Cryptocurrency investing presents exciting opportunities, but it’s essential to navigate the complex tax landscape strategically. At XOA TAX, we understand the unique challenges high-net-worth individuals face when managing digital assets. This guide provides valuable insights and strategies to help you optimize your tax liability while remaining compliant with IRS regulations.

Compliance First: Understanding the Rules of the Game

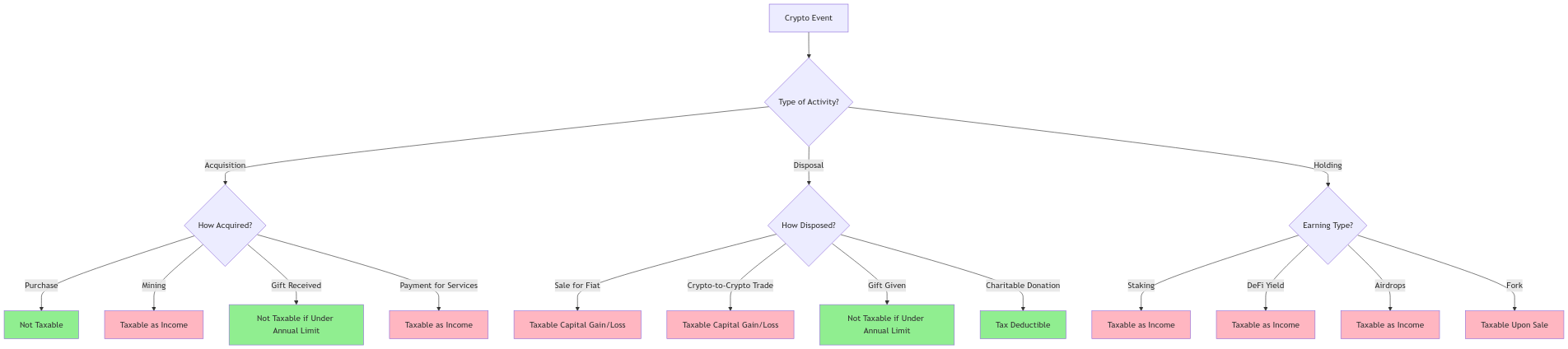

Before exploring tax minimization strategies, it’s crucial to establish a solid foundation in cryptocurrency tax compliance. The IRS classifies cryptocurrencies like Bitcoin and Ethereum as property, similar to stocks. This means any gains from selling, trading, or using crypto are subject to capital gains taxes.

To stay compliant, maintaining detailed records of your cryptocurrency transactions is critical. You need to track:

- Purchase dates and prices for every crypto acquisition.

- Sale dates and prices for every crypto disposal.

- The cost basis of each asset (this is usually the purchase price plus any fees).

- All crypto-to-crypto trades (e.g., swapping Bitcoin for Ethereum), as these are also taxable events.

- Any crypto received as income, as this is treated similarly to receiving cash.

Accurate record-keeping is crucial for properly reporting your crypto transactions on your tax return using Form 8949 and Schedule D. Remember, staying informed about the latest IRS guidelines is essential, as tax laws concerning cryptocurrencies are still evolving.

Smart Strategies to Minimize Your Tax Bill

Now that we’ve covered the essentials of compliance, let’s explore some savvy strategies to potentially reduce your crypto tax liability:

- Harvesting Losses: If you have crypto holdings that have decreased in value, consider selling them to realize a loss. This strategy, known as “loss harvesting,” allows you to offset gains in other assets and reduce your overall tax burden.

- HIFO (Highest In, First Out) Accounting: This method assumes that the first coins you sell are the ones you purchased at the highest price. By maximizing your losses and minimizing gains, you can potentially lower your tax liability.

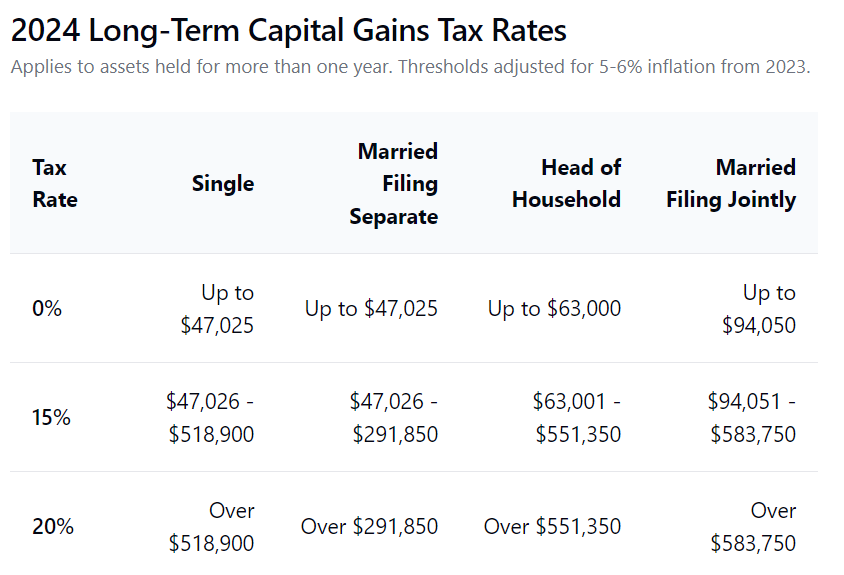

- Gifting to Family Members: Consider gifting crypto to family members in lower tax brackets. However, be mindful of the annual gift tax exclusion limits, which are $17,000 for 2023 and $18,000 for 2024. Gifting above these limits could trigger gift tax implications.

- Charitable Donations: Donating crypto directly to a qualified charity can provide a tax deduction for the fair market value of the donated asset while also helping you avoid capital gains taxes.

- Crypto Roth IRAs: While less common, some specialized custodians allow for holding cryptocurrencies within a Roth IRA. This can provide tax-free growth and withdrawals in retirement, but it’s essential to research the associated risks and restrictions.

Advanced Considerations for Wealthy Investors

For those with significant crypto holdings, additional factors come into play:

- Trusts: Setting up a trust can offer potential benefits for tax and estate planning purposes. However, trusts are complex instruments with varying tax implications depending on their structure and your specific circumstances. Consulting with a qualified tax professional is crucial before making any decisions.

- International Investments: If you hold crypto on foreign exchanges, be aware of reporting requirements such as the FBAR (Foreign Bank Account Report) for accounts exceeding certain thresholds. International tax laws can be intricate, so seeking professional guidance is recommended.

- Wash Sale Rules: While not yet definitively applied to crypto, wash sale rules could potentially come into play in the future. These rules prevent you from claiming a loss if you sell an asset and then buy a “substantially identical” one within a short time frame.

- Mining, Staking, and DeFi: These activities have unique tax implications. Mining income is generally taxable, and staking rewards are usually treated as income as well. DeFi (Decentralized Finance) involves various transactions with varying tax treatments. It’s best to research these areas carefully or consult with a tax expert.

- State Taxes: Remember that state tax laws regarding cryptocurrency can vary significantly. It’s essential to research your specific state’s regulations to ensure compliance.

Need More Help?

Navigating the world of crypto taxes can be challenging, but with the right knowledge and strategies, you can confidently manage your tax liability and protect your investments. If you have any questions or need personalized guidance, don’t hesitate to reach out to us at XOA TAX. We’re here to help!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime