This year has seen a series of devastating natural disasters across the United States. From hurricanes to floods, many individuals and businesses are facing immense challenges. We know how stressful dealing with taxes can be, especially when recovering from a natural disaster. At XOA TAX, we’re committed to helping you through this difficult time. We’re here to break down the IRS disaster relief provisions and help you understand what they mean for you.

Key Takeaways

- The IRS offers automatic tax relief for those in federally declared disaster areas: Deadlines for filing and payments have been extended, varying by location and disaster.

- Specific relief measures are in place for areas affected by Hurricane Helene, Hurricane Milton, and severe storms in Texas, Mississippi, and Maine: XOA TAX can provide personalized guidance to help you navigate these complex situations.

- Deadlines for filing and payments have been extended, varying by location and disaster: The IRS offers automatic tax relief for those in federally declared disaster areas.

Understanding Disaster Tax Relief

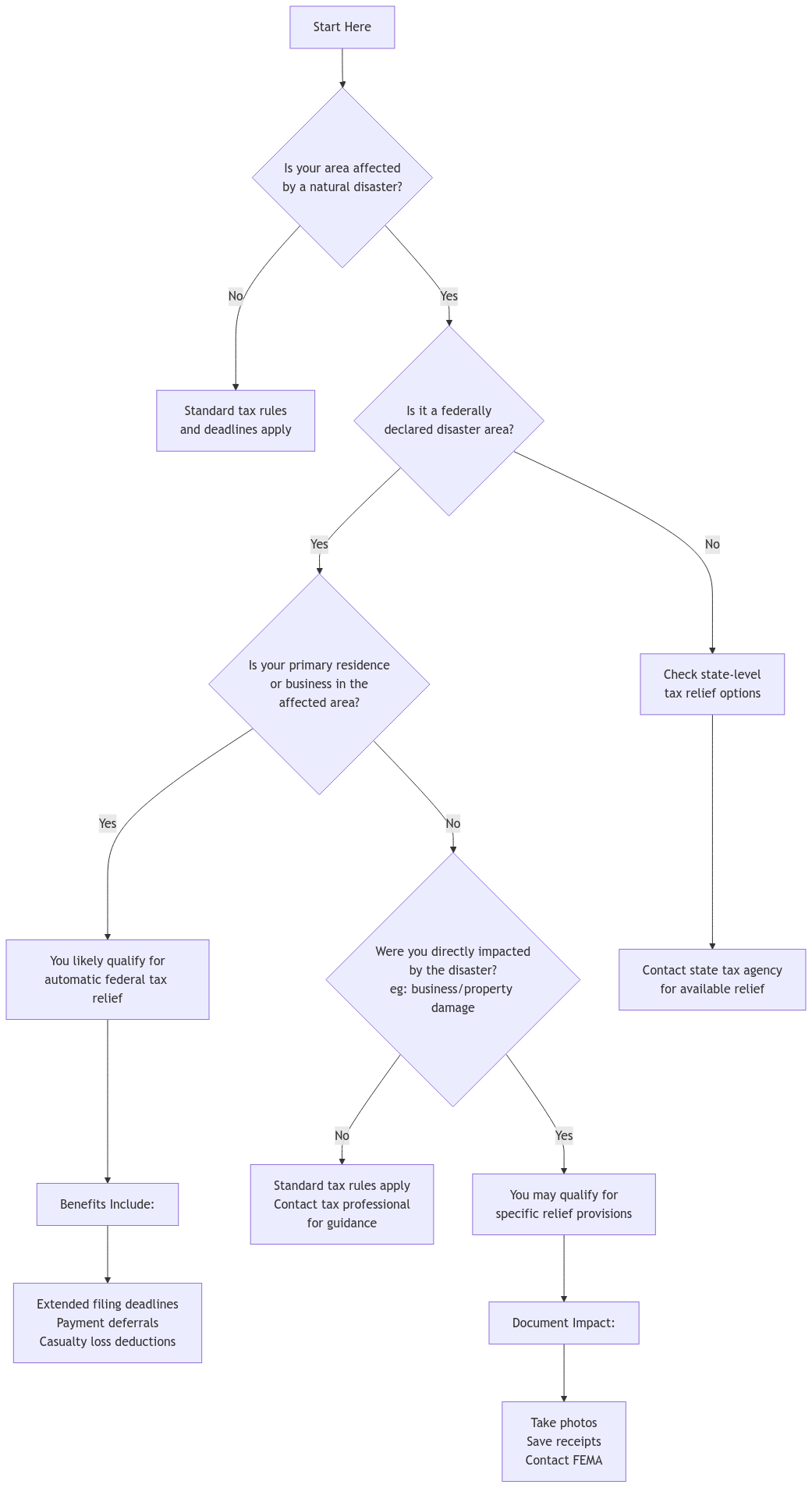

When disaster strikes, the IRS steps in to provide much-needed relief to affected taxpayers. This assistance comes in the form of extended deadlines for filing returns and making tax payments. The good news is that these extensions are automatic for those located in federally declared disaster areas. You don’t need to file any special forms or applications to qualify.

Current Disaster Relief Provisions

Let’s take a closer look at the specific disaster areas and their corresponding relief measures:

- Hurricane Helene and Hurricane Milton: If you’re in Alabama, Florida, Georgia, North Carolina, or South Carolina, you have until May 1, 2025, to file your 2023 and 2024 federal individual and business tax returns. This extension also covers quarterly estimated tax payments. Parts of Tennessee and Virginia are also included in this relief.

- Severe Storms in Texas and Mississippi: For those impacted by the severe storms and flooding that began in April 2024 in Texas and Mississippi, the IRS has extended the deadline to November 1, 2024. This applies to federal individual and business tax returns and payments.

- Severe Storms and Flooding in Maine: Residents and businesses in specific areas of Maine affected by severe storms and flooding have until July 15, 2024, to file their 2023 federal income tax returns and make related payments.

Important Considerations

- Retirement Plans: The SECURE 2.0 Act of 2022 includes provisions for disaster-related distributions and loans from retirement plans. If you’ve been impacted by a natural disaster, you may be able to access your retirement funds without the usual penalties. For instance, if you need to withdraw money for home repairs after a hurricane damaged your property, you may be able to do so without incurring the 10% early withdrawal penalty. These provisions offer a safety net during challenging times, but it’s important to understand the rules and potential tax implications.

- State Tax Relief: While the IRS provides federal tax relief, remember that state tax deadlines might differ. Each state has its own set of rules and regulations. Be sure to check with your state’s tax agency for specific guidance.

FAQs

How do I know if I qualify for disaster tax relief?

The IRS automatically provides relief to taxpayers in federally declared disaster areas. You can verify your location using the FEMA website’s Designated Areas list.

What if my records were destroyed in the disaster?

The IRS understands that disasters can lead to lost or damaged records. They offer guidance on reconstructing your records and claiming casualty losses. For example, if your home was damaged in a flood and you lost receipts for repairs, you can use bank statements, credit card statements, and photographs as evidence of the expenses. You can find helpful information on the IRS website or reach out to us for assistance.

Can XOA TAX help me with my disaster-related tax situation?

Absolutely! We can help you understand the specific relief measures that apply to you, assist with record reconstruction, and ensure you meet all the necessary deadlines.

Connecting with XOA TAX

Navigating tax obligations after a natural disaster can be complex. At XOA TAX, we’re dedicated to providing personalized guidance and support during these challenging times. Contact us today for a consultation. Our team is ready to assist you with:

- Understanding and claiming applicable tax relief

- Reconstructing lost or damaged tax records

- Filing amended returns

- Addressing any other tax-related concerns

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime