Tax season can be overwhelming, and many people look for ways to lower their tax bills. One idea that pops up is using tax-deferred contributions to bring your adjusted gross income (AGI) down to zero, potentially eliminating your income tax. But is this feasible? Let’s dive into the details and see what’s possible.

Strategic Framework for Tax-Deferred Planning

- Income Type Matters: Different types of income have different tax-deferral opportunities.

- Layered Optimization: Strategic ordering of contributions maximizes tax benefits.

- Time Horizon Impact: The power of tax-deferred growth compounds over decades.

- Regulatory Constraints: Understanding limits helps set realistic expectations.

Understanding Tax-Deferred Contributions

Tax-deferred contributions are money you put into retirement accounts like 401(k)s, 403(b)s, or IRAs. These contributions lower your current taxable income, meaning you pay less in taxes now and defer taxes until you retire. For example, if you contribute $10,000 to a traditional IRA, your AGI drops by that amount, postponing taxes on that money until you withdraw it in retirement.

Contribution Limits for 2024

| Account Type | Base Contribution | Catch-Up (50+) |

|---|---|---|

| 401(k) | $23,000 | $7,500 |

| Traditional/Roth IRA | $7,000 | $1,000 |

| SIMPLE IRA | $16,000 | $3,500 |

| SEP IRA | $69,000 | N/A |

| Solo 401(k) | $61,000 | $7,500 |

Can You Reduce Your AGI to $0?

- Only Earned Income Counts: You can only offset earned income (like wages or self-employment income). Investment income, such as dividends or capital gains, doesn’t get reduced by these contributions.

- Contribution Limits: Even if you max out all your contributions, the total amount you can defer is capped. For example, the combined limit for 401(k) and IRA contributions won’t typically cover enough to zero out your AGI unless your income is very low.

Practical Implementation Example

Consider Jane, a software engineer earning $120,000 annually:

Initial Position

- Gross Income: $120,000

- Marginal Tax Rate: 24%

- State Tax: 6%

Strategic Implementation

- 401(k) with Employer Match: $23,000

- HSA Contribution: $4,150

- Traditional IRA: $7,000

Results

- Reduced AGI: $85,850

- Tax Savings: ~$11,500

- Additional Employer Match: $6,000

This strategic approach not only reduces current tax liability but also builds significant tax-advantaged retirement savings.

Tax Savings Calculator

Calculate your potential tax savings from retirement contributions

Retirement Contributions

Your Tax Savings

Traditional vs. Roth IRAs

- Traditional IRA: Contributions may be tax-deductible, lowering your AGI. However, the deduction phases out at higher incomes. For 2024, the deduction starts to phase out at $77,000 and is fully phased out at $87,000 for single filers.

- Roth IRA: Contributions aren’t tax-deductible, but withdrawals in retirement are tax-free. In 2024, you can contribute up to $7,000, with contributions phasing out between $146,000 and $161,000 for single filers.

Required Minimum Distributions (RMDs)

- Born before 1959: Start at age 73

- Born after 1959: Start at age 75

These withdrawals are taxed as ordinary income, so it’s something to plan for in your retirement strategy.

SIMPLE IRAs

- 2024 Limit: $16,000 for employee contributions

- Employer Contributions: Must match 3% of your salary or contribute 2% non-electively

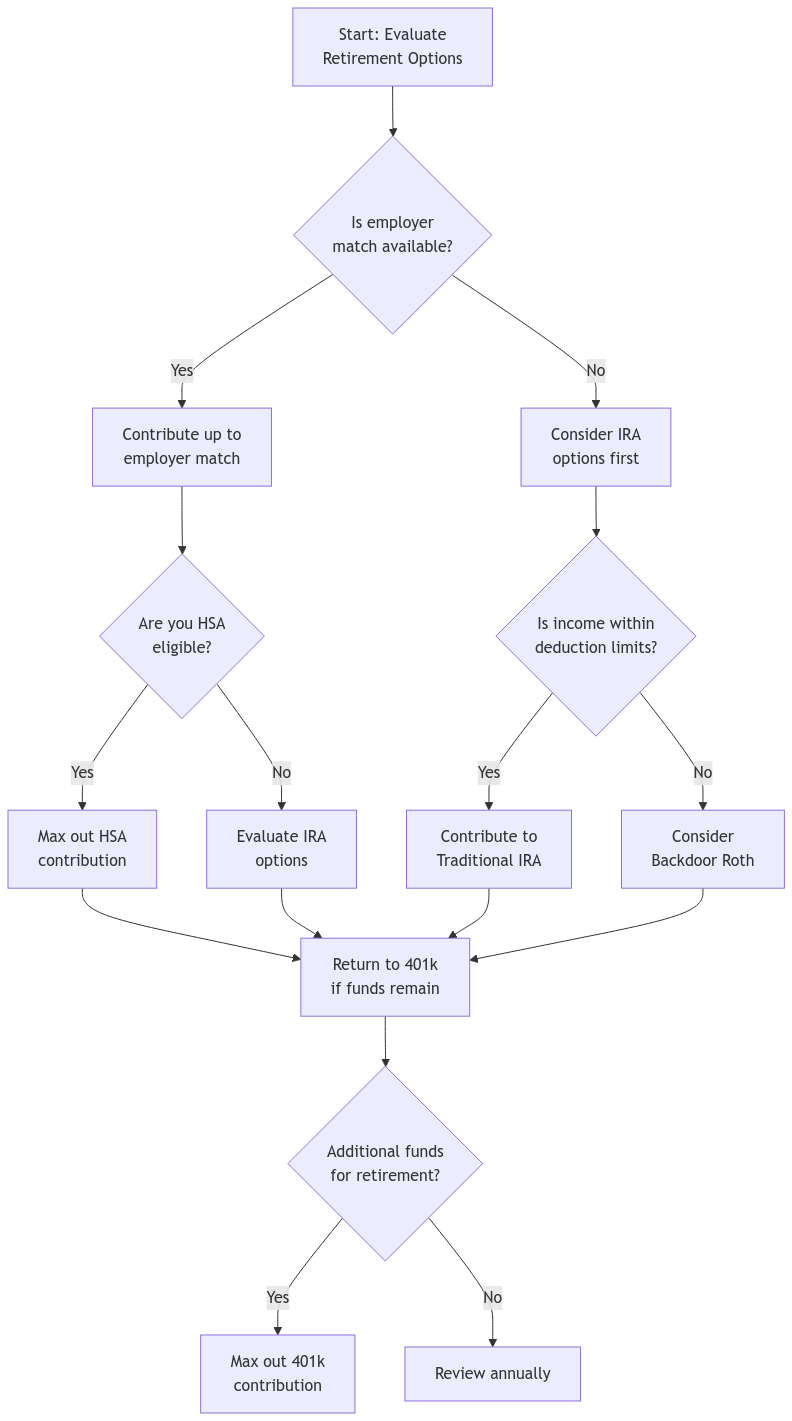

Strategic Decision Framework

Alternative Ways to Lower Your Tax Bill

- Tax Credits: These reduce your tax bill dollar-for-dollar. Some, like the Earned Income Tax Credit, can even result in a refund.

- Tax Deductions: These lower the amount of income that’s taxed. Common deductions include those for self-employed health insurance and up to $2,500 in student loan interest.

- Roth IRA Investments: While contributions aren’t tax-deductible, qualified withdrawals in retirement are tax-free.

- Relocating for Retirement: Moving to a state with no income tax can save you money on state taxes when you withdraw from retirement accounts.

State Tax Considerations

State taxes vary widely. Some states have no income tax, while others, like California, can tax up to 13.3% of your income. It’s important to understand your state’s tax rules, especially if you’re planning to move after retirement.

Coordinating Your Retirement Accounts

- Employer 401(k) Match: Always contribute enough to get the full employer match—it’s free money.

- Health Savings Account (HSA): If eligible, max out your HSA for its triple tax benefits.

- IRA Contributions: After the 401(k) match and HSA, consider contributing to a Traditional or Roth IRA.

- Max Out 401(k): Once IRA contributions are maxed, go back to your 401(k) to increase your savings.

- Advanced Strategies: Explore options like the backdoor Roth IRA for additional tax benefits.

Plans for the Self-Employed

- SEP IRA: Allows for higher contributions, up to $69,000 in 2024.

- Solo 401(k): Similar to a SEP IRA but with a slightly lower limit of $61,000, or $67,500 if you’re 50 or older.

Backdoor Roth and Mega Backdoor Roth

- Backdoor Roth IRA: Contribute to a Traditional IRA and then convert it to a Roth IRA.

- Mega Backdoor Roth: Make after-tax contributions to a 401(k) and then roll them over to a Roth IRA.

These methods can provide additional tax-free growth opportunities.

Beware of Early Withdrawal Penalties

Taking money out of your retirement accounts before age 59½ typically incurs a 10% penalty, plus taxes. Always consult a tax professional before making early withdrawals to avoid unexpected costs.

Frequently Asked Questions

What is the maximum contribution I can make to my 401(k)?

For 2024, you can contribute up to $23,000. If you’re 50 or older, you can add an extra $7,500.

Can I contribute to both a Roth and a Traditional IRA?

Yes, as long as your total contributions don’t exceed $7,000 for 2024 ($8,000 if you’re 50 or older). For example, you could put $3,000 into a Roth IRA and $4,000 into a Traditional IRA.

What is the tax credit for small employer pension plan startup costs?

Employers who set up a retirement plan for their employees can receive a credit covering up to 50% of the first three years’ costs, plus an additional $500 for auto-enrollment features.

Conclusion

Reducing your AGI to zero with tax-deferred contributions is an appealing idea, but practical limitations make it unfeasible for most. However, by understanding the available strategies and maximizing your contributions within the allowed limits, you can effectively lower your tax bill and build a solid foundation for your retirement.

Need Help with Tax Planning?

Navigating tax laws can be tricky, but you don’t have to do it alone. At XOA Tax, we can help you create a budget that maximizes your tax savings. Reach out to us:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime