Congratulations on deciding to build an investment property! It’s an exciting venture with the potential for significant financial rewards. At XOA TAX, we’re here to help you navigate the financial side of your project, starting with a solid understanding of the tax implications. Proper planning can make a big difference in your overall returns.

Key Takeaways

- Understand the difference between capitalized costs and deductible expenses.

- Learn how to accurately depreciate your investment property.

- Avoid common pitfalls that can lead to IRS scrutiny.

- Plan for refinancing and equity extraction after construction.

Understanding Construction Costs

When building an investment property, it’s crucial to distinguish between costs that can be immediately deducted and those that must be capitalized.

- Deductible Expenses: These are ordinary and necessary business expenses incurred during the construction phase. Examples include:

- Property taxes

- Insurance premiums

- Interest on construction loans (with limitations under IRC Section 163(j) – more on this below!)

- Capitalized Costs: These costs add to the value of your property and are recovered over time through depreciation. This includes:

- Materials used in construction

- Labor costs

- Building permits

- Architect fees

Depreciation: Your Long-Term Tax Advantage

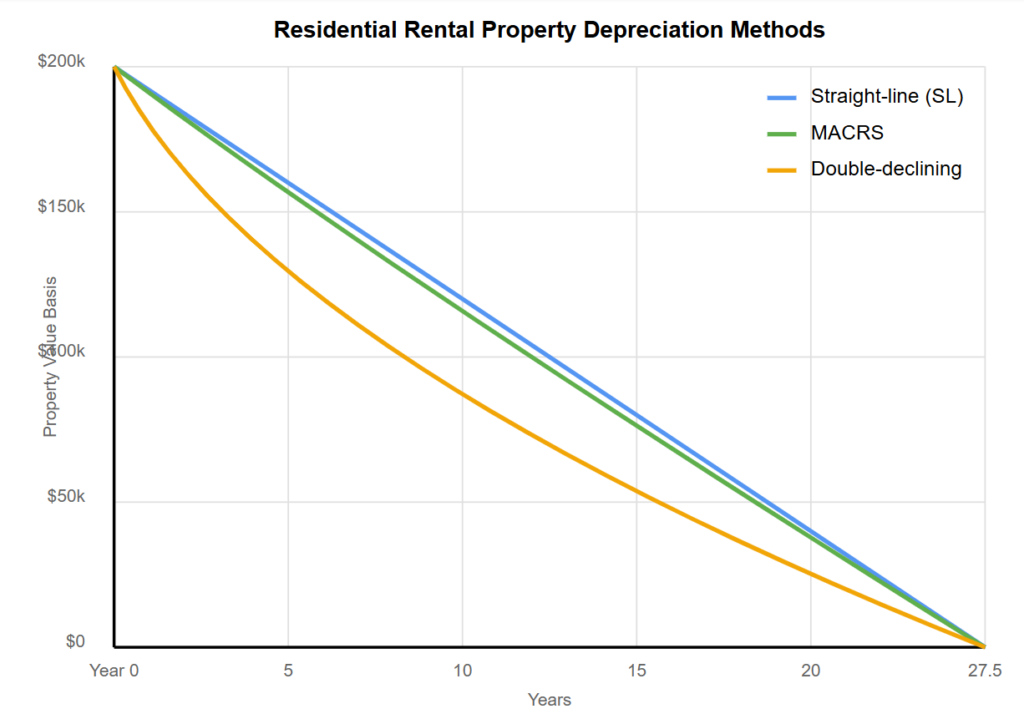

Depreciation allows you to deduct a portion of your capitalized costs each year over the useful life of the property. Residential rental properties are typically depreciated over 27.5 years, while commercial properties have a 39-year recovery period.

- Calculating Depreciation: The IRS provides specific methods for calculating depreciation, with the Modified Accelerated Cost Recovery System (MACRS) being the most common.

- Components of Depreciation: Land is not depreciable. You’ll need to allocate the purchase price between the land and the building for depreciation purposes.

Common Pitfalls to Avoid

- Misclassifying Costs: Incorrectly deducting capitalized costs can lead to IRS scrutiny. Always double-check the classification of each expense.

- Improper Documentation: Maintain meticulous records of all construction-related expenses. This includes invoices, receipts, and contracts. The IRS requires you to keep these records for at least 3 years from the date you file your tax return, but it’s generally recommended to keep them for 6 years. Digital records are acceptable, but they must be accurate, easily accessible, and in a format that can be reproduced for IRS review.

- Overlooking Land Improvements: While land itself isn’t depreciable, certain land improvements (like landscaping, fences, and paving) are depreciable over 15 years.

Refinancing Considerations

Once construction is complete, you might consider refinancing your construction loan.

- Interest Deductibility: The deductibility of interest on refinanced loans can be complex. Generally, interest on loans used to acquire or improve the property is deductible. However, IRC Section 163(j) limits the amount of deductible business interest. It’s also important to distinguish between business interest (related to a trade or business) and investment interest (related to passive activities), as they have different deductibility rules.

- Equity Extraction: If you refinance for more than your original loan amount, the excess cash is considered equity extraction. This can have tax implications depending on how you use the funds. Cash-out refinancing can also affect your property’s basis, which is used to calculate depreciation and gain or loss upon sale.

Cost Segregation Studies

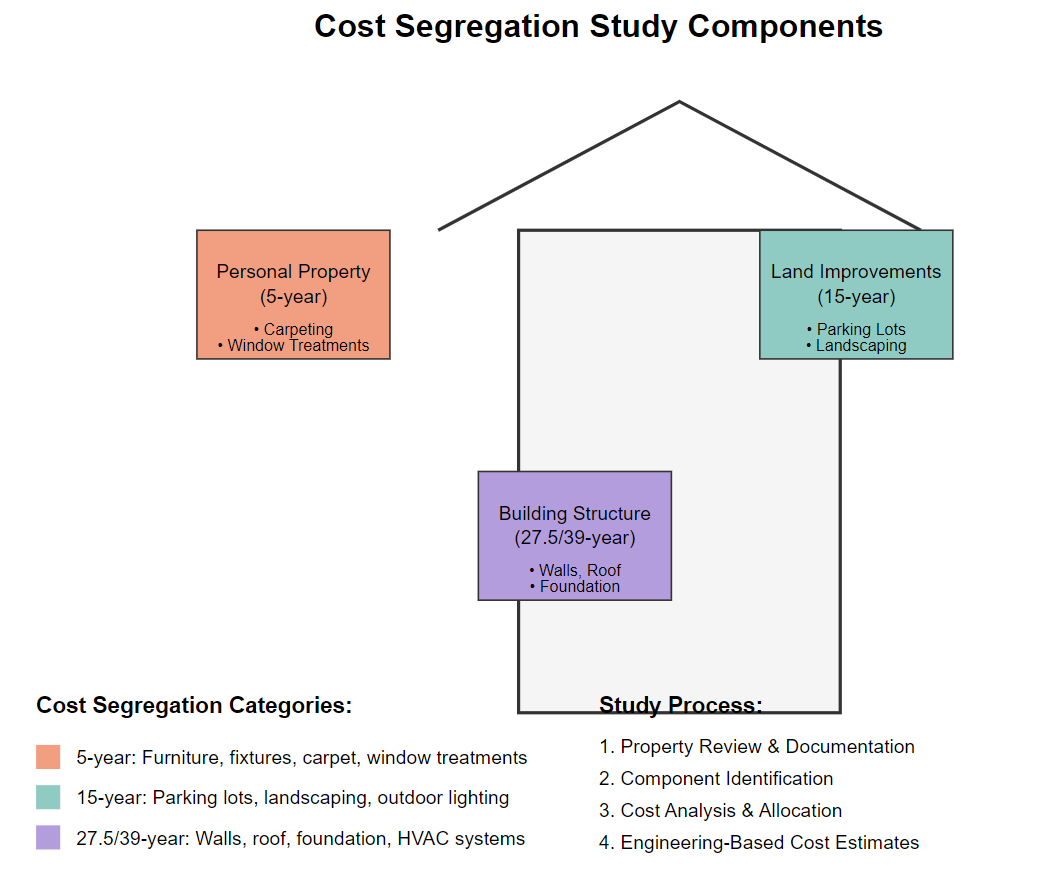

A cost segregation study can be a valuable tool for maximizing depreciation deductions. This study identifies and reclassifies building components into shorter depreciation lives, accelerating deductions and improving cash flow.

Cost Segregation Study Breakdown

A cost segregation study identifies and reclassifies commercial building components into shorter depreciation categories. The diagram illustrates how a $500,000 building might be segregated:

- Personal Property (5-year): Carpeting, window treatments, removable fixtures Typical allocation: 15-30% of cost Potential first-year deduction: $75,000-150,000

- Land Improvements (15-year): Parking lots, landscaping, outdoor lighting Typical allocation: 10-20% of cost Potential first-year deduction: $50,000-100,000

- Building Structure (27.5/39-year): Walls, roof, foundation, HVAC Remaining allocation: 50-75% of cost Annual deduction: ~$18,000-27,000

Engineering-based analysis determines exact allocations based on property specifics. This strategic reclassification can significantly accelerate depreciation deductions, potentially generating substantial tax savings in the early years of property ownership

We recommend exploring this option with a qualified cost segregation professional.

State-Specific Considerations

State tax laws can vary significantly, impacting your construction project in different ways. For example, some states offer property tax exemptions for new construction or rehabilitation projects. California offers solar energy tax credits, while Texas provides property tax abatements for renewable energy projects. Research the specific incentives available in your state to maximize your tax benefits.

If your investment property spans multiple states, you’ll need to comply with the tax laws of each state. This can be complex, and it’s crucial to seek professional guidance to ensure compliance.

Mixed-Use Properties

If you’re building a mixed-use property (e.g., a building with both residential and commercial units), you’ll need to allocate costs and depreciation between the different uses. This can be complex, and it’s essential to get it right to comply with IRS regulations.

Putting it into Practice: Tax Planning Examples

Depreciation Calculation Example: “Let’s say you purchase land for $50,000 and construct a residential rental property for $200,000. The total cost basis is $250,000. After a cost segregation study, you determine that $20,000 of the building costs qualify for 5-year depreciation (personal property), and the remaining $180,000 falls under the 27.5-year residential rental property category. Using MACRS, your annual depreciation deductions would be significantly higher in the early years due to the accelerated depreciation on the 5-year property.”

Cost Segregation Benefits Example: “A cost segregation study on a $500,000 building identifies $100,000 in components with shorter depreciation lives. This could result in $15,000 in additional depreciation deductions in the first five years, increasing cash flow and potentially reducing your tax liability.”

Depreciation Strategy Comparison: “We can compare straight-line depreciation versus accelerated depreciation methods, showing the impact on your tax liability over time. This will help you make informed decisions about which method is best suited for your investment goals.”

FAQ Section

Q: Can I deduct the cost of my own labor if I contribute to the construction of my investment property?

A: Generally, no. You cannot deduct the value of your own labor. However, you can deduct any out-of-pocket expenses you incur for materials or hired help. In some cases, you may be able to capitalize the value of your time spent supervising the construction, but this depends on the specific circumstances and your level of involvement.

Q: What happens if I sell my investment property before I fully depreciate it?

A: You may be subject to depreciation recapture, which means you’ll have to pay taxes on some or all of the depreciation you’ve claimed. The specific rules depend on whether the property is classified as Section 1250 property (real property) or Section 1245 property (personal property). Section 1250 recapture is generally taxed at a maximum rate of 25%, while Section 1245 recapture is taxed at your ordinary income tax rate.

Q: How do I determine the correct depreciation method for my property?

A: The IRS provides guidelines on depreciation methods. We recommend consulting with a tax professional to ensure you’re using the correct method for your specific situation.

Connecting with XOA TAX

Building an investment property is a significant undertaking with numerous tax implications. At XOA TAX, we can help you navigate the complexities of construction costs, depreciation, and refinancing. Our experienced CPAs can provide personalized guidance to ensure you maximize your tax benefits and achieve your investment goals.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime