Imagine this: Your crowdfunding campaign takes off, you hit your funding goal, and you’re ready to launch your dream business in the Golden State. But wait! Before you celebrate with a trip to Disneyland, remember those funds come with tax implications.

Crowdfunding has become a game-changer for entrepreneurs, providing an alternative avenue to raise capital. Platforms like Kickstarter, Indiegogo, and GoFundMe have helped countless startups get off the ground. But whether you’re offering pre-orders of your innovative gadget, promising exclusive experiences to your backers, or simply seeking donations to fuel your passion project, understanding the tax consequences is crucial. This is especially true in California, where specific regulations can trip up even the savviest entrepreneur.

Key Takeaways

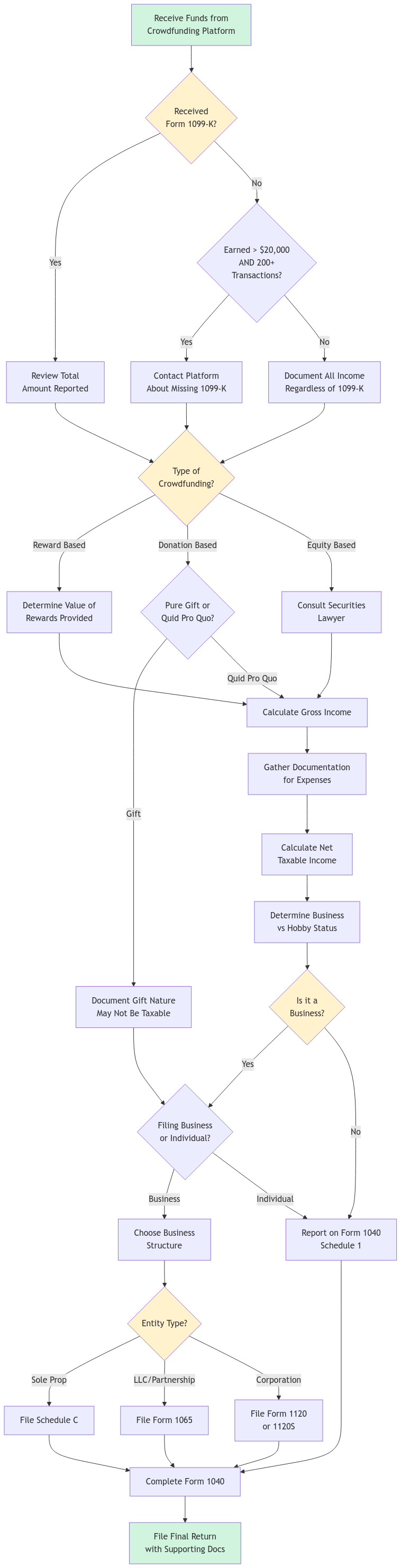

- Most crowdfunded income is taxable, but there are exceptions.

- Form 1099-K reporting requirements have specific thresholds.

- California has unique rules for high-earning and charitable crowdfunding campaigns.

- Sales tax may apply if you offer goods or services through your campaign.

- Keeping detailed records is vital for navigating crowdfunding taxes.

- Different crowdfunding models (donation-based, reward-based, equity-based) have distinct tax implications.

- You can often deduct crowdfunding-related expenses on your tax return.

Taxability of Crowdfunded Amounts

The IRS generally views funds raised through crowdfunding as taxable income. Why? Because, in most cases, there’s an exchange of value. You’re receiving money, and your backers are getting something in return – whether it’s a product, a service, or equity in your company.

However, there’s a key exception: gifts. For a contribution to be considered a gift, it must be given out of “detached and disinterested generosity,” with no expectation of receiving anything in return. Think of it like a birthday present from a loved one. They’re not giving you a gift because they expect something back; they’re giving it out of pure generosity.

Let’s illustrate this with some examples:

- Taxable: You raise funds to manufacture a new type of eco-friendly water bottle. Backers who contribute receive a water bottle as a thank you. This is taxable income because there’s a clear exchange of money for goods.

- Potentially Taxable: You’re crowdfunding to create a documentary film. Backers who contribute receive exclusive behind-the-scenes content and invitations to screenings. This could be taxable, depending on the value of the perks offered and whether they are considered substantial.

- Likely a Gift: Your friend starts a GoFundMe campaign to help you cover medical expenses after an unexpected accident. People contribute out of concern and a desire to help, not because they expect anything in return. This is likely to be considered a gift.

Different Crowdfunding Models and Their Tax Implications

- Donation-based: This model relies on pure generosity, with no expectation of anything in return. While these contributions might be considered gifts, it’s crucial to ensure there’s no quid pro quo involved.

- Reward-based: This is the most common model, where backers receive rewards in exchange for their contributions. The taxability here hinges on the value of the rewards. If the rewards are nominal (e.g., a thank-you note), the funds might be considered gifts. But if the rewards are substantial (e.g., early access to a product, significant discounts), the funds are likely taxable income.

- Equity-based: This involves offering backers shares or ownership in your company. This model has complex tax implications, often involving capital gains and losses. It’s essential to consult with both a tax professional and a securities lawyer to ensure compliance.

Reporting Requirements: Form 1099-K and Beyond

Crowdfunding platforms like Kickstarter and GoFundMe are required to issue Form 1099-K to individuals who receive payments exceeding specific thresholds. Currently, this threshold is $20,000 in gross payments AND over 200 transactions in a calendar year.

Here’s what you need to know about Form 1099-K:

- It reports the total amount of payments you received from the crowdfunding platform.

- The platform also sends a copy to the IRS.

- Receiving a Form 1099-K doesn’t automatically mean the entire amount is taxable. As we discussed, it depends on the nature of the funds (gift vs. income).

How to Report Crowdfunding Income

- Sole Proprietorship: Report income and expenses on Schedule C of your Form 1040.

- Partnership or LLC: Report on the appropriate partnership or corporate tax return.

- Maintain Thorough Records: Keep records of all income and expenses, including invoices, receipts, bank statements, and documentation supporting the nature of the contributions.

Penalties for Non-Compliance

- Accuracy-related penalties for underreporting income.

- Late filing penalties.

- Interest on any unpaid taxes.

State-Specific Considerations in California

California has its own set of rules when it comes to crowdfunding. Here are some key things to keep in mind:

- Charity Registration: If your crowdfunding campaign raises more than $25,000 and is deemed to be charitable in nature, you may be required to register with the California Office of the Attorney General as a charity. This includes campaigns that solicit funds for charitable purposes, even if you’re not a registered non-profit organization. Failure to register can result in fines and legal action.

- Sales Tax: If you offer tangible goods or certain services as rewards for crowdfunding contributions, you’ll likely need to collect and remit California sales tax. The sales tax rate varies depending on the location of the buyer, and California’s nexus rules determine whether you have a sales tax obligation in the state. Additionally, be aware of California’s marketplace facilitator laws, which may place sales tax collection and remittance responsibilities on the crowdfunding platform itself. You can find more information and resources on the California Department of Tax and Fee Administration (CDTFA) website.

California Resources

Deducting Crowdfunding Expenses

You can often deduct expenses related to your crowdfunding campaign, which can help reduce your taxable income and overall tax liability. Here are some common deductible expenses:

- Platform fees: Most crowdfunding platforms charge fees for their services. These fees are generally deductible.

- Marketing and advertising costs: Costs for advertising or marketing to promote your campaign are usually deductible.

- Payment processing fees: Fees charged by payment processors (like Stripe or PayPal) are also typically deductible.

- Consultants and professional services: Fees for consultants, lawyers, or accountants hired to help with your campaign may be deductible.

Important Note: To claim these deductions, keep detailed records of all your expenses, including invoices, receipts, and other supporting documentation.

Business Structure Considerations

Choosing the right business structure is a crucial step for any startup, and it can significantly impact your crowdfunding tax obligations. Here are some key considerations:

- Sole Proprietorship vs. LLC vs. Corporation: Each structure has different tax implications. Sole proprietors report income and expenses on their personal tax return (Schedule C), while LLCs and corporations have separate filing requirements and may face different tax rates.

- California LLC Fees and Taxes: California imposes an annual franchise tax on LLCs, which varies depending on your income. This is reported on California Form 3500.

- Impact on Self-Employment Tax: If you’re operating as a sole proprietor or a single-member LLC, you’ll be subject to self-employment tax on your crowdfunding income. This tax covers Social Security and Medicare.

- Entity Formation Timing: It’s generally advisable to establish your business entity before launching your crowdfunding campaign to ensure proper tax reporting from the start.

International Backers

If your crowdfunding campaign attracts international backers, you’ll need to consider some additional tax implications:

- VAT/GST Implications: Some countries impose value-added tax (VAT) or goods and services tax (GST) on goods and services sold within their borders. You may need to register for VAT/GST in those countries if you meet certain thresholds.

- Currency Conversion Reporting: If you receive payments in foreign currencies, you’ll need to convert them to US dollars for tax reporting purposes. Keep accurate records of the exchange rates used.

- International Shipping and Customs Duties: Factor in the costs of international shipping and any applicable customs duties when determining your expenses.

- Foreign Income Reporting Requirements: If you have significant income from international backers, you may need to file additional forms with the IRS, such as Form 1116 (Foreign Tax Credit) to avoid double taxation.

Best Practices for Crowdfunding Success

To minimize your tax risks and maximize your chances of crowdfunding success, consider these best practices:

- Set Aside Money for Taxes: Don’t spend all your crowdfunding income! Set aside a portion to cover your estimated tax liability

- Maintain Meticulous Records: Keep detailed records of all income and expenses related to your campaign. This includes invoices, receipts, bank statements, and platform fee statements.

- Separate Business Banking: Open a separate bank account for your business to keep your personal and business finances distinct. This not only simplifies accounting but also demonstrates a professional approach to your business.

- Regular Tax Planning: Consult with a tax professional throughout the year, not just during tax season. This will help you stay on top of your tax obligations and make informed financial decisions.

Timing of Income Recognition

When exactly is crowdfunding income considered taxable? It depends on your accounting method:

- Cash Method: If you use the cash method of accounting (most common for small businesses), you generally recognize income when you receive it. So, if a backer contributes to your campaign in December 2024 but you don’t receive the funds until January 2025, you’ll report that income on your 2025 tax return.

- Accrual Method: If you use the accrual method, you generally recognize income when you’ve earned it, regardless of when you receive payment. For example, if you deliver a reward to a backer in December 2024, you’ll recognize the income in 2024, even if the backer paid you in advance.

It’s important to understand your accounting method and how it affects the timing of income recognition for your crowdfunding campaign.

FAQs

What if I use the crowdfunding money for personal expenses?

If you use crowdfunded money for personal expenses, it’s still considered taxable income. You can’t avoid taxes by simply spending the money on personal items.

Do I need to pay estimated taxes on my crowdfunding income?

If your crowdfunding income is significant, you may need to pay estimated taxes throughout the year to avoid penalties. We recommend consulting with a tax professional to determine your estimated tax obligations. Generally, you’ll need to pay estimated taxes if you expect to owe at least $1,000 in taxes when you file.

Can I crowdfund for a non-profit in California? What are the tax implications?

Yes, you can crowdfund for a non-profit in California. Donations to registered charities are generally tax-deductible for the donors. However, the non-profit itself may have to register with the state and comply with various regulations, depending on the nature of the campaign and the amount of money raised.

Feeling Overwhelmed? XOA TAX Can Help!

Navigating the complexities of crowdfunding taxes can be challenging, especially with California’s unique rules. At XOA TAX, we have extensive experience helping startups understand their tax obligations and maximize their deductions. We can help you:

- Determine the taxability of your crowdfunding income.

- Meet your reporting requirements and avoid penalties.

- Comply with California’s specific crowdfunding regulations.

- Identify and claim all eligible deductions.

- Choose the right business structure for your startup.

- Plan for taxes before, during, and after your campaign.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime