So, you’ve dreamt of building your own online business, and Amazon FBA seems like the perfect launchpad. But where do you even begin?

Fear not, fellow entrepreneur! This comprehensive guide will walk you through the ins and outs of Amazon FBA, equipping you with the knowledge and confidence to navigate this exciting platform. From finding winning products and crafting compelling listings to understanding fees and mastering inventory management, we’ll cover it all.

Plus, we’ll sprinkle in some expert tips from us, your friendly CPAs at XOA TAX, to help you stay on top of the financial side of your FBA venture. Ready to dive in? Let’s get started!

Key Takeaways

- FBA Explained: We’ll break down how Fulfillment by Amazon (FBA) works and why it’s a game-changer for online sellers.

- Product Research Goldmine: Discover proven strategies for finding profitable products that align with your business goals.

- Listing Optimization Secrets: Learn how to create product listings that grab attention and convert browsers into buyers.

- Inventory Management Mastery: Find the sweet spot between meeting demand and avoiding excessive storage fees.

- Marketing and Advertising Power-Ups: Explore Amazon’s advertising tools to boost your product visibility and drive sales.

- The Fee Landscape: Understand the various FBA fees and how they impact your bottom line.

- Tax and Compliance Compass: We’ll highlight essential tax considerations for FBA sellers and how XOA TAX can help.

What is Amazon FBA?

Imagine this: You’ve found the perfect product, and orders are pouring in. But packing each order, printing shipping labels, and dealing with customer inquiries? That can quickly turn into a full-time job (and a stressful one at that!).

Enter Amazon FBA, your all-in-one solution for streamlined order fulfillment. You send your products to Amazon’s vast fulfillment centers, and they handle the heavy lifting – storing, packing, shipping, and even providing customer service. It’s like having a dedicated team working behind the scenes, allowing you to focus on growing your business.

Why Choose Amazon FBA?

- Prime Advantage: Your products become Prime eligible, granting you access to millions of Prime members who often prioritize Prime items in their searches.

- Increased Visibility: Prime eligibility can boost your product’s visibility in search results, leading to increased traffic and sales.

- Shipping Simplified: Say goodbye to the hassle of shipping! Amazon takes care of everything, from packing and labeling to delivery and returns.

- Customer Service Support: Amazon handles customer inquiries, returns, and refunds, freeing you from time-consuming customer service tasks.

Getting Started: Setting Up Your Account

Ready to embark on your FBA journey? The first step is creating an Amazon Seller account. You’ll need to provide some basic information about yourself and your business, including your tax identification number.

Next, you’ll choose between an Individual plan and a Professional plan.

- Individual Plan: Ideal for sellers who anticipate selling fewer than 40 items per month. You’ll pay $0.99 per item sold, plus other selling fees.

- Professional Plan: Best for sellers who plan to sell more than 40 items per month. It costs $39.99 per month, regardless of how many items you sell, and provides access to advanced selling tools and reports.

Product Research: Finding Your Niche

Now for the exciting part – finding products that will fly off the virtual shelves! Effective product research is crucial for FBA success. Here are some key factors to consider:

- Best Sellers Rank (BSR): This metric indicates how well a product is selling within its category. A lower BSR generally means higher sales volume.

- Competition Analysis: Analyze the existing competition for your chosen product. Look for niches with high demand and moderate competition.

- Profit Margin Calculations: Factor in all costs, including product sourcing, FBA fees, and advertising, to determine your potential profit margin.

- Return on Investment (ROI): Aim for a healthy ROI to ensure your business is profitable and sustainable.

XOA TAX Tip: Accurate record-keeping is essential for tracking your product costs and calculating your profits. We can help you set up a system that works for your business.

Creating Product Listings That Convert

Think of your product listing as your online storefront. It needs to be eye-catching, informative, and persuasive. Here’s how to create listings that shine:

- Keyword-Rich Titles: Use relevant keywords that accurately describe your product and align with what shoppers are searching for.

- High-Quality Images: Showcase your product with professional-looking photos that highlight its features and benefits.

- Compelling Descriptions: Write clear, concise, and engaging descriptions that highlight the key features, benefits, and uses of your product.

- A+ Content (Professional Sellers): Enhance your brand and product story with visually rich content, including comparison charts and enhanced images.

Prepping and Shipping Inventory

Time to get your products ready for their Amazon adventure! Ensure they’re packaged securely and labeled according to Amazon’s FBA guidelines to prevent delays or damage during transit.

Pro Tip: Start with a small batch of inventory to familiarize yourself with the FBA shipping process before sending large quantities.

Mastering Inventory Management

Maintaining optimal inventory levels is a delicate balancing act. You want to have enough stock to meet demand but not so much that you incur excessive storage fees. Amazon provides tools to help you track your inventory, forecast demand, and avoid stockouts or long-term storage fees.

Marketing and Advertising Your Products

In the competitive Amazon marketplace, effective marketing and advertising are essential for driving visibility and sales. Here are some key strategies:

- Pay-Per-Click (PPC) Advertising: Create targeted ad campaigns that appear when shoppers search for relevant keywords. Typical cost-per-click (CPC) can range from $0.50 to $3.00 or more for competitive categories like electronics or supplements, while less competitive categories like home goods might have lower CPCs. Start with a manual campaign targeting specific keywords and experiment with automatic campaigns.

- Amazon’s Brand Registry: Enroll in Brand Registry to access enhanced marketing features, such as A+ Content and Sponsored Brands ads. You’ll need a registered trademark to enroll. Brand Registry also allows you to create an Amazon storefront and access enhanced brand content options.

- Optimize Product Listings: Continuously optimize your listings with relevant keywords, high-quality images, and compelling copy to improve organic ranking.

Providing Excellent Customer Service

While Amazon handles many aspects of customer service, you still play a vital role in ensuring customer satisfaction. Respond promptly and professionally to customer inquiries, address any issues or complaints, and strive to build a loyal customer base.

Understanding the Fees

Amazon FBA comes with various fees, so it’s crucial to understand the fee structure to accurately calculate your profit margins. Here’s a breakdown of the main fees:

- Fulfillment Fees: These cover the cost of picking, packing, shipping, and handling customer service for your orders.

- Storage Fees: You’ll pay a monthly fee to store your inventory in Amazon’s fulfillment centers. These fees vary based on product size, weight, and the time of year. (See table below for details).

- Long-Term Storage Fees: If your inventory sits in a fulfillment center for more than 365 days, you’ll incur additional long-term storage fees. (See example calculation below).

- Referral Fees: Amazon charges a percentage of each sale as a referral fee, which varies by product category. (See section on Category Insights below).

Monthly Inventory Storage Fees

| January – September | October – December | |

|---|---|---|

| Standard-Size | $0.75 per cubic foot | $2.40 per cubic foot |

| Oversize | $1.15 per cubic foot | $3.70 per cubic foot |

Example of Long-Term Storage Fee Calculation:

Let’s say you have 100 units of a standard-size item that have been in a fulfillment center for over a year. Each unit occupies 0.5 cubic feet. The long-term storage fee is $6.90 per cubic foot.

- Total cubic feet: 100 units x 0.5 cubic feet/unit = 50 cubic feet

- Long-term storage fee: 50 cubic feet x $6.90/cubic foot = $345

For the most up-to-date fee information, please refer to Amazon’s official fee schedule

Category Insights

Referral fees vary depending on the product category. Here are some examples:

- Clothing & Accessories: 17%

- Beauty: 15%

- Home & Kitchen: 15%

- Books: 15%

- Electronics: 8%

Note: Some product categories are restricted or require approval to sell on Amazon. For a complete list of categories and their requirements, please refer to Amazon’s Seller Central Help.

Navigating the Tax Landscape

Selling on Amazon FBA has tax implications, and it’s essential to stay compliant with all applicable laws and regulations. Here are some key considerations:

- Sales Tax Nexus: Understand nexus laws to determine where you have a sales tax obligation. Economic nexus thresholds vary by state. For example, some states require businesses to collect sales tax if they have more than $100,000 in sales or 200 transactions within the state.

- Inventory Accounting: Choose an appropriate inventory accounting method (FIFO, LIFO, or weighted average) to accurately track your inventory costs.

- State-Specific Tax Obligations: Be aware of state-specific tax requirements, such as income tax and sales tax.

XOA TAX is Here to Help: We can guide you through the complexities of FBA taxes, ensuring you’re maximizing deductions and minimizing your tax liability.

Advanced FBA Strategies

Once you’ve mastered the basics, consider exploring these advanced FBA strategies:

- Virtual Bundles: Create virtual bundles of complementary products to offer increased value and convenience to your customers.

- FBA Small and Light Program: Reduce fulfillment fees for eligible small and lightweight products. To qualify, your product must weigh under 16 ounces, have a selling price of $10 or less, and meet specific dimension requirements.

- Amazon Global Logistics: Expand your reach and sell internationally with Amazon’s global logistics solutions.

Risk Management for FBA Sellers

While FBA offers many advantages, it’s important to be aware of potential risks and implement strategies to mitigate them:

- Inventory Diversification: Avoid relying on a single product or supplier to minimize the impact of supply chain disruptions or changing market trends.

- Account Suspension Prevention: Adhere to Amazon’s policies and terms of service to prevent account suspension. Carefully review product listing guidelines, maintain high customer service standards, and ensure your products comply with all safety regulations.

- Insurance Requirements: Consider obtaining appropriate insurance coverage to protect your business from potential liabilities, such as product liability insurance or business interruption insurance.

Expanding Your Reach: International Selling

Amazon FBA provides opportunities to expand your business globally. Explore these international selling programs:

- European Fulfillment Network (EFN): Fulfill orders from across Europe using your inventory stored in a single European fulfillment center.

- North America Remote Fulfillment (NARF): Fulfill orders from Canada and Mexico using your US-based inventory.

- Pan-European FBA: Store your inventory in Amazon’s European fulfillment centers and fulfill orders across Europe, optimizing delivery times and reducing shipping costs.

Staying Ahead in the FBA Game

The Amazon marketplace is constantly evolving. To maintain a competitive edge, it’s crucial to stay informed about the latest trends, policy changes, and best practices.

- Recent Policy Changes: Stay up-to-date on Amazon’s policy updates, such as changes to FBA storage limits, product listing guidelines, or category restrictions.

- Inventory Performance Index (IPI): Monitor your IPI score, which measures your inventory management efficiency. A low IPI can lead to storage limitations and higher fees. To improve your IPI, focus on optimizing your inventory levels, fixing stranded inventory, and increasing your sell-through rate.

- Restock Limits: Be aware of restock limits, which restrict the amount of inventory you can send to fulfillment centers. These limits are based on your sales history, IPI score, and available storage capacity.

Seasonal Selling Strategies

Maximize your sales during peak seasons by implementing effective seasonal selling strategies:

- Inventory Planning: Forecast demand for seasonal products and ensure you have enough inventory to meet customer needs without overstocking.

- Promotional Strategies: Leverage Amazon’s promotional tools, such as Lightning Deals and coupons, to drive sales during key shopping events like Prime Day, Black Friday, and Cyber Monday.

- Optimize Listings for Seasonal Trends: Update your product listings with relevant keywords and imagery that reflect seasonal trends and search patterns.

Common Pitfalls to Avoid

Steer clear of these common pitfalls that can hinder your FBA success:

- Inadequate Product Research: Thoroughly research your product niche to ensure there is sufficient demand, healthy profit margins, and manageable competition.

- Neglecting Keyword Optimization: Optimize your product listings with relevant keywords to improve visibility in search results.

- Failing to Comply with Amazon’s Policies: Carefully review and adhere to Amazon’s selling policies and terms of service to avoid account suspension or penalties.

- Poor Inventory Management: Avoid overstocking or understocking by accurately forecasting demand and monitoring your inventory levels.

- Ignoring Customer Service: Respond promptly and professionally to customer inquiries and address any issues or complaints to maintain high customer satisfaction.

Estimating Startup Costs

Launching an Amazon FBA business involves various startup costs. Here’s a basic breakdown of typical expenses:

- Product Sourcing: The cost of purchasing your initial inventory from manufacturers or suppliers.

- Inventory: The cost of storing your inventory, either in your own warehouse or at an Amazon fulfillment center.

- Shipping: The cost of shipping your inventory to Amazon fulfillment centers.

- Amazon Fees: FBA fees, including fulfillment fees, storage fees, and referral fees.

- Marketing: The cost of advertising your products on Amazon and other platforms.

- Other Expenses: Business registration fees, packaging materials, and other miscellaneous expenses.

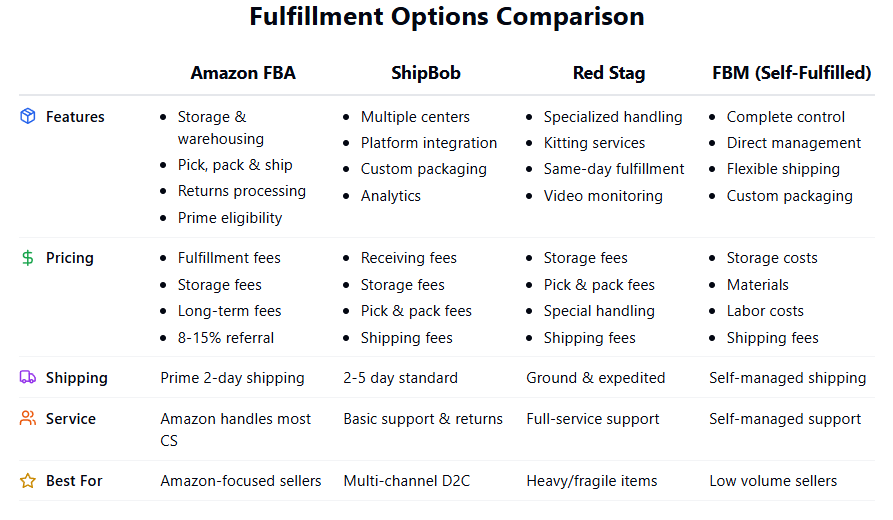

Comparing Fulfillment Options

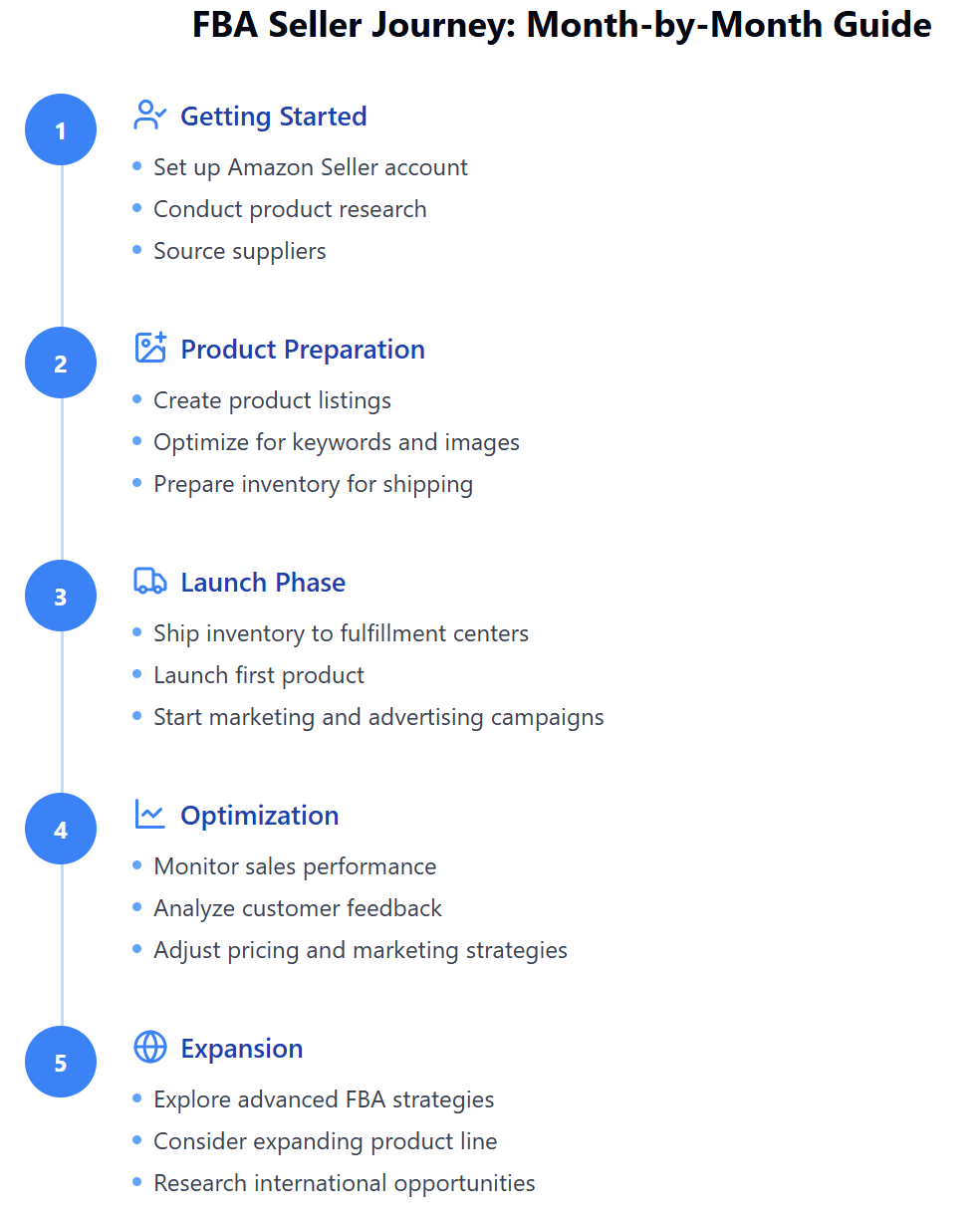

New Seller Timeline

- Month 1: Set up Amazon Seller account, conduct product research, source suppliers.

- Month 2: Create product listings, optimize for keywords and images, prepare inventory for shipping.

- Month 3: Ship inventory to Amazon fulfillment centers, launch first product, start marketing and advertising campaigns.

- Month 4: Monitor sales performance, analyze customer feedback, adjust pricing and marketing strategies as needed.

- Month 5: Explore advanced FBA strategies, consider expanding product line or selling internationally.

Tracking Your Success

Monitor these key metrics to measure your FBA success and identify areas for improvement:

- Sales Revenue: Track your overall sales revenue and identify your top-performing products.

- Conversion Rates: Measure the percentage of visitors who purchase your products.

- Customer Reviews: Monitor your product ratings and customer feedback to identify areas for improvement.

- Inventory Performance: Track your inventory levels, sell-through rates, and IPI score to optimize your inventory management.

- Advertising Performance: Analyze the performance of your PPC campaigns, including impressions, clicks, and conversion rates.

FAQs

How much does it cost to use FBA?

FBA fees vary based on several factors, including product size and weight, storage time, and shipping distance. Use Amazon’s FBA Revenue Calculator to estimate your costs. For example, a standard-size non-media item weighing 1 lb. would incur a fulfillment fee of $3.19 if shipped to a customer within the contiguous US.

What if my product doesn’t sell?

Thorough product research and effective marketing can help minimize this risk. You can also adjust your pricing, experiment with different advertising strategies, or consider creating product bundles to increase value and appeal.

Can I sell internationally using FBA?

Yes, Amazon offers various programs for international selling, such as the European Fulfillment Network (EFN), North America Remote Fulfillment (NARF), and Pan-European FBA.

Do I need a business license to use FBA?

Licensing requirements vary depending on your location, business structure, and the type of products you sell. It’s best to consult with a legal professional or your local government to ensure you comply with all regulations.

How can I improve my product rankings on Amazon?

Focus on optimizing your listings with relevant keywords, high-quality images, and compelling descriptions. Encourage satisfied customers to leave positive reviews, and leverage Amazon’s advertising tools to increase your visibility.

Connecting with XOA TAX

Feeling overwhelmed by the financial complexities of your Amazon FBA business? XOA TAX is here to guide you! We can help you:

- Navigate FBA fees and maximize your deductions.

- Understand sales tax nexus and ensure compliance.

- Choose the right inventory accounting method.

- Develop a tax-efficient strategy for your FBA business.

Contact us today for a free consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime