Have you ever filed your taxes and then felt a little nervous afterward? Like, what if you made a mistake? What if the IRS has questions? It’s a common worry! Many people find taxes confusing, and the thought of an audit can be scary. But that’s where audit support comes in. Think of it like having a tax expert in your corner, ready to help if the IRS comes knocking. At XOA TAX, we’re here to guide you through the process and make sure you’re prepared for anything.

Key Takeaways

- Audit support is like having a tax expert on your side to help with IRS questions.

- XOA TAX offers more than just basic tax preparation; we help you understand the rules and handle any issues that come up.

- Planning ahead can reduce your chances of being audited.

- We can help you understand complex tax rules and make sure your taxes are done right.

What is Audit Support?

Many people hire someone to prepare their taxes, but that doesn’t always include help with an audit. An audit is when the IRS takes a closer look at your tax return. It can be a complicated process, and it’s helpful to have someone experienced to guide you. That’s where XOA TAX comes in! We have a team of CPAs and tax attorneys who know tax laws inside and out. We’re here to help you understand what’s happening and make sure you’re treated fairly.

Why is Audit Support Important?

Imagine this: you get a letter from the IRS saying they want to audit your tax return. It can be a stressful situation! But with audit support, you have someone to help you understand the letter, gather the necessary documents, and even represent you in front of the IRS. This can save you a lot of time, worry, and potentially even money.

How XOA TAX Can Help

At XOA TAX, we believe in being proactive. That means we don’t just prepare your taxes; we help you plan to avoid problems in the first place. We’ll work with you to understand your specific situation and find ways to reduce your chances of being audited.

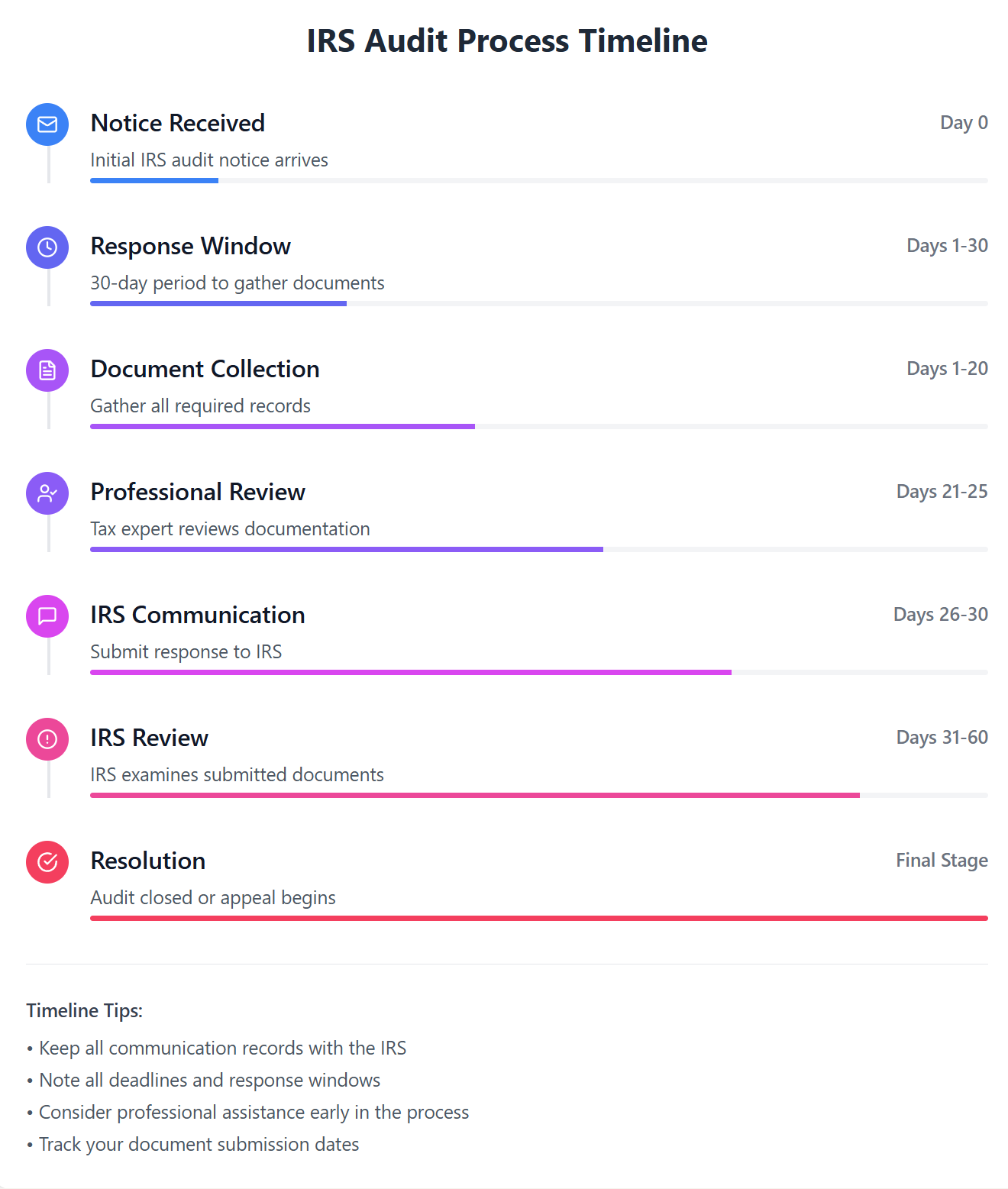

IRS Audit Process Timeline

Notice Received

Day 0You receive an IRS audit notice (CP2000 or similar) explaining what items are being reviewed.

The IRS will specify which items on your return are being examined and what documentation they need.

Response Window

Days 1-30You have 30 days to respond to the initial notice.

During this time, you should gather required documents and consult with a tax professional.

Document Gathering

Days 1-20Collect and organize all requested documentation.

Common documents include receipts, bank statements, and supporting records for deductions.

Professional Review

Days 21-25Tax professional reviews documents and prepares response.

Your tax professional will ensure all documentation is complete and properly organized.

IRS Review Period

Days 31-60IRS reviews your response and documentation.

The IRS typically takes 30-45 days to review submitted documentation.

Resolution

Final StageAudit is closed or appeal process begins.

If you disagree with the findings, you have 30 days to appeal the decision.

More Than Just Taxes

We also offer other helpful services like bookkeeping and payroll. This helps us get a complete picture of your finances and give you the best advice possible.

Understanding IRS Procedures

IRS procedures can be tricky. Our team stays current on all the latest tax laws and regulations to ensure your tax filings are accurate and compliant. We’ll handle all the communication with the IRS so you don’t have to!

Types of Audits

- Correspondence Audits: These are the most common and are usually handled through the mail. They typically involve simple questions or requests for documentation.

- Office Audits: These take place at an IRS office. They’re more in-depth than correspondence audits and might involve a review of more complex issues.

- Field Audits: These are the least common and are conducted at your home or business. They’re usually reserved for the most complex cases.

What Triggers an Audit?

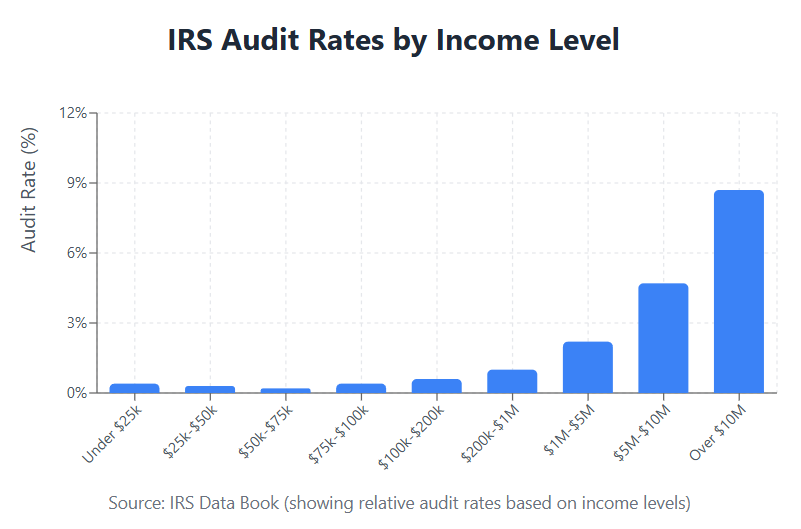

While anyone can be audited, some things make it more likely:

- Math errors on your return

- Mismatched information between your return and IRS records

- High income

- Claiming certain deductions or credits

- Being randomly selected

According to the IRS, the overall audit rate for individual tax returns in 2022 was less than 1%. However, the audit rate for those with incomes over $1 million was significantly higher, around 8%. It’s important to note that certain deductions or credits can also increase your chances of being audited.

Client Success Story

A small business owner was feeling overwhelmed by an IRS audit. They didn’t know where to start or what to do. XOA TAX stepped in and helped them understand the process, gather the right documents, and successfully resolve the audit. This allowed the business owner to get back to focusing on their business instead of worrying about taxes.

Affordable and Transparent Services

We believe everyone should have access to quality tax services. We offer affordable and transparent pricing so you know exactly what you’re paying for.

Preparing for a Potential Audit: A Checklist

- Keep your financial records organized.

- Make sure you have records of all your income and expenses. This includes things like:

- W-2s and 1099s (for income)

- Receipts and invoices (for expenses)

- Bank statements

- Credit card statements

- Learn some basic tax laws that apply to you.

- Talk to a tax professional for personalized guidance. We’re here to help!

How Long Should You Keep Tax Records?

The general rule is to keep your tax records for at least 3 years from the date you filed your return or the date you paid your taxes, whichever is later. However, there are some situations where you might need to keep them longer like 6-7 years. Link to the IRS page on record-keeping here

Frequently Asked Questions (FAQs)

What can cause an IRS audit?

Lots of things, like math errors, differences between your reported income and what the IRS has on file, or even just being randomly selected.

What if I get an audit notice?

Don’t panic! Call XOA TAX right away. We’ll help you understand what’s happening and guide you through the process.

How can I reduce my chances of being audited?

Keep good records, make sure everything is accurate, and plan ahead.

Peace of Mind with XOA TAX

With XOA TAX, you can relax knowing that your taxes are in good hands. Our team provides personalized support, allowing you to focus on what matters most to you.

Our Commitment to Confidentiality

At XOA TAX, we understand that your financial information is private. We are committed to protecting your confidentiality and handling your information with the utmost care.

Virtual Audit Support

We know that life can be busy. That’s why we offer virtual audit support, so you can get the help you need from the comfort of your own home or office.

Fee Structures

We offer different levels of audit support to meet your specific needs and budget. Contact us today to learn more about our fee structures and how we can help you.

Digital Document Organization

Keeping your tax documents organized can be a challenge. We can help you set up a digital system to keep track of everything efficiently and securely.

Responding to IRS Notices

It’s important to respond to IRS notices promptly and accurately. Most notices have a 30-day response deadline, but this can vary. We can help you understand the notice and ensure you meet all the requirements.

Penalties and Interest

Failing to pay taxes owed can result in penalties and interest. The IRS provides detailed information about penalties and interest on their website. Link to IRS page on penalties and interest

Payment Plans

If you can’t afford to pay your tax liability in full, the IRS offers payment plan options. We can help you explore these options and find a solution that works for you.

Conclusion

Taxes can be complicated, but you don’t have to face them alone. XOA TAX offers comprehensive audit support and IRS representation to help you navigate the process with confidence. We’re here to answer your questions, explain things clearly, and provide the guidance you need.

Ready to take the stress out of tax season? Schedule a consultation with one of our tax experts today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime