Soar to #Success with Best Bookkeepers in Sacramento, CA

Soar to #Success with Best Bookkeepers in Sacramento, CA

Spends the weekends doing bookkeeping instead of relaxing in Capitol Park? Don't worry! XOA TAX's bookkeepers got you covered. Equipped with the best software and experienced in many cases, our bookkeepers are ready to entangle your messy books situation.

Better books • Better decisions • Bigger profits

Better books • Better decisions • Bigger profits

Certified Experts With Powerful Bookkeeping System

Trustworthy Tax Advice You Can Count On

01

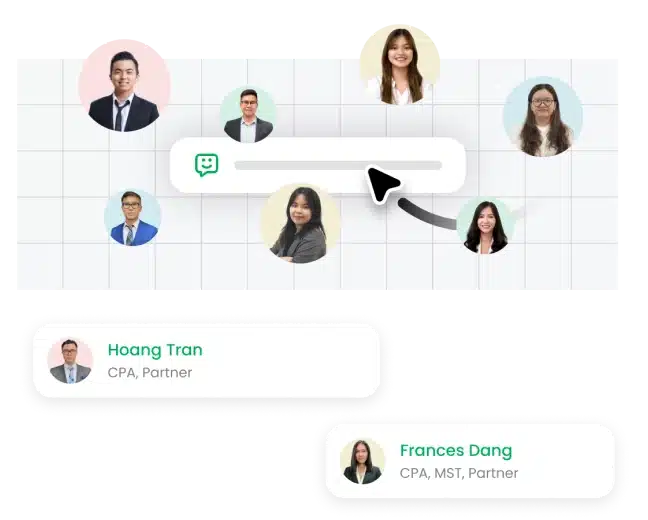

Dedicated Team of Experts

Get the support of a nationwide team of CPAs, bookkeepers, payroll experts, and tax pros.

02

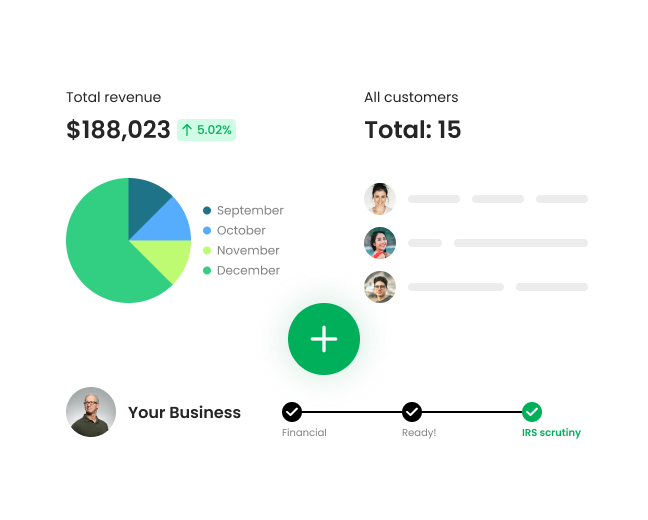

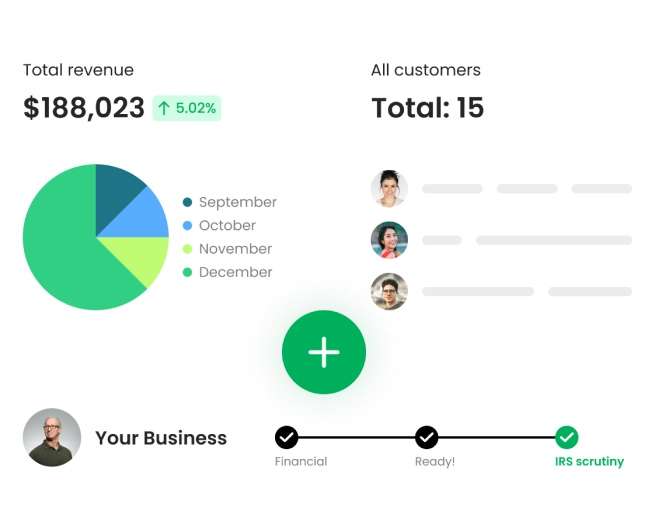

Tax-ready financials

Audit? Forget about it. We make sure your financial information is ready for IRS scrutiny.

03

Tidy tax-ready financials

Filing is complicated. That's why we send a financial package for each year of catch-up. It's every document you need to get organized and ready to file, in one place.

04

Fast turnaround times

We can complete months or years of overdue bookkeeping—fast. That means more time for your business and way less deadline stress.

01

Dedicated Team of Experts

Get the support of a nationwide team of CPAs, bookkeepers, payroll experts, and tax pros.

02

Tax-ready financials

Audit? Forget about it. We make sure your financial information is ready for IRS scrutiny.

03

Tidy tax-ready financials

Filing is complicated. That’s why we send a financial package for each year of catch-up. It’s every document you need to get organized and ready to file, in one place.

04

Fast turnaround times

We can complete months or years of overdue bookkeeping—fast. That means more time for your business and way less deadline stress.

We can help you #Thrive in any industry

Construction

Real estate

E-commerce

Laundry

Agencies

Designers

Construction

Real Estate

E-commerce

Laundry

Agencies

Designers

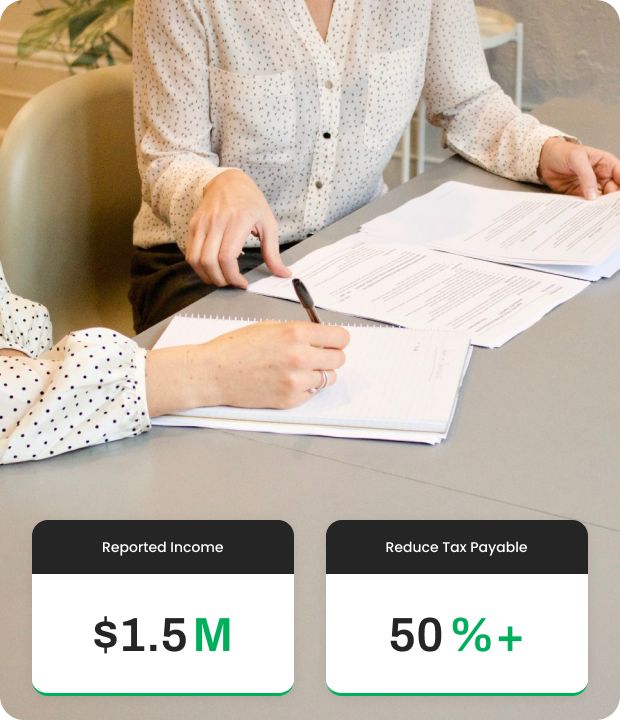

Our #Success Story

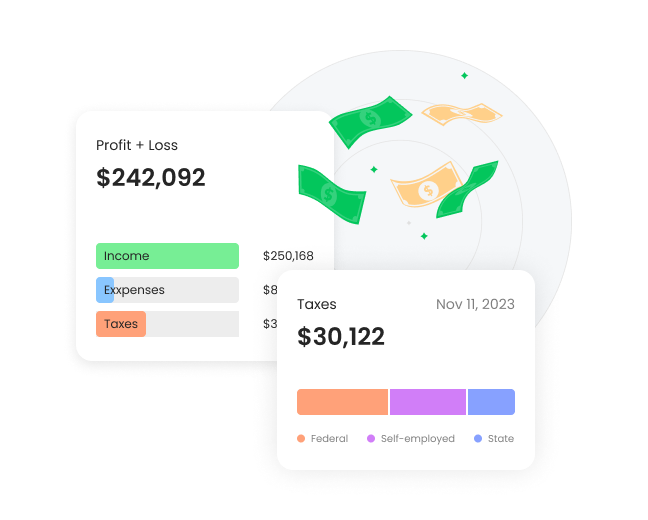

Financial Clarity

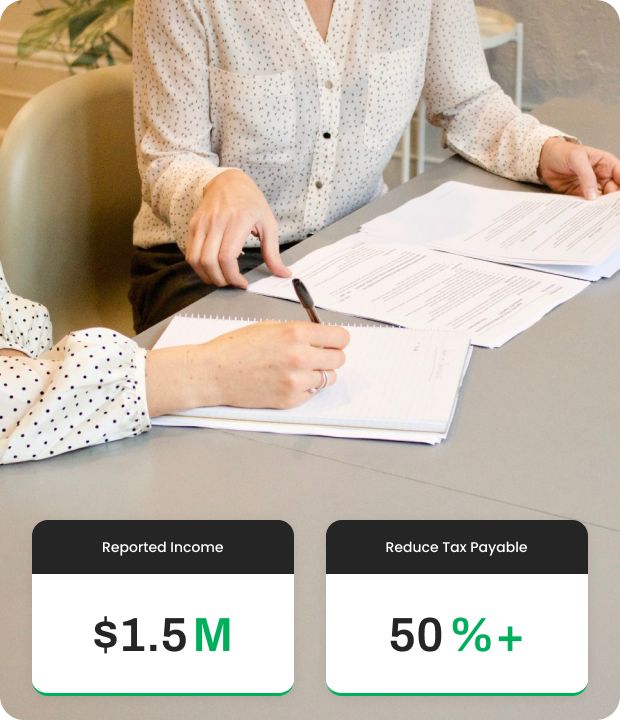

XOA TAX assisted a small business facing financial challenges, including inaccurate financial reporting and high tax liability.

By implementing precise inventory tracking and expense management, they achieved very encouraging results. Additionally, XOA TAX ensured compliance with accounting principles and improved the client's overall profitability through expert bookkeeping services.

Accurate. Timely. Efficient.

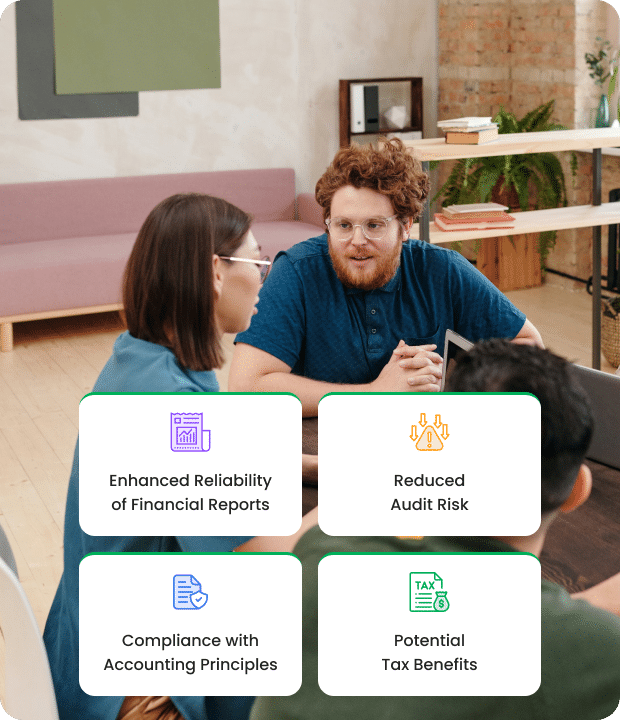

XOA TAX assisted a small business incorrectly classified repair and equipment expenses in the Profit and Loss Statement and faced issues with negative figures in liabilities.

XOA TAX addressed this by recording these expenses on the Balance Sheet, capitalizing equipment costs, and setting up a depreciation schedule. XOA TAX strategy improved financial report accuracy, reduced audit risks, ensured accounting compliance, and possibly offered tax advantages for Johnson, LLC.

Financial Clarity

XOA TAX assisted a small business facing financial challenges, including inaccurate financial reporting and high tax liability.

By implementing precise inventory tracking and expense management, they achieved very encouraging results. Additionally, XOA TAX ensured compliance with accounting principles and improved the client’s overall profitability through expert bookkeeping services.

Accurate. Timely. Efficient.

XOA TAX assisted a small business incorrectly classified repair and equipment expenses in the Profit and Loss Statement and faced issues with negative figures in liabilities.

XOA TAX addressed this by recording these expenses on the Balance Sheet, capitalizing equipment costs, and setting up a depreciation schedule. XOA TAX strategy improved financial report accuracy, reduced audit risks, ensured accounting compliance, and possibly offered tax advantages for Johnson, LLC.

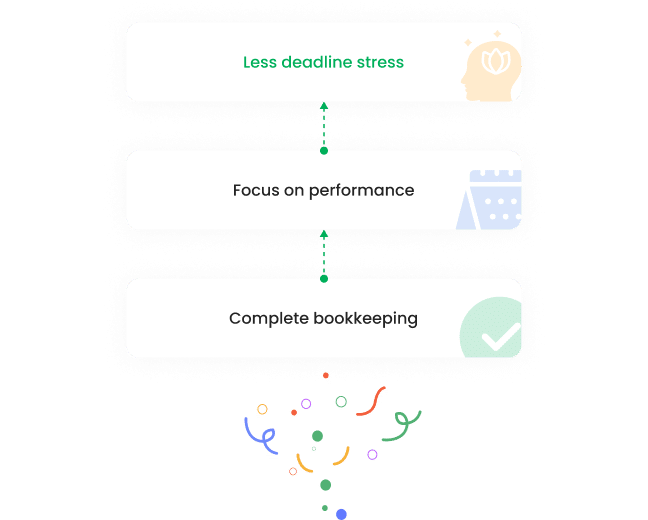

Lean Process,

Get Success.

We firmly believe that putting our customers first is the best way to help you achieve your goals.

Visualize Your Goals

Provide detailed instructions to accomplish your objectives.

Connect with CPAs

4.6 out of 5 star average expert rating by clients.

Optimize and Review

Advise on how to improve for a favorable outcome.

Financial Analysis

Analyze performance and other financial transactions

Packages and Pricing

From basic tax to complex accounting, we got you covered!

Services include: Your basic tax needs, legal advice, tax assessment

$0-$300

We'll walk you through the process, filling out all of the necessary tax forms

Securely upload your W-2 and 1099, we’ll add it in the right places

Guarantee maximum refund

Services include: Business Tax Returns, Accounting, Bookkeeping, Payroll, Additional Schedules and Forms

$0-$300

Focus on growing your business, and leave the tax to our experts and CPAs

Our experts support all your tax, accounting, and bookkeeping needs

Let us handle your employees' payroll, and maximize your tax returns, guaranteed

Services include: Payroll, Sales Tax, Bookkeeping

$0-$300

Get your business up and running with our tax experts, on-demand

Get your tax done right, hassle-free, and quickly

Our team of experts will review everything before you file, guaranteed with no mistake

Basic plan

Quarterly Bookkeeping and Bank Reconciliation (Max 50 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

- QBO Simple Start Subscription

- Transaction Processing

- Fixed Assets Register

- Trial Balance Preparation

- Data Security and Backups

- General Ledger Maintenance

- Month-End Close

- Business Tax Preparation

- Month-End Close

-

Individual Tax Preparation

- Email Support Only

Pro plan

- Popular

Quarterly Bookkeeping and Bank Reconciliation (Max 150 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

Everything in Basic plan and More

- QBO Subscription

- Sales Tax Reconcilations

- Payroll Reconcilations

- Loan Amortization

- Business Tax Preparation

- Unlimited Phone & Email Support

Elite plan

Monthly Bookkeeping and Bank Reconciliation (Max 300 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

Everything in Basic plan and Pro plan

- Audit Support

- Accounts Receivable Management

- Accounts Payable Management

- Inventory Tracking

- Perform COGS and Refund COST

- Merchant Reconciliation

- Free Tax Planning with CPAs

- Estimated Tax Payment Preparation

- Annual Corporation Renewal (State fees apply)

Customized Tax and

Accounting Solution

Every business needs a reliable partner. From accounting to helpful business insights, we are here for you.

Lynn B. Woods

Westminster, CA

- 0

- 1

8/30/2023

I highly recommend XOA TAX for their unmatched expertise in tax preparation and bookkeeping. Their bookkeeping services have organized my finances, so tax time is easy. XOA TAX provides prompt, reliable customer service year-round, taking the stress out of tax season by expertly handling my return. Their professionalism and attention to detail is impressive.

Phyllis H. Bauman

Westminster, CA

- 2

- 12

6/23/2023

I've used XOA TAX for taxes the past 2 years - they're awesome! Friendly, knowledgeable staff take the time to understand my complex tax situation with rental properties and multiple businesses. They ask tons of questions and always find extra deductions I miss, getting me max refunds. Before XOA, taxes were a pain. Now I look forward to my yearly appointment.

Marvin G. Winter

Westminster, CA

- 5

- 20

5/14/2023

XOA TAX is a great CPA firm which gets the job done right and fast. It made the entire process easy and stress free. He offers different options based on my needs saving my time so rest assure my tax season had been great.

Success Stories: U.S. Launches Made Easy with Us!

Claim Your E-book

Dive into our expertly crafted eBook on Bookkeeping and discover the golden keys to financial mastery. Packed with invaluable insights and easy-to-implement strategies, this guide is your first step towards financial empowerment. Say goodbye to financial confusion and hello to clarity and growth. 🚀💼📈