Running a small business? Then you’re likely juggling multiple priorities, from managing clients and projects to keeping a close eye on your finances. One of the most important financial decisions you’ll make is choosing the right accounting method. Cash basis accounting, with its focus on actual cash flow, is a popular choice for many small businesses and freelancers. In this comprehensive guide, we’ll explore everything you need to know about cash basis accounting, including its benefits, limitations, and tax implications.

Key Takeaways

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid.

- This method is often simpler and more cost-effective than accrual accounting.

- It provides a clear picture of your current cash on hand but might not reflect long-term profitability.

- Small businesses and freelancers often favor cash basis accounting, but some businesses are ineligible.

- Consulting with a tax professional at XOA TAX is crucial to determine the best accounting method for your business.

What is Cash Basis Accounting?

Cash basis accounting operates on a simple principle: transactions are recorded only when cash changes hands. This means revenue is recognized when you receive a payment, and expenses are recorded when you pay a bill. This differs from accrual accounting, where transactions are recorded when revenue is earned or expenses are incurred, regardless of when cash is actually received or paid.

Example: Let’s say you own a small bakery. You bake and deliver a wedding cake in June, but the client doesn’t pay you until July. Under cash basis accounting, you would record the revenue in July when you receive the payment.

Who Uses Cash Basis Accounting?

Cash basis accounting is particularly popular among:

- Small businesses: Its simplicity makes it easier to manage finances, especially without a dedicated accounting team.

- Freelancers and sole proprietors: It provides a clear, immediate understanding of cash flow, which is vital for independent contractors.

While larger companies and publicly traded companies are required to use accrual accounting to comply with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), cash basis accounting is often suitable for businesses not subject to these reporting rules. However, certain businesses, such as C corporations with over $30 million in gross receipts for the 2024 tax year, are prohibited by the IRS from using the cash method (see IRS Publication 538, specifically section 2.02 for more details).

Benefits of Cash Basis Accounting

- Simplicity: Cash basis accounting is easy to understand and implement, even without in-depth accounting knowledge.

- Cost-effectiveness: It can reduce the need for complex accounting software and potentially lower your accounting costs.

- Clear cash flow: It provides a real-time snapshot of your available funds, making it easier to manage day-to-day operations and make informed financial decisions.

- Tax advantages: Taxes are paid only on the income you actually receive. This can allow for potential tax deferral by strategically timing when you send invoices and make payments. For example, if you delay sending an invoice until the next tax year, you can defer the tax liability on that income.

Limitations of Cash Basis Accounting

While cash basis accounting offers many advantages, it’s essential to be aware of its limitations:

- Inaccurate long-term view: It doesn’t provide a complete picture of your business’s financial health, especially if you have significant outstanding invoices (money you’re owed) or bills (money you owe).

- Not GAAP/IFRS compliant: This method is unsuitable for public companies or businesses seeking external investment, which often require accrual accounting for a more comprehensive financial picture.

Cash Basis Accounting and Financial Statements

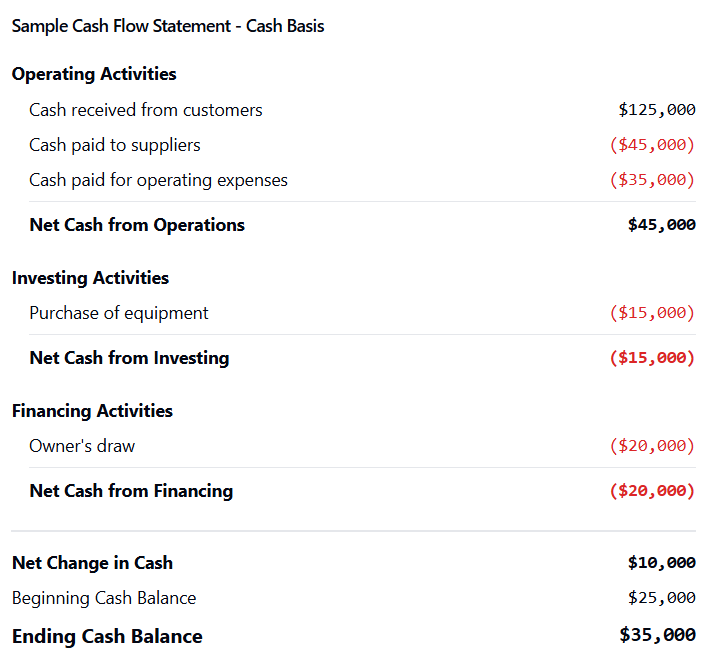

Under cash basis accounting, financial statements present a focused view of your cash transactions:

- Income Statement: Shows revenue when cash is received and expenses when cash is paid.

- Balance Sheet: Primarily reflects cash on hand and settled liabilities. It doesn’t include accounts receivable (money owed to you) or accounts payable (money you owe to others).

- Cash Flow Statement: Details all cash inflows and outflows from operations, investing, and financing activities.

Tax Implications of Cash Basis Accounting

One of the key advantages of cash basis accounting is its potential to impact your taxes. Since you’re taxed only on the income you receive, you might be able to defer tax liabilities by managing when you send invoices and make payments. However, it’s crucial to consult with a tax professional to ensure you’re implementing tax planning strategies that align with your business goals and comply with current regulations.

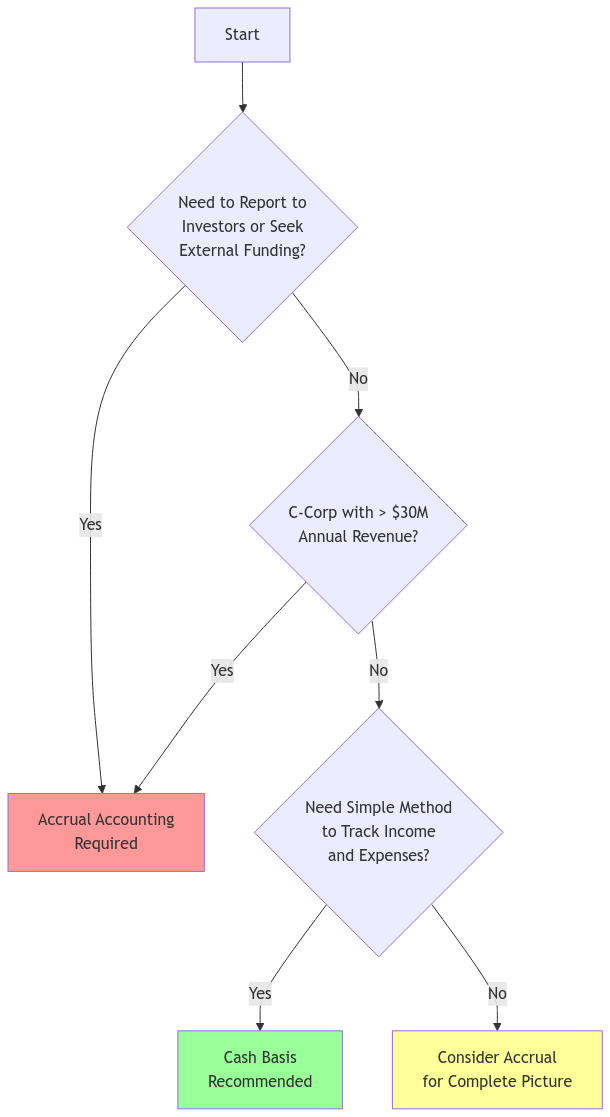

Cash vs. Accrual Accounting: Which is Right for You?

Choosing the right accounting method is a crucial decision. Use this flowchart to help you decide:

- Do you need to report to investors or seek external funding?

- Yes: Accrual accounting is likely required.

- No: Move to the next question.

- Is your business a C-corporation with over $30 million in annual revenue?

- Yes: You cannot use cash basis accounting.

- No: Move to the next question.

- Do you need a simple method to track income and expenses?

- Yes: Cash basis accounting could be a good fit.

- No: Consider accrual accounting for a more complete financial picture.

Need help determining the best approach for your business? At XOA TAX, our experienced CPAs can provide personalized guidance to help you make informed decisions. Contact us today for a free consultation.

Cash Basis Accounting in the US for 2024 (and Beyond)

The general guidelines for cash basis accounting remain consistent. Small businesses (generally those with under $30 million in gross receipts) can typically use this method. However, tax laws and regulations are subject to change. Staying informed is crucial.

Changing Your Accounting Method

If you need to switch accounting methods (for example, from cash basis to accrual accounting), you’ll generally need approval from the IRS. This involves filing Form 3115, Application for Change in Accounting Method. XOA TAX can guide you through this process, ensuring a smooth transition and compliance with IRS regulations.

State-Specific Considerations

While the IRS allows many small businesses to use cash basis accounting, it’s important to remember that states may have their own specific requirements. Some states might mandate accrual accounting for certain types of businesses or income levels. Always consult with a tax professional to understand the rules in your state.

Digital Payment Processing and Cash Basis Accounting

In today’s digital world, many businesses receive payments through platforms like PayPal, Stripe, and Square. For cash basis accounting, the general rule is to recognize the income when the funds are deposited into your bank account, even if they are initially held by the payment processor. However, it’s essential to maintain detailed records of all transactions and reconcile them with your bank statements.

Hybrid Accounting Methods: Modified Cash Basis

In addition to the standard cash basis and accrual methods, there’s also a hybrid approach known as modified cash basis accounting. This method combines elements of both, offering more flexibility. For example, it might allow for the recognition of accounts receivable while still using cash basis for other transactions. This can be a suitable option for some businesses, but it’s important to discuss the implications with your tax advisor.

Frequently Asked Questions (FAQs)

Can businesses using cash basis accounting be audited?

Yes, any business can be audited, regardless of its chosen accounting method. Auditors focus on verifying the accuracy and completeness of your financial records. For cash basis accounting, they will examine bank statements, receipts, and other documentation to ensure that revenue is recorded when cash is received and expenses are recorded when cash is paid. Maintaining organized and detailed records is crucial for a smooth audit process.

How are financial statements prepared under cash basis accounting?

Financial statements under cash basis accounting emphasize cash transactions. The income statement shows revenue and expenses only when cash is exchanged. The balance sheet primarily reflects cash on hand and settled liabilities, omitting accounts receivable and accounts payable. The cash flow statement provides a detailed view of all cash inflows and outflows. Here’s an example: [Image suggestion: Include a sample simplified balance sheet prepared using the cash basis method. Alt text: Example of a balance sheet using the cash basis method.]

What are the benefits of cash basis accounting for small businesses?

Cash basis accounting offers several benefits for small businesses, including simplicity, cost-effectiveness, and a clearer picture of cash flow. It can also simplify tax reporting by focusing on received income.

Who cannot use cash basis accounting?

Publicly traded companies, large enterprises, and C corporations exceeding the IRS revenue threshold cannot use cash basis accounting. These entities typically must use accrual accounting to comply with GAAP or IFRS.

Can inventory assets be recorded with cash basis accounting?

While cash basis accounting generally doesn’t track inventory, there are some exceptions for small businesses. If you have inventory, it’s crucial to consult with a tax professional to determine the correct way to account for it and whether any special rules apply to your business.

What are the tax implications of cash basis accounting?

Businesses using cash basis accounting are taxed on income when it’s received, not when it’s earned. This can provide opportunities for tax deferral. However, it’s essential to consult with a tax professional for personalized advice.

Need Help with Cash Basis Accounting?

Choosing the right accounting method and ensuring accurate record-keeping are crucial for your business’s success. At XOA TAX, our team of experienced CPAs can provide expert guidance on:

- Determining the most suitable accounting method for your business. We’ll consider your business structure, size, industry, and long-term goals to help you make the best choice.

- Implementing and maintaining accurate accounting systems. We can help you set up efficient processes and choose the right software for your needs.

- Developing effective tax planning strategies. We’ll work with you to minimize your tax liability and maximize your deductions, ensuring you remain compliant with all regulations.

- Navigating complex IRS regulations. We stay up-to-date on the latest tax laws and can help you understand how they apply to your business.

Contact us today for a consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime