Hey there, fellow Californians! It’s your friends at XOA TAX, here to break down the sometimes confusing world of California income tax for 2024. Think of us as your friendly neighborhood tax guides, ready to help you navigate those tricky tax trails.

Just like a multi-layered cake, California’s income tax system has different levels, or “brackets,” with increasing tax rates as your income grows. But don’t worry, we’ll help you figure out which slice of the cake you’re enjoying and how much you might need to pay on it.

Key Takeaways

- California has its own income tax, completely separate from what you pay Uncle Sam.

- The state uses a progressive tax system, kind of like a staircase with increasing rates.

- These tax brackets change a bit each year to keep up with inflation.

- You can often shrink your taxable income with things called “deductions” and “credits.”

- Knowing your filing status (single, married, etc.) is super important for figuring out your taxes.

California’s Progressive Tax System: Like Climbing Stairs

Imagine climbing a staircase. Each step you take represents a different income level, and as you climb higher, the tax rate goes up. But here’s the good news: you only pay the higher rate on the part of your income that falls on that specific step.

For example, if you’re single and earn $60,000, you wouldn’t pay 9.3% on the whole thing. Instead, you’d pay 1% on the first $10,756, then 2% on the amount between $10,757 and $25,499, and so on. It’s like paying different prices for different parts of your income.

2024 Tax Brackets and Rates: A Closer Look

We get it, tables filled with numbers can be a bit overwhelming. So, let’s break down those 2024 tax brackets in a way that’s easier to digest.

2024 California Tax Bracket Calculator

Your Tax Breakdown

Total Tax: $0

Effective Tax Rate: 0%

Single Filers

| Tax Rate | Taxable Income Bracket |

|---|---|

| 1% | $0 to $10,756 |

| 2% | $10,757 to $25,499 |

| 4% | $25,500 to $40,245 |

| 6% | $40,246 to $55,866 |

| 8% | $55,867 to $70,606 |

| 9.3% | $70,607 to $360,659 |

| 10.3% | $360,660 to $432,787 |

| 11.3% | $432,788 to $721,314 |

| 12.3% | $721,315 and above |

Married Filing Jointly

| Tax Rate | Taxable Income Bracket |

|---|---|

| 1% | $0 to $21,512 |

| 2% | $21,513 to $50,998 |

| 4% | $50,999 to $80,490 |

| 6% | $80,491 to $111,732 |

| 8% | $111,733 to $141,212 |

| 9.3% | $141,213 to $721,318 |

| 10.3% | $721,319 to $865,574 |

| 11.3% | $865,575 to $1,442,628 |

| 12.3% | $1,442,629 and above |

Head of Household

| Tax Rate | Taxable Income Bracket |

|---|---|

| 1% | $0 to $21,527 |

| 2% | $21,528 to $51,000 |

| 4% | $51,001 to $65,744 |

| 6% | $65,745 to $81,364 |

| 8% | $81,365 to $96,107 |

| 9.3% | $96,108 to $490,493 |

| 10.3% | $490,494 to $588,593 |

| 11.3% | $588,594 to $980,987 |

| 12.3% | $980,988 and above |

Married Filing Separately

| Tax Rate | Taxable Income Bracket |

|---|---|

| 1% | $0 to $10,756 |

| 2% | $10,757 to $25,499 |

| 4% | $25,500 to $40,245 |

| 6% | $40,246 to $55,866 |

| 8% | $55,867 to $70,606 |

| 9.3% | $70,607 to $360,659 |

| 10.3% | $360,660 to $432,787 |

| 11.3% | $432,788 to $721,314 |

| 12.3% | $721,315 and above |

The Mental Health Services Tax

If your taxable income is over $1 million, there’s an extra 1% Mental Health Services Tax on top of your regular rate. This means the highest tax rate you could pay is 13.3%.

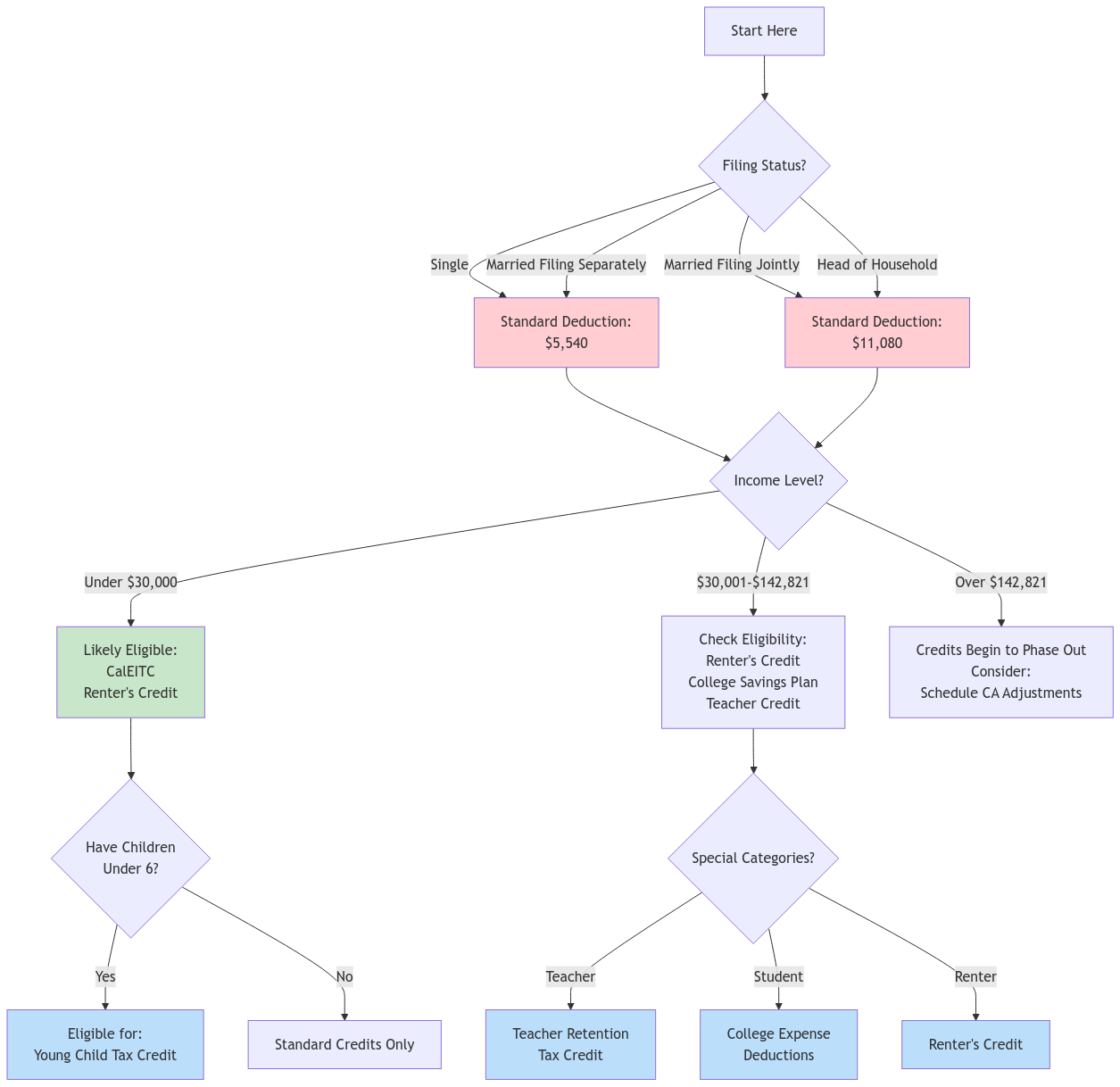

Shrinking Your Taxable Income: Deductions and Exemptions

Here’s the really good news: you can often make your taxable income smaller, which means you’ll owe less in taxes. It’s like getting a discount on that cake we were talking about!

Standard Deductions

- Single or Married Filing Separately: $5,540

- Married Filing Jointly, Qualifying Widow(er), or Head of Household: $11,080

Personal Exemption Credits

- $144 for yourself

- $446 for each person you claim as a dependent

Important Note: These exemption credits start to disappear gradually as your income goes up. Here’s a quick look at when that happens:

| Filing Status | Phase-Out Begins |

|---|---|

| Single | $142,821 |

| Married Filing Jointly | $285,642 |

| Head of Household | $214,231 |

| Married Filing Separately | $142,821 |

Want the nitty-gritty details on this phase-out? Check out the California Franchise Tax Board website.

Keeping Good Records: Your Tax Superhero Power

Think of good record-keeping as your tax superpower. It means keeping track of all your income and expenses throughout the year, like a detective gathering clues. This makes doing your taxes way easier and helps you take advantage of every deduction you deserve.

Here are some examples of documents you’ll want to keep handy:

- W-2s and 1099s: These show how much you earned from your job or other sources.

- Medical Bills: If you had a lot of medical expenses, you might be able to deduct some of them.

- Charitable Donation Receipts: Did you donate to charity? Keep those receipts!

- Business Expense Records: If you’re self-employed or run a business, keep detailed records of all your income and expenses.

Estimated Taxes: Paying as You Go

If you think you’ll owe $500 or more in California income tax, you’ll probably need to make estimated tax payments throughout the year. This is like paying your taxes in installments, so you don’t get hit with a huge bill all at once in April.

Who Needs to Pay Estimated Taxes?

You might need to pay estimated taxes if you have income that doesn’t have taxes automatically taken out, like:

- Money you make from your own business

- Interest and dividends from investments

- Capital gains (profit from selling something like stocks)

- Rental income

When are Estimated Taxes Due?

Estimated tax payments are usually due four times a year:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

Calculating Your Estimated Taxes

Figuring out how much to pay can feel like a puzzle, but we’ve got you covered. Here are a few ways to calculate those estimated taxes:

- Form 540-ES Worksheet: Grab a copy of Form 540-ES and use the handy worksheet to guide you.

- Last Year’s Taxes: Take a peek at your tax return from last year. That can give you a good starting point.

- FTB’s Online Calculator: The Franchise Tax Board has a nifty online calculator that can help you estimate your payments.

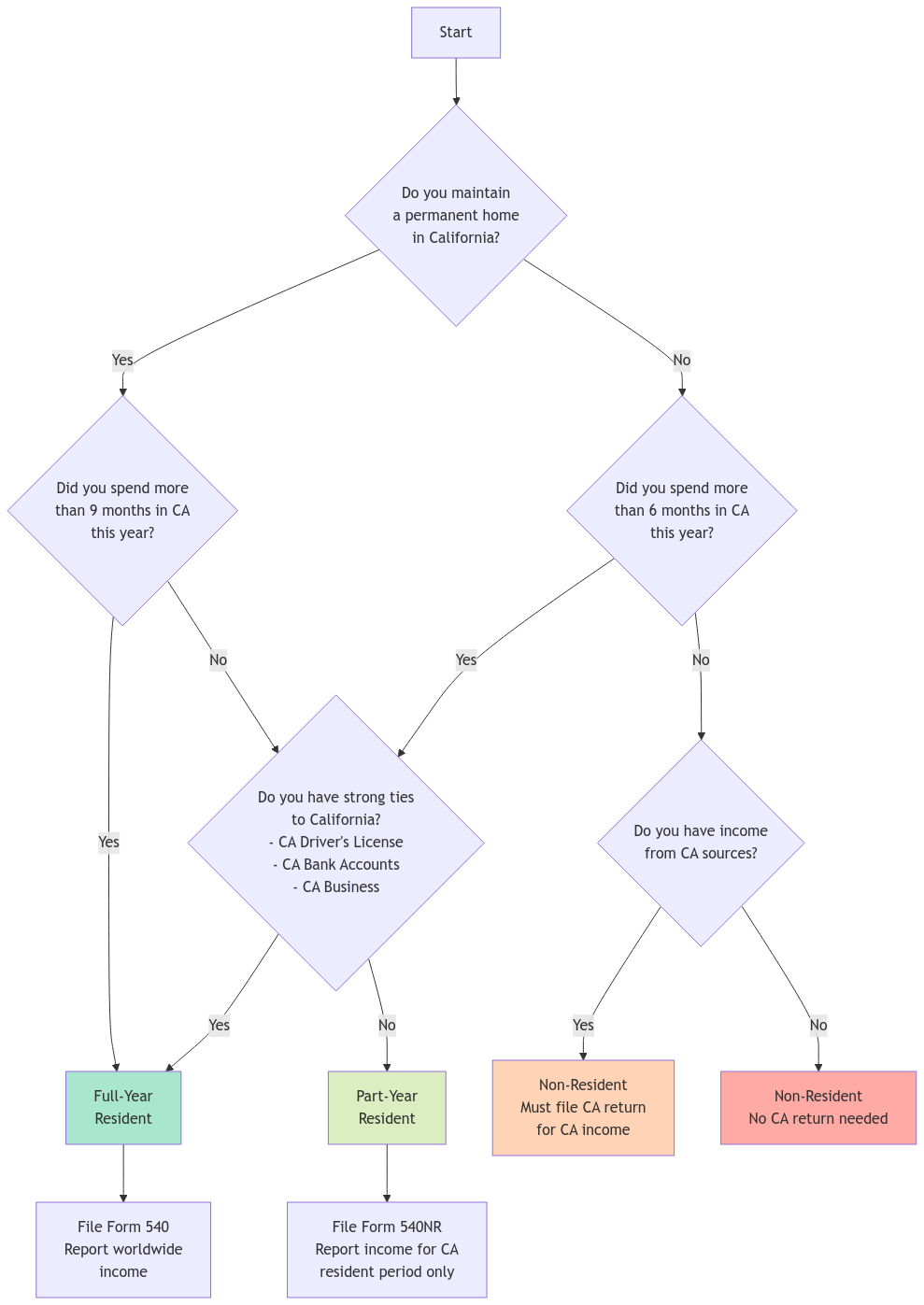

New to California? Welcome!

Just landed in the Golden State? Awesome! Here’s a quick intro to how California taxes work for newcomers:

Are You a Resident?

- Resident: If you’re in California with the intention of staying put, you’re considered a resident for tax purposes.

- Nonresident: Just visiting or here temporarily? Then you’re generally considered a nonresident.

How You’re Taxed

- Residents: You’ll pay taxes on all your income, no matter where it comes from.

- Nonresidents: You’ll only pay taxes on income you earned within California.

If you moved to California during the year, or if you left the state, you’ll file as a part-year resident. This means you’ll only pay taxes on the income you earned while you were a California resident.

California Tax Credits: Extra Savings!

California has some cool tax credits that can help you save even more money on your taxes. Think of them as bonus discounts! Here are a few examples:

- Earned Income Tax Credit (CalEITC): This credit is designed for working folks with low to moderate incomes.

- Young Child Tax Credit (YCTC): If you qualify for the CalEITC and have a little one under 6 years old, you might get this credit too.

- Renter’s Credit: If you rent your home in California, you might be eligible for this credit.

Want to learn more about these credits and others? Head over to the Franchise Tax Board website.

California Schedule CA (540): Fine-Tuning Your Income

When it’s time to file your California tax return, you might need to make some adjustments to your income. These adjustments are reported on California Schedule CA (540). Here are a couple of examples:

- Saving for College: If you’ve been contributing to California’s 529 College Savings Plan, you might be able to deduct those contributions. It’s a great way to save for future education expenses!

- Teacher’s Credit: If you’re a teacher, you might be able to claim a special credit to help lower your taxes.

Make sure to take a close look at Schedule CA (540) to see which adjustments might apply to you.

E-filing: The Easy Way to File

California loves it when taxpayers file their returns electronically. In fact, if you earn a certain amount, you might have to e-file.

Why E-file?

- Speedy Refunds: Get your refund faster than waiting for the mail.

- Accuracy is Key: E-filing helps reduce errors, so you’re less likely to make mistakes.

- Safe and Secure: Your tax information is safe and sound when you e-file.

You can find a list of approved e-filing websites and helpful resources on the Franchise Tax Board website.

Working in Different States? Check Out Reciprocal Agreements

If you live in California but work in another state (or the other way around), you might be wondering how that affects your taxes. Good news! California has special agreements with some neighboring states.

What’s a Reciprocal Agreement?

It means you only pay income tax to the state where you live, even if you work in a different state. This can make things a lot simpler and prevent you from having to file taxes in two states.

Which States Have Reciprocal Agreements with California?

Currently, California has reciprocal agreements with:

- Arizona

- Indiana

- Oregon

- Virginia

So, if you live in California and work in any of these states, you’ll only need to file a California tax return. And if you live in one of these states and work in California, you’ll only file a tax return in your home state.

Important Note: It’s always a good idea to double-check the specific rules and requirements for reciprocal agreements, as they can sometimes change. You can find more information on the California Franchise Tax Board website or by contacting us at XOA TAX.

Alternative Minimum Tax (AMT): A Different Calculation

California has its own Alternative Minimum Tax (AMT). It’s a special way of calculating your taxes that might apply to some people.

Who Might Need to Worry About the AMT?

The AMT often comes into play if you have certain deductions or exemptions. You might be more likely to be affected by the AMT if you have:

- High itemized deductions

- Big capital gains (profit from selling assets)

- Incentive stock options

If you think the AMT might apply to you, it’s a good idea to chat with a tax pro.

Regular Tax vs. AMT Comparison

Regular Tax

| Starting Income | $200,000 |

| Standard Deduction | -$5,540 |

| Personal Exemption | -$144 |

| Taxable Income | $194,316 |

| Regular Tax | $15,824 |

AMT Calculation

| Starting Income | $200,000 |

| AMT Exemption | -$15,775 |

| AMT Income | $184,225 |

| AMT (7% rate) | $12,896 |

Final Tax Liability

In this example, you would pay the Regular Tax of $15,824

(Since Regular Tax is higher than AMT)

Important Notes:

- You pay the higher of Regular Tax or AMT

- AMT exemption phases out for higher incomes

- Example uses single filer rates for 2024

- Actual calculations may vary based on specific circumstances

AMT Phase-Out Schedules: When Exemptions Start to Fade

Just like those personal exemption credits, the AMT exemption amount can also start to disappear gradually as your income rises. Here’s a handy table showing you those phase-out schedules:

| Filing Status | Exemption Amount | Phase-Out Begins |

|---|---|---|

| Single | $15,775 | $164,473 |

| Married Filing Jointly | $23,661 | $246,604 |

| Head of Household | $19,718 | $205,538 |

| Married Filing Separately | $11,831 | $123,302 |

Frequently Asked Questions

What’s the difference between a tax deduction and a tax credit?

Think of a tax deduction as a way to lower your taxable income. It’s like getting a discount on the amount of income you’re taxed on. A tax credit, on the other hand, directly reduces the amount of tax you owe. It’s like getting a coupon for money off your final bill.

I’m a freelancer. Do I need to pay estimated taxes?

If you expect to owe $500 or more in California income tax, then yes, you’ll likely need to make estimated tax payments throughout the year. This is because taxes aren’t automatically withheld from your freelance income like they are from your paycheck if you’re an employee.

I just moved to California from another state. Do I need to file a California tax return?

If you earned income while you were a California resident, then yes, you’ll need to file a California tax return. You’ll file as a part-year resident and report only the income you earned while living in California.

Where can I find more information about California tax laws and regulations?

The best place to find detailed and up-to-date information is the official website of the California Franchise Tax Board.

Need More Help? XOA TAX is Here for You!

We know that even with friendly guides and helpful explanations, taxes can still feel a bit overwhelming. But remember, you don’t have to face them alone! At XOA TAX, we’re your tax allies, ready to answer your questions, guide you through the process, and help you make the most of your tax situation.

So, if you’re feeling puzzled or just want some expert advice, don’t hesitate to reach out. We’re always happy to help!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime