Hey there, fellow crypto enthusiasts! Ever wonder if those Bitcoin gains could mean a bigger tax bill? At XOA TAX, we’re here to help you navigate the world of cryptocurrency taxes – no confusing jargon, just friendly guidance. Think of us as your tax buddies, here to break it down in a way that’s easy to understand.

Key Takeaways

- Cryptocurrency is considered property by the IRS, just like a house or a car.

- Buying and holding crypto isn’t taxed, but selling, trading, or using it to buy things can be.

- Mining or staking rewards? Those count as income, just like your paycheck.

- Keep good records! It’s super important for figuring out your gains and losses.

- Don’t worry, we’re here to help you make sense of it all!

What Exactly Are Cryptocurrency Taxes?

Imagine you bought some Bitcoin a while back, and now it’s worth way more. Awesome, right? But when you sell that Bitcoin for dollars, the IRS sees that increase in value as a capital gain, and guess what? That’s taxable.

Think of it like selling a collectible card. You bought it for $5, and now someone’s willing to pay $50 for it. You made a $45 profit, and that’s what the IRS is interested in.

Taxable Events: When Do You Owe Taxes?

Here’s the good news: just buying and holding cryptocurrency doesn’t mean you owe taxes. It’s only when you do certain things with it that taxes come into play. Here are some common taxable events:

- Selling Crypto for Cash: Trading your Bitcoin for dollars, for example.

- Trading One Crypto for Another: Swapping your Ethereum for some shiny new Litecoin.

- Using Crypto to Buy Stuff: Ordering that pizza with Bitcoin (hopefully, it wasn’t worth millions now!).

- Getting Paid in Crypto: If your awesome coding skills earned you some Dogecoin.

Capital Gains: Short-Term vs. Long-Term

Remember that collectible card example? The profit you made is a capital gain. Now, here’s where it gets a bit interesting. The tax you owe on that gain depends on how long you held the crypto.

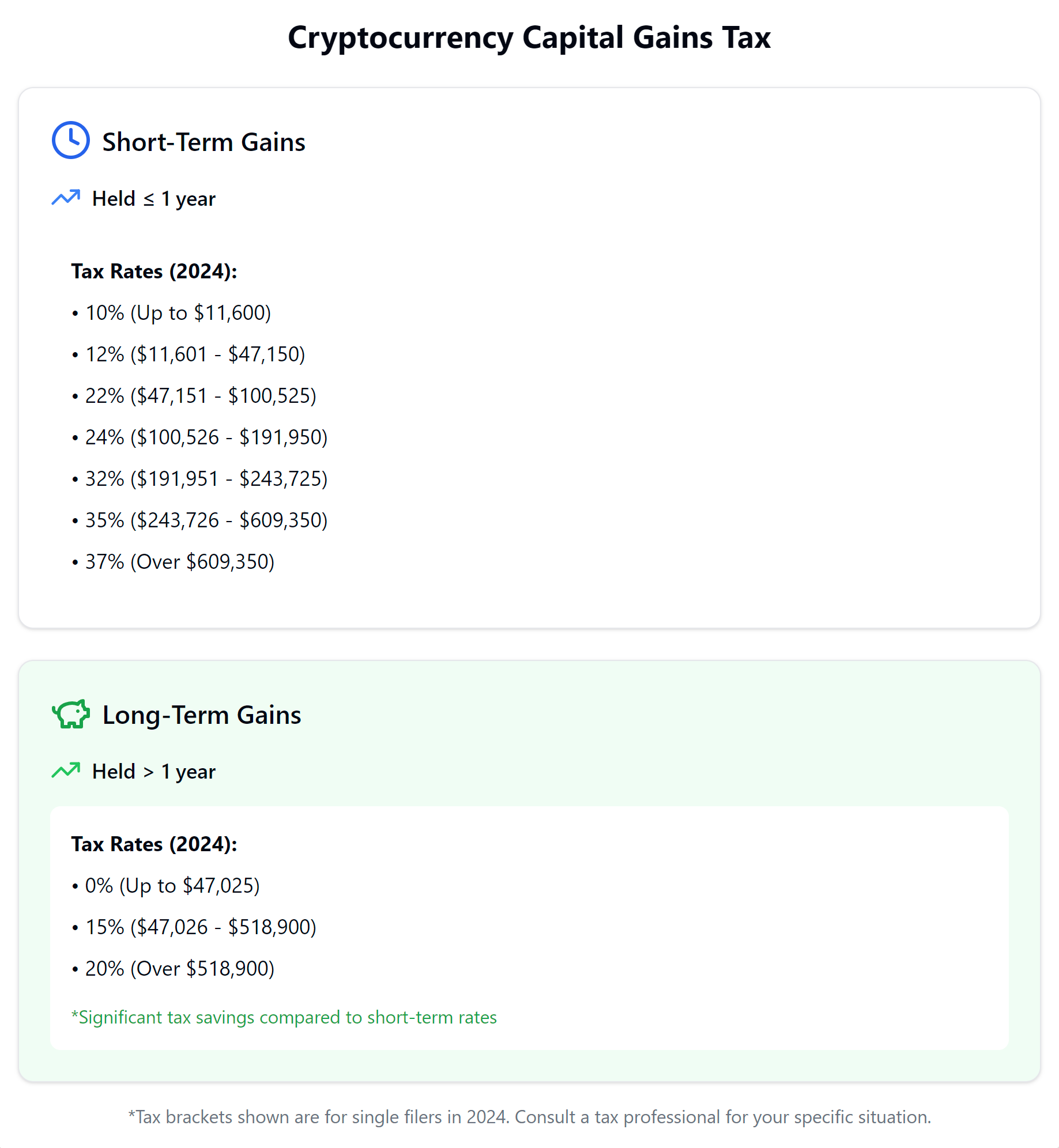

- Short-Term: If you held the crypto for one year or less, it’s a short-term gain, and you’ll pay taxes at your regular income tax rate.

- Long-Term: If you held it for more than a year, it’s a long-term gain, and you get a sweet deal – lower tax rates!

Income from Crypto: Mining and Staking

Besides buying and selling, you can also earn cryptocurrency through things like mining (using powerful computers to solve complex problems) or staking (holding certain cryptocurrencies to support the network).

Any rewards you earn from these activities are treated as income, just like the money you get from your job. So, you’ll need to pay taxes on that too.

Reporting Your Crypto Transactions

The IRS wants to know about your crypto activities, and that’s where tax forms come in. Don’t worry, it’s not as scary as it sounds!

- Form 8949 and Schedule D: These forms are like your crypto diary, where you list all your buys, sells, and trades.

- Form 1040 and Schedule 1: This is where you report your overall income, including any crypto earnings.

New Rules on the Block: Reporting Requirements

The crypto world is constantly changing, and so are the rules. Starting in 2026, cryptocurrency brokers (like those big exchanges you use) will have to report your transactions to the IRS. This means keeping accurate records is more important than ever!

Smart Moves to Lower Your Tax Bill

Want to keep more of your hard-earned crypto? Here are a couple of strategies:

- Tax-Loss Harvesting: If you have some crypto that’s not doing so well, you can sell it at a loss to offset gains from other crypto. It’s like balancing the scales!

- Holding for the Long Haul: Remember those lower tax rates for long-term gains? Holding your crypto for more than a year can save you some serious cash.

Common Crypto Tax Mistakes (and How to Avoid Them)

- Forgetting to Report: Even small transactions count, so make sure you report everything to the IRS.

- Messing Up the Math: Keep detailed records of all your buys, sells, and trades so you can calculate your gains and losses accurately.

- Ignoring Airdrops and Forks: Sometimes you might receive free crypto through airdrops or hard forks. These are also taxable, so don’t forget about them!

FAQs

What if I accidentally send my crypto to the wrong address? Is that a taxable event?

Ouch, that’s a tough one! Unfortunately, sending crypto to the wrong address is usually considered a loss. And yes, even though it wasn’t a sale, you might be able to claim that loss on your taxes. It’s a bit complex, so definitely reach out to us if you find yourself in this situation.

Can I use a tax software program to report my cryptocurrency transactions?

Absolutely! Many popular tax software programs now include sections for reporting cryptocurrency. Just make sure the software you choose is up-to-date with the latest crypto tax laws. And remember, we’re always here if you need help navigating the software or have any questions.

Are there any tax benefits to donating cryptocurrency to charity?

Yes, there can be! Donating crypto to a qualified charity can be a tax-savvy move. If you’ve held the crypto for more than a year, you can generally deduct its fair market value at the time of donation. This means you might be able to avoid paying capital gains taxes on that donation. Pretty cool, right? Just make sure the charity accepts crypto donations and get a receipt for your records.

Do I need to report every single crypto transaction, even small ones?

Yes, it’s important to report all your crypto transactions, no matter how small. Even if you just bought a cup of coffee with Bitcoin, it’s still a taxable event. The IRS takes cryptocurrency reporting seriously, so it’s best to be thorough and accurate.

What if I received some cryptocurrency as a gift? Do I need to pay taxes on that?

Great question! Generally, receiving cryptocurrency as a gift isn’t taxable to you when you receive it. However, if you later sell or trade that gifted crypto, you might have to pay taxes on any gains. The good news is that you’ll usually use the original value of the crypto when it was gifted to you as your cost basis, which can help reduce your tax liability.

I’m feeling a bit lost with all this. Can XOA TAX really help me with my crypto taxes?

Absolutely! We understand that crypto taxes can be confusing. That’s why we’re here to guide you through the process. We can help you understand the rules, track your transactions, and file your taxes correctly. Think of us as your crypto tax superheroes! Don’t hesitate to reach out – we’re always happy to help.

Need Help with Your Crypto Taxes?

We know that all this tax stuff can be a bit overwhelming. That’s why we’re here to help! At XOA TAX, we’re experts in cryptocurrency taxation. We can answer your questions, help you with your tax forms, and make sure you’re on the right track.

Connect with us today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime