Selling your business or its assets is a huge accomplishment. But before you pop the champagne, there’s a critical financial matter to address: bulk sales tax. Understanding this often-overlooked area can save you from significant headaches and ensure a smooth transition to the next chapter.

What is Bulk Sales Tax?

Imagine this: you’ve poured your heart and soul into your business, and now it’s time to move on. You find the perfect buyer, negotiate a great price, and are ready to celebrate. But wait! What about any outstanding sales tax you owe to the state? This is where bulk sales tax laws come in. They act as a safety net for creditors, ensuring that a business’s sales tax debts are settled before the proceeds from a major asset sale are distributed.

The Legal Framework: UCC Article 6

Bulk sales laws are often rooted in Article 6 of the Uniform Commercial Code (UCC), a set of standardized laws governing commercial transactions adopted by most states. While many states have revised or repealed Article 6, they typically retain similar provisions within their own legal codes. For example, California’s bulk sales law is found in the California Commercial Code, Division 6. These laws aim to prevent business owners from selling off assets and disappearing without paying their dues.

When Does Bulk Sales Tax Apply?

Bulk sales tax typically applies when you sell:

- Inventory: All or a substantial portion of your stock.

- Business Assets: Fixtures, equipment, and other tangible property essential to your business operations.

- The Entire Business: In a complete sale of the business as a going concern.

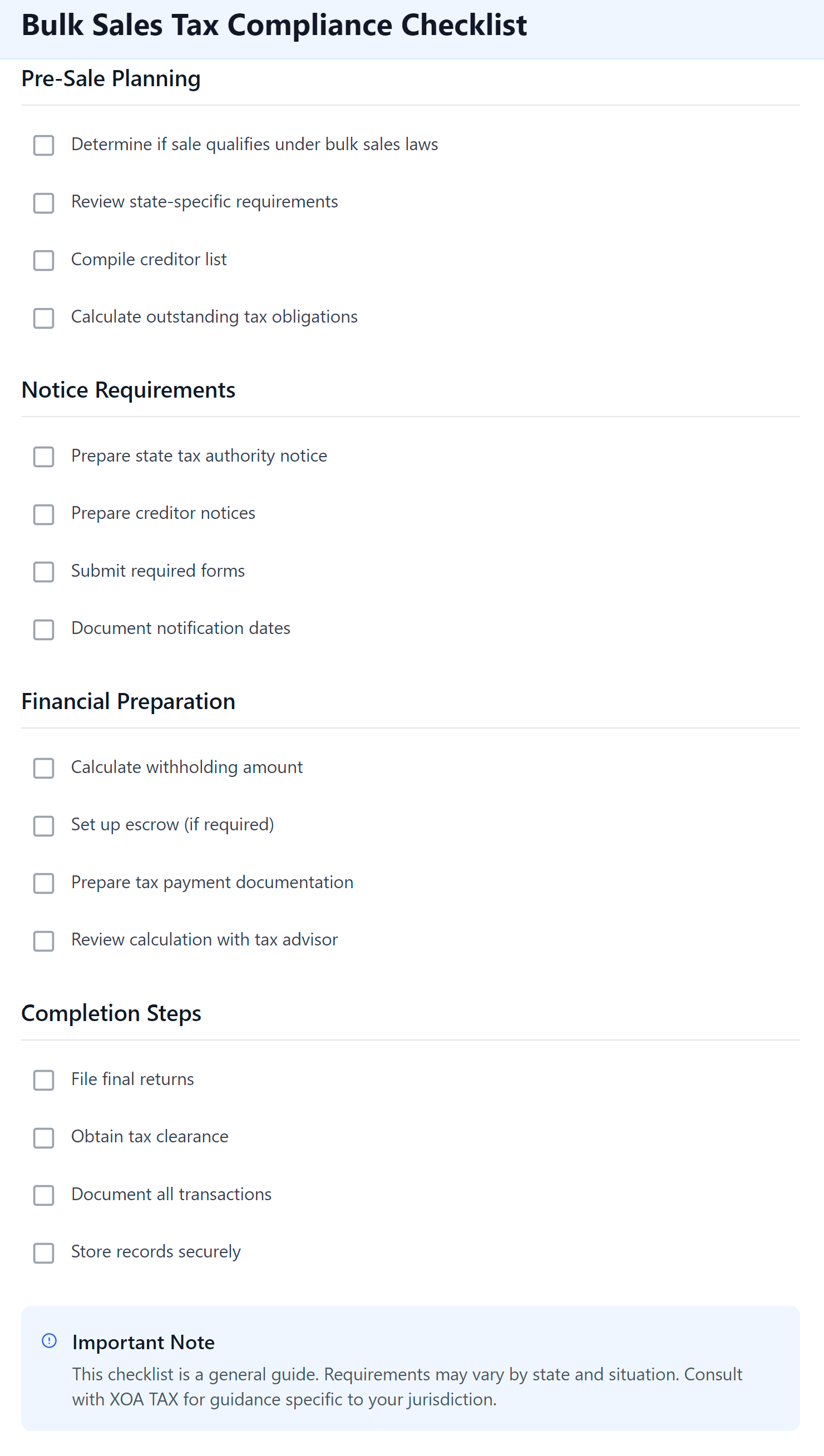

Let’s visualize the complete bulk sales tax process to better understand what’s involved:

Bulk Sales Tax Process

Follow these steps to ensure compliance with bulk sales tax requirements

Initial Assessment

Determine if your sale qualifies under bulk sales tax laws.

- ✓ Review state-specific bulk sale criteria

- ✓ Inventory assets to be sold

- ✓ Assess if sale meets threshold requirements

- ✓ Gather business documentation

Notice Requirements

Notify relevant parties about the upcoming sale.

- ✓ Submit notice to state tax authority (10-45 days before sale)

- ✓ Notify creditors with detailed sale information

- ✓ Complete required state forms (e.g., Form BOE-400-B in CA)

- ✓ Document all notifications sent

Tax Calculation

Calculate and prepare for tax obligations.

- ✓ Determine outstanding sales tax liabilities

- ✓ Calculate withholding requirements

- ✓ Prepare escrow arrangements if needed

- ✓ Document all calculations

Compliance & Documentation

Ensure all legal requirements are met.

- ✓ File all necessary forms with tax authorities

- ✓ Obtain tax clearance certificates

- ✓ Maintain detailed transaction records

- ✓ Prepare final documentation package

Important Note

Requirements vary by state. Consult with XOA TAX for specific guidance on your jurisdiction’s requirements and timelines.

Your Responsibilities as a Seller

- Determine if the Sale Qualifies: Review your state’s laws to see if your transaction meets the criteria for a bulk sale. This often involves thresholds related to the percentage of assets being sold and the type of business.

- Provide Notice: You’ll need to notify both the state tax authority AND your creditors about the upcoming sale. This usually involves submitting a detailed list of creditors, the sale information, and the proposed sale date.

- Notice Periods: These vary by state, typically ranging from 10 to 45 days before the sale. For instance, California requires a 12-day notice.

- Required Forms: States may have specific forms for this notice. For example, California uses Form BOE-400-B, “Notice of Sale/Transfer of Business Assets.”

- Calculate and Withhold Sales Tax: This step ensures you have funds to cover potential outstanding sales tax liabilities.

- Past vs. Current Taxes: Bulk sales tax primarily deals with past due sales tax obligations, not the sales tax on the transaction itself. However, you may need to collect and remit sales tax on the sale of certain assets, depending on your state’s laws.

- Example Calculation: Let’s say your business has $10,000 in past-due sales tax. You’re selling inventory worth $50,000. In this case, you’d need to withhold the $10,000 from the sale proceeds to ensure it’s paid to the state.

- File Necessary Forms: Depending on your state, you may need to file additional forms with the tax authority to document the sale and any tax payments.

Consequences of Non-Compliance

- Personal Liability: You could be held personally responsible for the unpaid sales tax.

- Penalties and Interest: Significant financial penalties can accrue, adding to your debt.

- Legal Action: Creditors can take legal action to recover the debt, potentially jeopardizing your sale and future financial stability.

Navigating the Complexities

Bulk sales tax laws can be intricate and vary significantly from state to state.

- State-Specific Research: Always research the specific requirements in your state. For example, some states have exemptions for certain types of sales or assets.

- Professional Guidance: Consult with a tax professional like XOA TAX. We can help you understand your obligations, calculate the correct tax amount, and ensure you meet all requirements.

Tips for a Smooth Sale:

- Plan Ahead: Begin the process early to allow ample time for compliance.

- Gather Information: Compile a complete and accurate list of creditors and outstanding debts.

- Document Everything: Maintain detailed records of the sale, including notices, tax payments, and correspondence.

- Use a Checklist: Create a checklist of all necessary steps to ensure nothing is overlooked.

- Consult with Professionals: Don’t hesitate to seek guidance from a tax advisor or attorney experienced in bulk sales transactions.

FAQs

Do all states have bulk sales tax laws?

Most states have some form of bulk sales law, often derived from UCC Article 6. However, the specific requirements vary significantly. Some states have repealed Article 6 but maintain similar regulations under different legislation. It’s essential to check the specific laws in your state.

What happens if the buyer is also a business?

Even if the buyer is another business, bulk sales tax laws generally still apply. The buyer may be required to withhold a portion of the purchase price to cover the seller’s potential tax liabilities. This protects the state and creditors.

How long do I need to keep records related to the bulk sale?

It’s advisable to keep records related to the bulk sale for at least several years, as the statute of limitations for sales tax audits can vary. Consult with a tax professional for specific guidance on record retention.

Can I avoid bulk sales tax if I sell my business assets gradually over time?

While structuring a sale as a series of smaller transactions might seem like a way to avoid bulk sales tax, this can be risky. If it’s deemed an attempt to circumvent the law, you could face penalties. Legitimate business restructuring over time is different from intentional tax avoidance. Consult with a tax professional for guidance on structuring your sale.

What about selling digital assets?

The rules regarding bulk sales tax and digital assets are still evolving. Some states may consider digital assets as intangible property and exempt them from bulk sales laws, while others may treat them differently. It’s crucial to consult with a tax professional to understand the specific requirements in your state.

Connecting with XOA TAX:

Selling a business involves many financial and legal complexities. XOA TAX can provide expert guidance on navigating bulk sales tax laws, ensuring a smooth and compliant transaction. We can help you:

- Determine your bulk sales tax obligations.

- Calculate the correct tax amount.

- Prepare and file necessary notices and forms.

- Represent you in any interactions with tax authorities.

Contact us today for a free consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime