Navigating the world of taxes can be challenging, and for families with autistic children, it can feel even more complex. At XOA TAX, we understand these complexities. This guide sheds light on how the IRS views autism and outlines potential tax benefits available to families in the US.

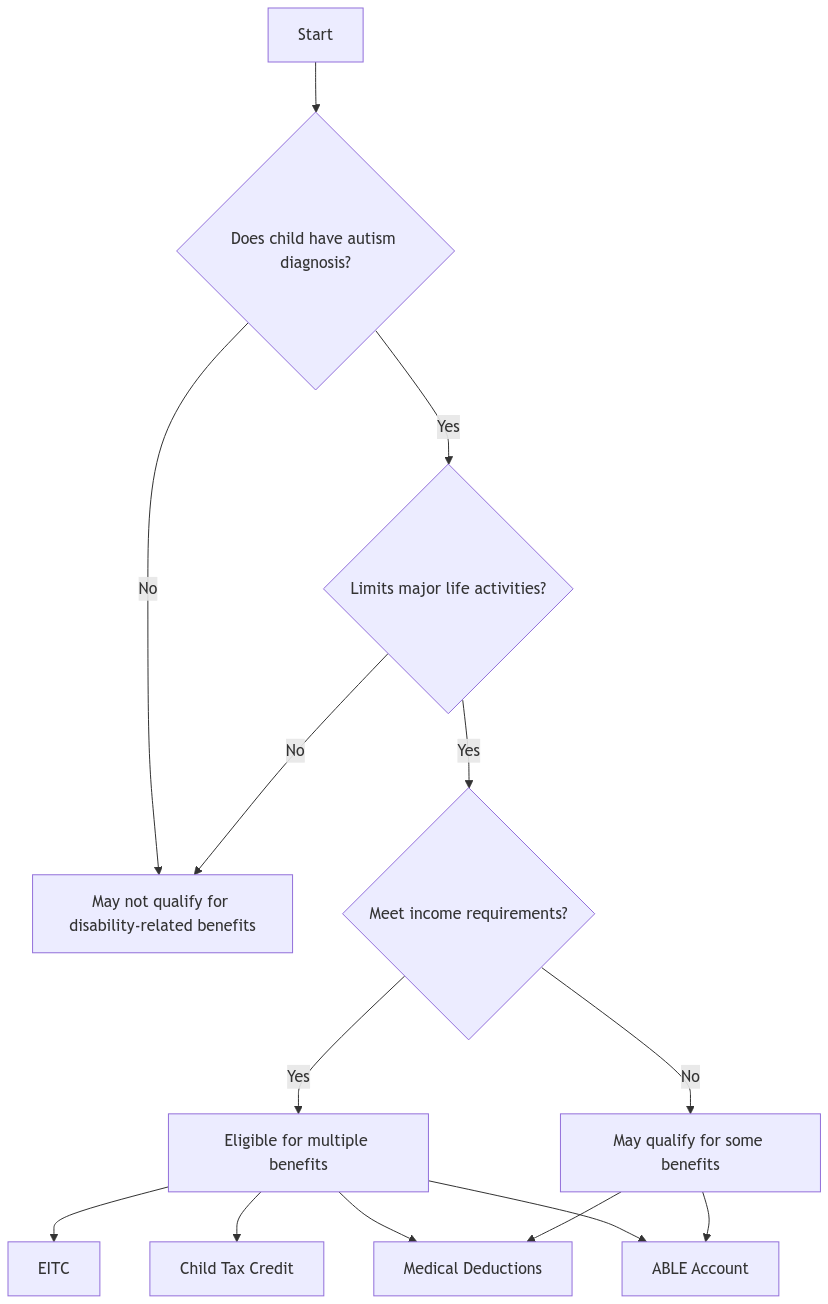

Does the IRS Recognize Autism as a Disability?

Yes, the IRS recognizes autism as a disability if it significantly limits one or more major life activities. This aligns with the Americans with Disabilities Act (ADA). If your child’s autism meets the IRS criteria, your family may qualify for valuable tax benefits.

Key Tax Benefits for Families with Autistic Children

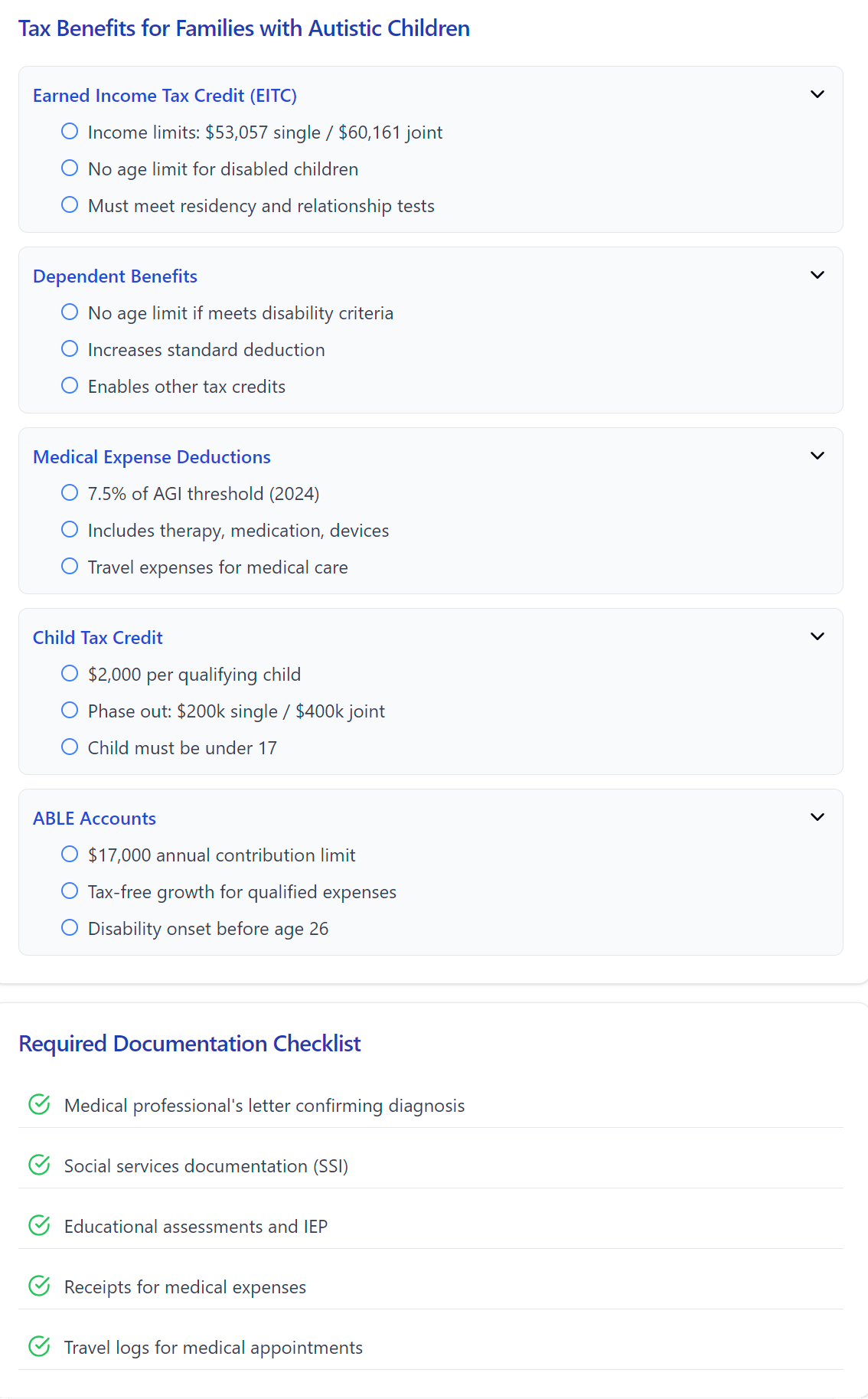

1. Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is a refundable tax credit that can provide much-needed financial relief for eligible families. To qualify, your child must be considered permanently and totally disabled by the IRS, regardless of their age, and meet the criteria of a “qualifying child” for the EITC. Here’s a breakdown:

- Qualifying Child Tests:

- Age Test: No age limit applies for permanently disabled children.

- Relationship Test: The child must be your biological, step, foster, or adopted child.

- Residency Test: The child must have lived with you in the US for more than half the tax year.

- Support Test: The child cannot provide more than half of their own support.

- Income Limitations: The EITC is a credit designed for lower- and moderate-income families. The income thresholds for claiming the EITC vary depending on your filing status and the number of qualifying children. For 2024, the maximum income to claim the EITC with three or more qualifying children is $53,057 for single filers and $60,161 for married filing jointly. You can find the most up-to-date income limits on the IRS website

2. Claiming Your Autistic Child as a Dependent

Typically, there are age restrictions for claiming a child as a dependent. However, if your autistic child meets the IRS disability criteria, they can be claimed as a dependent regardless of their age. Claiming a child as a dependent can provide significant tax advantages, including:

- Increased Standard Deduction: Claiming a dependent increases your standard deduction, reducing your taxable income.

- Eligibility for Other Tax Credits: You may become eligible for other tax credits, such as the Child Tax Credit, depending on your income and family situation.

3. Medical Expense Deductions

The IRS allows you to deduct eligible medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI) for 2024. You can potentially deduct various medical expenses related to your child’s autism treatment, including:

- Therapy: Costs for therapies such as ABA therapy, speech therapy, and occupational therapy.

- Medication: Expenses for prescription medications used to manage autism-related symptoms.

- Assistive Technology: Costs for devices and equipment that help your child with daily living and communication, such as communication devices or sensory tools.

- Special Education: Tuition and related expenses for special schools or programs recommended by a physician.

- Travel Expenses: You can deduct costs for travel essential to medical care, such as mileage to and from appointments and lodging if necessary.

Remember to keep thorough records of all medical expenses, including receipts and invoices. For a comprehensive list of deductible medical expenses, refer to IRS Publication 502.

4. Child Tax Credit

In addition to the EITC, families with autistic children might also be eligible for the Child Tax Credit. This credit can help offset the costs of raising a child. Here’s what you need to know:

- Eligibility: To qualify, your child must be under 17 at the end of the tax year, a US citizen, national, or resident alien, and claimed as your dependent.

- Credit Amount: The Child Tax Credit amount for 2024 is $2,000 per qualifying child.

- Income Limits: The full amount of the credit begins to phase out for taxpayers with incomes above $200,000 for single filers and $400,000 for married filing jointly. For more details, visit the IRS Child Tax Credit page

5. ABLE Accounts

ABLE accounts (Achieving a Better Life Experience) are tax-advantaged savings accounts specifically designed for individuals with disabilities. These accounts allow families to save money for disability-related expenses without jeopardizing eligibility for government benefits.

- Benefits: Earnings in ABLE accounts grow tax-free, and distributions for qualified disability expenses are also tax-free.

- Contribution Limits: The annual contribution limit to an ABLE account for 2024 is $17,000.

- Eligibility: To be eligible for an ABLE account, the disability must have onset before age 26.

For more information on ABLE accounts and how they can benefit your family, you can explore resources like the ABLE National Resource Center: https://ablenrc.org/

State Tax Benefits for Families with Autistic Children

In addition to federal tax benefits, many states offer their own tax credits or deductions for families with autistic children. These benefits vary significantly from state to state. Some examples include:

- Tax Credits for Disability-Related Expenses: Some states offer tax credits to offset the costs of therapy, education, and other disability-related expenses.

- Property Tax Exemptions: Certain states provide property tax exemptions or reductions for families with disabled children.

- Sales Tax Exemptions: Some states exempt certain medical equipment and supplies from sales tax.

To learn more about specific tax benefits available in your state, you can consult your state’s tax agency website or reach out to a tax professional knowledgeable about your state’s laws.

Autism Tax Benefits Calculator

Estimate your potential tax benefits related to autism care and support.

Estimated Tax Benefits Summary

Earned Income Tax Credit (EITC)

$0

Medical Expense Deduction

$0

Child Tax Credit (CTC)

$0

ABLE Account Benefits

Dependent Benefits

$0

Total Estimated Benefits

$0

Proving Autism as a Disability for Tax Purposes (Documentation)

Proper documentation is essential when claiming autism-related tax benefits. The IRS requires evidence to support your claim. Gather the following documentation:

- Medical Documentation: A letter from a qualified medical professional (pediatrician, psychiatrist, etc.) confirming the autism diagnosis and explaining how it substantially limits major life activities.

- Social Services Documentation (If Applicable): Records showing eligibility for government disability benefits, such as Supplemental Security Income (SSI).

- Educational Reports/Assessments: Reports from your child’s school or therapists detailing the impact of autism on their learning, development, and daily living.

FAQs

What if my child’s autism diagnosis is recent? Can I still claim these tax benefits?

Yes, you can potentially claim tax benefits for the current tax year as long as your child meets the IRS criteria for disability. Gather the necessary documentation from your child’s medical providers and therapists to support your claim.

Are there any age restrictions for the medical expense deduction?

No, there are no age restrictions for claiming medical expenses related to your child’s autism. As long as the expenses exceed 7.5% of your AGI and are qualified medical expenses, you can deduct them.

Can I use funds from an ABLE account to pay for any expense related to my child’s autism?

While ABLE accounts offer flexibility, the expenses must qualify as disability-related. These can include education, housing, transportation, assistive technology, and healthcare costs. However, using ABLE funds for non-qualified expenses may result in taxes and penalties.

What if I’m unsure whether my child meets the IRS definition of disability?

If you’re unsure, it’s best to consult with a qualified tax professional. They can help you determine if your child meets the criteria and guide you through the process of claiming relevant tax benefits.

Where can I find more information about my state’s specific tax benefits for families with disabilities?

You can usually find detailed information on your state’s tax agency website. Look for sections related to tax credits or deductions for individuals with disabilities or special needs. You can also contact your state’s tax agency directly or consult with a tax professional in your state.

Need Help with Autism-Related Tax Benefits?

We understand that navigating these tax benefits can be confusing. At XOA TAX, we’re here to help. Our experienced CPAs can guide you through the process, ensure you claim all the benefits you’re entitled to, and answer any questions you may have.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime