Key Takeaways

- Proper Crypto Tax Reporting Requires Accurate Forms: Reporting your cryptocurrency transactions properly involves filling out several tax forms, including Form 8949 for reporting capital gains and losses, Schedule D for summarizing those gains and losses, and potentially Schedule C or Schedule SE if you’re self-employed.

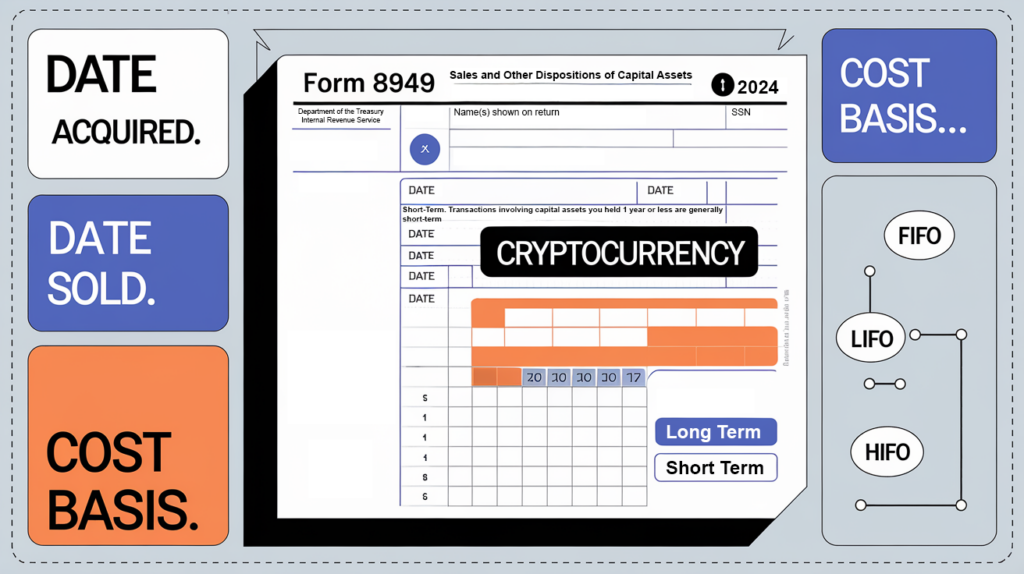

- Detail is Crucial: When filling out Form 8949, you must specify the cryptocurrency asset sold, exchanged, or spent, including the “Date acquired,” “Date sold or disposed of,” proceeds, cost basis, and any necessary adjustments.

- Cost Basis Tracking Methods Matter: Choosing the appropriate cost basis tracking method (FIFO, LIFO, HIFO) can significantly impact your tax liability. Understanding these methods is essential for accurate reporting and potential tax optimization.

- Tax Optimization Strategies: Implementing strategies like tax-loss harvesting can help minimize your tax liability. Being proactive about your crypto tax planning can lead to significant savings.

How Does the IRS Classify Cryptocurrency?

The Internal Revenue Service (IRS) classifies cryptocurrency as property for federal tax purposes. This means that general tax principles applicable to property transactions apply to transactions involving cryptocurrency. Whenever you sell, exchange, or use cryptocurrency, you may have a taxable event that needs to be reported on your taxes.

Tracking Crypto Transactions: To track your cryptocurrency transactions, you can use blockchain explorers specific to each cryptocurrency. For Bitcoin, popular block explorers include blockchain.com, blockchair.com, and btc.com. Additionally, many cryptocurrency exchanges and wallets provide transaction histories that you can download and use for tax reporting.

What Forms Do I Need to Report Cryptocurrency?

- Form 1040: The standard individual income tax return form.

- Form 8949: Used to report sales and dispositions of capital assets, including cryptocurrency.

- Schedule D (Form 1040): Summarizes capital gains and losses from Form 8949.

- Schedule 1 (Form 1040): Used to report additional income such as hobby income, unemployment compensation, or other income.

- Schedule C (Form 1040): Used to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Schedule SE (Form 1040): Used to calculate self-employment tax if you had net earnings from self-employment of $400 or more.

Form 1040

Form 1040 is the primary form used by U.S. taxpayers to file an annual income tax return. On the 2024 Form 1040, there is a question at the top of the form:

“At any time during 2024, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

You must answer “Yes” if you engaged in any transaction involving cryptocurrency during the year, including:

- Receiving cryptocurrency as payment for goods or services.

- Receiving new cryptocurrency as a result of mining or staking activities.

- Receiving cryptocurrency through a hard fork or airdrop.

- Exchanging cryptocurrency for goods or services.

- Exchanging one cryptocurrency for another cryptocurrency.

- Selling cryptocurrency.

- Any other disposition of a financial interest in cryptocurrency.

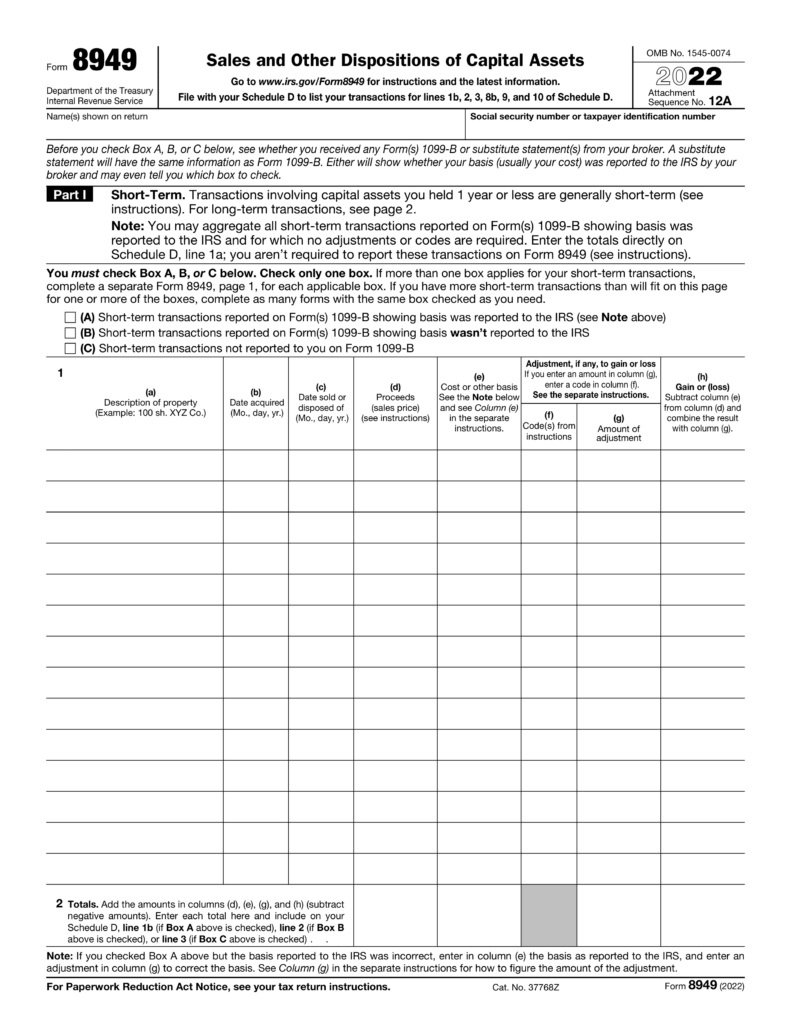

Form 8949 – Sales and Other Dispositions of Capital Assets

Form 8949 is used to report sales and exchanges of capital assets, including cryptocurrency. Each taxable event involving the sale or exchange of cryptocurrency must be reported on Form 8949.

When Do I Need to Report Cryptocurrency on Form 8949?

- Selling cryptocurrency for fiat currency (e.g., USD).

- Exchanging one cryptocurrency for another (e.g., trading Bitcoin for Ethereum).

- Using cryptocurrency to purchase goods or services.

Understanding Fair Market Value (FMV): For tax purposes, the fair market value (FMV) of cryptocurrency is its value in U.S. dollars at the time of the transaction. This value is used to calculate your capital gain or loss.

Determining the “Date Acquired”: The “Date Acquired” is the date you obtained ownership of the cryptocurrency. Determining this date can be straightforward or complex, depending on how you acquired the cryptocurrency:

- Purchases: The date you bought the cryptocurrency on an exchange or from another person.

- Mining: The date the cryptocurrency was successfully mined (i.e., when it was added to your wallet).

- Staking Rewards: The date the staking rewards were credited to your wallet or account.

- Airdrops and Hard Forks: The date you had control over the cryptocurrency received via airdrop or hard fork.

- Gifts: The date the cryptocurrency was gifted to you.

It’s important to keep detailed records of when and how you acquired your cryptocurrency to accurately report on Form 8949.

How to Fill Out Form 8949 for Cryptocurrency

- Description of Property: Specify the cryptocurrency and quantity sold (e.g., “0.5 BTC”).

- Date Acquired: The date you originally acquired the cryptocurrency.

- Date Sold or Disposed Of: The date you sold, exchanged, or otherwise disposed of the cryptocurrency.

- Proceeds: The amount you received from the sale or disposition, measured in U.S. dollars.

- Cost Basis: The amount you originally paid for the cryptocurrency, including any fees or commissions, measured in U.S. dollars.

- Adjustments: Any adjustments to the gain or loss, such as fees associated with the sale.

- Gain or Loss: Calculated as Proceeds minus Cost Basis, adjusted for any necessary adjustments.

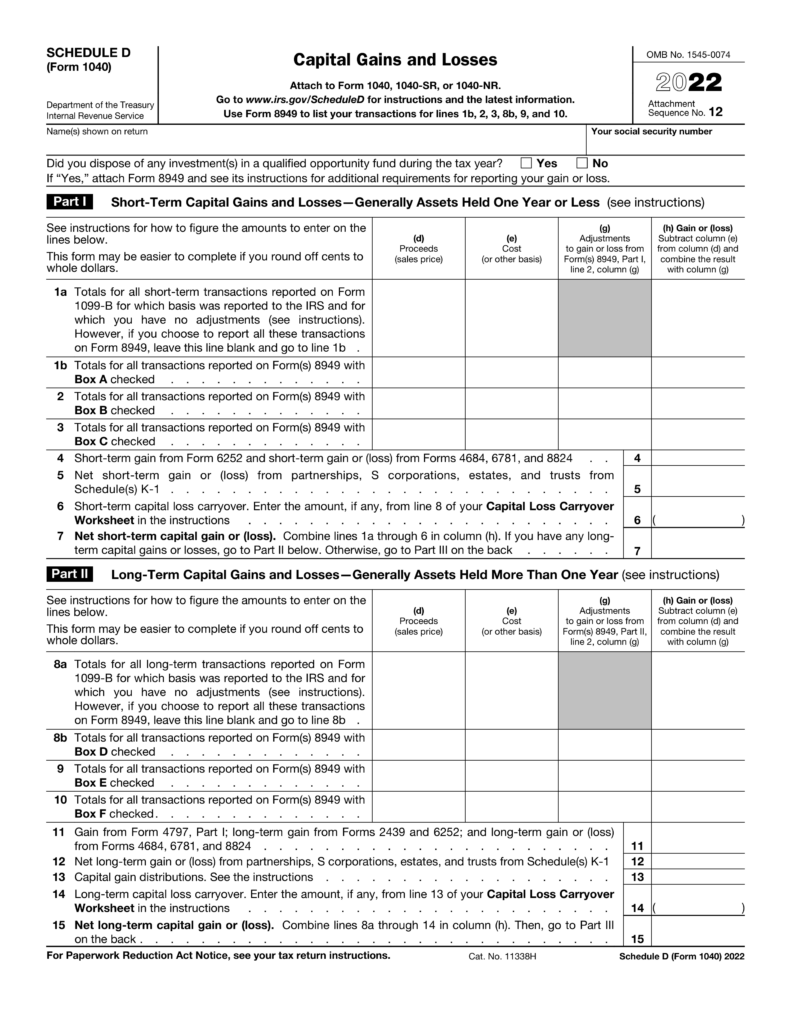

Schedule D (Form 1040)

Schedule D is used to summarize your capital gains and losses from all sources, including cryptocurrency, stocks, bonds, and other capital assets. You will transfer the totals from Form 8949 to Schedule D.

Short-Term vs. Long-Term Capital Gains

- Short-Term: Assets held for one year or less. Short-term capital gains are taxed at your ordinary income tax rate.

- Long-Term: Assets held for more than one year. Long-term capital gains are taxed at preferential rates (0%, 15%, or 20%) depending on your taxable income and filing status.

Schedule 1 (Form 1040)

If you received cryptocurrency through activities that generate ordinary income (not capital gains), such as mining, staking, airdrops, or receiving payment for goods or services, you may need to report this income on Schedule 1.

Schedule C (Form 1040) and Schedule SE (Form 1040)

If you are self-employed and received cryptocurrency as income from a trade or business, you need to report this income on Schedule C. This includes income from mining, staking, or providing services for which you are paid in cryptocurrency.

If your net earnings from self-employment are $400 or more, you must also file Schedule SE to calculate self-employment tax (Social Security and Medicare taxes).

Cost Basis Tracking Methods

Determining your cost basis—the original value of an asset for tax purposes—is crucial for accurately calculating capital gains or losses. The IRS allows several methods for tracking the cost basis of your cryptocurrency holdings:

First-In, First-Out (FIFO)

Under FIFO, the first cryptocurrency units you acquire are considered the first ones you sell or dispose of. This method is straightforward and commonly used.

Example: You bought 1 BTC in January 2023 for $30,000 and another 1 BTC in June 2023 for $20,000. If you sell 1 BTC in December 2023, under FIFO, you are considered to have sold the BTC bought in January at $30,000.

Last-In, First-Out (LIFO)

With LIFO, the last cryptocurrency units you acquire are considered the first ones you sell. This method can result in different capital gains or losses compared to FIFO.

Example: Using the same scenario, under LIFO, the BTC you sell in December is considered the one you bought in June for $20,000.

Highest-In, First-Out (HIFO)

HIFO allows you to sell the cryptocurrency units with the highest cost basis first. This method can minimize your capital gains or maximize your losses, potentially reducing your tax liability.

Example: If you have multiple lots of BTC purchased at different prices, HIFO lets you choose the BTC with the highest purchase price as the one you sold.

Specific Identification

To use methods like LIFO or HIFO, you must be able to specifically identify the cryptocurrency units sold. This requires detailed records of each transaction, including unique identifiers like wallet addresses and transaction IDs.

Tax Implications

- FIFO: May result in higher capital gains if the earliest purchased cryptocurrency was bought at a lower price.

- LIFO and HIFO: Can potentially reduce taxable gains but require meticulous record-keeping and may be scrutinized by the IRS.

IRS Requirements

The IRS requires that you use a consistent method for calculating your cost basis and that you can adequately identify the specific units sold. Without specific identification, you must default to FIFO.

Tax Optimization Strategies

Minimizing your tax liability requires proactive planning. Here are some strategies to consider:

Tax-Loss Harvesting

Tax-loss harvesting involves selling cryptocurrency at a loss to offset capital gains from other investments.

- How It Works: If you have realized capital gains during the year, you can sell underperforming cryptocurrency assets at a loss. The losses can offset your gains, reducing your taxable income.

- Limitations: Net capital losses can offset up to $3,000 of ordinary income per year. Excess losses can be carried forward to future tax years.

Holding Periods

Holding cryptocurrency for more than one year can qualify you for long-term capital gains tax rates, which are lower than short-term rates.

Strategy: Plan your trades to hold assets for at least one year to benefit from reduced tax rates.

Strategic Gift Giving

Gifting cryptocurrency can be a tax-efficient way to transfer wealth.

Annual Exclusion: You can gift up to $17,000 per recipient per year (as of 2023; verify the 2024 limit) without incurring gift tax.

Charitable Donations

Donating cryptocurrency to qualified charitable organizations can provide a tax deduction.

Benefit: You may deduct the fair market value of the donated cryptocurrency, potentially avoiding capital gains tax on appreciated assets.

Wash Sale Rule Considerations

As of 2023, the wash sale rule—which disallows the deduction of losses if you buy the same or a substantially identical asset within 30 days—does not apply to cryptocurrency. However, proposed legislation may change this, so stay informed on current laws for 2024. For the latest updates, refer to the IRS Wash Sale Rule or reputable news sources such as CoinDesk and The Block.

How to Report Your Cryptocurrency Taxes

Reporting cryptocurrency on your taxes involves several steps:

Step 1: Calculate Your Crypto Gains and Losses

For each taxable event:

- Determine the Cost Basis: The amount you originally paid for the cryptocurrency, including fees, using your chosen cost basis method (FIFO, LIFO, HIFO).

- Determine the Proceeds: The amount you received when you sold or disposed of the cryptocurrency, including the fair market value at the time of the transaction.

- Calculate Gain or Loss: Subtract the cost basis from the proceeds.

Example:

- Purchase Transactions:

- Bought 1 BTC on January 1, 2023, for $30,000.

- Bought 1 BTC on June 1, 2023, for $20,000.

- Sale Transaction:

- Sold 1 BTC on December 1, 2023, for $25,000.

- Using HIFO:

- Highest cost basis is $30,000 (BTC bought in January).

- Gain/Loss: $25,000 (Proceeds) – $30,000 (Cost Basis) = $5,000 Loss.

Step 2: Fill Out Form 8949

- List Each Transaction: Provide details for each taxable event, including date acquired, date sold, proceeds, cost basis, and gain or loss.

- Specify Cost Basis Method: Indicate the cost basis method used and ensure consistency throughout your reporting.

- Separate Short-Term and Long-Term Transactions: Use Part I for short-term and Part II for long-term transactions.

Selecting the Correct Box on Form 8949

- Box A: Short-term transactions reported on Form 1099-B showing basis reported to the IRS.

- Box B: Short-term transactions reported on Form 1099-B not showing basis reported to the IRS.

- Box C: Short-term transactions not reported on Form 1099-B.

- Box D: Long-term transactions reported on Form 1099-B showing basis reported to the IRS.

- Box E: Long-term transactions reported on Form 1099-B not showing basis reported to the IRS.

- Box F: Long-term transactions not reported on Form 1099-B.

Select the appropriate box based on whether you received a Form 1099-B from an exchange and whether the basis was reported.

Step 3: Summarize Totals on Schedule D

- Transfer Totals: Move the totals from Form 8949 to Schedule D.

- Calculate Net Gain or Loss: Summarize your capital gains and losses to determine your overall tax liability.

- Apply Any Capital Loss Carryovers: If you have capital loss carryovers from previous years, include them to offset current gains.

Step 4: Report Ordinary Income from Cryptocurrency

- Mining and Staking Income: Report as self-employment income on Schedule C.

- Airdrops and Hard Forks: Report the fair market value at the time of receipt as ordinary income on Schedule 1.

Step 5: Implement Tax Optimization Strategies

- Apply Losses: Use capital losses to offset capital gains.

- Carry Forward Losses: If losses exceed gains, carry forward the excess to future tax years.

Step 6: Complete the Rest of Your Tax Return and File

- Review for Accuracy: Double-check all entries and calculations.

- File by the Deadline: Typically April 15th, 2025, for the 2024 tax year, unless extended.

- Pay Any Taxes Owed: Ensure timely payment to avoid penalties and interest.

In Conclusion

As a cryptocurrency investor, it is essential to understand your tax obligations and ensure that you are compliant with IRS regulations. By accurately reporting your cryptocurrency transactions and implementing tax optimization strategies, you can minimize your tax liability and avoid potential penalties.

If you are unsure about how to report your cryptocurrency activities or need assistance with tax planning, consider consulting with a qualified tax professional or the team at XOA TAX, who can guide you through the process step by step.

Frequently Asked Questions (FAQs)

Will I Receive a Form 1099 for Cryptocurrency?

Starting in the 2023 tax year and moving forward into 2024, cryptocurrency exchanges and platforms are increasingly issuing Form 1099-B to customers, reporting proceeds from sales and exchanges of cryptocurrency. You may also receive Form 1099-MISC for certain types of income, such as staking rewards or miscellaneous income over $600.

How Does the IRS Know If I Own Cryptocurrency?

The IRS can identify cryptocurrency ownership through:

- Third-Party Reporting: Exchanges report transactions via Forms 1099.

- Blockchain Analysis: The IRS uses advanced tools to trace cryptocurrency transactions and link wallet addresses to individuals.

- Audits and Data Sharing: The IRS may obtain records during audits or through data-sharing agreements with other government agencies and foreign governments.

- Voluntary Disclosure: You report your holdings on your tax return.

What Happens If I Don’t Report Cryptocurrency?

Failure to report cryptocurrency transactions can lead to:

- Interest and Penalties: Additional amounts added to your tax bill for late payment or underpayment.

- Accuracy-Related Penalties: Up to 20% of the underpayment due to negligence or disregard of rules.

- Civil Fraud Penalties: Up to 75% of the underpayment if due to fraud.

- Criminal Charges: In cases of willful tax evasion, leading to fines and possible imprisonment.

Do I Need to Report Cryptocurrency If I Didn’t Sell?

If you only purchased cryptocurrency and did not sell, exchange, or dispose of it, you generally do not need to report it on your tax return. However, you must answer “Yes” to the virtual currency question on Form 1040 if you engaged in any transactions involving cryptocurrency.

Do I Have to Report Small Amounts of Cryptocurrency?

Yes, all cryptocurrency transactions must be reported, regardless of the amount. There is no minimum threshold for reporting taxable cryptocurrency transactions.

Do I Have to Report Cryptocurrency If I Sold Less Than $600?

Yes, you must report all sales of cryptocurrency, regardless of the amount. The $600 threshold pertains to information reporting requirements for payers, not for taxpayers’ obligation to report income.

Note: Tax laws and regulations can change. Always consult the latest IRS guidelines or a tax professional for the most current information related to the 2024 tax year.

Need help with your crypto taxes?

Contact XOA TAX today!

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

anywhere

anywhere  anytime

anytime