Hey there, amazing philanthropists! It’s your Friendly Financial Coach from XOA TAX, here to help you navigate the rewarding world of charitable giving. Donating to a cause you believe in is a fantastic way to make a difference, and guess what? It might even give your tax return a little boost!

We’ll explore the ins and outs of tax-deductible donations, ensuring you get the most out of your generosity while staying on the right side of the tax law.

What Exactly is a Charitable Donation?

Think of a charitable donation as a gift with a purpose. It’s a voluntary contribution you make to a qualified non-profit organization that’s doing good in the world. These organizations are tackling all sorts of challenges, from fighting poverty and advancing education to protecting our planet and providing disaster relief.

You can donate in all kinds of ways: cash, clothes, even your old car (imagine the tax deduction on that!). But here’s the thing, to unlock those tax benefits, your donation needs to go to the right place.

The Golden Rule: Donate to Qualified Organizations

Before you open your wallet, make sure your chosen charity is a real deal 501(c)(3) organization. Think of it as a special club recognized by the IRS. You can easily check an organization’s status using the IRS’s handy-dandy Tax Exempt Organization Search tool (think of it like a detective tool for do-gooders!).

Pro Tip: Even your local church or place of worship needs to meet these 501(c)(3) requirements for your donation to be tax deductible.

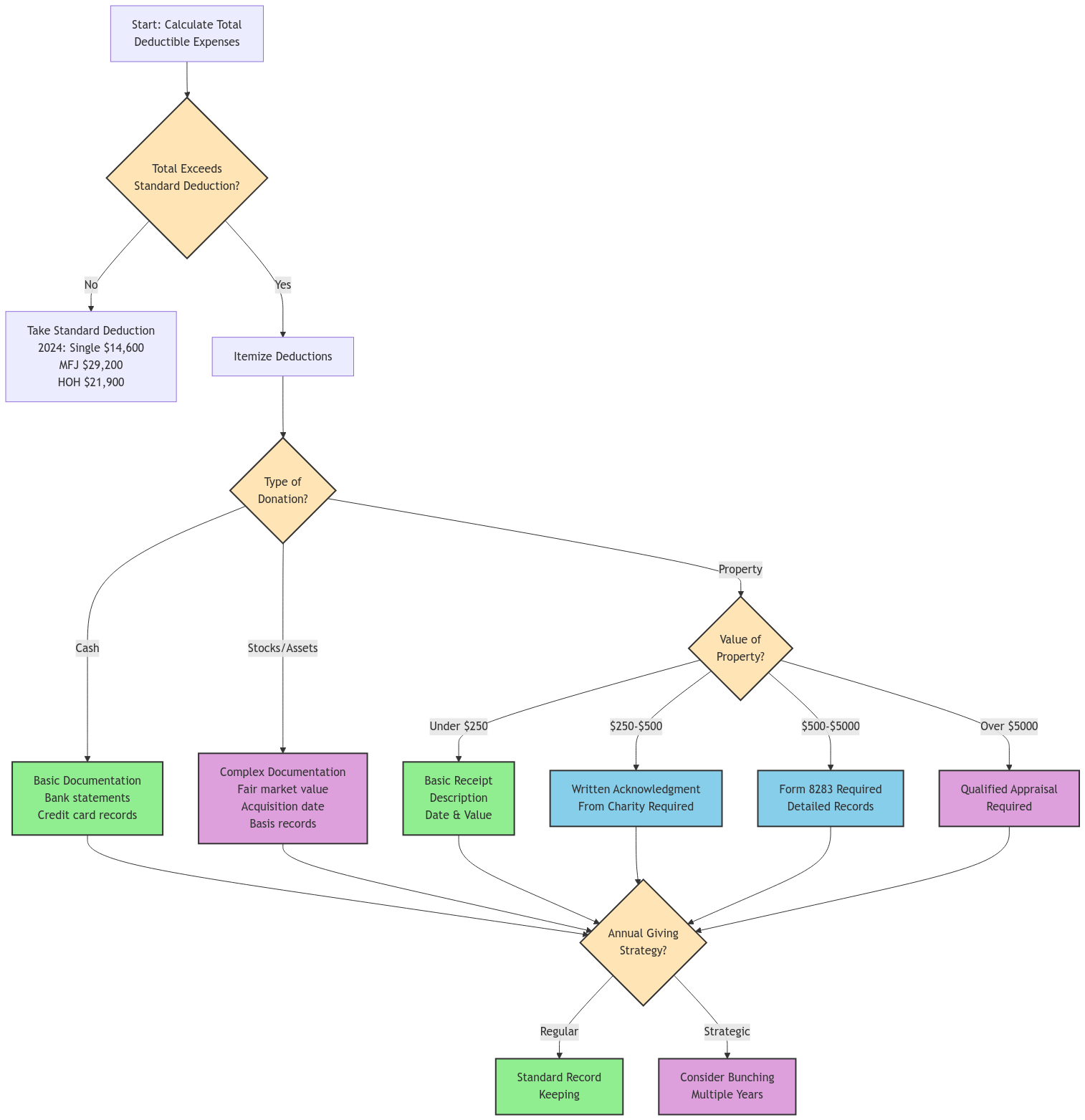

Keep Those Receipts! (Documentation is Key)

Just like keeping track of your gym membership receipts (those New Year’s resolutions, am I right?), holding onto your donation records is super important. Here’s the lowdown:

- Cash Donations: Keep those bank statements, canceled checks, and credit card statements organized. If you donate online, make sure to save those confirmation emails or download transaction records.

- Non-Cash Donations: Jot down a description of what you donated and estimate its fair market value. For items valued over $500, you’ll need to complete Form 8283, Noncash Charitable Contributions. For items valued over $5,000, you might need a qualified appraisal.

- Big-Hearted Donations: If you donate over $250, make sure you get a written acknowledgment from the charity with the date and amount.

Real-Life Example: Let’s say you donate $300 and a gently-used bicycle to your local animal shelter. You’ll want to keep your bank statement for the cash donation and snag a receipt from the shelter listing both the cash and the bike. This way, you’re all set when tax season rolls around!

Volunteering Your Time (and Deducting Some Expenses!)

While your time is priceless (truly!), you can actually deduct some expenses related to your volunteer work. Here’s the scoop:

- Mileage: You can deduct 14 cents per mile driven for volunteer activities. So, keep track of those trips to the soup kitchen or the animal shelter!

- Out-of-Pocket Costs: Expenses for supplies, uniforms, or other necessary items required for your volunteer work can be deductible. Think of things like the gardening gloves you bought for that community garden project.

Friendly Reminder: Keep a detailed log of these expenses throughout the year. Every little bit counts! And remember, you can’t deduct the value of your time spent volunteering.

Claiming Your Deductions: It’s Showtime!

To claim those well-deserved deductions, you’ll need to itemize them on Schedule A of your Form 1040. This is where you’ll list all your qualifying expenses, like charitable donations, medical expenses, and mortgage interest.

If your itemized deductions are greater than the standard deduction, you’ll lower your taxable income, which could mean a smaller tax bill or a bigger refund! Woohoo!

Tech Tip: Try using a tax deduction calculator to see how your charitable giving can impact your tax situation. It’s like a sneak peek into your tax return!

Maximize Your Giving, Maximize Your Benefits

- Double-Check that 501(c)(3) Status: Use the IRS search tool to be extra sure.

- Be a Record-Keeping Superstar: Keep all your receipts and acknowledgments organized. Digital copies are great too!

- Think Beyond Cash: Donating stocks or real estate you’ve held for a while can have extra tax advantages. (Talk to a tax advisor for the inside scoop!)

Donating Appreciated Assets (Stocks, Real Estate, etc.)

Did you know that donating stocks or real estate that you’ve held for a long time can have significant tax advantages? It’s true! You might be able to avoid capital gains taxes and get a deduction for the fair market value of the asset. This can be a bit complex, so it’s always a good idea to talk to a tax advisor (like those awesome folks at XOA TAX!) to make sure you’re maximizing your benefits.

Bunching Your Donations

Have you heard of “bunching?” It’s a strategy where you group several years’ worth of charitable donations into a single year. This can help you exceed the standard deduction threshold and itemize your deductions, potentially leading to greater tax savings.

Which Donations Make the Cut?

The Good Guys:

- Donations to those awesome 501(c)(3) organizations we talked about.

- Cash donations (including those made through online platforms, digital wallets, and apps).

- Donating things like clothes, cars, or even real estate.

- Giving goods or services (though you can’t deduct the value of your time).

The Not-So-Good Guys:

- Donations to political campaigns or organizations.

- Contributions to individuals or foreign organizations (unless they meet specific IRS requirements).

- Some private foundations might have special rules.

Need More Info? Head over to the IRS website for all the details.

State Tax Implications

Remember that state tax laws can be different from federal laws. Some states might have their own rules about charitable donation deductions, so it’s always a good idea to check with a tax professional or your state’s tax agency to make sure you’re following the local guidelines.

Standard Deduction vs. Itemizing

When it comes to claiming deductions, you have two main options: taking the standard deduction or itemizing your deductions. The standard deduction is a fixed amount that reduces your taxable income. For 2024, the standard deduction is:

- $14,600 for single filers and married individuals filing separately

- $29,200 for married couples filing jointly

- $21,900 for heads of household

Itemizing means listing out all your eligible deductions, like charitable donations, medical expenses, and state and local taxes. If your itemized deductions exceed the standard deduction, it usually makes sense to itemize. But if your itemized deductions are less than the standard deduction, you’ll likely get a bigger tax break by taking the standard deduction.

Understanding Your Deduction Options

Below is a detailed comparison to help you understand different donation types and make an informed decision between standard and itemized deductions:

Donation Types Comparison

- Simplest to document

- Immediate deduction

- Easy to value

- Bank record or receipt

- Written acknowledgment for $250+

- Clear out unused items

- Help specific causes

- Receipt required

- Form 8283 for $500+

- Appraisal for $5000+

- Avoid capital gains tax

- Deduct full market value

- Held for >1 year

- Professional valuation

- Detailed records

2024 Standard vs. Itemized Deduction Comparison

Standard Deduction

Single: $14,600

Married Filing Jointly: $29,200

Head of Household: $21,900

Best for: Taxpayers with few deductible expenses or simple tax situations

Itemized Deductions

Common items:

- Charitable donations

- Mortgage interest

- State and local taxes (up to $10,000)

- Medical expenses (over 7.5% of AGI)

Best for: Taxpayers with significant deductible expenses exceeding standard deduction

Common Breakeven Scenarios (Single Filer)

Scenario A

Charitable Donations: $8,000

Mortgage Interest: $5,000

Property Taxes: $3,000

Total: $16,000 → Itemize

Scenario B

Charitable Donations: $4,000

Mortgage Interest: $6,000

Property Taxes: $4,000

Total: $14,000 → Standard

Frequently Asked Questions (FAQs)

What’s the most I can deduct for donations?

Great question! It depends on your income (specifically your adjusted gross income or AGI), what you’re donating, and who you’re donating to. Generally, you can deduct up to 60% of your AGI for cash donations to public charities. For all the specifics, check out IRS Publication 526 or chat with a tax pro.

How do I know what tax bracket I’m in, and why does it matter for deductions?

Your tax bracket is like your tax level, and it’s based on your taxable income. You can find the current tax brackets on the IRS website. The higher your income, the higher your tax bracket. Being in a higher tax bracket means you might save more on taxes by itemizing deductions like charitable contributions.

I’ve heard of something called the Pease limitation. Does that affect my donation deduction?

You’re right, the Pease limitation can sometimes reduce itemized deductions for folks with higher incomes. But the good news is, most charitable contributions are usually exempt from this limitation.

If I donate $1,000, how much will I get back on my tax refund?

That’s where your tax bracket comes into play! Let’s say you’re in the 24% tax bracket. A $1,000 donation could potentially reduce your tax bill by $240 (24% of $1,000). But remember, your refund also depends on other factors like your other deductions and your overall tax situation. For a personalized estimate, it’s best to connect with a tax professional.

I donate a lot to Goodwill. Can I claim those donations without receipts?

The IRS loves documentation, so it’s important to keep records of all your donations, even small ones. For anything over $250, a receipt or written acknowledgment from the charity is a must-have. Hang onto those bank statements or credit card statements to back up your donations. For non-cash donations, it’s helpful to familiarize yourself with IRS Publication 561, Determining the Value of Donated Property.

Can I deduct those pesky transaction fees when I donate online?

Unfortunately, those transaction fees usually aren’t deductible. Only the actual amount that goes to the charity counts. But if you cover the fees yourself, the full amount might be deductible. It’s a bit tricky, so talking to a tax pro can clear things up.

I’ve heard about something called a “donor-advised fund.” What is that?

A donor-advised fund is like a charitable savings account. You make a donation to the fund, get an immediate tax deduction, and then recommend grants to your favorite charities over time. It’s a great way to simplify your giving and potentially increase your impact.

Can I donate cryptocurrency to charity? Is it tax-deductible?

Yes, you can donate cryptocurrency to charity, and it can be tax-deductible! The IRS generally treats cryptocurrency as property, so the deduction rules for donating property apply. You’ll need to determine the fair market value of the cryptocurrency on the date of the donation and keep good records.

I’m retired and have an IRA. Can I make charitable donations directly from my IRA?

You sure can! It’s called a Qualified Charitable Distribution (QCD), and it allows individuals aged 70½ or older to transfer funds directly from their IRA to a qualified charity.

Key Benefits of QCDs:

• Tax Efficiency: QCDs are excluded from your taxable income, which can be advantageous compared to taking a taxable distribution and then making a charitable donation.

• Satisfying RMDs: For those aged 73 or older, QCDs can count toward satisfying your Required Minimum Distributions (RMDs) for the year.

Important Considerations:

• Eligible Accounts: QCDs must come from a traditional IRA. While Roth IRAs are eligible, they are less commonly used for QCDs due to their tax-free distribution status.

• Direct Transfer: The funds must be transferred directly from your IRA custodian to the qualified charity to qualify as a QCD.

• Qualified Charities: Not all charitable organizations are eligible to receive QCDs. For instance, donor-advised funds and private foundations typically do not qualify.

• Annual Limit: For 2024, the maximum annual QCD limit is $105,000 per individual.

Given the specific rules and potential tax implications, it’s advisable to consult with a tax advisor or financial planner to determine if a QCD aligns with your financial goals and to ensure compliance with IRS regulations.

The Bottom Line: Give Smart, Give Strategically

Understanding how tax-deductible donations work empowers you to support the causes you love while potentially lowering your tax bill. Remember these golden rules:

- Verify the Charity’s Status: Make sure they’re a legit 501(c)(3) organization.

- Keep Meticulous Records: Organized records are your best friend during tax season.

- Think About Timing: Plan your donations strategically with your tax pro.

- Consider Different Giving Methods: Explore options like donating appreciated assets or bunching your donations to maximize your tax benefits.

By following the IRS guidelines, you’ll stay on the right side of the tax law and maximize the impact of your generosity.

Need Expert Assistance?

Feeling a bit overwhelmed? No worries, we’re here to help! The XOA TAX team is ready to answer your questions and guide you through the world of charitable giving and tax deductions.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime