Divorce or separation adds another layer of complexity to tax season. At XOA TAX, we often hear from clients who are unsure how to navigate the Child Tax Credit (CTC) after a life change. It’s important to understand how the rules apply to your specific situation to maximize this valuable tax benefit. Let’s break down the key aspects of the CTC for divorced or separated parents.

Key Takeaways

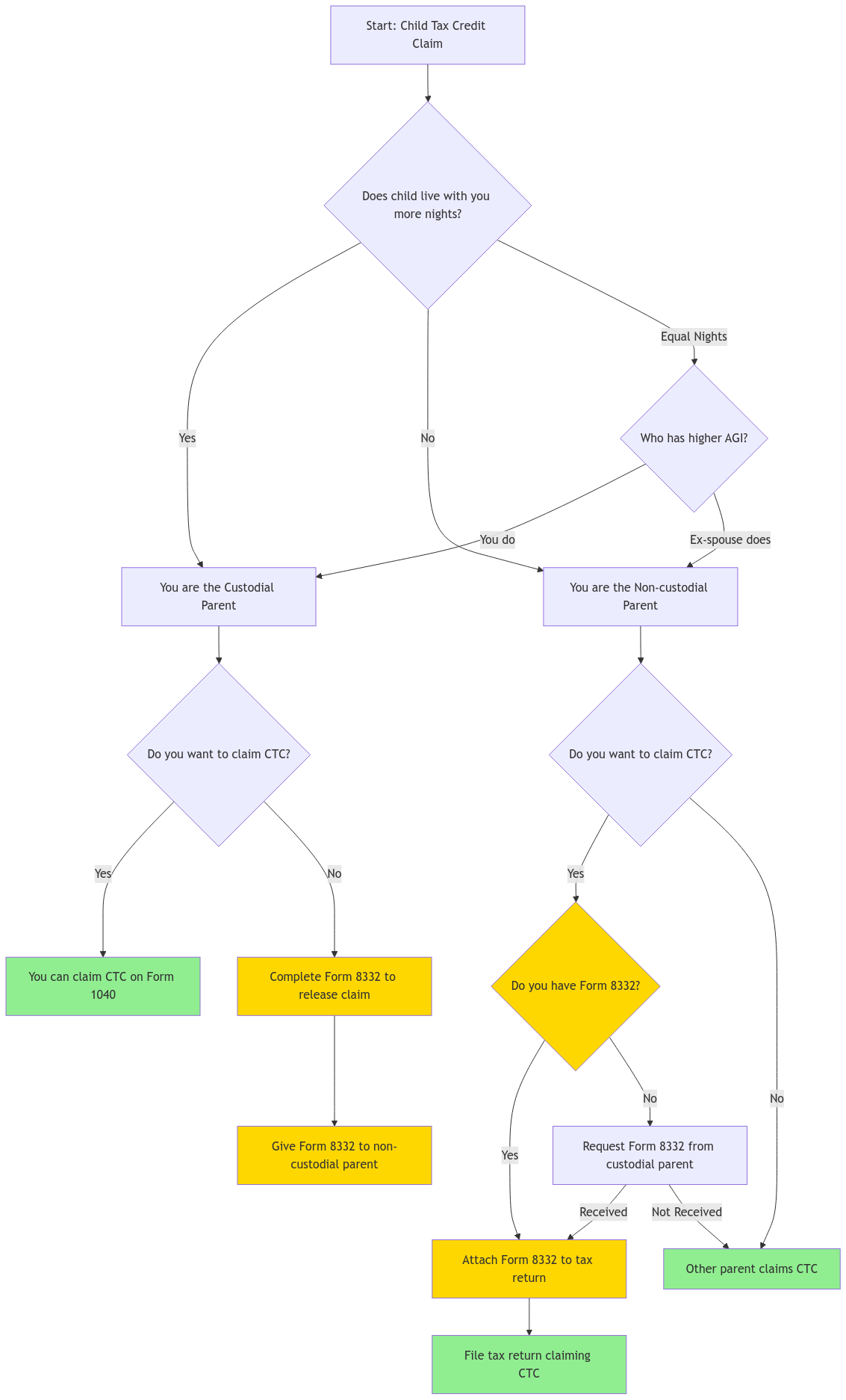

- Generally, the custodial parent (the parent with whom the child lives most of the year) claims the CTC.

- The custodial parent can transfer the right to claim the CTC to the noncustodial parent using IRS Form 8332.

- A court order alone is not sufficient for the noncustodial parent to claim the CTC; Form 8332 is still required.

- Open communication between parents is essential to avoid confusion and potential issues with the IRS.

Who Claims the Child Tax Credit?

The IRS has specific rules for determining who can claim the CTC when parents are divorced or separated. In most cases, the custodial parent is entitled to the credit. This is the parent with whom the child lived for the greater number of nights during the year.

What if the child spends an equal amount of time with both parents?

If the child resides with each parent for the same number of nights, the IRS considers the parent with the higher adjusted gross income (AGI) to be the custodial parent for CTC purposes.

How Can the Noncustodial Parent Claim the Credit?

The IRS provides a mechanism for the noncustodial parent to claim the CTC. This involves the custodial parent completing and signing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. This form must be attached to the noncustodial parent’s tax return.

Is a court order enough for the noncustodial parent to claim the CTC?

No. While a court order might state which parent can claim the child as a dependent, it doesn’t override IRS rules. The noncustodial parent must have a signed Form 8332 to claim the CTC, regardless of what a court order says.

The Importance of Communication and Documentation

Clear communication between divorced or separated parents is crucial when it comes to tax benefits. Both parents should have a clear understanding of:

- Who will claim the CTC each year.

- The requirements for transferring the credit.

- The importance of maintaining proper documentation (Form 8332, custody agreements, etc.).

Required Documentation Checklist:

- Form 8332 (if applicable)

- Custody agreement or court order

- Child’s Social Security card

- Any other relevant documentation supporting your claim

By being proactive and organized, parents can avoid disagreements and potential problems with the IRS.

Understanding the Child Tax Credit in 2024

For the 2024 tax year (filed in 2025), the Child Tax Credit provides a maximum benefit of $2,000 per qualifying child under the age of 17.

A portion of this credit, called the Additional Child Tax Credit (ACTC), is refundable. This means that even if you don’t owe any taxes, you may be able to receive a refund of up to $1,700 per child.

Income Limits and Phase-Outs

To qualify for the full CTC, your Modified Adjusted Gross Income (MAGI) must fall below certain thresholds:

- $200,000 for single filers

- $400,000 for married couples filing jointly

If your MAGI exceeds these limits, the amount of CTC you can claim will gradually decrease. This phase-out reduces the credit by $50 for every $1,000 of income above the threshold. For example, a married couple with a MAGI of $410,000 would see their CTC reduced by $500 per child.

Who is a Qualifying Child?

| Qualifying Child Criteria | Description |

|---|---|

| Age | Under 17 at the end of the tax year |

| Relationship | Son, daughter, stepchild, foster child, sibling, stepsibling, or a descendant of any of them |

| Support | Did not provide more than half of their own support |

| Residency | Lived with you for more than half of the year |

| Dependency | Claimed as a dependent on your tax return |

| Citizenship | U.S. citizen, U.S. national, or U.S. resident alien |

| Social Security Number | Valid Social Security Number issued before the tax return’s due date |

Claiming the Credit

To claim the CTC, you’ll need to complete Form 1040 and Schedule 8812. Schedule 8812 helps calculate the amount of the credit you can claim, including any refundable portion.

Don’t Forget State Tax Credits!

Many states also offer their own child tax credits, with varying amounts and eligibility requirements. For example, California offers the Young Child Tax Credit for families with children under age 6, and New York provides a refundable child tax credit with income limits. Be sure to research the specific rules in your state to see if you qualify for additional benefits.

Special Rules for Military Families

Military families may face unique circumstances that affect their eligibility for the CTC. For instance, deployments and changes of station can impact residency requirements. The IRS has special provisions to address these situations, so it’s important to consult with a tax professional if you’re in the military.

How the CTC Interacts with Other Tax Benefits

The CTC can affect other tax benefits you might be eligible for, such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit. It’s important to understand how these credits work together to maximize your tax savings.

FAQ Section

Q: Can we alternate claiming the CTC each year?

A: Yes, you can. However, the custodial parent must sign Form 8332 each year that they wish to transfer the credit to the noncustodial parent.

Q: What if we disagree on who should claim the child?

A: If you cannot reach an agreement, you may need to seek legal advice or mediation to resolve the dispute.

Q: Where can I get Form 8332?

A: You can download Form 8332 from the IRS website: https://www.irs.gov/forms-pubs/about-form-8332

Connect with XOA TAX

We understand that dealing with taxes, especially after a major life event, can be stressful. Our team of experienced CPAs is here to provide personalized guidance and support. Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime