Navigating the world of taxes can be confusing, especially for young adults and their families. One common question we hear is, “Am I a dependent?” It’s a crucial question because your dependency status can significantly impact your tax return – and maybe even someone else’s! So, let’s dive in and clear up any confusion.

What Does It Mean to Be a Dependent?

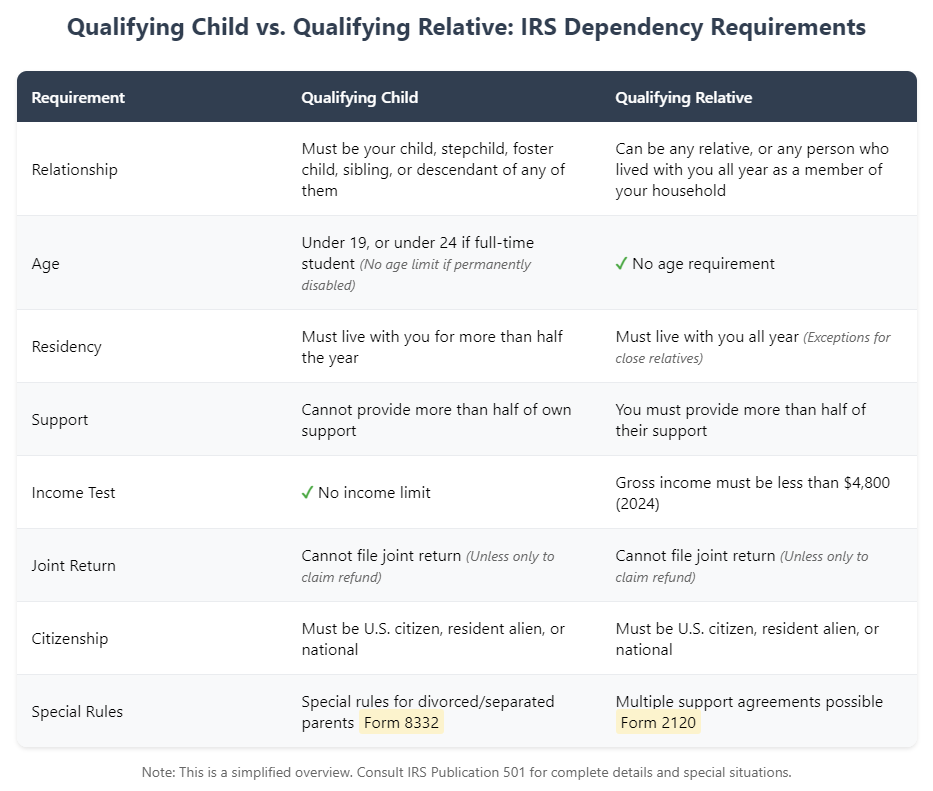

In the eyes of the IRS, a dependent is someone who relies on another taxpayer for financial support. This usually applies to children or other qualifying relatives. To figure out if someone is a dependent, the IRS uses a few key tests:

- Relationship Test: You have to be a qualifying child or relative of the taxpayer. This means a son, daughter, stepchild, foster child, sibling, stepsibling, half-sibling, or a descendant of any of them. It can also include parents, grandparents, aunts, uncles, and in-laws. (See IRS Publication 501 for a complete list.)

- Age Test: Generally, you need to be under 19 years old, or under 24 if you’re a full-time student. There’s also an exception for individuals who are permanently and totally disabled.

- Residency Test: You must have lived with the taxpayer for more than half the year.

- Support Test: You can’t have provided more than half of your own support (things like food, shelter, clothing, medical care, and education).

- Gross Income Test: For 2024, a qualifying relative’s gross income must be less than $4,800.

Busting Those Dependency Myths

There are a few common misconceptions about dependency that we often encounter:

- Myth: “If I’m a full-time student, I’m automatically a dependent.”

- Reality: While being a full-time student is a factor, it doesn’t automatically make you a dependent. The IRS looks at the whole picture, including your age, living situation, and who provides your support.

- Myth: “If I’m a dependent on someone else’s return, I can’t claim a dependent of my own.”

- Reality: This isn’t always true! It depends on your specific circumstances, such as your age, income, and whether you’re married.

Why Does Dependency Status Matter?

How Dependency Status Affects Your Taxes

Tax Credits

- Child Tax Credit (up to $2,000 per qualifying child)

- Earned Income Credit restrictions for dependents

- Credit for Other Dependents ($500)

- Child and Dependent Care Credit

Deductions

- Lower standard deduction for dependents

- Medical expense deduction considerations

- Student loan interest deduction limitations

- Itemized deduction restrictions

Filing Requirements

- Lower income thresholds for required filing

- Cannot file as Head of Household

- Cannot claim someone else as a dependent

- Joint return restrictions

Education Benefits

- American Opportunity Credit (up to $2,500)

- Lifetime Learning Credit (up to $2,000)

- Tuition and Fees Deduction limitations

- Scholarship/grant tax treatment

Dependency status can significantly impact your taxes. Here’s why:

- Claiming Certain Tax Benefits: If you’re claimed as a dependent on someone else’s return, you can’t claim certain tax credits or deductions on your own return. For example, you wouldn’t be able to claim the Child Tax Credit or the Earned Income Credit.

- Standard Deduction: Your standard deduction amount is lower if you’re claimed as a dependent.

- Filing Requirements: You might not even need to file a tax return if you’re a dependent and your income is below a certain threshold.

On the flip side, if you’re the one claiming a dependent, you might be able to claim certain tax benefits, like the Child Tax Credit or the Credit for Other Dependents.

Dependency and Education Tax Breaks

Your dependency status can also affect your eligibility for education tax benefits. If someone claims you as a dependent, you can’t claim the American Opportunity Tax Credit (AOTC) on your tax return. However, the person claiming you might be able to claim the AOTC (up to $2,500 per eligible student) or the Lifetime Learning Credit (up to $2,000) for your educational expenses, depending on their income and other eligibility factors.

When Things Get Complicated: Special Circumstances

Life throws curveballs, and sometimes family situations make dependency claims a bit more complex. Here are a few scenarios we’ve encountered:

- Estranged Parents: If a child lives with a relative other than their parents due to estrangement or family difficulties, things can get tricky. The relative providing support might be able to claim the child, even if the parents are still legally responsible. It’s essential to keep detailed records of who’s providing support and where the child lives. In cases of divorced or separated parents, the IRS has a “Special Rule for Children of Divorced or Separated Parents” (see IRS Publication 504), and Form 8332 may be required.

- Shared Custody: When parents are divorced or separated, the parent with whom the child lives for most of the year typically claims them. But, parents can sometimes agree to alternate claiming the child each year.

- Abuse or Neglect: If a child lives with someone other than their parents due to abuse or neglect, the caregiver might be able to claim them, even if they don’t meet all the usual dependency requirements. Documentation is crucial in these situations, and it’s wise to seek guidance from a tax professional or social services.

What if a Parent Claims a Child Wrongly?

If you believe a parent is claiming a child as a dependent when they shouldn’t be, here’s what you can do:

- Talk to the parent: Try to resolve the issue amicably. Explain the dependency rules and show them documentation of who’s providing support.

- Contact the IRS: If talking doesn’t work, you can report the situation to the IRS. Be prepared to provide evidence to support your claim.

- File your own tax return: If you meet the requirements to claim the child, go ahead and file your own tax return claiming them. You might need to fill out Form 8332, Release of Claim to Exemption for Child of Divorced or Separated Parents, if it applies to your situation.

Protecting Yourself with an Identity Protection PIN (IP PIN)

Identity theft can throw a wrench into dependency claims. If you’re worried about someone wrongly claiming you or your child, the IRS offers a helpful tool called the Identity Protection PIN (IP PIN).

What is an IP PIN?

It’s a six-digit number that acts like a secret code for your tax records. It helps prevent someone else from filing a tax return using your Social Security number.

Who should get an IP PIN?

- Victims of identity theft: The IRS might automatically send you an IP PIN if you’ve experienced identity theft or tax-related fraud.

- Anyone who wants extra protection: You can proactively request an IP PIN for added security. As of 2024, IP PINs are available to all taxpayers nationwide.

How to get an IP PIN:

You can get an IP PIN online using the IRS’s Get an IP PIN tool. You’ll need to verify your identity through a secure process.

Important things to remember about IP PINs:

- Keep your IP PIN confidential. Don’t share it with just anyone.

- Renew your IP PIN every year. The IRS will send you a new one annually.

How to Avoid Being Claimed as a Dependent

If you want to avoid being claimed as a dependent, here are a few things you can do:

- Increase your income: If you provide more than half of your own financial support, you can’t be claimed as a dependent.

- Move out: If you don’t live with your parents or guardians for more than half the year, you can’t be claimed as a dependent.

- File a joint return: If you file a joint return with your spouse, you can’t be claimed as a dependent on someone else’s return.

- Get married: Marriage generally makes you an independent taxpayer for federal tax purposes, even if you meet other dependency criteria.

Remember, even if you meet the criteria for dependency, you can always talk to your parents or guardians about whether they claim you. If they agree not to, you can claim yourself on your tax return.

FAQ

Can I be claimed as a dependent if I file a joint return?

Nope! If you file a joint return, you can’t be claimed as a dependent on someone else’s return.

Can I be claimed as a dependent if I’m married?

Generally, no. Marriage usually makes you independent for tax purposes.

Can I claim myself as a dependent?

No, you can’t claim yourself.

Can I claim my parent as a dependent?

You might be able to! If you provide more than half of their financial support and they meet the other dependency requirements, you can potentially claim them.

A Quick “Am I a Dependent?” Checklist

To help you quickly assess your potential dependency status, consider these questions:

- Age: Are you under 19, or under 24 and a full-time student?

- Living Situation: Do you live with your parents or another relative for more than half the year?

- Support: Who pays for most of your expenses (food, housing, medical, etc.)?

- Income: Is your gross income less than $4,800 (for 2024)?

If you answered “yes” to most of these questions, you might be considered a dependent.

Understanding the Support Test: An Example

Figuring out who provides the most support can be tricky. Use our interactive calculator below to help determine your support status:

Support Test Calculator

Enter your expenses to determine if you meet the IRS support test for dependency.

Figuring out who provides the most support can be tricky. Here’s an example to help you understand how it works:

Example Support Calculation:

Imagine the total cost of your support for the year (housing, food, education, medical, etc.) is $24,000. This breaks down as follows:

- Housing: $12,000

- Food: $6,000

- Education: $4,000

- Medical: $2,000

If you personally provided $11,000 of this support, you wouldn’t exceed half ($12,000), so you could potentially be claimed as a dependent by someone else. However, if you provided $13,000, you would have provided more than half of your own support and couldn’t be claimed as a dependent.

Important Note: Keep accurate records of your expenses and who paid for them. This will help you determine whether you meet the support test. While this guide focuses on federal tax rules, state dependency rules may differ. Some states follow federal guidelines, while others have their own criteria. Check with your state’s tax authority or a tax professional for state-specific guidance.

Essential Documentation Checklist

Keep these records to support your dependency claim

Required Documents

- Birth certificates or legal documents proving relationship

- Social Security cards or tax ID numbers

- School records proving student status

- Lease agreement or property records showing residency

- Medical bills and receipts

- Proof of income (W-2s, 1099s, etc.)

Financial Records

- Utility bills and payment records

- Grocery and household expense receipts

- Education expense records

- Childcare payment receipts

- Bank statements showing support payments

- Insurance payments (health, car, etc.)

Special Situation Documents

- Form 8332 (divorced/separated parents)

- Multiple support agreements

- Disability verification

- Non-citizen documentation

- Court orders or custody agreements

- Death certificates (if applicable)

Important: This checklist is a general guide. Your specific situation may require additional documentation. Consult with a tax professional for personalized advice.

Connecting with XOA Tax

We know taxes can be confusing, especially when it comes to dependency rules and special circumstances. If you have any questions or need help with your specific situation, please don’t hesitate to contact us!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime