Hey there, fellow entrepreneurs! Ever landed a big client who paid you upfront for a whole year of your awesome product or service? That’s a fantastic feeling, right? But then comes the question – how do you record that chunk of money in your books? Don’t worry, we’re here to help! At XOA TAX, we’re all about making taxes less confusing, and today we’re going to break down this tricky topic: deferred revenue.

Think of it like this: you’ve got a stack of gift cards your customers bought for the holidays. You’re excited about the cash, but you haven’t actually earned it yet until those gift cards are used. That’s essentially what deferred revenue is – money received for services or goods you haven’t delivered yet.

Key Takeaways

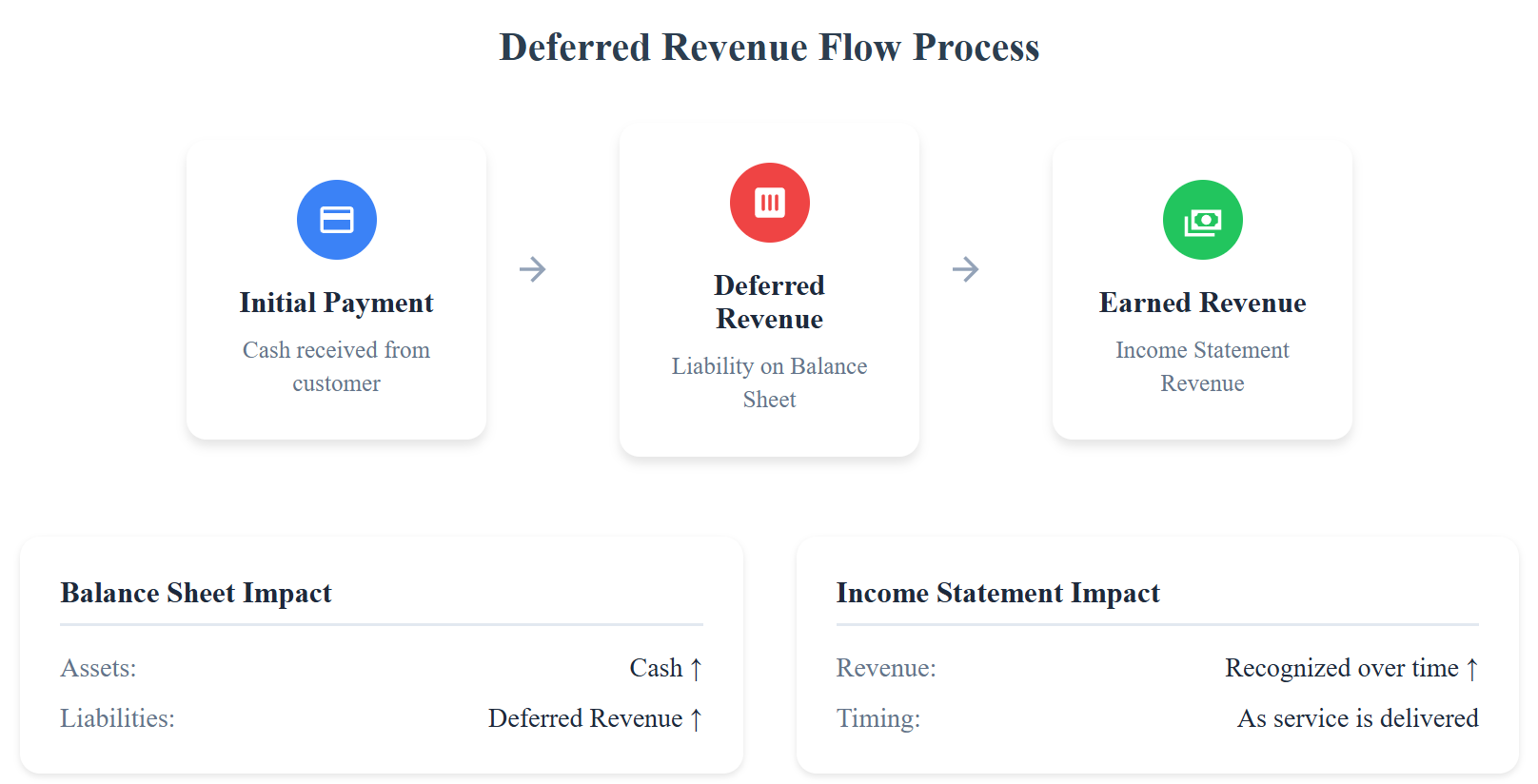

- Deferred revenue affects your balance sheet, income statement, and cash flow statement. It starts as a liability (like an IOU) on your balance sheet and shows up as cash coming in from your operations on your cash flow statement.

- Accrued expenses are like the flip side of deferred revenue – expenses you’ve used up but haven’t paid for yet. Both are super important parts of accrual accounting under GAAP (Generally Accepted Accounting Principles).

- Keeping track of deferred revenue correctly is key to having accurate financial reports, which helps show everyone how healthy your business is financially.

What Exactly is Deferred Revenue?

Deferred revenue, sometimes called unearned revenue, is basically payment received for goods or services that haven’t been delivered yet. This happens a lot in different businesses. Imagine a software company with yearly subscriptions or a construction company getting upfront payments for a big project – they both deal with deferred revenue.

Now, here’s the interesting part. Under GAAP, this upfront payment is considered a liability on your balance sheet. Why a liability? Because you owe your customer something – those goods or services they paid for! As you deliver on your promise, the deferred revenue slowly turns into earned revenue.

Why Does Deferred Revenue Matter?

- Clear Financial Picture: Deferred revenue shows you what you’re committed to delivering and gives you a good grasp of your financial obligations.

- Smart Cash Flow Management: It helps you predict your future cash flow, which is super helpful for planning and making sure you have enough resources. This is especially important for businesses with ups and downs in their revenue throughout the year.

- Accurate Financial Reporting: Recording deferred revenue correctly prevents you from making your income look bigger than it actually is. This keeps you in line with GAAP and makes sure your financial info is reliable.

How Deferred Revenue Works

GAAP uses a system called double-entry accounting. Here’s how you record deferred revenue:

- Initial Payment: When you get that upfront payment, you increase your cash (or accounts receivable if it’s an invoice) and increase your deferred revenue liability.

- Revenue Recognition: As you deliver your product or service, you decrease the deferred revenue liability and increase your revenue. This basically moves the money from an “IOU” to your actual earnings.

Remember, the golden rule of accounting is that the amount you debit must always equal the amount you credit!

ASC 606: The Rules of Revenue Recognition

The Five Steps of Revenue Recognition

Identify Contract

Determine if you have a valid contract with your customer

Performance Obligations

List out what you’re promising to deliver

Transaction Price

Calculate the total deal value

Allocate Price

Split the price across deliverables

Recognize Revenue

Record revenue as obligations are met

The Financial Accounting Standards Board (FASB) has a set of rules called Accounting Standards Codification (ASC) 606 that tells you exactly how to recognize revenue, including deferred revenue. This standard has a five-step model:

- Figure out the contract with your customer.

- Identify what you need to do in the contract (your performance obligations).

- Determine the price of the deal.

- Allocate the price to each thing you need to do in the contract.

- Recognize revenue as you complete each part of the contract.

Understanding these steps is crucial for handling deferred revenue correctly. For example, if you have a software subscription, your promise is to give access to your software over the subscription period. You recognize revenue each month as you provide the service.

Timing is Everything: When to Recognize Revenue

Figuring out the right time to recognize revenue is important. ASC 606 helps you with this by considering things like:

- Performance Obligations: When are you done fulfilling your side of the contract?

- Transfer of Control: When does the customer actually get control of the product or service?

- Significant Financing Components: Does the deal include any special financing that needs to be accounted for separately?

Deferred Revenue vs. Accrued Expenses

Think of deferred revenue as money you’ve received for a promise you haven’t fulfilled yet. Accrued expenses are the opposite – expenses you’ve used but haven’t paid for yet. Both fall under accrual accounting, which means you recognize transactions when they happen, not just when cash changes hands.

- Deferred Revenue: A liability showing you need to deliver goods or services in the future.

- Accrued Expenses: Can be current (due within a year) or long-term liabilities, showing what you owe to vendors or service providers.

Deferred Revenue and Your Financial Statements

Financial Statement Impact of Deferred Revenue

Balance Sheet

Income Statement

Cash Flow Statement

- Cash Flow Statement: The initial payment boosts your cash flow from operating activities. When you recognize the revenue later, it doesn’t affect the cash flow statement because there’s no actual cash moving at that point.

- Balance Sheet: Deferred revenue shows up as a liability. As you deliver what you promised, the liability goes down, and your equity goes up.

- Income Statement: Revenue is recognized on the income statement as you deliver the goods or services.

Example: Let’s Talk SaaS

Let’s say your awesome SaaS company gets $1,200 for a one-year software subscription. Here’s how you’d record it:

Initial Entry:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| Jan 1 | Cash | Customer prepays for annual subscription | $1200 | |

| Deferred Revenue | $1200 |

Monthly Recognition:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| Jan 31 | Deferred Revenue | Service delivered for January | $100 | |

| Revenue | $100 |

You’d repeat this every month until the whole $1,200 becomes recognized revenue.

FAQs

What are some common examples of deferred revenue?

Think subscriptions (software, magazines, streaming services), long-term contracts (construction projects, service agreements), gift cards, and even airline tickets!

How is deferred revenue different from accounts receivable?

Accounts receivable is money people owe you for things you’ve already delivered, while deferred revenue is money you’ve received for things you’ll deliver in the future.

What if a customer cancels a service with deferred revenue?

You might need to give a refund. This would involve adjusting your deferred revenue and cash. How you do this depends on your refund policy and the contract.

How does deferred revenue affect a company’s taxes?

Good news! You don’t pay taxes on deferred revenue until it’s earned.

How are deposits different from deferred revenue?

While both involve getting cash upfront, deposits usually secure a future commitment but don’t always guarantee revenue. For example, a security deposit for an apartment is refundable, but deferred revenue means you have to deliver something.

How does deferred revenue affect financial ratios?

Deferred revenue can impact key financial ratios. For instance, it can lower a company’s current ratio (current assets / current liabilities) because it increases current liabilities. It’s important to analyze these impacts when checking out a company’s financial health.

Are there industry-specific rules for deferred revenue?

Yep, some industries have specific guidelines. For example, real estate companies need to consider leasehold improvements, and e-commerce businesses might have special rules for online courses or digital products.

How does GAAP differ from IFRS in handling deferred revenue?

Both GAAP (US standards) and IFRS (international standards) have similar ideas about revenue recognition, but there are some differences in how they’re applied.

Where can I find more info on deferred revenue under US GAAP?

The Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 606 is your go-to guide for this.

What’s the deal with contract assets and contract liabilities?

ASC 606 makes a distinction between these. A contract asset is when you have a right to get paid before you finish your work (like if you’ve spent money but haven’t billed the client yet). A contract liability, like deferred revenue, is when you’ve been paid before you’ve done your part of the deal.

How do you handle variable consideration with deferred revenue?

Variable consideration is when the price isn’t fixed and depends on things like bonuses or discounts. ASC 606 has rules for estimating and recognizing this, which can get complicated sometimes.

Need Help with Deferred Revenue?

We get it – deferred revenue can be a bit puzzling. But don’t worry, XOA TAX is here to help! Our friendly CPAs can guide you through the process, making sure you’re following the rules and keeping your financial reports accurate.

Get in touch with us today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime