Imagine this: You’ve built a successful business, and now you’re considering selling. Congratulations! That’s a huge achievement. But with a potential sale comes the looming reality of capital gains taxes. Fortunately, there are strategies to help minimize your tax burden, and one such strategy is the equity rollover.

At XOA TAX, we often help clients navigate the complexities of business sales and acquisitions. We understand that these transactions can be significant financial events with important tax implications. This guide will break down the ins and outs of equity rollovers, explaining how they work and when they might be a good option for you.

Key Takeaways

- Equity rollovers allow you to defer paying capital gains tax on the sale of a business.

- This strategy involves reinvesting your proceeds from the sale into equity in the acquiring company.

- Rollovers can be a valuable tool for business owners looking to minimize their immediate tax liability and participate in the future growth of the new company.

- Certain conditions and regulations must be met to qualify for this tax deferral.

What is an Equity Rollover?

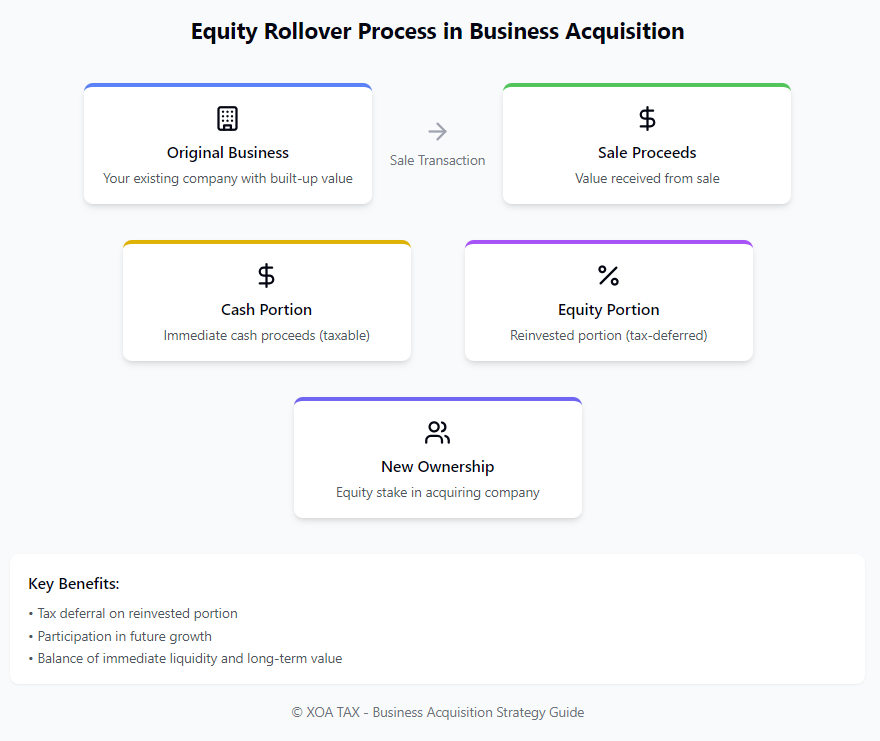

In the simplest terms, an equity rollover is a method of deferring the payment of capital gains taxes when you sell a business. Instead of receiving only cash for your company, you receive a combination of cash and equity (stock) in the company acquiring your business.

Think of it like this: you’re essentially rolling your existing ownership into a new venture. By doing so, you’re not realizing the full capital gain immediately, and therefore, you can postpone paying taxes on that gain until you eventually sell the new shares.

How Does an Equity Rollover Work?

- Negotiation: During the sale negotiations, you and the buyer agree on the portion of the purchase price to be paid in cash and the portion to be paid in equity in the acquiring company.

- Structure: The transaction is structured to meet the requirements of the tax code to qualify as a tax-deferred exchange. This often involves specific legal and financial structuring.

- Share Issuance: Upon completion of the sale, you receive shares in the acquiring company, effectively reinvesting a portion of your proceeds.

- Tax Deferral: The capital gains tax on the portion of the sale proceeds reinvested in equity is deferred until you sell those shares in the future.

Benefits of Equity Rollovers

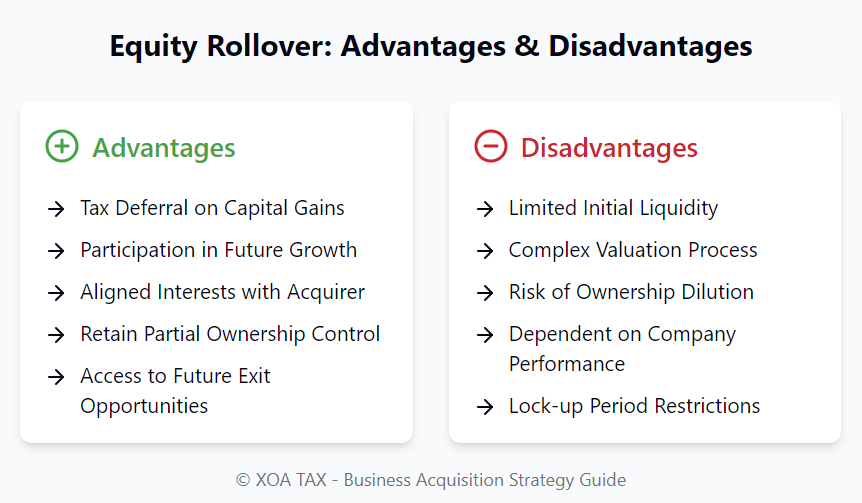

Tax Deferral: The most significant benefit is the ability to defer paying capital gains taxes, allowing you to retain more capital for reinvestment or other purposes.

Continued Growth Participation: By taking equity in the acquiring company, you can participate in the potential future growth and success of the new entity.

Reduced Risk: In some cases, taking equity can mitigate risk by aligning your interests with the acquiring company’s performance.

Considerations and Potential Drawbacks

Liquidity: Your investment in the acquiring company’s equity may be less liquid than cash, meaning you may not be able to access those funds as easily.

Valuation: Determining the fair market value of the equity you receive is critical for tax purposes and can sometimes be complex.

Dilution: Your ownership stake in the new company may be diluted over time if the company issues additional shares.

Company Performance: The value of your equity is tied to the performance of the acquiring company, which carries inherent risks.

Is an Equity Rollover Right for You?

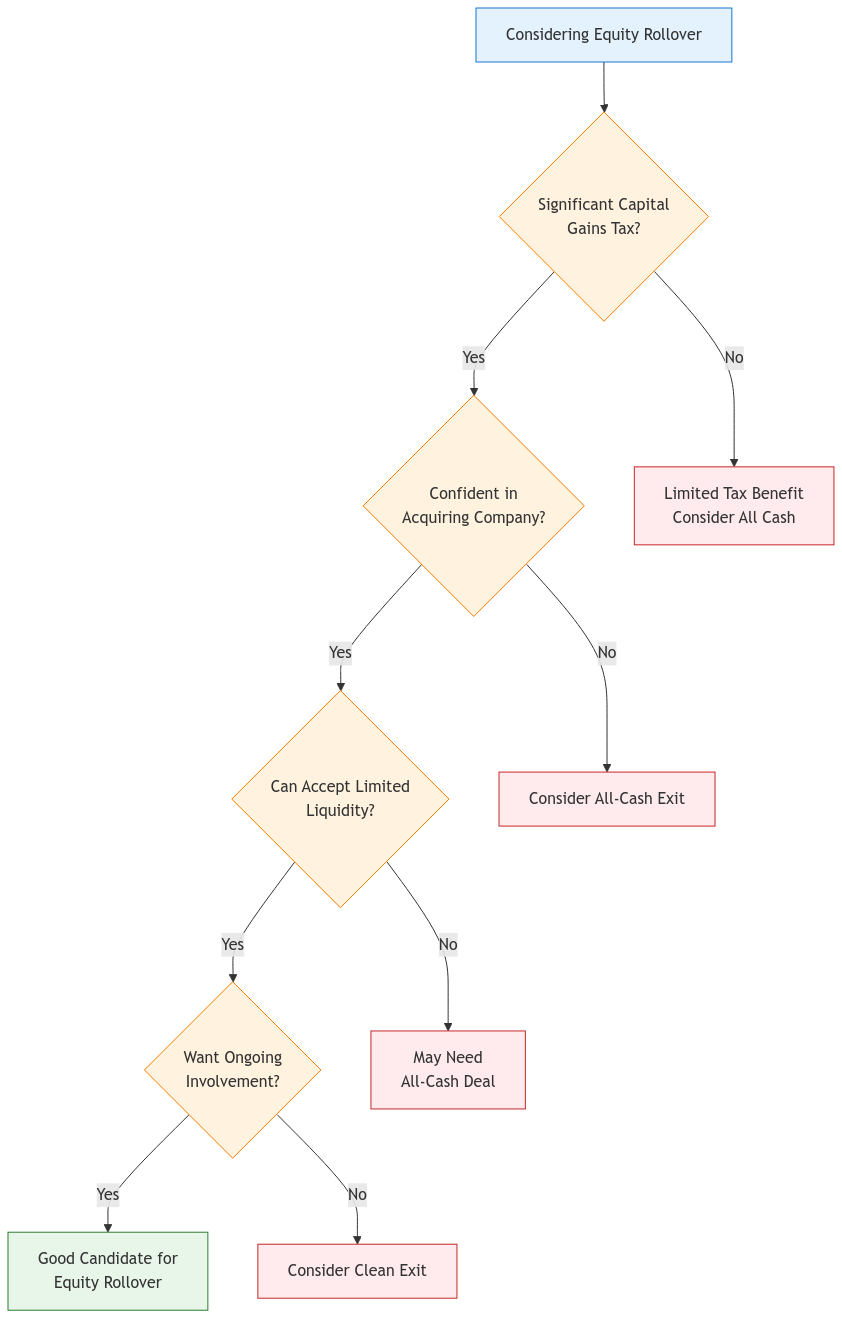

Your Tax Situation: An equity rollover is generally most beneficial for those facing a significant capital gains tax liability.

Investment Goals: Consider your investment timeline and risk tolerance. Are you comfortable tying up a portion of your proceeds in a less liquid asset?

Confidence in the Acquiring Company: Do you believe in the long-term growth potential of the acquiring company?

Your Role in the New Company: Will you have an active role in the new company, or will you be a passive investor?

Technical Requirements for Tax Deferral

To ensure your equity rollover qualifies for tax deferral, certain technical requirements must be met. These primarily revolve around Internal Revenue Code Section 351, which deals with transfers to corporations controlled by the transferor, and Section 368, which covers corporate reorganizations.

- IRC Section 351 or 368 Compliance: The transaction must be structured to meet the specific requirements of either Section 351 or Section 368. This often involves careful planning and may necessitate different legal structures depending on the specifics of the deal.

- Control Requirement: Generally, you’ll need to acquire at least 80% of the voting stock and 80% of all other classes of stock of the acquiring corporation immediately after the transfer to qualify for tax deferral under Section 351.

- Continuity of Interest: This principle requires that you maintain a significant equity interest in the acquiring corporation after the transaction. This demonstrates that the transaction is a genuine restructuring and not simply a disguised sale.

- Step Transaction Doctrine: The IRS may scrutinize a series of related transactions to determine if they should be treated as a single integrated transaction for tax purposes. This doctrine can impact the tax treatment of an equity rollover if the steps are not carefully planned.

- Holding Period: The holding period of the shares you receive in the acquiring company will generally tack on to the holding period of the stock you exchanged in your original company. This is important for determining whether any future gain or loss is long-term or short-term.

Section 368 Reorganizations:

- Type A: Statutory mergers

- Type B: Stock-for-stock exchanges

- Type C: Asset acquisitions

Each type has specific requirements that must be met for tax-free treatment.

Potential Risks and Considerations

Securities Law Compliance: Business acquisitions and equity issuances are subject to various federal and state securities laws. Compliance with these regulations is essential and often requires specialized legal counsel.

Lock-Up Periods: It’s common for acquiring companies to impose lock-up periods, restricting your ability to sell the shares you receive for a certain duration after the transaction.

Representations and Warranties: As the seller, you’ll typically be required to make certain representations and warranties about your business. These statements can expose you to liability if they are found to be inaccurate.

Due Diligence: Both you and the acquirer will conduct extensive due diligence to evaluate the respective businesses. This process can be time-consuming and resource-intensive.

Post-Closing Adjustments: The final purchase price may be subject to adjustments after the closing based on the financial performance of your business during a specified period.

Illustrative Example

Let’s say you’re selling a business valued at $5,000,000. Your original basis in the business is $500,000, resulting in a potential capital gain of $4,500,000. If you opt for an equity rollover and reinvest 40% of the proceeds into the acquiring company, you could defer capital gains tax on $1,800,000.

Assuming a federal capital gains rate of 20% plus the 3.8% net investment income tax:

- Without rollover: $4,500,000 × 23.8% = $1,071,000 tax due immediately

- With 40% rollover: $2,700,000 × 23.8% = $642,600 tax due immediately ($1,800,000 gain deferred)

This could result in significant immediate tax savings, allowing you to retain more capital for reinvestment or other purposes. However, it’s crucial to consider the long-term implications, such as the future tax liability when you eventually sell the new shares and the performance of the acquiring company.

Mitigating Risks in Equity Rollovers

Escrow Arrangements: A portion of the purchase price can be held in escrow to protect you in case the acquiring company breaches any representations or warranties.

Earn-Out Structures: These tie a portion of the purchase price to the future performance of the business, providing an incentive for the acquiring company to maintain or grow the business post-acquisition.

Tag-Along/Drag-Along Rights: These contractual provisions protect minority shareholders. Tag-along rights allow you to sell your shares if the majority shareholder sells their stake, while drag-along rights allow the majority shareholder to force minority shareholders to sell if a favorable offer is received for the entire company.

Anti-Dilution Provisions: These protect your ownership stake by preventing the acquiring company from issuing new shares that would significantly dilute your ownership percentage.

Key Documentation Required

Transfer Agreements: These outline the terms of the sale and transfer of your business to the acquiring company.

Shareholder Agreements: These govern the relationship between you and the other shareholders in the acquiring company, including your rights and obligations.

Securities Compliance Documents: These ensure compliance with applicable securities laws, which may include registration statements or exemption filings.

Tax Opinion Letters: These provide an independent assessment of the tax implications of the transaction.

Valuation Reports: These determine the fair market value of your business and the equity you receive in the acquiring company.

Typical Transaction Timeline

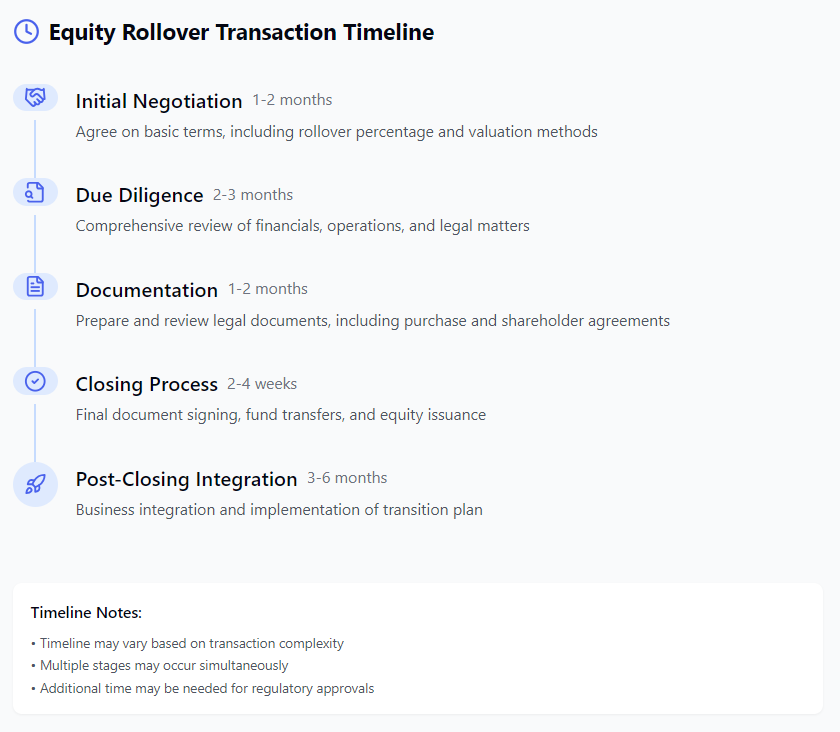

- Initial Structuring (1-2 months): This involves determining the structure of the transaction, negotiating key terms, and conducting preliminary due diligence.

- Due Diligence (2-3 months): Both parties conduct in-depth due diligence to evaluate the respective businesses.

- Documentation (1-2 months): Legal documents are drafted and reviewed, including the transfer agreement, shareholder agreement, and other relevant agreements.

- Closing Conditions (1 month): The parties work to satisfy any remaining conditions to closing the transaction.

- Post-Closing Requirements: This may include integrating the businesses, filing necessary documents, and addressing any post-closing adjustments.

Industry-Specific Considerations

Technology Companies: Intellectual property valuation can be a significant factor in these transactions.

Manufacturing: Considerations related to equipment, inventory, and supply chain contracts may be relevant.

Service Businesses: Assigning customer contracts and ensuring continuity of service can be important.

Professional Practices: Licensing, regulatory compliance, and client relationships may require special attention.

Key Due Diligence Areas

Financial Statements and Projections: Review historical financial performance and future projections to assess the financial health of the acquiring company.

Tax Returns and Compliance History: Ensure the acquiring company has a clean tax compliance record and no outstanding tax liabilities.

Material Contracts and Commitments: Review key contracts, leases, and other commitments to understand the acquiring company’s obligations.

Employee Agreements and Benefits: Assess employee compensation, benefits, and any potential liabilities related to employee matters.

Intellectual Property Rights: Verify ownership and protection of intellectual property assets.

Regulatory Compliance: Ensure the acquiring company complies with all relevant industry regulations and licensing requirements.

XOA TAX Can Help

Navigating the complexities of equity rollovers requires careful planning and a thorough understanding of the tax implications. At XOA TAX, we have extensive experience advising clients on business acquisitions and divestitures. We can help you:

- Determine if an equity rollover is a suitable strategy for your situation.

- Structure the transaction to meet the requirements for tax deferral.

- Negotiate favorable terms with the acquiring company.

- Ensure compliance with all applicable tax laws and regulations.

FAQs

What types of businesses can qualify for an equity rollover?

Generally, any type of business can potentially qualify, but the specific rules and regulations can vary. It’s essential to consult with a tax professional to determine eligibility in your specific case.

Are there any limits on the amount of gain that can be deferred through an equity rollover?

There are no specific limits on the amount of gain that can be deferred. However, the deferral applies only to the portion of the sale proceeds reinvested in the acquiring company’s equity.

What happens if I sell the shares I receive in the acquiring company?

When you sell the shares, you will recognize the deferred capital gain and be liable for capital gains tax at that time.

Can I use an equity rollover in a partial sale of my business?

Yes, equity rollovers can be used in partial sales, but the structuring can be more complex. It’s crucial to seek professional advice to ensure compliance with tax laws.

State Tax Implications

Varying Tax Rates and Rules: State capital gains tax rates can differ significantly from federal rates. Some states may also have specific regulations regarding rollovers or exchanges.

Multi-State Considerations: If your business and the acquiring company are located in different states, you may need to navigate the tax laws of both jurisdictions. This can add complexity and requires careful planning.

State-Specific Compliance: It’s essential to ensure compliance with all applicable state tax laws and filing requirements.

Connecting with XOA TAX

Selling a business is a major decision with significant tax implications. If you’re considering an equity rollover or have questions about the tax aspects of business acquisitions, we encourage you to reach out to XOA TAX. Our experienced CPAs can provide personalized guidance and support to help you achieve your financial goals.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime