Ever feel like your bank statement is speaking a different language than your accounting records? Don’t worry, you’re not alone! Bank reconciliation is the key to deciphering those discrepancies and ensuring your financial records are accurate and reliable. Let’s break down this essential process step-by-step.

What is a Bank Reconciliation Statement?

A Bank Reconciliation Statement (BRS) is like a detective tool for your finances. It helps you compare your company’s accounting records (your cash book) with your bank statement to uncover any hidden differences. Think of it as a checkpoint to ensure everything matches up.

The Purpose of Bank Reconciliation

Bank reconciliation isn’t just about finding errors; it’s a crucial process for maintaining the financial health of your business. Here’s why:

- Ensuring Accuracy: Accurate records are the foundation of sound financial decisions. Bank reconciliation helps you identify and correct any discrepancies, ensuring your financial reports are reliable.

- Detecting Errors: Mistakes happen! Bank reconciliation helps catch those pesky errors that can slip through the cracks, like transposed numbers, missing transactions, or duplicate entries.

- Preventing Fraud: Unfortunately, fraud is a reality for businesses. Bank reconciliation can help detect unauthorized transactions or suspicious activities, protecting your company from financial loss.

- Improving Cash Flow Management: Knowing your true cash position is essential for effective cash flow management. Bank reconciliation gives you a clear picture of your available funds, helping you make informed decisions about spending, investing, and borrowing.

- Meeting Regulatory Requirements: In many jurisdictions, businesses are required to perform bank reconciliations regularly to comply with regulations. This ensures transparency and accountability in financial reporting.

Identifying Accounting Errors and Detecting Fraud

Bank reconciliation acts as a safeguard against errors and fraudulent activities. Here are some common issues it can help uncover:

- Misrecorded Checks: Imagine accidentally recording a check for $1,000 as $100. Bank reconciliation would quickly flag this discrepancy.

- Unrecorded Bank Fees: Banks often charge fees for various services. If these fees aren’t properly recorded in your cash book, your reconciliation will highlight the difference.

- Unauthorized Transactions: If someone makes an unauthorized withdrawal from your account, bank reconciliation will bring it to your attention.

Managing Risk

Bank reconciliation is a key component of effective risk management. Here’s how it contributes to a safer financial environment:

- Accurate Financial Statements: Reliable financial statements are essential for informed decision-making by investors, lenders, and other stakeholders. Bank reconciliation ensures the accuracy of these statements.

- Internal Controls: Strong internal controls are crucial for preventing and detecting errors and fraud. Bank reconciliation is an important internal control that helps safeguard your assets.

- Segregation of Duties: Separating responsibilities related to cash handling and record-keeping helps reduce the risk of fraud. Bank reconciliation reinforces this segregation by providing an independent check on transactions.

- Cybersecurity: In today’s digital world, cybersecurity is paramount. Regularly reviewing your bank statements through reconciliation can help identify any suspicious online activity.

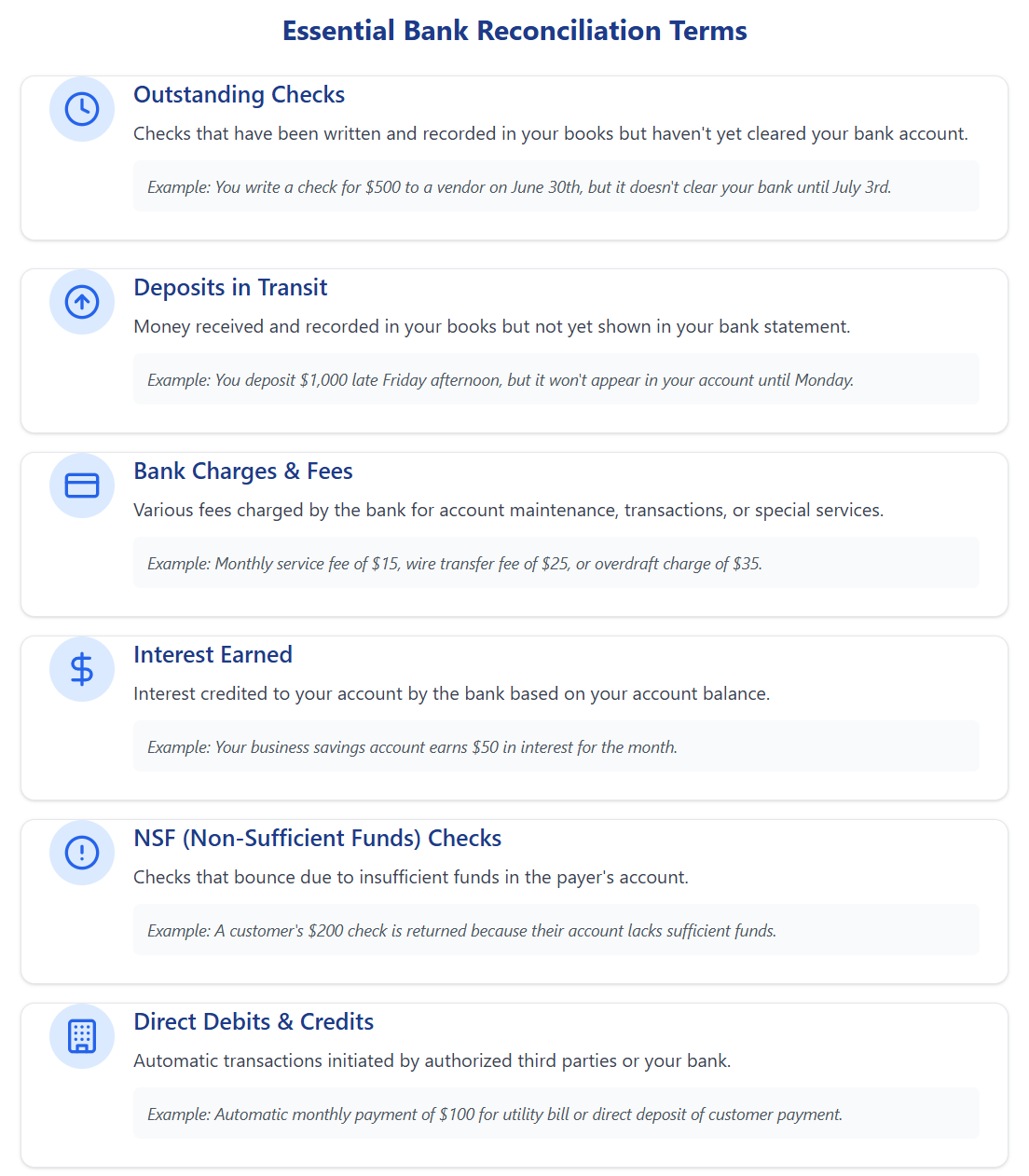

Terms Used in Bank Reconciliation

Understanding the Bank Reconciliation Statement Process

Let’s break down the process into manageable steps:

- Gather Your Documents: Start by collecting your bank statement and your cash book for the period you want to reconcile.

- Compare the Balances: Look at the ending balance on your bank statement and compare it to the ending balance in your cash book. Do they match?

- Identify Discrepancies: If the balances don’t match, it’s time to put on your detective hat! Carefully compare each transaction listed on your bank statement to the entries in your cash book. Note any differences.

- Adjust the Cash Book: Make adjustments in your cash book for any transactions that haven’t yet been recorded. This might include bank fees, interest earned, or direct debits.

- Prepare the Bank Reconciliation Statement: Create a formal statement that summarizes the adjustments made and shows that the adjusted cash book balance now matches the bank statement balance.

Numerical Example

Let’s illustrate this with a simple example:

| Item | Cash Book | Bank Statement |

|---|---|---|

| Starting Balance | $10,000 | $10,000 |

| Deposit in Transit | $500 | – |

| Outstanding Check #123 | – | $200 |

| Bank Service Fee | – | $25 |

| Adjusted Balance | $10,500 | $10,275 |

Reconciliation:

- Add deposit in transit to the bank statement balance: $10,275 + $500 = $10,775

- Subtract outstanding check from the bank statement balance: $10,775 – $200 = $10,575

- Subtract bank service fee from the cash book balance: $10,500 – $25 = $10,475

Now, both the adjusted cash book balance and the bank statement balance match at $10,475.

Bank Reconciliation in the Digital Age

Thankfully, we’re not stuck in the era of manually comparing paper statements anymore! Modern accounting software offers a range of features to automate and streamline the bank reconciliation process. These tools can:

- Connect directly to your bank accounts: This allows for automatic downloads of transactions, saving you time and reducing the risk of manual errors.

- Categorize transactions: Software can intelligently categorize transactions, making it easier to identify discrepancies.

- Provide real-time reconciliation: Some advanced tools offer real-time reconciliation, giving you an up-to-the-minute view of your cash position.

While automation is a huge help, it’s important to remember that human oversight is still crucial. Regularly review your reconciled statements to ensure accuracy and identify any potential red flags.

Looking Ahead: Blockchain and Bank Reconciliation

Although still in its early stages, blockchain technology has the potential to revolutionize bank reconciliation. By providing a secure and transparent record of transactions, blockchain could eliminate the need for manual reconciliation altogether. This could lead to significant cost savings and increased efficiency for businesses.

Frequently Asked Questions About Bank Reconciliation

How often should I perform bank reconciliation?

The frequency depends on your business type and transaction volume. Small businesses typically need monthly reconciliation, while high-transaction businesses may require weekly reviews. E-commerce companies often benefit from bi-weekly reconciliation due to their transaction patterns. At XOA TAX, we can assess your specific needs and recommend the optimal schedule for your business.

What’s the difference between my bank balance and book balance?

Your bank balance shows what appears on your bank statement, while your book balance reflects your internal accounting records. These numbers often differ due to timing differences in recording transactions. Common reasons include outstanding checks, deposits in transit, unrecorded bank fees, and automatic payments not yet entered in your books. Understanding these differences is key to maintaining accurate financial records.

How long should bank reconciliation take?

With proper systems in place, monthly reconciliation typically takes 1-2 hours. However, this can vary based on transaction volume, business complexity, and your bookkeeping quality. XOA TAX can help streamline your process to minimize the time required while ensuring accuracy.

What documents do I need for bank reconciliation?

You’ll need your bank statements, check registers, deposit slips, sales records, credit card statements, and general ledger. Maintaining organized records throughout the month significantly simplifies the reconciliation process. Our team can help you establish an efficient document management system.

What are common reconciliation discrepancies?

Typical discrepancies include transposed numbers (writing $53 instead of $35), missing transactions, unrecorded bank fees, uncredited interest earnings, outstanding checks, and NSF (Non-Sufficient Funds) checks. XOA TAX can help identify and resolve these issues efficiently.

How do I handle outstanding checks in reconciliation?

Outstanding checks require careful monitoring. List them separately on your reconciliation statement and track their age. Checks outstanding for more than six months need special attention and may need to be voided and reissued. We can establish proper procedures for managing aged outstanding checks.

Can bank reconciliation be automated?

Most modern accounting software offers automation features for bank reconciliation. While bank feeds can automatically import transactions and rules can handle recurring items, human oversight remains essential for accuracy. XOA TAX can help you implement and optimize automated systems while maintaining proper controls.

What should I do if I find fraud during reconciliation?

If you suspect fraud, document everything thoroughly and contact your bank immediately. File necessary police reports and consult with a CPA to review and strengthen your internal controls. Contact XOA TAX for immediate assistance with fraud investigation and prevention strategies.

How long should I keep bank reconciliation records?

In California, retain reconciliation records for at least seven years. Maintain digital backups and secure physical copies. Some industries may require longer retention periods. Our team can advise on specific requirements for your business type.

Are bank reconciliations required for tax purposes?

While not directly submitted with tax returns, bank reconciliations are essential for accurate tax reporting and maintaining proper audit trails. They help defend tax positions and support business deductions. XOA TAX ensures your reconciliations meet all tax compliance requirements.

What’s the best software for bank reconciliation?

The ideal software depends on your business size, industry, transaction volume, and integration needs. While QuickBooks, Xero, and Sage are popular options, we can recommend and implement the best solution for your specific situation.

How do I handle electronic transactions in reconciliation?

Electronic transactions require systematic handling through automatic bank feeds, clear categorization, and regular review of automated matches. Proper documentation remains crucial. We can help establish efficient systems for managing digital transactions.

Is professional bank reconciliation worth the cost?

Professional reconciliation provides value through error prevention, fraud detection, time savings, better financial insights, and peace of mind. Contact us for a personalized cost-benefit analysis.

What happens if I don’t do bank reconciliation?

Neglecting reconciliation can lead to undetected fraud or errors, cash flow problems, tax reporting issues, missed business insights, and compliance problems. Let XOA TAX help you maintain proper financial controls.

What bank reconciliation services does XOA TAX offer?

We provide comprehensive services including monthly reconciliation, system setup, staff training, fraud prevention consulting, internal control review, and technology implementation. Contact us for a customized service package.

How can XOA TAX help improve our reconciliation process?

We review your current procedures, recommend improvements, implement automated systems, train staff, and provide ongoing support. Schedule a consultation to discuss your specific needs and let us help optimize your financial processes.

Connecting with XOA TAX

Feeling overwhelmed by the bank reconciliation process? XOA TAX can help! Our experienced CPAs can assist you with reconciling your accounts, identifying discrepancies, and implementing strong internal controls. Contact us today for a free consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime