For those with higher incomes, exceeding the Roth IRA contribution limits can feel like a missed opportunity to enjoy tax-free retirement savings. But don’t worry, there’s a strategy designed just for you: the Backdoor Roth IRA. This allows you to contribute to a Roth IRA indirectly, even if your income exceeds the normal limits. Sometimes called a “two-step Roth IRA” or a “Roth conversion,” this strategy can be a powerful tool for your retirement planning. Let’s break down how it works and why it might be a good fit for your financial goals.

Key Takeaways

- A Backdoor Roth IRA: involves contributing to a Traditional IRA and then converting it to a Roth IRA.

- This strategy: is ideal for those whose income exceeds the limits for direct Roth IRA contributions.

- While the principal amount of the conversion: is tax-free, any earnings accrued before the conversion are taxable.

- It’s crucial to understand the pro-rata rule: especially if you have existing Traditional IRA balances.

1. What is a Backdoor Roth IRA?

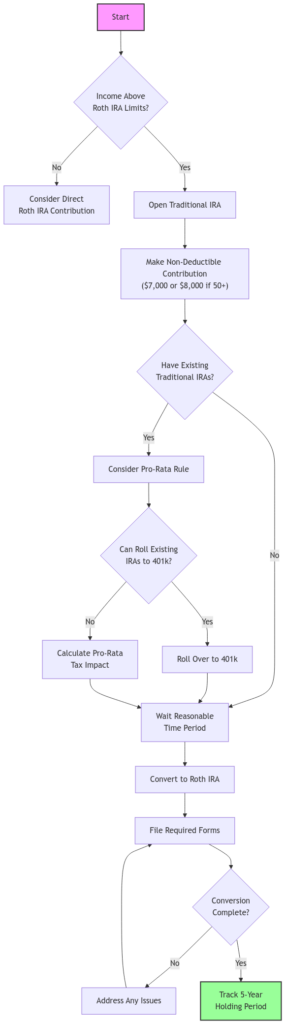

A Backdoor Roth IRA is a legal workaround that allows high-income earners to contribute to a Roth IRA indirectly. This is done by making a non-deductible contribution to a Traditional IRA and then converting those funds to a Roth IRA. This strategy effectively bypasses the income limits imposed on direct Roth IRA contributions.

2. Steps to Implement a Backdoor Roth IRA

The process is straightforward, but it’s important to follow the steps carefully:

- Open a Traditional IRA: If you don’t already have one, the first step is to open a Traditional IRA account with a brokerage firm or financial institution.

- Make a Non-Deductible Contribution: Contribute after-tax dollars to your Traditional IRA. Because your income exceeds the limit for a tax deduction, these contributions are considered non-deductible. For 2024, the maximum contribution is $7,000, or $8,000 if you’re age 50 or older.

- Convert to a Roth IRA: Convert the funds from your Traditional IRA to a Roth IRA. This conversion is what allows the funds to grow tax-free and be withdrawn tax-free in retirement.

3. Tax Implications of the Conversion

It’s important to understand the tax implications of converting your Traditional IRA to a Roth IRA.

Tax-Free Principal, Taxable Earnings

Since you made contributions to the Traditional IRA with after-tax dollars, you won’t be taxed on the principal amount when you convert it. However, any earnings on those contributions before the conversion are taxable.

Timing is Key

To minimize the taxable earnings, it’s generally advisable to convert the funds to a Roth IRA soon after making the contribution to the Traditional IRA. However, be mindful of the “step-doctrine,” where the IRS could potentially challenge very quick conversions. It’s best to consult with a tax professional to determine the appropriate timing.

Understanding the Pro-Rata Rule

The “pro-rata rule” can add complexity to the Backdoor Roth IRA. This rule means the IRS considers all your Traditional, SEP, and SIMPLE IRAs when determining the taxable portion of a conversion.

Pro-Rata Rule Calculation Example:

When you have:

- $50,000 in existing Traditional IRA (pre-tax)

- $7,000 new non-deductible contribution

Total IRA balance: $57,000

Your conversion will be:

- Non-taxable portion = ($7,000 ÷ $57,000) × $7,000 = $858

- Taxable portion = $7,000 – $858 = $6,142

This means approximately 12.3% of your conversion would be tax-free, while 87.7% would be taxable.

One strategy to avoid the pro-rata rule is to roll over your pre-tax IRA funds into an employer-sponsored 401(k) plan, if your plan allows. This effectively isolates the non-deductible contributions you made for the conversion.

4. Reporting Requirements

Accurate record-keeping and tax reporting are essential when executing a Backdoor Roth IRA. Here are the key forms involved:

- Form 8606: This form is used to report non-deductible contributions to Traditional IRAs and conversions to Roth IRAs. Accurate completion of Form 8606 is crucial to avoid unnecessary taxation in the future.

- Form 1099-R: Your IRA custodian will issue this form, detailing the distribution from the Traditional IRA as part of the conversion process.

- Form 5498: This form reports the contributions made to your Traditional IRA and your Roth IRA.

5. Impact of Existing Traditional or SIMPLE IRAs

As mentioned earlier, the pro-rata rule requires that all Traditional, SEP, and SIMPLE IRAs be considered when determining the taxable portion of a conversion. If you have existing pre-tax IRA balances, a portion of your conversion may be taxable.

Example 1: Simple Pro-Rata Calculation

Imagine you have $30,000 in an existing Traditional IRA (all pre-tax contributions) and you make a new non-deductible contribution of $6,000. Your total IRA balance is now $36,000. When you convert $6,000 to a Roth IRA, the pro-rata rule applies:

- Non-taxable portion = ($6,000 ÷ $36,000) × $6,000 = $1,000

- Taxable portion = $6,000 – $1,000 = $5,000

In this scenario, approximately 16.7% of your conversion would be tax-free, while 83.3% would be taxable.

Example 2: Multiple IRA Accounts

Suppose you have multiple IRAs:

- $40,000 in a Traditional IRA (pre-tax)

- $20,000 in a SEP IRA (pre-tax)

- $6,000 new non-deductible contribution to another Traditional IRA

Your total IRA balance is $66,000. If you convert the $6,000 non-deductible contribution, the pro-rata rule calculation would be:

- Non-taxable portion = ($6,000 ÷ $66,000) × $6,000 = $545

- Taxable portion = $6,000 – $545 = $5,455

In this case, only about 9.1% of your conversion would be tax-free, while 90.9% would be taxable.

Example 3: Rolling Over Pre-Tax Funds to a 401(k)

To avoid the pro-rata rule, you might roll over your pre-tax IRA funds into an employer-sponsored 401(k) plan, if allowed. For instance, if you have $50,000 in a Traditional IRA (pre-tax) and make a $7,000 non-deductible contribution, your total IRA balance is $57,000. By rolling the $50,000 into a 401(k), only the $7,000 remains in the IRA. Now, when you convert the $7,000, the entire amount is non-taxable since there are no pre-tax funds left in your IRA.

These examples demonstrate how the pro-rata rule can impact the taxable portion of your Roth conversion depending on your existing IRA balances. Careful planning can help minimize the tax burden, and consulting with a financial advisor can provide personalized guidance.

6. Spousal Considerations

It’s important to remember that each spouse’s IRA accounts are treated separately. Your spouse’s existing Traditional or SIMPLE IRAs do not affect your ability to perform a Backdoor Roth IRA conversion. However, if your spouse also wants to execute a Backdoor Roth IRA, they must consider their own existing IRA balances and the implications of the pro-rata rule.

7. The Once-Per-Year Rollover Rule

Keep in mind the IRS rule that limits IRA-to-IRA rollovers to once per year. This could impact your Backdoor Roth IRA strategy if you are also considering rollovers between other IRA accounts.

8. Potential Risks and Considerations

While the Backdoor Roth IRA is a valuable strategy, it’s important to be aware of potential risks:

- Legislative Changes: Tax laws are subject to change, which could potentially affect the viability of the Backdoor Roth IRA strategy in the future. Stay informed about current legislation and consult with a tax professional.

- Five-Year Rule: Withdrawals of converted amounts within five years may be subject to a 10% penalty if you’re under 59 ½. This rule applies separately to each conversion.

9. Frequently Asked Questions (FAQ)

What are the income limits for direct Roth IRA contributions in 2024?

For 2024, if your modified adjusted gross income is $161,000 or greater as someone filing as single, married filing separately, or head of household, you can’t contribute to a Roth IRA (the phase-out begins at $146,000). The limit is $240,000 for those who are married filing jointly or are qualifying widow(er)s (the phase-out begins at $230,000).

Can I do a Backdoor Roth IRA if I have a 401(k) through my employer?

Yes, having a 401(k) does not prevent you from doing a Backdoor Roth IRA. In fact, as we’ll discuss later, rolling over pre-tax IRA funds into your 401(k) can be a strategy to avoid the pro-rata rule.

Is there an age limit for Backdoor Roth IRA contributions?

No, there is no age limit for contributing to a Traditional IRA and converting it to a Roth IRA. As long as you have earned income, you can utilize this strategy.

Need Help with Your Retirement Strategy?

Navigating the Backdoor Roth IRA can be complex. At XOA TAX, our experienced CPAs can help you determine if this strategy is right for you and guide you through the process. Contact us today for a personalized consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime