Navigating corporate taxes can be challenging, especially when multiple affiliated companies are involved. At XOA TAX, we’re here to help you determine whether filing a consolidated tax return is the right choice for your business group. We’ll explore what consolidated tax returns are, their benefits and drawbacks, and key considerations to help you make an informed decision.

Key Takeaways

- Filing a consolidated tax return combines the financials of affiliated companies into one tax return.

- This approach can offer benefits like offsetting profits and losses among group members and simplifying some administrative tasks.

- Potential downsides include increased complexity and possible limitations on certain deductions.

- Careful evaluation is essential to determine if this filing method aligns with your business goals.

What Is a Consolidated Tax Return?

A consolidated tax return allows an affiliated group of corporations to file a single federal income tax return as if they were one entity. This means combining the income, deductions, and credits of all group members on one return.

Who Can File?

An affiliated group is defined by the Internal Revenue Code as one or more chains of “includible” corporations connected through stock ownership with a common parent corporation. The key criteria are:

- The parent corporation must directly own at least 80% of the voting power and 80% of the value of the stock of at least one subsidiary.

- Each other includible corporation in the group must be at least 80% owned (voting power and value) directly by one or more of the other includible corporations.

Note on Stock Ownership

While the general rule requires 80% ownership, there’s an exception for certain types of preferred stock under Section 1504(a)(4). This exception can allow companies with more complex stock structures to qualify for consolidated filing.

Advantages of Filing a Consolidated Return

Offsetting Profits and Losses: If some companies in the group have losses while others have profits, those losses can offset the profits, potentially reducing the overall tax liability.

Deferral of Intercompany Transactions: Income from transactions between group members can be deferred until it is realized outside the group. For example, if one subsidiary sells goods to another at a profit, the gain is not recognized until the goods are sold to an external party.

Simplified Reporting: Instead of filing separate returns for each company, a consolidated return can streamline reporting requirements.

Tax Attribute Sharing: Credits and deductions can be shared among group members, which might not be possible if filing separately.

Disadvantages of Filing a Consolidated Return

Increased Complexity: Preparing a consolidated return involves complex calculations and meticulous record-keeping, especially for intercompany transactions and adjustments.

Potential for Higher Tax Liability: In some cases, the consolidated approach can lead to a higher tax bill, especially if certain group members have significant capital gains or if the timing of income and deductions is unfavorable.

Limitations on Deductions and Credits: Certain deductions and credits may be limited or lost when filing consolidated returns. For instance, limitations on net operating loss (NOL) deductions imposed by the Tax Cuts and Jobs Act (TCJA) can significantly impact consolidated groups.

Compliance Risks: The complexity increases the risk of errors, which can lead to penalties.

Post-TCJA International Tax Implications

The Tax Cuts and Jobs Act introduced several international tax provisions that can affect consolidated groups with foreign subsidiaries:

- Global Intangible Low-Taxed Income (GILTI): U.S. shareholders of controlled foreign corporations (CFCs) must include GILTI in their taxable income. Consolidated groups need to aggregate GILTI amounts from all CFCs owned by group members.

- Foreign-Derived Intangible Income (FDII): This provision offers a lower tax rate on income from exporting goods and services. Consolidated groups calculate FDII on a group basis.

- Base Erosion and Anti-Abuse Tax (BEAT): Applies to large corporations making deductible payments to foreign related parties. Consolidated groups must consider BEAT thresholds and calculations at the group level.

Form 8858 Requirements

If your consolidated group includes foreign disregarded entities or foreign branches, you may need to file Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches. This form reports information about these entities and ensures compliance with international tax reporting obligations.

Industry-Specific Examples

Manufacturing Industry: A manufacturing parent company with subsidiaries that handle production, distribution, and sales can benefit from consolidated returns by offsetting the high initial costs of a new production facility (operating at a loss) against the profits of established sales subsidiaries.

Technology Sector: A tech company acquiring startups can use the losses from research and development expenses of the new subsidiaries to offset the profits of the parent company, optimizing tax liability through consolidated filing.

Retail Chains: A retail corporation with stores in different states can consolidate the profits from high-performing locations with the losses from new or underperforming ones, smoothing out taxable income.

Intercompany Transaction Deferrals

For example, suppose Subsidiary A sells inventory to Subsidiary B at a profit of $100,000. Under consolidated return rules, this profit is not recognized immediately for tax purposes. Instead, the gain is deferred until Subsidiary B sells the inventory to an external party. This deferral can provide cash flow benefits but requires careful tracking to ensure proper reporting when the transaction is finally realized outside the group.

Compliance Pitfalls to Avoid

Incorrect Ownership Percentages: Miscalculating ownership percentages can disqualify a group from filing consolidated returns.

Improper Treatment of Intercompany Transactions: Failing to correctly defer or eliminate intercompany profits can result in incorrect taxable income calculations.

Inadequate Documentation: Lack of detailed records can lead to disallowed deductions or credits upon audit.

Timeline and Checklist for Filing

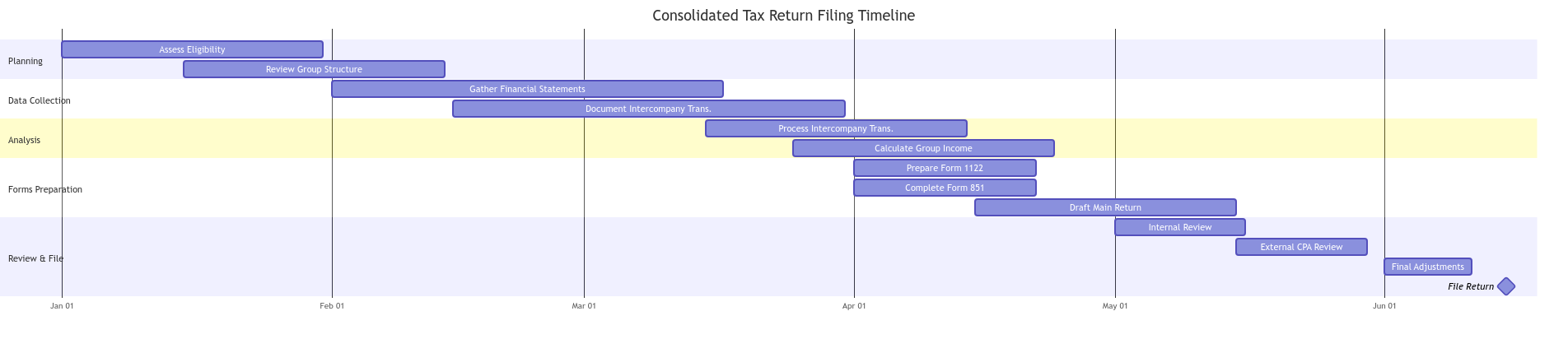

Step 1: Assess Eligibility

– Confirm that your group meets the ownership and inclusion criteria.

– Review stock ownership structures and any exceptions.

Step 2: Prepare Authorization Forms

– Form 1122: Obtain consent from each subsidiary to be included in the consolidated return.

– Form 851: Complete the Affiliations Schedule detailing all group members.

Step 3: Gather Financial Data

– Collect income statements, balance sheets, and cash flow statements for each group member.

– Document all intercompany transactions, including loans, sales, and services.

Step 4: Adjust Intercompany Transactions

– Eliminate or defer intercompany profits and losses as required.

– Make necessary adjustments for inventory, fixed assets, and other transactions.

Step 5: Calculate Consolidated Taxable Income

– Combine adjusted income, deductions, and credits from all group members.

– Consider limitations on NOLs and other tax attributes.

Step 6: Review International Tax Obligations

– Aggregate GILTI, FDII, and BEAT calculations if applicable.

– Prepare and file Form 8858 for foreign entities.

Step 7: File the Return

– Submit the consolidated tax return by the due date, including all required schedules and attachments.

– Ensure compliance with both federal and state filing requirements.

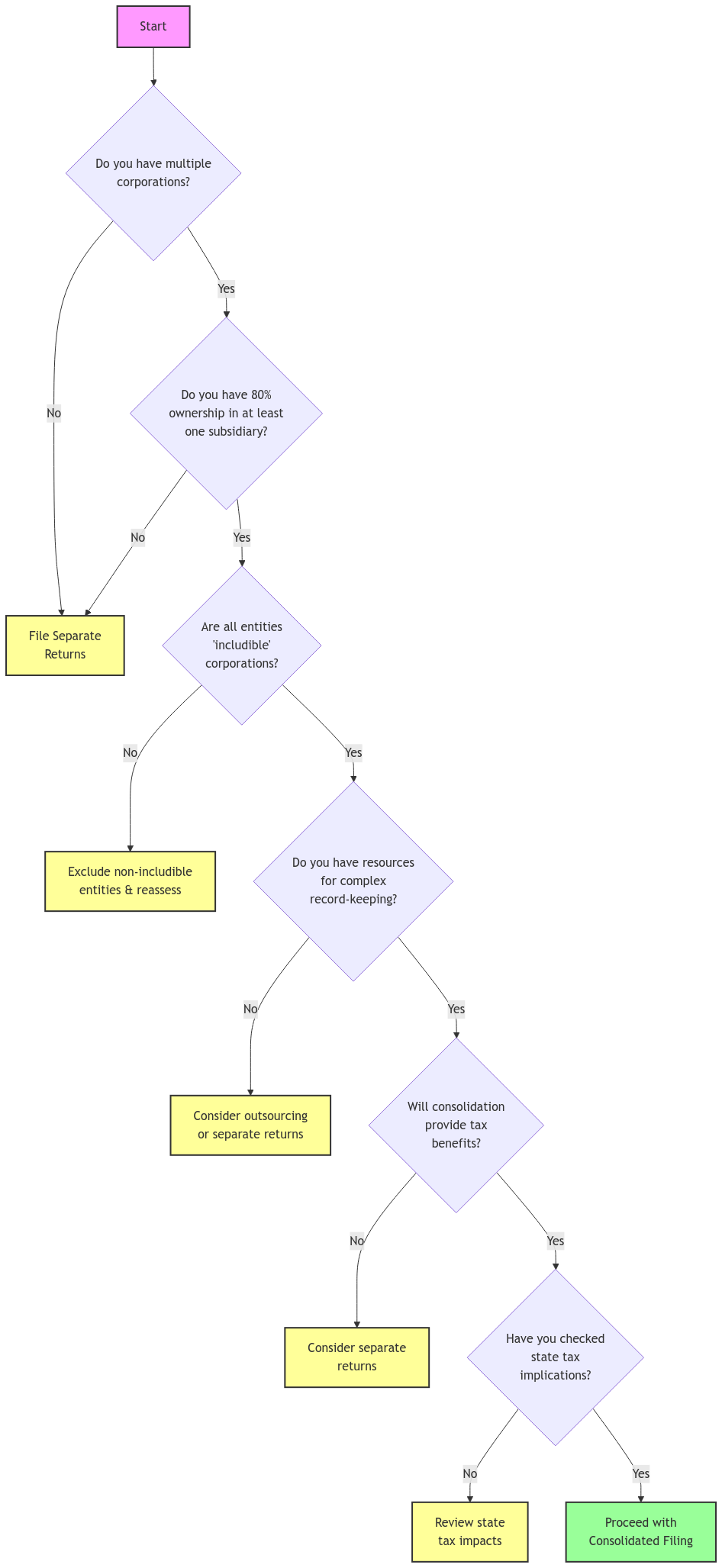

Visual Guide: Decision Tree for Filing Consolidated Returns

Timeline Visualization

- January to March: Assess eligibility and gather financial data.

- April: Adjust intercompany transactions and calculate taxable income.

- May: Complete necessary forms and review international tax obligations.

- June 15: File the consolidated tax return (for calendar-year corporations with an extension).

Simple Numerical Example

Imagine a parent company with two subsidiaries:

- Subsidiary X: Profitable, with taxable income of $500,000.

- Subsidiary Y: Operating at a loss of $200,000.

If filing separately, Subsidiary X would owe tax on $500,000, and Subsidiary Y would carry forward its $200,000 loss. By filing a consolidated return, the group’s taxable income is reduced to $300,000 ($500,000 – $200,000), lowering the overall tax liability.

Potential Penalties for Non-Compliance

Accuracy-Related Penalties: Up to 20% of the underpaid tax due to negligence or disregard of rules.

Late Filing Penalties: If the return is filed after the deadline without an extension.

Information Reporting Penalties: For failing to provide required information or schedules.

Documentation Requirements

Maintaining detailed records is crucial:

- Intercompany Transactions: Document all intercompany sales, loans, and transfers, including terms and pricing.

- Allocations of Income and Expenses: Keep records showing how income and expenses are allocated among group members.

- Authorization Forms: Retain copies of Form 1122 for each subsidiary.

- Supporting Schedules: Maintain all calculations and supporting documents used in preparing the consolidated return.

Statute of Limitations

Generally, the IRS has three years from the date a return is filed to assess additional taxes. However:

- Substantial Understatement: If the consolidated return omits more than 25% of gross income, the statute extends to six years.

- Failure to File or Fraud: In cases of fraud or failure to file, there is no statute of limitations.

Should You File a Consolidated Return?

Deciding whether to file a consolidated return depends on:

- Financial Profiles of Group Members: Consider the profitability and losses of each company.

- Future Plans: Think about acquisitions, dispositions, or restructurings that might affect group composition.

- Administrative Capacity: Ensure you have the resources to handle the increased complexity.

- State Tax Implications: Understand how states where you operate treat consolidated returns, as rules vary widely.

Consulting with a tax professional can help you weigh these factors and decide on the best course of action.

State Tax Considerations

State rules on consolidated returns differ:

- Separate Returns Required: Some states mandate separate returns for each company.

- Consolidated or Combined Returns Allowed: Others permit or require consolidated or combined reporting, which may differ from federal rules.

- Apportionment Methods Vary: The way income is allocated to states can change under consolidated filing.

Understanding state-specific rules is essential to avoid surprises and ensure compliance.

FAQs

1. How Do We Elect to File a Consolidated Return?

You make the election by filing a consolidated return, including:

- Form 1122: Each subsidiary must sign this form to consent to be included.

- Form 851: Attach this Affiliations Schedule to provide details about the group members.

The election is made with the timely filing of the consolidated return for the tax year.

2. Can We Stop Filing a Consolidated Return Later?

Once you elect to file consolidated returns, the election remains in effect for future years. To discontinue, you generally need IRS permission, which is not always granted. Revenue Procedure 2021-40 provides guidance on when and how a group can request to terminate its consolidated filing status.

3. How Are Intercompany Transactions Treated?

Intercompany transactions are generally deferred or eliminated for tax purposes until realized outside the group. Accurate tracking and reporting are essential. Failure to properly adjust for these transactions can lead to incorrect taxable income.

4. Are There Additional Forms for Reportable Transactions?

Yes. If your group engages in certain reportable transactions, you may need to file Form 8886, Reportable Transaction Disclosure Statement. This form notifies the IRS about transactions that have the potential for tax avoidance or evasion.

5. Do We Need to File Form 8858?

If your consolidated group includes foreign disregarded entities or foreign branches, you are required to file Form 8858. This form reports information about these entities and ensures compliance with international tax reporting obligations.

6. What Are the Record-Keeping Requirements?

You must maintain comprehensive records, including:

- Details of Intercompany Transactions: Dates, amounts, and terms.

- Allocation Schedules: How income, deductions, and credits are divided among group members.

- Supporting Documentation: Contracts, invoices, and other evidence supporting transactions.

7. How Does the IRS Audit Consolidated Returns?

The IRS audits the consolidated return as a whole but may examine records of any group member. Having organized documentation and understanding the consolidated return rules can facilitate the audit process.

8. What Happens If We Add or Remove a Group Member?

Adding or removing a member can affect:

- Tax Attributes: NOLs and credits may be limited or lost.

- Intercompany Transactions: Deferred gains or losses may need to be recognized.

- Filing Requirements: You may need to file separate returns for the departing member.

Careful planning is necessary to manage the tax implications.

9. How Are Net Operating Losses (NOLs) Treated?

- Current Year NOLs: Losses from one group member can offset profits of others.

- Carryforwards and Carrybacks: There are complex rules about how pre-consolidation NOLs can be used, and limitations may apply under Section 382.

Understanding these rules is important to maximize tax benefits.

Connecting with XOA TAX

Filing consolidated tax returns is a complex process with many factors to consider. At XOA TAX, our experienced CPAs can help you navigate these challenges. We’ll work with you to evaluate your options, ensure compliance, and develop strategies to minimize your tax liability.

Contact XOA TAX today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This content is for informational purposes and should not be considered legal, tax, or financial advice. Tax laws and regulations change frequently and can vary by jurisdiction. Consult a qualified professional for advice specific to your situation.

anywhere

anywhere  anytime

anytime