Selling a business is a major financial and life decision. Whether you’re a seasoned entrepreneur or a first-time business owner, understanding the tax implications is crucial for maximizing your after-tax proceeds. One area that often causes confusion is how capital gains taxes apply when the sale involves a mix of cash and equity compensation. At XOA TAX, we help clients navigate these complexities every day. Let’s break down the key considerations and strategies for minimizing your tax burden.

Key Takeaways

- Capital gains taxes apply to profits from selling a business, regardless of whether you receive cash or equity.

- The holding period of the asset and your income level determine your capital gains tax rate.

- Equity compensation can defer capital gains taxes, but it also comes with risks and complexities.

- Careful planning and professional advice are essential for minimizing taxes in a business sale.

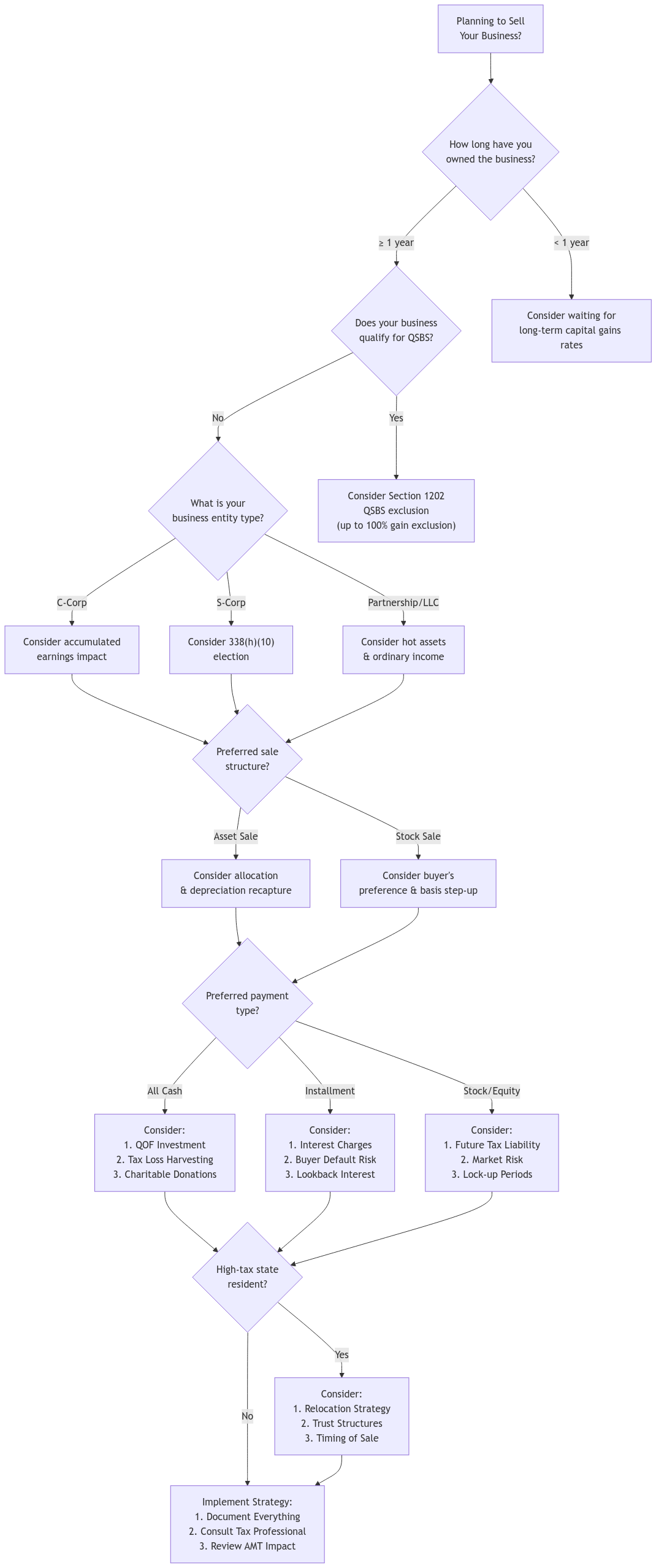

Decision-Making Framework

Selling a business involves numerous interconnected decisions that can significantly impact your tax liability. To help you navigate this complex process, we’ve created a comprehensive decision tree that maps out the key considerations and their tax implications. This flowchart will serve as your roadmap throughout the sales process, from initial planning to final execution. Each decision point represents a critical juncture where proper tax planning can make a substantial difference in your after-tax proceeds. Follow along with this flowchart as we dive deeper into each element in the sections below:

Understanding Capital Gains Tax

When you sell a capital asset, like a business, for more than its cost basis (what you originally paid for it), you realize a capital gain. This gain is subject to capital gains tax, which varies depending on your income level and how long you’ve held the asset.

For 2024, the long-term capital gains tax rates (for assets held longer than one year) are:

| Filing Status | 0% Rate | 15% Rate | 20% Rate |

|---|---|---|---|

| Single | Up to $47,025 | $47,026 to $518,900 | Over $518,900 |

| Married Filing Jointly | Up to $94,050 | $94,051 to $583,750 | Over $583,750 |

| Married Filing Separately | Up to $47,025 | $47,026 to $291,850 | Over $291,850 |

| Head of Household | Up to $63,000 | $63,001 to $551,350 | Over $551,350 |

It’s important to remember that these are federal rates.

State Capital Gains Tax Considerations

In addition to federal capital gains taxes, you may also owe taxes to your state. State tax rates vary significantly, from 0% in states like Texas and Florida to over 13% in California.

It’s crucial to understand the specific rules and rates in your state to accurately assess your overall tax liability. You can find more information about your state’s capital gains tax rates here.

The Net Investment Income Tax (NIIT)

High-income taxpayers may also be subject to the Net Investment Income Tax (NIIT), a 3.8% tax on certain investment income, including capital gains. This applies if your modified adjusted gross income exceeds $250,000 for married couples filing jointly, $200,000 for single filers, or $125,000 for married couples filing separately.

Cash vs. Equity Compensation in Business Sales

Many business sales involve a combination of cash and equity (typically stock in the acquiring company). Here’s how capital gains taxes work in each scenario:

- Cash Compensation: When you receive cash for your business, the capital gain is recognized immediately, and you’ll owe taxes in the year of the sale.

- Equity Compensation: Receiving stock defers the capital gains tax until you sell the shares. This can be advantageous as it allows you to control the timing of your tax liability. However, the value of the stock can fluctuate, and you’ll be subject to capital gains tax whenever you sell, even if it’s years later.

Example: Let’s say you sell your business for $1 million, with $500,000 in cash and $500,000 in stock. You’ll owe capital gains tax on the $500,000 cash payment in the year of the sale. The tax on the stock portion is deferred until you sell those shares.

Strategies to Manage Capital Gains Tax

Installment Sale: Instead of receiving all the cash at once, you can structure the sale to receive payments over several years. This can spread out your tax liability and potentially keep you in a lower tax bracket. However, it’s important to consider factors like interest charges on deferred payments, the risk of buyer default, and how this might impact your long-term financial and retirement plans. Also, be aware of the potential for “lookback interest” which may apply in certain installment sale situations.

Qualified Opportunity Funds (QOFs): Investing your capital gains in a QOF within 180 days of the sale can defer or even eliminate your tax liability. QOFs invest in designated low-income communities. Keep in mind that QOFs require a 10-year holding period to realize the full tax benefits.

Tax-Loss Harvesting: If you have capital losses from other investments, you can use them to offset your capital gains from the business sale.

Charitable Donations: Donating appreciated assets, like stock received in the sale, to charity can allow you to avoid capital gains tax altogether.

Advanced Tax Strategies

Section 1202 Qualified Small Business Stock (QSBS) Exclusion: If you hold qualified small business stock for more than five years, you may be able to exclude a significant portion of the gain from your taxable income. For stock acquired after September 27, 2010, the exclusion can be up to 100%! However, there is a limit on the amount of gain that can be excluded, which is the greater of $10 million or 10 times your basis in the stock. It’s important to note that state treatment of QSBS varies, so consult with a tax professional for guidance on your specific situation.

Section 338(h)(10) Election: This election can be beneficial in certain situations, allowing the sale to be treated as a sale of assets even if it’s structured as a stock sale. This can have significant tax implications for both the buyer and seller.

Employee Stock Ownership Plans (ESOPs): Selling your business to an ESOP can offer various tax advantages and provide a succession plan for your company.

Section 1045 Rollover: This allows you to defer capital gains taxes by reinvesting the proceeds from the sale of qualified small business stock into another qualified small business investment within 60 days.

Understanding Your Cost Basis

Accurately determining the cost basis of your business is essential for calculating your capital gains tax. While it generally includes the original purchase price plus capital improvements, there are other factors to consider:

- Depreciation: How you’ve depreciated assets in your business can affect your cost basis. Keep in mind that you may be subject to depreciation recapture rules, which could result in some of the gain being taxed at ordinary income rates.

- Previous Reorganizations: If your business has undergone any reorganizations or restructurings, this can impact your cost basis.

- Business Debt: Outstanding business debt can also factor into your cost basis calculation.

- PPP Loan Forgiveness: If you received a Paycheck Protection Program (PPP) loan that was forgiven, this can affect your cost basis.

We recommend consulting with a tax professional to ensure you accurately calculate your cost basis and avoid any potential issues with the IRS.

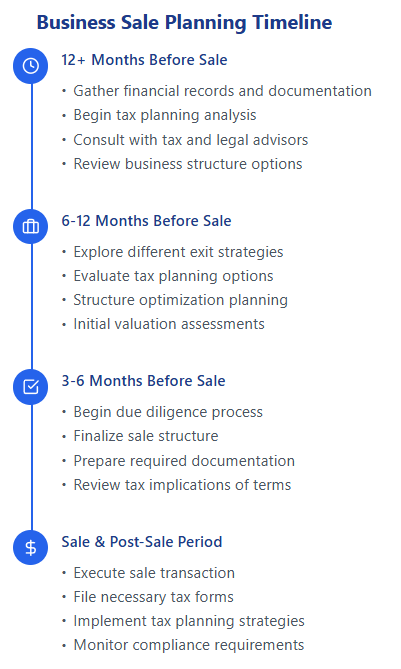

Pre-Sale Planning Timeline

- 12+ months before the sale: Start gathering financial records and consulting with tax and legal advisors.

- 6-12 months before the sale: Explore different exit strategies and tax planning options.

- 3-6 months before the sale: Begin the due diligence process and finalize the sale agreement.

- Post-sale: File the necessary tax forms and comply with all reporting requirements.

Each phase of this timeline is crucial for maximizing your sale value while minimizing tax liability. Let’s explore what you should focus on during each period:

Important Considerations Before Selling

Alternative Minimum Tax (AMT): The AMT is a separate tax system designed to ensure that high-income taxpayers pay a minimum amount of tax. Significant capital gains from the sale of your business could trigger the AMT, resulting in a higher tax liability than calculated under the regular tax system.

Asset Sales vs. Stock Sales: The structure of your sale (whether it’s an asset sale or a stock sale) has significant tax implications. In an asset sale, the buyer purchases individual assets of the business. In a stock sale, the buyer purchases the stock of the company, acquiring all assets and liabilities. The tax consequences can differ significantly for both the buyer and the seller, so it’s essential to carefully consider which structure is most advantageous for your situation.

Treatment of Specific Assets: Certain assets have unique tax treatments in a business sale. For example:

- Goodwill: Goodwill is an intangible asset that represents the value of a business beyond its tangible assets. In a business sale, goodwill is typically treated as a capital asset and is subject to capital gains tax.

- Accounts Receivable: If you sell accounts receivable as part of an asset sale, the proceeds are generally treated as ordinary income rather than capital gains.

- Hot Assets: In the sale of a partnership interest, “hot assets” (such as unrealized receivables and inventory) can trigger ordinary income tax rates.

Accumulated Earnings and Profits: If you’re selling a C-corporation, the accumulated earnings and profits can impact the tax consequences of the sale.

Self-Created Intangibles: The tax treatment of self-created intangibles (like patents or copyrights) can be complex.

FAQs

What is the cost basis of my business?

Determining your cost basis can be complex. It generally includes the original purchase price plus any capital improvements you’ve made. However, factors like depreciation, business debt, and previous reorganizations can also come into play. Consult with a tax professional to accurately calculate your basis.

How do I report the sale of my business on my tax return?

You’ll typically report the sale on Form 8949 and Schedule D of your Form 1040.

What happens if I receive stock options as part of the sale?

Stock options have their own set of tax rules. The tax treatment depends on whether they are qualified or non-qualified stock options.

What is the difference between an asset sale and a stock sale?

In an asset sale, the buyer purchases individual assets of the business. In a stock sale, the buyer purchases the stock of the company, acquiring all assets and liabilities. The tax implications for both the buyer and seller can differ significantly between these two structures.

How is goodwill treated for tax purposes in a business sale?

Goodwill is an intangible asset that represents the value of a business beyond its tangible assets. In a business sale, goodwill is typically treated as a capital asset and is subject to capital gains tax.

How is the purchase price allocated among different assets in a business sale?

The purchase price must be allocated among the different assets acquired in the sale. This allocation can affect the buyer’s depreciation deductions and the seller’s capital gains tax liability.

Summary of Tax Strategies

| Strategy | Description | Requirements |

|---|---|---|

| Installment Sale | Spread out tax liability by receiving payments over several years. | Buyer agreement, potential interest charges, careful financial planning, awareness of potential “lookback interest.” |

| QOFs | Defer or eliminate tax liability by investing in Qualified Opportunity Funds. | 10-year holding period, investment in designated low-income communities. |

| Tax-Loss Harvesting | Offset capital gains with capital losses from other investments. | Existing capital losses. |

| Charitable Donations | Avoid capital gains tax by donating appreciated assets. | Donation to a qualified charity. |

| QSBS Exclusion | Exclude a portion (or all) of the gain from the sale of Qualified Small Business Stock. For stock acquired after September 27, 2010, the exclusion can be up to 100%! However, there is a limit on the amount of gain that can be excluded (the greater of $10 million or 10 times your basis in the stock). State treatment of QSBS varies. | Stock held for more than 5 years, specific requirements for the business, consult with a tax professional for state-specific guidance. |

| Section 338(h)(10) | Treat the sale as an asset sale even if structured as a stock sale. | Buyer and seller agreement, specific qualifications. |

| ESOPs | Sell to an Employee Stock Ownership Plan for potential tax advantages and succession planning. | Establishment of an ESOP, compliance with ESOP regulations. |

| Section 1045 Rollover | Defer gains by reinvesting proceeds into another qualified small business investment. | Reinvestment within 60 days, qualified small business investment. |

Need Help Navigating Your Business Sale?

Selling a business involves many intricate details, especially when it comes to taxes. At XOA TAX, we have extensive experience guiding clients through this process. We can help you understand your options, minimize your tax liability, and ensure a smooth transaction.

Connect with us today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime