As many of you approach retirement, you might be thinking about downsizing or relocating. Selling your home can be a significant financial decision, especially if you’ve lived there for a long time and it has greatly appreciated in value. Today, I’d like to discuss a tax-wise alternative to selling your appreciated home: aging in place.

Home Sale Tax Pathways

Path A: Sell Now

Current Home Sale

Decide to sell your appreciated home now

Apply Exclusion

Use $250K (single) or $500K (married) exclusion

Pay Taxes Now

Capital gains tax due on amount above exclusion

Path B: Age in Place

Keep Home

Continue living in your home

Step-up in Basis

Home value adjusts to fair market value at death

Heirs’ Benefit

Heirs only taxed on gains after inheritance

Understanding the Tax Implications of Selling Your Home

For many homeowners, the home sale gain exclusion provides substantial tax savings. Under IRC Section 121, this exclusion allows you to:

- Shelter up to $250,000 of profit from capital gains tax if you’re single

- Shelter up to $500,000 if you’re married filing jointly

- Use this exclusion multiple times during your lifetime (there is no lifetime limit)

However, to qualify for the exclusion, you must meet two key requirements:

- You must have owned and used the home as your primary residence

- This must be for at least two of the five years before the sale

Note: Special rules may apply if you had to move due to health issues, job changes, or unforeseen circumstances.

State Tax Considerations

Before making any decisions, be aware that state tax treatment of home sales may differ from federal rules. Some states:

- Have different exclusion amounts

- May not recognize the federal exclusion

- Offer special property tax relief programs for seniors

- Have unique basis calculation methods

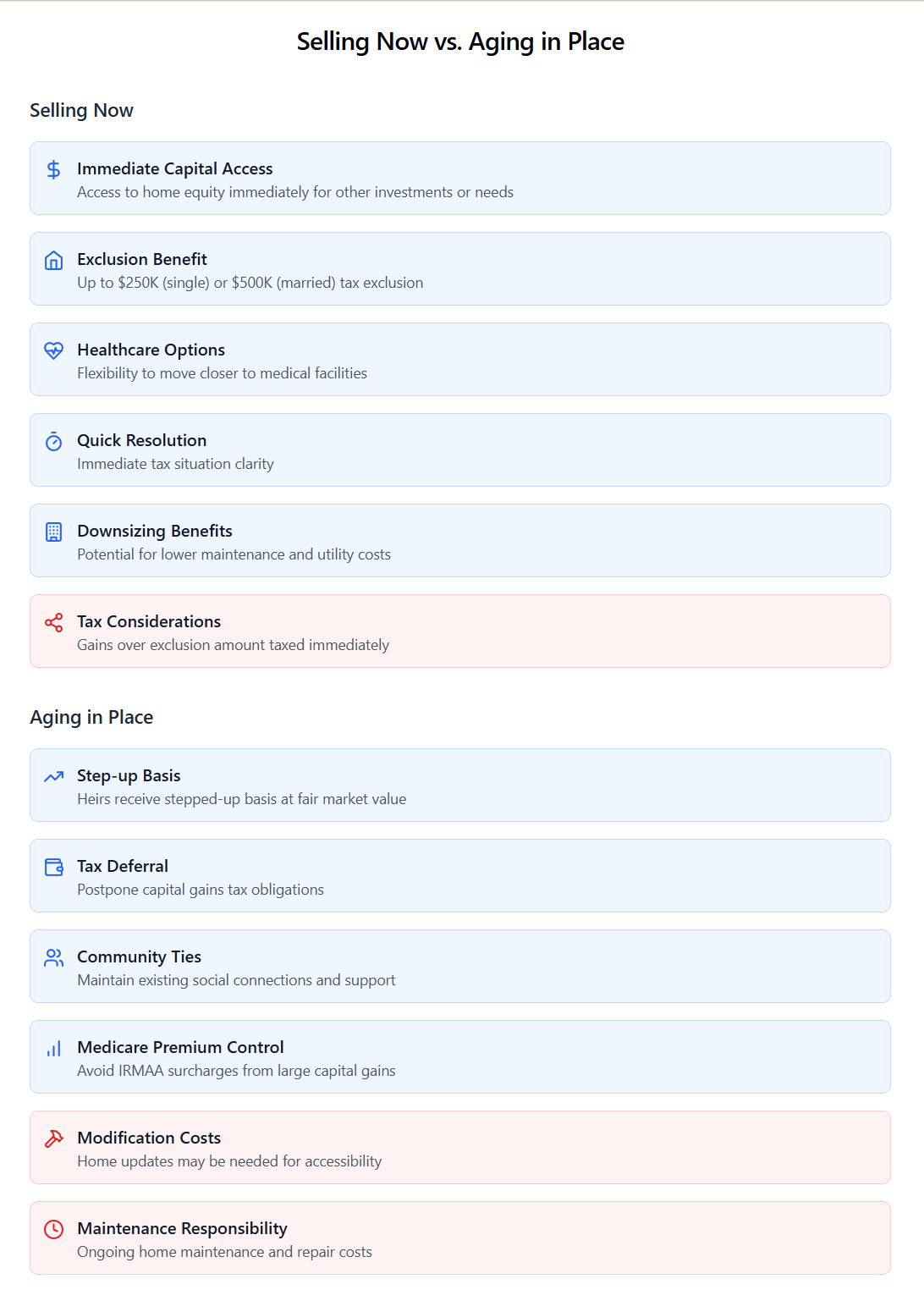

When Aging in Place Makes Sense

If you’re a senior whose home has appreciated significantly beyond the exclusion amounts, aging in place can be a smart tax strategy. Here’s why:

- When you pass away, your heirs will inherit your home at its fair market value as of the date of your death (known as the “step-up in basis”)

- Your heirs will only owe capital gains tax on any appreciation that occurs after they inherit the home

- This can potentially save hundreds of thousands in capital gains taxes

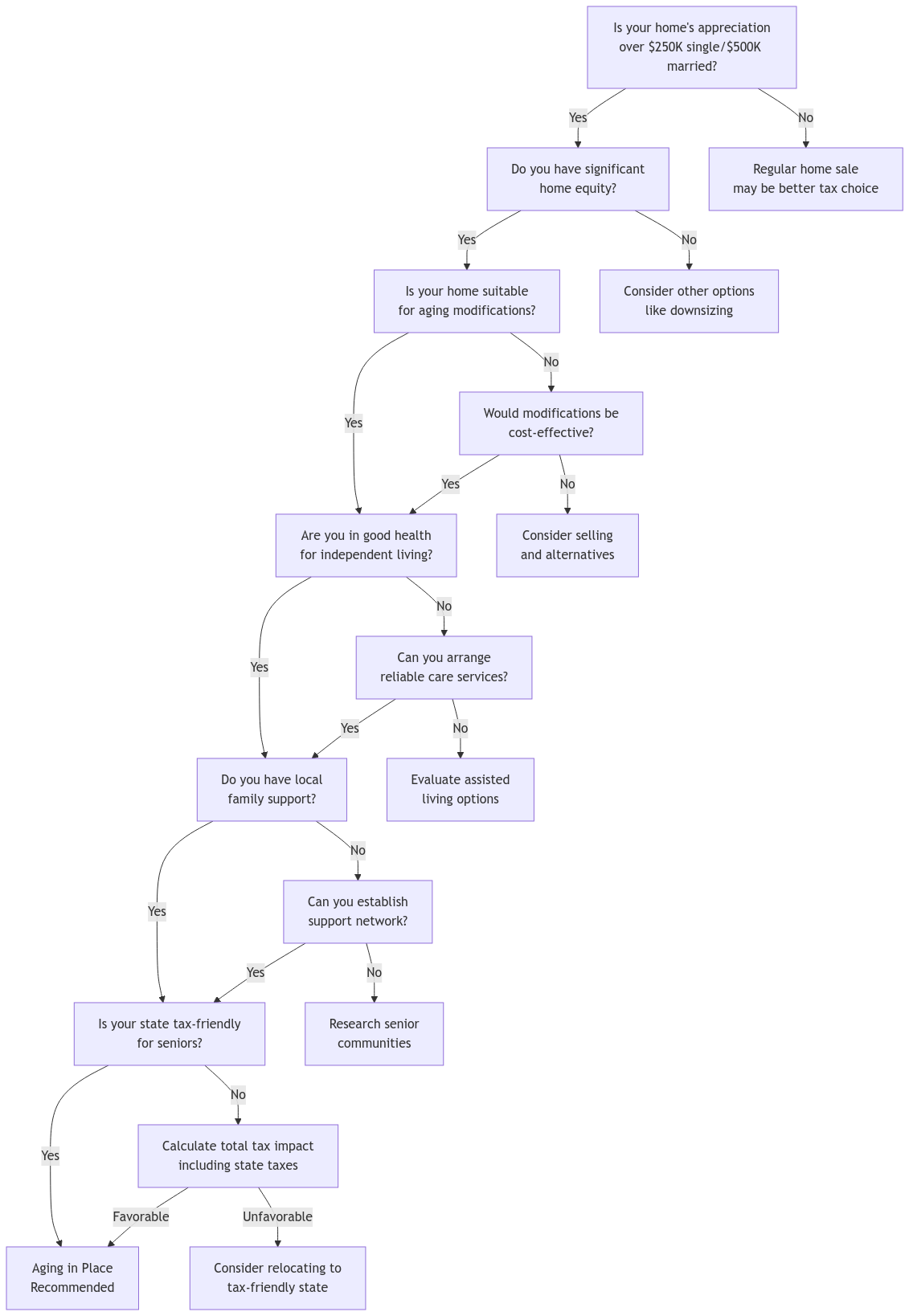

Is Aging in Place Right for You?

Use this decision tree to evaluate whether aging in place might be the right tax strategy for your situation:

Impact on Medicare Premiums

Important consideration: A large home sale could affect your Modified Adjusted Gross Income (MAGI), which determines your Medicare premiums. This could result in:

- Higher Part B premiums

- Increased Part D costs

- Income-Related Monthly Adjustment Amount (IRMAA) surcharges

Detailed Example with Tax Calculations

Let’s examine a scenario:

- Original purchase price: $100,000 (30 years ago)

- Current market value: $600,000

- Single homeowner

Scenario 1 – Selling Now:

- Gain: $500,000 ($600,000 – $100,000)

- Exclusion: $250,000

- Taxable gain: $250,000

- Potential tax (at 20% long-term capital gains rate): $50,000*

Scenario 2 – Aging in Place:

- Heir’s basis: $600,000 (fair market value at death)

- If heirs sell for $650,000

- Taxable gain: $50,000 ($650,000 – $600,000)

- Potential tax (at 20%): $10,000*

Note: Actual tax rates may vary based on income level and state of residence

Special Considerations for Married Couples

For married couples, several special provisions apply:

- Surviving Spouse Benefits:

- Can still qualify for the full $500,000 exclusion if:

- Sale occurs within 2 years of spouse’s death

- Haven’t remarried

- Met the ownership and use tests when spouse died

- Can still qualify for the full $500,000 exclusion if:

- Step-up in Basis Rules:

- In community property states: Both halves get stepped up

- In other states: Only the deceased spouse’s half gets stepped up

Documentation Requirements

To support your tax position, maintain records of:

- Original purchase documents and cost basis

- Home improvements and capital expenditures

- Property tax assessments

- Appraisals or value estimates

- Primary residence documentation

Additional Benefits of Aging in Place

Beyond tax advantages, consider these benefits:

Financial:

- Avoid moving costs:

- Potentially lower housing costs than assisted living:

- Preserve equity for future needs:

Personal:

- Maintain familiar surroundings:

- Keep existing social networks:

- Preserve independence:

- Control over living environment:

Making Aging in Place Work for You

Consider these practical steps:

Home Modifications:

- Install safety features (grab bars, ramps):

- Improve accessibility (wider doorways):

- Update lighting and flooring:

Care Planning:

- Research home health services:

- Investigate community resources:

- Discuss options with family:

Financial Planning:

- Review insurance coverage:

- Consider long-term care options:

- Evaluate home equity options:

Professional Guidance Checklist

Before deciding, consult with:

- Tax advisor about specific tax implications

- Financial planner for long-term financial impact

- Elder law attorney for estate planning

- Healthcare provider about aging-in-place viability

- Home modification specialist for necessary updates

References

For more information, consult:

- IRS Publication 523: Selling Your Home

- IRS Publication 551: Basis of Assets

- IRS Publication 554: Tax Guide for Seniors

- Local property tax assessor’s office

- State department of taxation

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime