Conservation easements have long been a valuable tool for landowners seeking to preserve natural resources while potentially reaping tax benefits. However, the landscape surrounding these easements has become increasingly complex, as the IRS continues to intensify its scrutiny of certain transactions. At XOA TAX, we understand that navigating these changes can be challenging. This blog post aims to shed light on recent developments and provide guidance to help you stay informed and compliant.

Key Takeaways

- The IRS is actively combating abusive syndicated conservation easement (SCE) transactions.

- New regulations require increased reporting for certain conservation easement arrangements.

- Taxpayers should be aware of potential penalties and seek professional advice to ensure compliance.

Understanding Conservation Easements

A conservation easement is a legal agreement between a landowner and a qualified organization (like a land trust or government agency) that permanently restricts the use of land to protect its conservation values. These values might include protecting wildlife habitat, preserving scenic views, or safeguarding historical resources. In return for donating this easement, landowners may be eligible for federal income tax deductions.

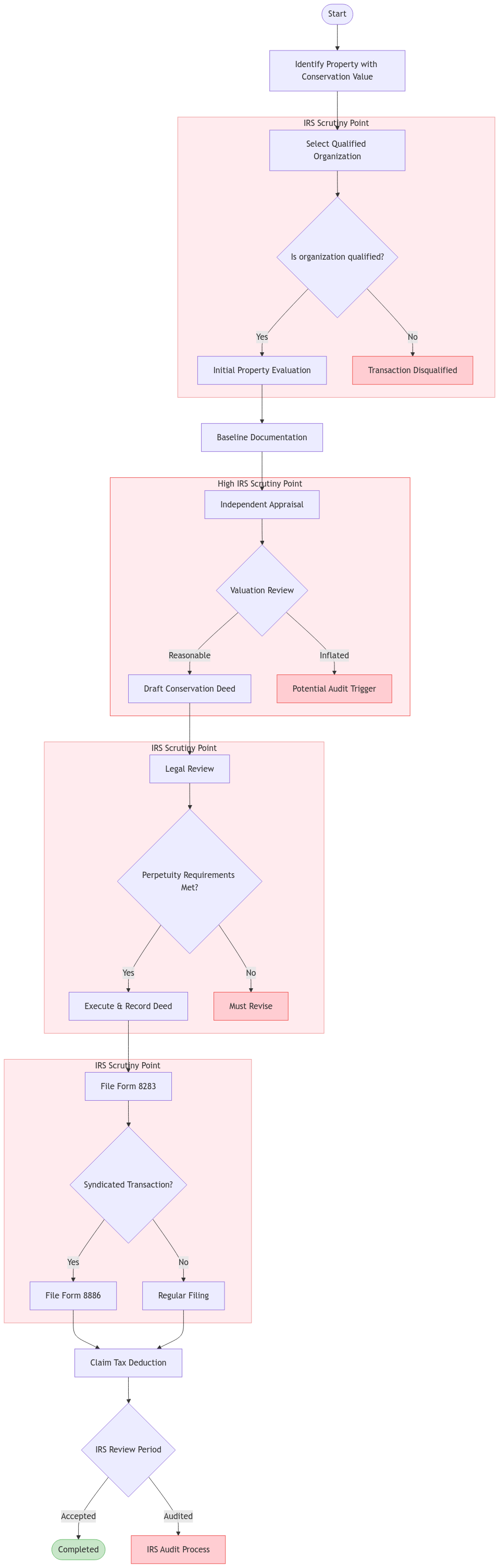

The IRS Cracks Down on Abusive SCEs

In recent years, the IRS has grown increasingly concerned about certain syndicated conservation easement (SCE) transactions. These arrangements often involve partnerships that acquire property and then donate conservation easements, sometimes with inflated appraisals to maximize tax deductions. The IRS considers many of these transactions as abusive tax shelters designed to generate excessive tax benefits for investors.

Increased Scrutiny and Regulatory Changes

- Listed Transactions: The IRS has identified certain types of SCEs as “listed transactions.” This designation requires participants and material advisors to report these transactions to the IRS using Form 8886 (Reportable Transaction Disclosure Statement) and Form 8918 (Material Advisor Disclosure Statement), increasing transparency and aiding in the identification of potentially abusive arrangements.

- SECURE 2.0 Act and Deduction Limitations: The SECURE 2.0 Act of 2022 introduced provisions disallowing deductions for certain qualified conservation contributions made after December 29, 2022, by partnerships or S corporations. These provisions specifically target contributions exceeding 2.5 times the sum of each partner’s or shareholder’s relevant basis.

- IRS Notice 2017-10: In 2017, the IRS issued Notice 2017-10, which officially designated certain syndicated conservation easements as listed transactions, signaling the agency’s intent to crack down on these arrangements.

Implications for Taxpayers

Increased Reporting Obligations: If you are involved in a transaction that falls under the listed transaction rules, you must fulfill the necessary reporting requirements, including filing Forms 8886 and 8918, to avoid penalties.

Scrutiny of Appraisals: The IRS is paying close attention to the valuation of conserved property. Obtaining an independent, qualified appraisal is crucial to ensure the fair market value of the easement is accurately determined.

Penalties and Legal Actions: Engaging in abusive SCE transactions can lead to substantial penalties, including back taxes, interest, and potentially even criminal prosecution. The statute of limitations for conservation easement audits generally extends three years from the date the tax return was filed or two years from the date the tax was paid, whichever is later.

Protecting Yourself: XOA TAX Recommendations

Consult with Tax Professionals: Before proceeding with a conservation easement, seek guidance from experienced tax professionals like our team at XOA TAX. We can help you understand the latest regulations, assess the legitimacy of a potential transaction, and ensure you meet all reporting requirements.

Obtain a Qualified Appraisal: Work with a qualified appraiser who has expertise in valuing conservation easements. This will help you avoid overvaluation issues that can trigger IRS scrutiny. The appraiser should have demonstrable experience with conservation easements, adhere to the Uniform Standards of Professional Appraisal Practice (USPAP), and be independent of the transaction.

Maintain Thorough Documentation: Keep detailed records of all aspects of the conservation easement donation, including the deed of easement, baseline documentation report, appraisal, and any correspondence with the qualified organization.

Stay Informed: Tax laws are constantly evolving. Stay up-to-date on the latest IRS guidance and regulations related to conservation easements.

Frequently Asked Questions (FAQ)

Q: What is the difference between a legitimate conservation easement and an abusive one?

A: A legitimate conservation easement is driven by a genuine desire to protect conservation values. Abusive SCEs, on the other hand, are primarily motivated by tax benefits, often involving inflated appraisals and complex partnership structures designed to generate excessive deductions.

Q: Are there still legitimate ways to utilize conservation easements for tax benefits?

A: Absolutely. Conservation easements remain a valuable tool for landowners seeking to protect natural resources and potentially reduce their tax burden. The key is to ensure the transaction is structured properly and complies with all applicable laws and regulations.

Q: What are the perpetuity requirements for conservation easements?

A: Conservation easements must be granted in perpetuity, meaning the restrictions on the land must remain in place forever. This ensures the long-term protection of the conservation values.

Q: What qualifies as a “qualified organization” for receiving a conservation easement?

A: A qualified organization is typically a government agency or a non-profit land trust that has a conservation mission. The organization must have the resources and commitment to enforce the easement restrictions in perpetuity.

Connecting with XOA TAX

Navigating the complexities of conservation easements can be challenging. At XOA TAX, our team of experienced CPAs can provide expert guidance and support to ensure you remain compliant with the ever-changing tax laws. Whether you’re considering donating a conservation easement or have questions about your existing arrangement, we’re here to help. Contact us today for a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime