Taxes! Just the word might make you feel a bit like you’re lost in a maze. But don’t worry, we’re here to help. One of the best things you can do is find a trusted tax professional to guide you. Think of it like choosing a coach for your finances – you want someone knowledgeable and supportive, who you can easily talk to. This blog post will help you find the perfect tax pro for your needs.

Key Takeaways

- Choosing the right tax professional can save you time, money, and stress.

- Asking the right questions upfront helps you find a good fit.

- Look for experience, clear communication, and someone who specializes in your needs.

- Don’t hesitate to reach out to XOA TAX for personalized guidance.

Why a Tax Professional is a Good Investment

Imagine trying to learn a new game without knowing the rules. That’s what it’s like doing your taxes without some guidance. A tax professional is like your rule book and coach all in one! They can help you:

- Understand the tax laws: Tax laws can change a lot, and it’s hard to keep up. A tax pro knows all the latest rules.

- Avoid costly mistakes: Even a small error on your taxes can lead to penalties. A professional helps you get it right the first time.

- Save money: They can find deductions and credits you might miss, which means more money in your pocket.

- Reduce stress: Knowing your taxes are in expert hands gives you peace of mind.

Questions to Ask a Potential Tax Professional

Finding the right tax professional is like finding the right pair of shoes. You need the right fit! Here are some questions to ask:

1. What are your qualifications and experience?

Just like you’d want a doctor with the right training, you want a tax pro with the right credentials. Are they a Certified Public Accountant (CPA), an Enrolled Agent (EA), or a tax attorney? Do they have a Preparer Tax Identification Number (PTIN), which is required for all paid tax preparers? You can even check their credentials using the CPA Verify with Credentials. Do they have experience with your specific situation (like small business taxes, investments, or rental income)?

2. How do you communicate with clients?

Everyone has a different communication style. Some people like emails, others prefer phone calls or in-person meetings. Make sure your tax pro communicates in a way that works for you.

3. What types of tax situations do you specialize in?

Tax professionals can have different areas of focus. Some specialize in small businesses, others in individual taxes, and some in complex issues like international taxation. Find someone who understands your unique needs.

4. How do you stay updated on tax law changes?

Tax laws are constantly changing! A good tax professional keeps learning to stay up-to-date. Ask about their continuing education and how they ensure they’re giving you the most current advice.

5. What are your fees?

It’s important to understand how your tax pro charges for their services. Do they charge by the hour, by the form, or a flat fee? Get a clear explanation of their pricing structure upfront.

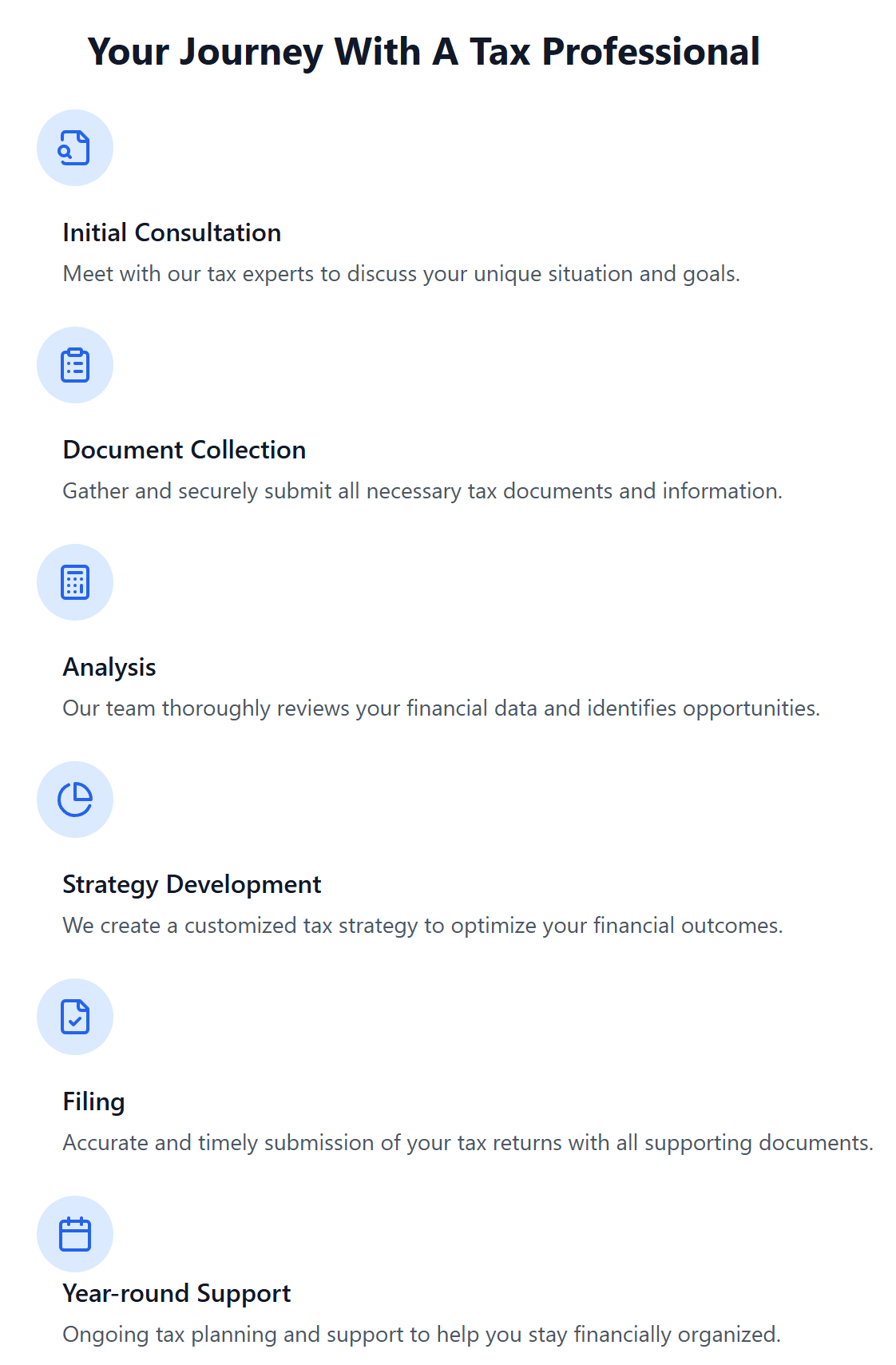

6. Can you help with tax planning throughout the year?

A good tax professional doesn’t just help you at tax time. They can also help you plan throughout the year to minimize your tax liability.

7. What happens if I get audited?

While we all hope to avoid an audit, it’s good to know your tax pro has your back. Ask if they can represent you before the IRS if needed.

FAQs

Is it really worth hiring a tax professional?

Absolutely! Even if you think your taxes are simple, a tax pro can help you find deductions you might miss and ensure you’re filing correctly. They can save you time, money, and stress in the long run.

How do I find a reputable tax professional in my area?

You can ask for referrals from friends, family, or your financial advisor. You can also check with professional organizations like the National Association of Tax Professionals or the American Institute of CPAs.

What should I bring to my first meeting with a tax professional?

Be prepared! Bring your previous year’s tax return, all your tax documents (like W-2s and 1099s), and any records of expenses you want to deduct.

Connecting with XOA TAX

At XOA TAX, we’re not just number crunchers; we’re your partners in navigating the tax maze. Our team includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), and tax attorneys with expertise in a wide range of areas, including small business taxes, real estate, and international tax. Whether you’re located here in California or anywhere else in the country, we’re here to help.

We understand the importance of keeping your financial information secure. That’s why we use encryption and secure portals to protect your data. And with our 4.8-star ratings on Yelp and Google, you can trust that you’re in good hands.

If you have more questions or need personalized guidance, don’t hesitate to contact us. We’re here to help you make sense of your taxes and achieve your financial goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime