Starting a business opens up a world of opportunities. Amidst the excitement of bringing your ideas to life, there’s an important decision to make early on: selecting the legal structure for your business. This choice influences your taxes, personal liability, and how your business operates. Let’s explore the key differences between C Corporations, S Corporations, and Limited Liability Companies (LLCs) to help you find the best fit for your venture.

Key Takeaways

- C Corporations: Offer strong liability protection and are attractive to investors but may face double taxation.

- S Corporations: Provide pass-through taxation and liability protection but have ownership restrictions.

- LLCs: Combine liability protection with operational flexibility but might find it harder to attract certain investors.

Quick Comparison Table

| Feature | C Corporation | S Corporation | LLC |

|---|---|---|---|

| Liability Protection | High | High | High |

| Tax Treatment | Double Taxation | Pass-Through | Flexible |

| Ownership Restrictions | None | Yes | None |

| Raising Capital | Excellent | Limited | Moderate |

| Administrative Burden | High | High | Moderate |

| Self-Employment Tax | N/A | Potential Savings | Yes |

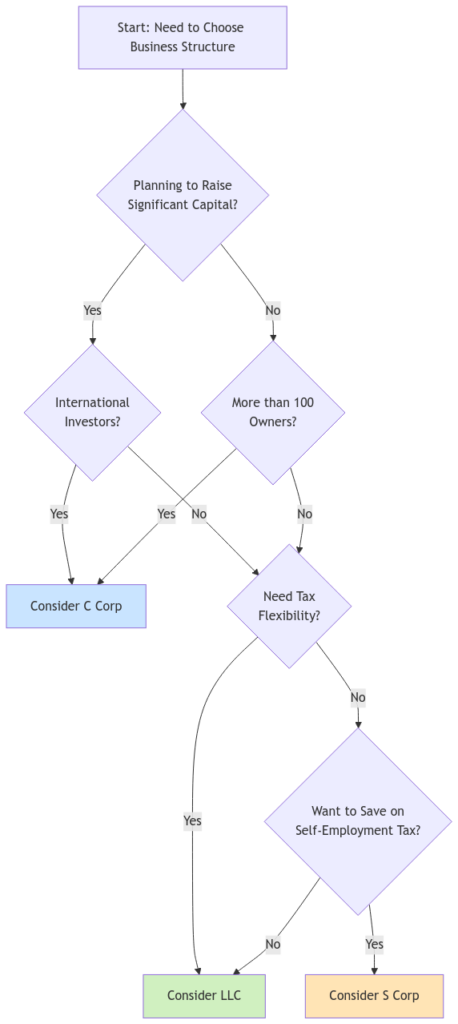

Use this flowchart as a quick guide to determine which business structure might be most appropriate for your situation. While this provides a good starting point, remember to consider all factors and consult with professionals before making your final decision.Understanding C Corporations

A C Corporation is a separate legal entity from its owners. This means the corporation itself can enter into contracts, own property, and be involved in legal proceedings independently of its shareholders.

Features of C Corporations

- Perpetual Existence: The corporation continues to exist even if ownership changes.

- Unlimited Shareholders: There are no limits on the number of shareholders or their nationalities.

- Multiple Stock Classes: Can issue different types of stock, such as common and preferred shares.

- Ideal for Going Public: Suitable structure for companies planning an initial public offering (IPO).

Tax Considerations

- Corporate Tax Rate: As of 2023, C Corporations pay a flat federal corporate tax rate of 21%.

- Double Taxation: Profits are taxed at the corporate level, and dividends distributed to shareholders are taxed again on their personal tax returns.

- Tax Deductions: Eligible for certain business deductions not available to other structures, like deducting the full cost of employee benefits.

Advantages of C Corporations

- Liability Protection: Shareholders are typically not personally responsible for business debts or legal obligations.

- Attracting Investors: The ability to issue stock makes it easier to raise capital from investors, including venture capitalists.

- Employee Incentives: Can offer stock options and other equity-based compensation to attract and retain employees.

- Credibility: Often perceived as more established and credible, which can be beneficial in dealings with other businesses and financial institutions.

Disadvantages of C Corporations

- Double Taxation: Earnings are taxed twice, which can reduce the overall return to shareholders.

- Complexity and Costs: More regulations, record-keeping, and reporting requirements can lead to higher administrative costs.

- Regulatory Compliance: Must adhere to strict corporate formalities, including holding regular board and shareholder meetings and maintaining detailed records.

Exploring S Corporations

An S Corporation combines the liability protection of a corporation with the tax benefits of a partnership.

Qualification Requirements

- Shareholder Limit: Up to 100 shareholders.

- Residency: Shareholders must be U.S. citizens or resident aliens.

- Stock Classes: Only one class of stock is permitted.

- Tax Year: Generally must adopt a calendar year as its fiscal year.

Tax Benefits

- Pass-Through Taxation: Profits and losses pass through to shareholders’ personal tax returns, avoiding corporate-level taxation.

- Self-Employment Tax Savings: Shareholders who are employees can potentially reduce self-employment taxes by taking a reasonable salary and receiving the rest of the income as distributions.

- Offsetting Income: Shareholders can use business losses to offset other income on their personal tax returns, subject to certain limitations.

Advantages of S Corporations

- Liability Protection: Shareholders’ personal assets are generally protected from business liabilities.

- Tax Savings: Avoidance of double taxation can lead to significant tax savings.

- Investment Appeal: Though more limited than C Corps, can still attract investment from qualifying shareholders.

Disadvantages of S Corporations

- Ownership Restrictions: Limits on the number and type of shareholders can restrict growth and investment opportunities.

- Stock Limitations: Having only one class of stock can make it challenging to offer different levels of investment or profit sharing.

- Strict Compliance: Must meet ongoing eligibility requirements to maintain S Corp status, and mistakes can result in loss of this status.

Understanding LLCs

A Limited Liability Company (LLC) offers liability protection like a corporation but with the operational flexibility of a partnership.

Features of LLCs

- Flexible Management: Can be managed by members or appointed managers.

- Operational Flexibility: Fewer formalities compared to corporations; operating agreements can be customized.

- Flexible Taxation: Can choose to be taxed as a sole proprietorship, partnership, S Corp, or C Corp.

Tax Considerations

- Pass-Through Taxation: By default, profits and losses pass through to members’ personal tax returns.

- Tax Election Options: LLCs can elect to be taxed as an S Corp or C Corp if beneficial.

- Self-Employment Taxes: Members may owe self-employment taxes on their share of the profits.

Advantages of LLCs

- Liability Protection: Members are typically not personally liable for business debts and obligations.

- Tax Flexibility: Ability to choose the most advantageous tax classification.

- Simplicity: Generally fewer administrative requirements and lower setup costs than corporations.

- Operational Flexibility: Members have the freedom to decide how the business is run and how profits are shared.

Disadvantages of LLCs

- Raising Capital: May find it harder to attract investors who prefer the stock options and clear ownership structures of corporations.

- Self-Employment Taxes: Members may be subject to self-employment taxes on the entire net income of the LLC.

- Variation by State: Laws governing LLCs can vary significantly from state to state, which can affect operations in multiple jurisdictions.

Making the Right Choice

Selecting the appropriate business structure depends on several factors unique to your situation.

Considerations

- Liability Protection: All three structures offer personal liability protection, but the extent and specifics can vary.

- Tax Implications: Consider whether pass-through taxation or the corporate tax rate is more beneficial for your financial situation.

- Management and Ownership: Think about how you want to manage the business and whether you plan to bring on multiple owners or investors.

- Investment Needs: If raising significant capital is a priority, a C Corporation might be the most suitable.

- Administrative Responsibilities: Be realistic about the time and resources you can devote to compliance and administrative tasks.

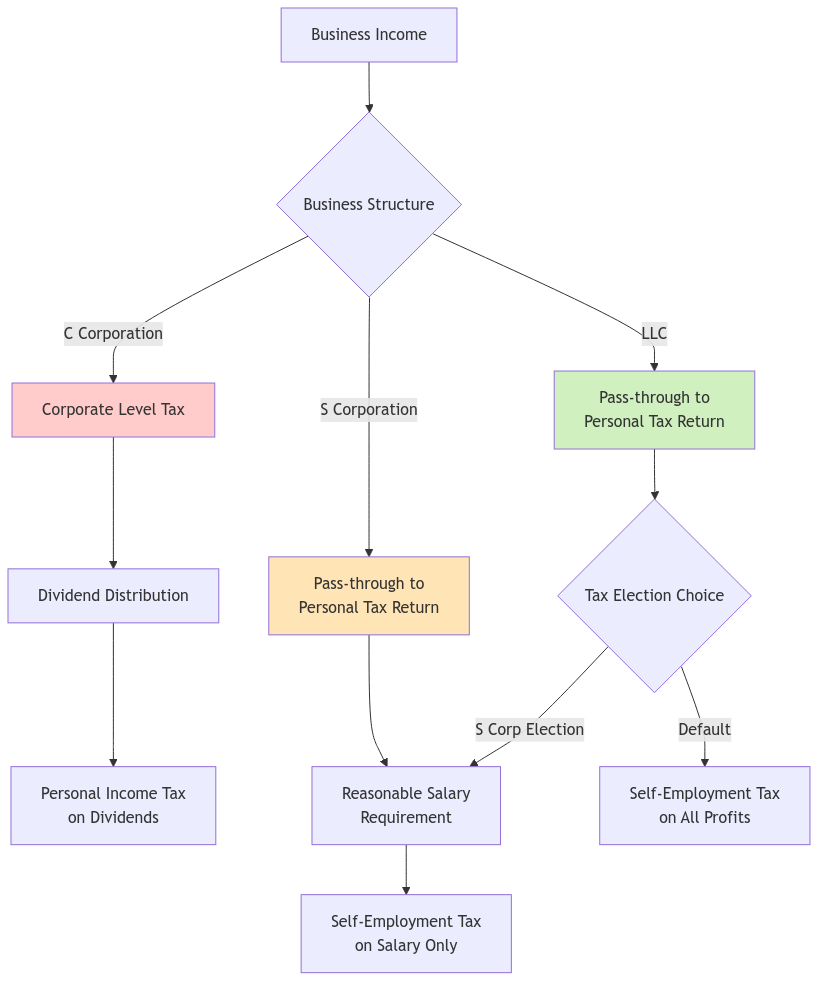

This flowchart illustrates how income flows through different business structures and its tax implications. Understanding these paths is crucial for making an informed decision about your business structure and planning for tax efficiency.Real-World Examples

Tech Startup Aiming for Rapid Growth

Scenario: A technology company plans to develop a cutting-edge app and attract venture capital.

Recommended Structure: C Corporation

Reasons:

- Investor Attraction: Venture capitalists often prefer investing in C Corporations.

- Stock Options: Ability to offer stock options can help attract top talent.

- Growth Potential: Suitable for businesses planning to go public in the future.

Freelance Consultant

Scenario: An individual provides consulting services and wants to protect personal assets while keeping things simple.

Recommended Structure: LLC

Reasons:

- Simplicity: Easier to set up and maintain than a corporation.

- Tax Flexibility: Pass-through taxation avoids corporate taxes.

- Liability Protection: Shields personal assets from business liabilities.

Family-Owned Retail Store

Scenario: A family is opening a small retail shop with plans to keep ownership within the family.

Recommended Structure: S Corporation

Reasons:

- Pass-Through Taxation: Avoids double taxation while providing liability protection.

- Ownership Structure: Limits on shareholders are not an issue for a family business.

- Salary and Dividends: Can pay family members reasonable salaries and distribute additional profits as dividends, potentially reducing self-employment taxes.

FAQs

Q: Can I change my business structure later?

A: Yes, you can change your business structure as your business grows or your needs change. However, converting from one structure to another can have tax implications and may require legal paperwork. It’s advisable to consult with a legal or tax professional before making changes.

Q: How does self-employment tax affect S Corp owners and LLC members?

A:

- S Corp Owners: Shareholders who work for the company must be paid a reasonable salary, which is subject to employment taxes. Additional profits can be distributed as dividends, which may not be subject to self-employment taxes.

- LLC Members: Generally, all profits are subject to self-employment taxes unless the LLC elects to be taxed as an S Corp.

Q: Do I need professional help to form my business entity?

A: While you can file the necessary paperwork yourself, working with an attorney or accountant can ensure that you’re choosing the best structure for your situation and complying with all legal requirements. Professional advice can save you time and prevent costly mistakes down the road.

Next Steps

Choosing the right business structure sets the foundation for your company’s future success. Take the time to assess your goals, consult with professionals, and make an informed decision that aligns with your vision.

- Assess Your Goals: Clarify your short-term and long-term objectives.

- Consult Professionals: Seek advice from legal and tax experts.

- Consider the Future: Think about how your choice will impact your business down the line.

Embarking on your business journey is a significant step. With the right structure in place, you’ll be better positioned to achieve your goals and navigate the challenges ahead.

How XOA TAX Can Help

Navigating the complexities of business structures and tax implications can be overwhelming. The team at XOA TAX is here to provide personalized guidance tailored to your unique situation. Our experienced CPAs can help you:

- Evaluate Options: Understand the pros and cons of each business structure.

- Tax Planning: Develop strategies to minimize your tax liabilities.

- Compliance Assistance: Ensure you’re meeting all legal and regulatory requirements.

Get in Touch Today

Website: www.xoatax.com

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: Contact Us

Disclaimer: This information is provided for general informational purposes and should not be considered legal, tax, or financial advice. Laws and regulations vary by location and change over time. Please consult a professional advisor for advice specific to your circumstances.

anywhere

anywhere  anytime

anytime