The travel industry is global, with businesses often serving clients across borders. If your LLC is based outside the U.S. but you’re crafting dream vacations for California residents, understanding California’s source income rules is essential for your tax compliance. Let’s explore how the Golden State taxes income earned by non-U.S. resident LLCs, particularly those in the travel sector.

Key Takeaways

- California taxes income “sourced” in the state, even if your business is located elsewhere.

- Services performed outside the U.S. for California clients can be considered California source income under market-based sourcing rules.

- Non-U.S. resident LLCs may have filing requirements in California, including those for single-member LLCs.

- Proper tax planning is essential to minimize your tax liability and ensure compliance.

What is California Source Income?

California source income, as defined in California Revenue and Taxation Code Section 23040, is any income derived from activities within California or from property located in the state. This seems straightforward, but it can get tricky when you’re providing services remotely.

California Source Income and the Travel Industry

Imagine this: Your travel agency is based in Europe, and you arrange a California family’s trip to Bali. Even though you performed the services outside the U.S., California may still consider this California source income. This is due to market-based sourcing rules, which apply specifically to the sale of services. California Code of Regulations, Title 18, Section 25136-2, provides more specific rules for sourcing these types of sales. Essentially, if the benefit of your service is delivered to a California resident, it can be considered California source income.

Tax Implications for Non-U.S. Resident LLCs

If California considers your travel agency’s services as California source income, your LLC might have the following tax obligations:

- Filing a California tax return: You may need to file Form 565, Partnership Return of Income, or Form 568, Limited Liability Company Return of Income. Single-member LLCs may have different filing requirements, so it’s important to check with a tax professional or the California Franchise Tax Board website [link to FTB website].

- Paying California income tax: The tax rate will depend on your LLC’s income. California also imposes an $800 minimum franchise tax on LLCs, even if you have no net income.

- Understanding potential apportionment: If your LLC has income from both California and other sources, you may need to apportion your income to determine the amount taxable by California. This involves using specific apportionment formulas to allocate income based on factors like sales, property, and payroll.

Minimizing Your Tax Liability

- Structuring your business: Explore different business structures to see which might be most tax-efficient for your situation.

- Claiming deductions: Ensure you’re claiming all allowable deductions to reduce your taxable income. For travel agencies, this might include expenses like marketing, home office deductions (if applicable), and professional fees.

- Seeking professional advice: Consult with a qualified CPA experienced in international taxation to develop a tailored tax strategy.

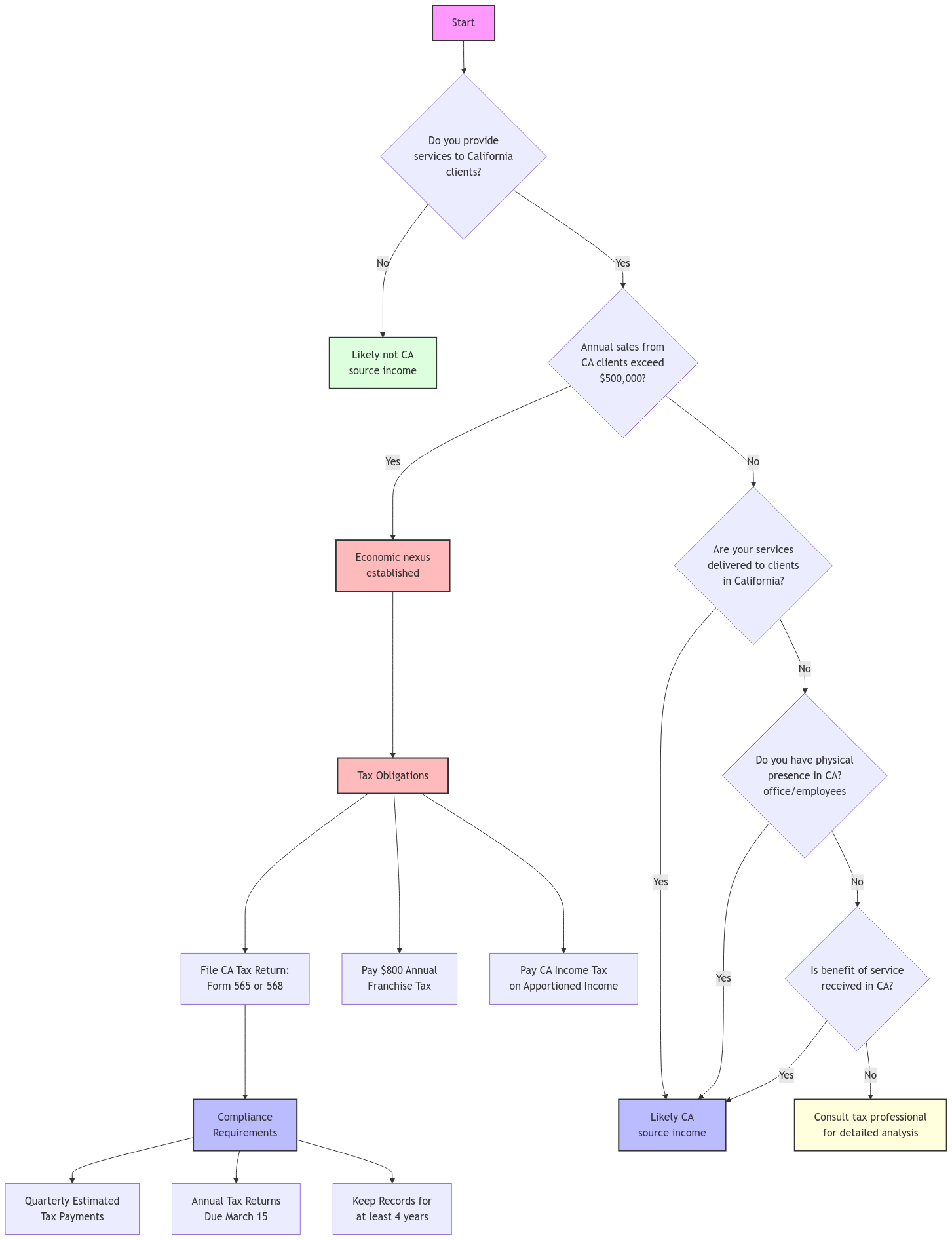

Do You Have California Source Income?

Economic Nexus

California has adopted economic nexus rules, meaning that even if you don’t have a physical presence in the state, you may still have tax obligations if you exceed certain thresholds for sales in California. The current threshold is $500,000 in sales from California sources. It’s important to be aware of these rules, as they can significantly impact your tax liability.

LLC Member Liability

One of the advantages of an LLC is that it generally provides liability protection to its members. This means that your personal assets are typically protected from business debts and liabilities. However, it’s important to understand how these rules apply to non-U.S. residents and whether there are any exceptions.

International Tax Considerations

This section explores the complexities of international taxation for non-U.S. resident LLCs operating in the travel industry.

FDAP Income

Income from sources outside the U.S., such as interest, dividends, and royalties, is considered Fixed, Determinable, Annual, or Periodical (FDAP) income. This income may be subject to U.S. withholding tax.

Effectively Connected Income (ECI)

If your business has a U.S. trade or business, some of your income may be considered ECI and subject to regular U.S. income tax rates.

Tax Treaties

The U.S. has tax treaties with many countries that can affect how your income is taxed. These treaties can provide benefits such as reduced tax rates or exemptions. It’s essential to consult a tax advisor to determine if a treaty applies to your situation.

Important Reporting Requirements

- FBAR: If you have a financial interest in, or signature authority over, foreign financial accounts that exceed certain thresholds, you may need to file a Report of Foreign Bank and Financial Accounts (FBAR) with the U.S. Treasury Department.

- FATCA: The Foreign Account Tax Compliance Act (FATCA) requires foreign financial institutions to report information about accounts held by U.S. taxpayers. This could impact your business if you have accounts with foreign banks.

International Payment Processing

Processing payments from international clients can introduce complexities in terms of currency exchange rates, fees, and potential tax implications. It’s crucial to choose a payment processor that meets your needs and understand any tax reporting requirements associated with international transactions.

California Sales Tax for Travel Agencies

While many travel agency services are not taxable in California, there are some exceptions. For example, selling tangible goods like travel guides or souvenirs may be subject to sales tax. It’s important to determine if the specific services you offer are taxable and to collect and remit sales tax accordingly.

To ensure compliance, travel agencies should consult the California Department of Tax and Fee Administration (CDTFA) or a tax professional to understand their specific tax responsibilities. This approach helps in determining which transactions are taxable and ensures proper collection and remittance of sales tax.

Filing Deadlines and Extensions

- Annual Returns: California LLC tax returns are typically due on the 15th day of the third month after the end of the tax year. For calendar year taxpayers, this means March 15th.

- Estimated Taxes: Estimated taxes are typically due in quarterly installments throughout the year.

- Extensions: You can request an extension to file your tax return, but this does not extend the deadline to pay your taxes.

Record-Keeping Requirements

Maintaining accurate and organized records is crucial for tax compliance. California requires businesses to keep various records, including:

- Income and expense records: Invoices, receipts, bank statements, etc.

- Sales tax records: If you sell taxable goods or services.

- Employment records: If you have employees.

You should generally keep these records for at least four years, but it’s best to consult with a tax professional for specific guidance. Digital record-keeping is acceptable as long as the records are complete and accurate.

Recent Updates for 2024

Stay informed about any recent California tax rate changes, new filing requirements, or regulatory changes affecting international businesses. For example, monitor updates to the state’s income tax brackets or new legislation impacting LLCs.

Common Pitfalls to Avoid

- Misunderstanding market-based sourcing rules.

- Failing to register with the California Franchise Tax Board when required.

- Missing estimated tax payments.

- Incorrectly classifying income.

New LLC Compliance Timeline

1. First 30 Days:

- Register with the California Secretary of State: Submit the necessary formation documents to legally operate in California.

- Obtain an Employer Identification Number (EIN): Secure an EIN from the IRS for tax reporting and banking purposes.

2. First 90 Days:

- Implement an Accounting System: Set up a system to accurately track income and expenses.

- Register for Sales Tax (if applicable): If your services or products are subject to sales tax, register with the California Department of Tax and Fee Administration.

3. Ongoing Responsibilities:

- Quarterly Estimated Tax Payments: Calculate and remit estimated taxes to avoid penalties.

- Annual Tax Returns: File returns by the 15th day of the third month after your tax year ends (e.g., March 15 for calendar-year taxpayers).

- Minimum Franchise Tax: Pay the $800 minimum franchise tax annually, regardless of income.

Example Calculation: California Source Income

Consider a travel agency with the following revenue distribution:

- Total Revenue: $1,000,000

- Revenue from California Clients: $600,000

- Revenue from Non-California Clients: $400,000

To determine the portion of income subject to California tax:

California Apportionment Percentage: $600,000 (California revenue) ÷ $1,000,000 (total revenue) = 60%

Thus, 60% of the agency’s income is considered California source income and is subject to state taxation.

FAQs

I’m a non-U.S. resident with an LLC. Do I need a California Employer Identification Number (EIN)?

While not always required, obtaining an EIN can be helpful for various business activities, such as opening a bank account or filing taxes. You can apply for an EIN online through the IRS website.

How do I determine the exact amount of my income that is considered California source income?

This can be complex and depends on the specifics of your business activities. It’s best to consult with a tax professional who can analyze your situation and provide guidance.

Are there any tax treaties between the U.S. and my country that might affect my tax liability?

The U.S. has tax treaties with many countries. These treaties can impact how your income is taxed in the U.S. A tax advisor can help you determine if a treaty applies to your situation.

What’s the difference between California sales tax and California source income?

California sales tax is a tax on the sale of tangible goods and some services in California. It’s collected from consumers at the point of sale and remitted to the state. California source income, on the other hand, is a broader concept that includes income earned from activities within California, regardless of whether sales tax applies. This can include income from services provided to California clients, even if those services are performed outside the state.

Connecting with XOA TAX

Understanding and complying with California’s source income rules is vital for your travel agency’s financial health. At XOA TAX, we have a team of experienced CPAs specializing in international taxation. We can help you navigate these complexities, optimize your tax strategy, and ensure you meet all your filing obligations.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime