Roth IRAs offer fantastic tax advantages for retirement savings, but unfortunately, they come with income limitations. For 2024, if your modified adjusted gross income (MAGI) falls within the phase-out range—starting at $146,000 for single filers and $230,000 for those married filing jointly—your ability to contribute directly to a Roth IRA will be reduced or eliminated. But don’t worry! There’s another way – the “backdoor Roth IRA.” This strategy allows you to contribute to a Roth IRA even if your income disqualifies you from direct contributions.

At XOA TAX, we often guide our clients through this process. Think of this post as your roadmap to understanding and executing a backdoor Roth IRA conversion. We’ll break down the steps involved and highlight potential pitfalls to help you make informed decisions for your retirement.

Key Takeaways

- The backdoor Roth IRA is a legal strategy for high earners to contribute to a Roth IRA despite income limits.

- The process involves contributing to a Traditional IRA and then converting it to a Roth IRA.

- It’s crucial to understand the “pro rata rule” to minimize taxes during the conversion.

- Proper planning and execution are essential to avoid penalties and maximize tax benefits.

Understanding the Backdoor Roth IRA

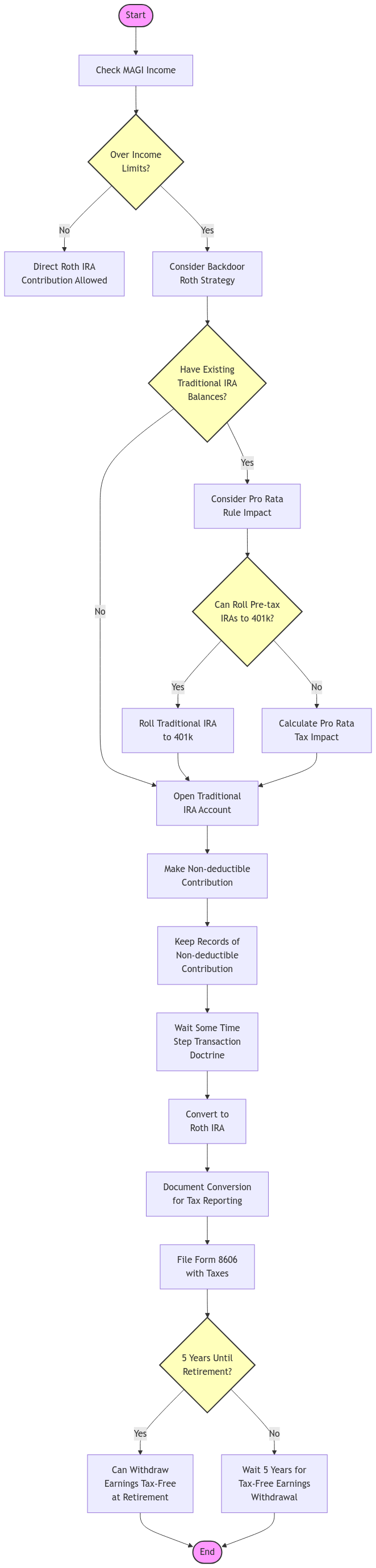

A backdoor Roth IRA involves two main steps:

- Contribute to a Traditional IRA: Even if you exceed the income limits for a Roth IRA, there are generally no income limits for contributing to a Traditional IRA. For 2024, you can contribute up to $7,000 if you’re under 50, or $8,000 if you’re 50 or older. You can make contributions for a given tax year up until Tax Day of the following year. However, keep in mind that the deductibility of your Traditional IRA contributions may be limited if you or your spouse are covered by a retirement plan at work.

- Convert the Traditional IRA to a Roth IRA: You’ll then convert the funds from your Traditional IRA to a Roth IRA. This conversion is a taxable event, but we’ll discuss strategies to minimize the tax implications.

Step-by-Step Guide to the Backdoor Roth

- Verify your eligibility: While there’s no income limit to contribute to a Traditional IRA, ensure you meet the other eligibility requirements (such as having earned income).

- Open a Traditional IRA: If you don’t already have one, open a Traditional IRA with a brokerage firm or financial institution.

- Make a non-deductible contribution: It’s important to make a non-deductible contribution to your Traditional IRA. This means you won’t claim a tax deduction for this contribution on your tax return. Keep accurate records of this.

- Convert to a Roth IRA: Contact your IRA provider to initiate the conversion of your Traditional IRA to a Roth IRA.

- Important Note: While some providers may have internal processing times, there’s no IRS-mandated waiting period between your contribution and conversion.

- Report the conversion on your tax return: You’ll report the conversion on Form 8606 when you file your taxes. This form helps calculate any tax you may owe on the converted amount.

The Step Transaction Doctrine

The IRS has a “step transaction doctrine” that allows them to look at a series of transactions as one if they believe the steps were taken to achieve a specific tax outcome. In the context of the backdoor Roth, the IRS could potentially view the contribution and immediate conversion as a single transaction, attempting to disallow it. While this is a concern, the IRS has not actively challenged the backdoor Roth strategy. To minimize any potential risk, it’s generally advisable to allow some time to pass between your contribution and conversion.

Navigating the Pro Rata Rule

The pro rata rule can be a significant hurdle for those with existing pre-tax Traditional IRA balances. Here’s how it works:

When you convert funds from a Traditional IRA to a Roth IRA, the IRS doesn’t just look at the specific IRA you’re converting. Instead, they consider all your Traditional IRA assets, including rollover IRAs and SEP IRAs. They calculate the taxable portion of your conversion based on the ratio of pre-tax funds to after-tax funds across all your Traditional IRAs.

Example:

Let’s say you have $90,000 in a Traditional IRA from a previous 401(k) rollover (pre-tax money) and you contribute $7,000 (after-tax) to a new Traditional IRA for the backdoor Roth. When you convert that $7,000, the IRS will calculate the taxable portion as follows:

- Total Traditional IRA balance: $97,000

- Pre-tax balance: $90,000

- After-tax balance: $7,000

- Taxable percentage of conversion: ($90,000 / $97,000) = 92.8%

This means that even though you contributed $7,000 after-tax, 92.8% of that conversion ($6,496) would be considered taxable, while the remaining 7.2% ($504) would be non-taxable.

Important Note: Employer-sponsored retirement plans, like 401(k)s, are not subject to the pro rata rule.

Strategies to Minimize the Pro Rata Rule’s Impact:

- If possible, roll over your pre-tax IRA funds into your current employer’s 401(k) plan if it allows such rollovers.

- Consider contributing to a Roth 401(k) if your employer offers one.

- Consult with a tax professional at XOA TAX to discuss your specific situation and explore other strategies.

The 5-Year Rule and Other Considerations

Keep in mind the 5-year rule for Roth IRA withdrawals. While you can always withdraw your contributions tax-free and penalty-free, any earnings you withdraw before age 59 ½ are generally subject to a 10% penalty, and you’ll owe taxes on those earnings if the account hasn’t been open for at least five years.

Once-Per-Year Rollover Rule:

You’re generally limited to one IRA rollover per year. This means that if you roll over funds from one IRA to another, you typically can’t do another rollover within a 12-month period. This is important to consider if you’re strategizing around the pro rata rule. However, this rule does not apply to Roth conversions from a Traditional IRA.

State Tax Implications:

It’s important to be aware that some states may have their own tax rules regarding Roth IRA conversions. Be sure to check the specific laws in your state or consult with a tax professional.

Mega Backdoor Roth

Some employer-sponsored 401(k) plans offer a “mega backdoor Roth” option. This allows you to make after-tax contributions to your 401(k) above the regular contribution limits, and then convert those after-tax contributions to a Roth IRA. This can be a powerful tool for high earners to further increase their retirement savings in a tax-advantaged way. If your employer offers this option, it’s worth exploring with a tax professional.

Timeline Example

Here’s a possible timeline for executing a backdoor Roth IRA:

- January – April: Contribute the maximum amount to your Traditional IRA for the previous tax year.

- May – June: Convert the Traditional IRA to a Roth IRA. This allows some time between the contribution and conversion, addressing the step transaction doctrine concern.

- Following Year: Report the conversion on Form 8606 when you file your taxes.

This is just an example, and the optimal timing may vary depending on your individual circumstances.

FAQs about Backdoor Roth IRAs

Why would I choose a backdoor Roth IRA over a Traditional IRA?

While a Traditional IRA offers upfront tax deductions, a Roth IRA provides tax-free growth and withdrawals in retirement. If you anticipate being in a higher tax bracket in retirement, the backdoor Roth can be a valuable strategy.

Is the backdoor Roth IRA legal?

Yes, the backdoor Roth is a completely legal strategy. It’s a combination of existing tax laws that allow for this type of conversion.

Can I contribute to both a backdoor Roth IRA and a 401(k)?

Yes, you can generally contribute to both, as long as you stay within the contribution limits for each.

Connecting with XOA TAX

Navigating the complexities of backdoor Roth IRAs can be challenging. At XOA TAX, our experienced CPAs can provide personalized guidance tailored to your specific financial situation. We can help you:

- Determine if a backdoor Roth is the right strategy for you.

- Optimize the conversion process to minimize your tax liability.

- Develop a comprehensive retirement plan to achieve your financial goals.

Contact us today to schedule a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime