Tax season can be daunting! Whether you’re looking forward to a refund or feeling stressed about the process, the question of how to file often arises. With DIY tax software like TurboTax gaining popularity, is professional help still necessary?

At XOA TAX, we empower our clients with knowledge. This post explores the ins and outs of DIY tax software (TurboTax Deluxe, Premier, Self-Employed) and professional CPA services. We’ll help you understand the advantages and disadvantages of each, so you can confidently make the best choice for your needs – no matter where you are.

Key Takeaways

- DIY tax software like TurboTax can be a great option for simple tax returns.

- CPAs offer expert guidance and personalized advice for more complex situations, no matter your location.

- Income, investments, tax knowledge, and budget all play a role in your decision.

- XOA TAX, proudly headquartered in Orange County, CA, serves clients across the United States and internationally, offering expert tax solutions wherever you are.

DIY Tax Software: A Closer Look

Imagine assembling a bookshelf from IKEA. You have instructions, labeled parts, and a sense of accomplishment. That’s similar to using TurboTax or other tax software. It’s often a good fit if your tax situation is straightforward.

Pros:

- Cost-effective: DIY software is generally less expensive than hiring a CPA, with options like IRS Free File available for those with qualifying incomes.

- User-friendly: The software guides you step-by-step, making it easy to follow.

- Convenient: File your taxes from anywhere, at your own pace.

Cons:

- May Require Upgrades: Complex situations might require higher-priced versions (Premier, Self-Employed).

- Limited Personalized Advice: Software can’t offer the tailored advice of a CPA.

- Potential for Errors: Incorrect data entry can lead to costly mistakes.

When a CPA Makes a Difference

Now imagine building a custom home. You’d want an experienced architect and contractor, right? That’s where a CPA comes in. They have the expertise to handle complex tax scenarios and offer personalized strategies to help you:

- Maximize Deductions: CPAs identify deductions and credits you might miss, potentially saving you money, no matter where your income is earned or where your assets are located.

- Navigate Complex Situations: Investments, rental properties, international income, or a business? A CPA ensures accurate reporting and takes advantage of all applicable tax laws, regardless of your location.

- Reduce Errors: Avoid costly mistakes with a CPA ensuring your return is accurate.

- Plan for the Future: CPAs provide year-round tax planning advice, not just during tax season. This is especially valuable for those with international tax obligations.

- Handle Multi-State & International Taxes: CPAs are equipped to handle the complexities of filing taxes in multiple states or countries, ensuring compliance with all relevant regulations.

Pros:

- Expertise: CPAs are tax professionals with in-depth knowledge of tax laws and regulations, both domestically and internationally.

- Personalized Advice: Tailored guidance based on your unique financial situation, wherever you are located.

- Error Reduction: Avoid mistakes and ensure accuracy, no matter how complex your tax situation.

- Peace of Mind: Knowing a professional is handling your taxes alleviates stress, especially when dealing with cross-border tax issues.

- Audit Support: CPAs can represent you before the IRS or other tax authorities, regardless of your location.

Cons:

- Higher Cost: CPAs generally charge more than DIY software. However, the potential tax savings and peace of mind often outweigh the cost, especially when dealing with complex international tax matters.

- Less Control: You are entrusting your tax preparation to a professional.

Choosing the Right Path: CPA vs. TurboTax

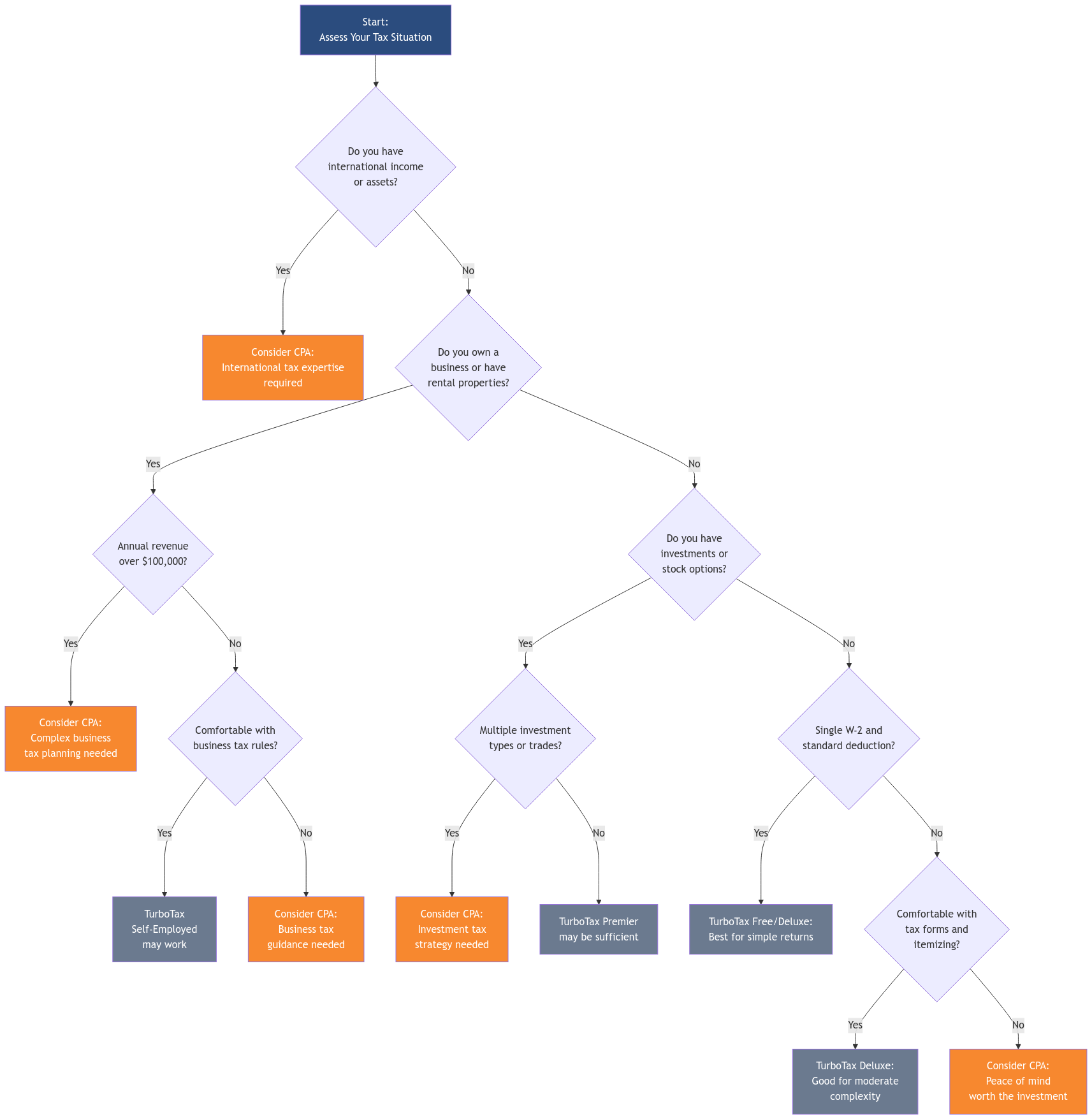

Deciding depends on your needs. Consider these questions:

- How complex are your finances? Simple W-2 or investments, rental income, a business, or international assets?

- Tax Law Comfort Level? Confident with forms, deductions, and credits, or do you need guidance?

- What’s your budget? Affordable option or invest in professional help for savings and peace of mind?

- Year-Round Planning Needs? CPAs offer ongoing tax strategies, essential for those with complex or international financial situations.

- Geographic Considerations? Do you need a CPA who understands multi-state or international tax laws?

FAQs

Can a CPA help me with tax planning throughout the year, even if I have international income?

Absolutely! CPAs can help you develop strategies to minimize your tax liability year-round, including those with international tax obligations. This can involve retirement planning, investment strategies, business structure advice, and navigating international tax treaties.

What if I started with DIY software and now I’m stuck?

No problem! A CPA can review your work, correct errors, and take over, no matter where you are located.

I’m a freelancer with clients overseas. Is it worth hiring a CPA?

Freelancers with international clients often have unique tax situations. A CPA can be a valuable partner in navigating self-employment taxes, maximizing deductions, and complying with international tax regulations.

What security measures do CPAs take to protect my information, especially with international clients?

Reputable CPAs, like XOA TAX, take data security seriously. We use encryption, secure storage, and comply with all privacy regulations, including those relevant to international data protection, to protect your sensitive financial information.

What documents do I need to provide to a CPA or to file with tax software, particularly if I have international income or assets?

You’ll need your Social Security number (or ITIN), income statements (W-2s, 1099s), and documentation for deductions and credits. If you have international income or assets, you may also need foreign income statements, proof of foreign taxes paid, and documentation related to foreign bank accounts and investments. A CPA can provide a personalized list.

Connecting with XOA TAX

Taxes can be confusing. At XOA TAX, we guide and support you.

Whether you have a simple question or need full-service tax preparation, our experienced CPAs are ready to assist you, wherever you are in the world. Contact us today for a free consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state, locality, and internationally. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime