When a business sells a significant portion or all of its assets, it’s often referred to as a bulk sale. These transactions can be complex and have unique tax implications, especially regarding sales tax. Let’s break down some common misconceptions surrounding bulk sales tax to help you navigate this intricate area.

Misconception 1: Bulk Sales Tax Is a Separate Tax

Reality: Bulk sales tax isn’t a separate tax. It’s the same sales tax that applies to everyday transactions but is handled differently in bulk sales due to the nature and volume of the assets involved.

Misconception 2: The Seller Is Always Responsible

Reality: While the seller is primarily responsible for collecting and remitting the sales tax, the buyer can also share liability. If the seller doesn’t collect the tax, the burden may shift to the buyer. It’s crucial for both parties to understand their obligations to avoid unexpected tax liabilities.

Misconception 3: All Assets Are Subject to Sales Tax

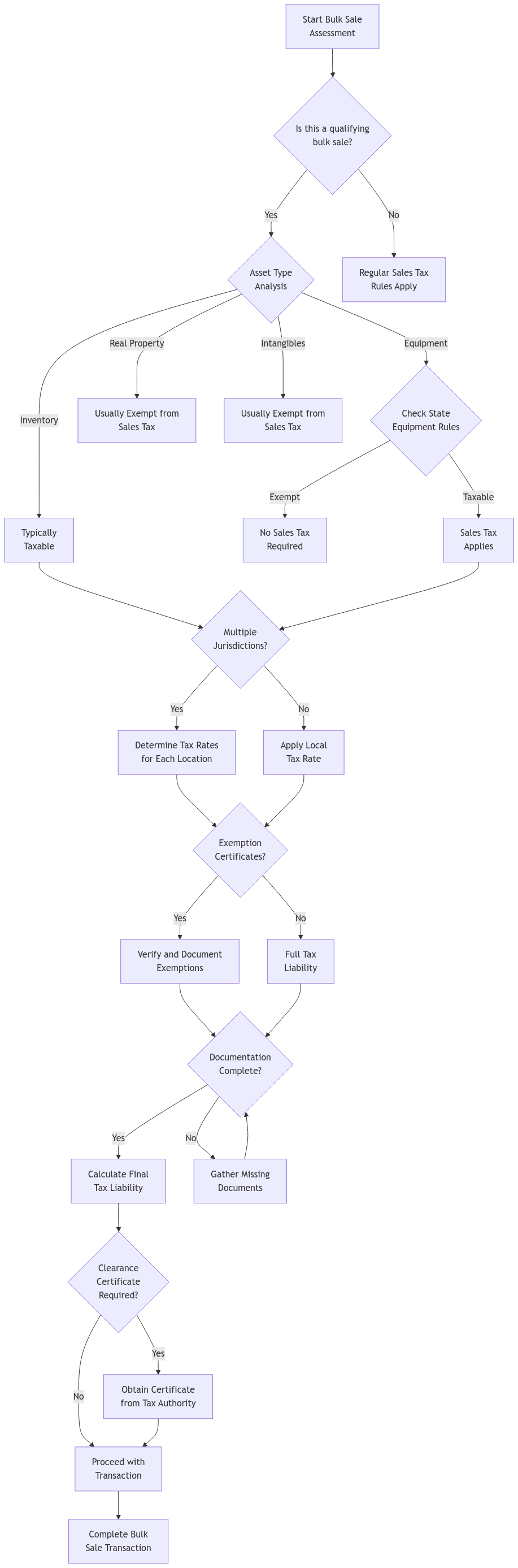

Reality: Not all assets are taxable in a bulk sale. Typically, inventory held for resale is subject to sales tax. However, certain assets, like equipment or machinery, may be exempt or taxed differently depending on your state’s laws and the specific circumstances of the sale. For example, real property is typically excluded, and the treatment of intangible assets (like patents or trademarks) can vary.

Misconception 4: Successor Liability Doesn’t Apply

Reality: Successor liability is a key concept in bulk sales. If the buyer acquires a business with outstanding sales tax liabilities and doesn’t take necessary precautions, they may become liable for the seller’s unpaid taxes. Due diligence is crucial for buyers to protect themselves from inheriting tax debts.

Misconception 5: Compliance Is Optional

Reality: Bulk sales often trigger specific notice requirements to the state’s tax authority. These notices help ensure the proper collection and remittance of sales tax. Non-compliance can lead to penalties and interest, even if the tax is eventually paid. For instance, California requires notification to the California Department of Tax and Fee Administration (CDTFA) at least 10 days before the sale.

Tips for Navigating Bulk Sales Tax

- Consult the Experts: Seek guidance from a tax professional or attorney specializing in bulk sales. They can provide tailored advice based on your specific situation and state laws. For example, some states may have specific exemptions for certain industries or types of businesses.

- Understand Your State’s Laws: Sales tax laws vary significantly from state to state. Research your state’s bulk sales laws or consult with a professional to ensure compliance.

- Review the Sales Agreement Carefully: Pay close attention to sales tax-related clauses in the agreement. Clarify any uncertainties with the other party and your legal counsel.

- Obtain a Clearance Certificate: In some states, buyers can request a certificate from the tax authority confirming the seller’s sales tax obligations have been met. This helps protect the buyer from successor liability.

FAQs

How do I determine the sales tax rate for a bulk sale?

The sales tax rate depends on several factors, including the type of asset sold, the location of the sale, and any applicable exemptions. Consult your state’s tax authority or a tax professional for guidance.

What are the penalties for non-compliance with bulk sales tax laws?

Penalties vary by state and may include fines, interest on unpaid taxes, and even criminal charges in severe cases. It’s essential to comply with all notice requirements and remittance deadlines.

How can I protect myself from successor liability as a buyer?

Conduct thorough due diligence, review the seller’s tax records, and consider obtaining a clearance certificate from the state’s tax authority. Consult with a legal professional to ensure you take the necessary precautions.

Connecting with XOA TAX

Navigating bulk sales tax can be challenging. If you have questions or need assistance with a bulk sale transaction, reach out to XOA TAX. Our team of experienced professionals can provide expert guidance and support to help you stay compliant and avoid costly mistakes.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime