRS Code §2036.

Benefits

- Estate Tax Reduction: Apply valuation discounts for lack of control and marketability.

- Asset Protection: Shields assets from creditors.

- Control Retention: Senior family members can retain control as general partners.

Considerations and Risks

- IRS Scrutiny: Must have a legitimate non-tax purpose.

- Documentation Requirements: Formal partnership agreements and adherence to formalities.

- Potential Audit Triggers: Improper use can lead to assets being included in the estate.

Implementation Details

- Setup Timeline: 2-3 months.

- Professional Costs: Legal and valuation fees ranging from $10,000 to $25,000.

- Maintenance Requirements: Annual meetings, record-keeping.

Practical Example

Case Study: A family owns $15 million in investment assets.

- Strategy: Transfer assets to an FLP.

- Valuation Discounts: Apply 30% discount, reducing taxable estate value.

- Tax Implications: Potential estate tax savings of over $1 million.

Recent Court Case

Estate of Powell v. Commissioner (2017): Highlighted the importance of proper structuring and not retaining control.

In simpler words: This is a case that deals with estate taxes and the use of family limited partnerships (FLPs). FLPs are often used in estate planning to transfer assets to family members while potentially reducing estate taxes. However, there are specific rules that must be followed to make sure the FLP is legitimate in the eyes of the IRS.

In this case, the court found that the FLP created by Mrs. Powell before her death didn’t meet those requirements. She kept too much control over the assets in the FLP, and the way it was structured didn’t truly remove those assets from her estate. As a result, the court said that the assets in the FLP should be included in her estate for tax purposes.

This case emphasizes the importance of careful planning and proper structuring when using FLPs in estate planning. It’s crucial to make sure that control over the assets is genuinely transferred and that the FLP serves a legitimate business purpose beyond just reducing estate taxes. Otherwise, the IRS might challenge the FLP and include the assets in the estate, leading to a higher tax bill.

Industry-Specific Considerations

- Family Farms: Useful for transferring agricultural assets.

- Private Equity: Families with investment holdings can benefit.

10. Section 1202 Stock Exclusion

Overview

Qualified Small Business Stock (QSBS) under IRS Code §1202 allows exclusion of capital gains upon sale if certain conditions are met.

Benefits

- Tax-Free Capital Gains: Exclude up to $10 million or 10 times the adjusted basis.

- Investor Attraction: Makes investing in your company more appealing.

Considerations and Risks

- Strict Eligibility Criteria: Must be a C Corporation, hold stock for over five years, and meet active business requirements.

- Industry Limitations: Certain businesses like professional services are excluded.

- Documentation Requirements: Maintain records to prove qualification.

Implementation Details

- Setup Timeline: Must acquire stock at original issue.

- Professional Costs: Legal fees ranging from $5,000 to $10,000.

- Maintenance Requirements: Compliance with operational requirements.

Practical Example

Case Study: An investor purchases $2 million in QSBS and sells it after six years for $12 million.

- Tax Benefit: Exclude $10 million of gain.

- Savings: Potential tax savings of approximately $2.38 million at a 23.8% rate.

Recent Court Case

Wilson v. Commissioner (2019): Underlined the necessity of meeting all QSBS requirements.

State-Specific Information

- California: Offers limited QSBS benefits; consult state tax laws.

Industry-Specific Considerations

- Biotech Firms: Often qualify and attract venture capital.

- Manufacturing Startups: Eligible if meeting criteria.

11. International Tax Planning

Overview

For businesses with international operations, understanding GILTI and FDII is crucial for tax efficiency.

GILTI Calculations

- Inclusion: U.S. shareholders of Controlled Foreign Corporations (CFCs) must include GILTI in taxable income under IRS Code §951A.

- Calculation:

- GILTI = Net CFC Tested Income – (10% of QBAI)

- Tax Rate: Effective rate of 10.5% after deductions.

Benefits

- FDII Deduction: Domestic C Corporations can deduct up to 37.5% of FDII under IRS Code §250.

- Global Competitiveness: Enhances after-tax earnings.

Considerations and Risks

- Complex Compliance: Requires detailed calculations and documentation.

- Regulatory Changes: Subject to international agreements like OECD BEPS.

- Reporting Requirements: Forms 5471, 8992, and transfer pricing documentation.

Implementation Details

- Setup Timeline: Ongoing; align with fiscal year.

- Professional Costs: International tax advisor fees ranging from $10,000 to $30,000 annually.

- Maintenance Requirements: Regular compliance and reporting.

Practical Example

Case Study: A U.S. company owns a foreign subsidiary with $2 million in net income and $5 million in tangible assets.

- GILTI Calculation:

- 10% of QBAI: $500,000.

- GILTI Income: $2 million – $500,000 = $1.5 million.

- Tax Liability:

- Before FTCs: $1.5 million x 21% = $315,000.

- After FTCs: Foreign taxes paid may reduce U.S. tax.

Recent Regulatory Updates

IRS Final Regulations (2020): Provided guidance on GILTI high-tax exclusions.

Industry-Specific Considerations

- Manufacturing Abroad: Tangible assets can reduce GILTI inclusion.

- Software Companies: May face higher GILTI; planning is essential.

12. State and Local Tax (SALT) Deduction Workarounds

Overview

With the federal SALT deduction capped at $10,000 under IRS Code §164(b)(6), some states offer Pass-Through Entity (PTE) taxes as a workaround.

Benefits

- Increased Federal Deductions: Allows the business to deduct state taxes at the entity level.

- Immediate Tax Relief: Reduces federal taxable income for owners.

Considerations and Risks

- State-Specific Legislation: Rules vary significantly.

- Election Deadlines: Must make timely elections.

- Compliance Requirements: Careful tracking and reporting.

Implementation Details

- Setup Timeline: Must elect before the tax year begins.

- Professional Costs: Tax advisor fees ranging from $1,000 to $3,000.

- Maintenance Requirements: Annual elections and state filings.

Practical Example

State-Specific Details

- New York:

- Election Deadline: March 15 annually.

- Tax Rate: Up to 10.9%.

- Compliance: File Form CT-6.

- California:

- Election Deadline: June 15 annually.

- Tax Rate: 9.3% on qualified net income.

- Compliance: Requires consent from qualified taxpayers.

Industry-Specific Considerations

- Professional Services: High-income entities benefit significantly.

- Real Estate Partnerships: Can leverage PTE taxes effectively.

XOA TAX’s Expertise

Navigating these advanced strategies requires specialized knowledge. At XOA TAX, we offer:

- Personalized Implementation Plans: Tailored timelines and schedules.

- Cost-Benefit Analyses: Detailed projections for informed decisions.

- State-Specific Guidance: Expertise in multi-state compliance.

- Industry-Specific Solutions: Customized strategies for your sector.

Our Credentials:

- Certified Public Accountants (CPAs)

- Tax Attorneys

- IRS Enrolled Agents

Frequently Asked Questions

Q1: How have COVID-related tax changes affected Cost Segregation Studies?

The CARES Act (2020) allows 100% bonus depreciation for Qualified Improvement Property (QIP), enabling immediate expensing and enhancing the benefits of Cost Segregation Studies.

Q2: Can you provide a detailed example of GILTI calculations for a software company?

A software company with minimal tangible assets abroad may have higher GILTI inclusion. For example, if the foreign subsidiary has $1 million in net income and $100,000 in tangible assets:

- GILTI Calculation:

- 10% of QBAI: $10,000.

- GILTI Income: $1 million – $10,000 = $990,000.

- Tax Liability:

- Before FTCs: $990,000 x 21% = $207,900.

Strategies: Consider increasing tangible assets or restructuring.

Q3: What are the recent court cases affecting the use of FLPs?

Estate of Powell v. Commissioner (2017) emphasized proper structuring and not retaining control over FLP assets to achieve estate tax benefits.

Q4: How do state-specific SALT workarounds function in states like California and New York?

In California, electing to pay PTE tax allows the entity to deduct state taxes at the federal level, bypassing the $10,000 cap. New York offers a similar mechanism, with specific rates and compliance requirements.

Q5: What are the costs and timelines involved in setting up a Captive Insurance Company?

The setup takes 6-12 months, with initial costs ranging from $75,000 to $150,000 and annual maintenance between $50,000 and $100,000.

Connect with XOA TAX

Ready to implement these strategies? XOA TAX is here to assist you every step of the way.

Website: www.xoatax.com

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: Get in Touch

Our experts are prepared to provide you with personalized, industry-specific tax solutions. Contact us today to schedule a consultation.

Disclaimer

This material is for informational purposes only and does not constitute legal, tax, or financial advice. Tax laws and regulations are complex and subject to change, including COVID-related provisions and state-specific laws. Consult a qualified professional before making any decisions based on this information. XOA TAX does not provide legal advice and recommends consulting with your legal advisor for legal matters.

anywhere

anywhere  anytime

anytime