When going through a divorce, dividing assets like a family home can be complex. Beyond the emotional aspects, there are important financial and tax implications to consider. One key concept is understanding your “cost basis” in the house and how a divorce buyout can affect it. Let’s break it down.

Understanding the Basics of Cost Basis

Your cost basis in a property is essentially what you paid for it. This typically includes the purchase price, closing costs, and any significant improvements you’ve made over the years. This figure is crucial because it helps determine your capital gains or losses when you eventually sell the property.

Cost Basis Worksheet Example:

Original purchase price: $_______

+ Initial closing costs: $_______

+ Significant improvements: $_______

+ Buyout amount (if applicable): $_______

= Total Cost Basis: $_______

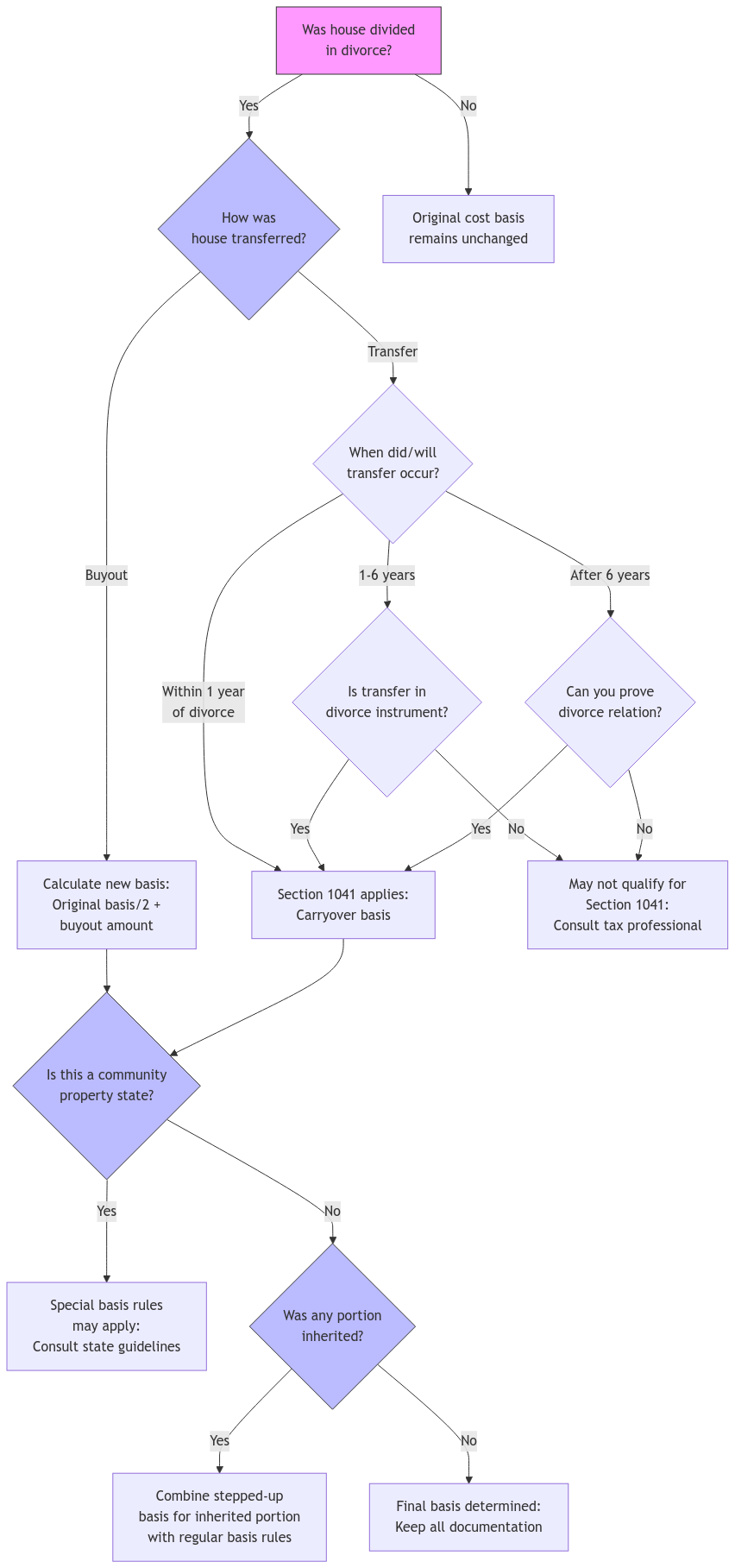

Use this flowchart to understand how different scenarios affect your cost basis calculation:

Interactive Cost Basis Calculator

Use this calculator to estimate your cost basis based on different scenarios. Select your situation from the dropdown menu and input your specific numbers for a detailed breakdown.

Divorce Cost Basis Calculator

Note: This calculator is for estimation purposes only. Your specific situation may vary based on state laws, timing of transfer, and other factors. Please consult with a tax professional for precise calculations based on your circumstances.

How a Divorce Buyout Impacts Your Cost Basis

In a divorce settlement where one spouse buys out the other’s share of the house, the cost basis needs to be adjusted. The IRS views this buyout as a purchase of the selling spouse’s interest in the property.

Example:

Imagine a couple bought their house for $200,000. During the divorce, one spouse buys out the other’s half for $150,000. The spouse keeping the house now has a new cost basis of $250,000 ($100,000 initial cost + $150,000 buyout).

Transfers Incident to Divorce: A Possible Exception

It’s important to note that there can be exceptions to this rule. Under Internal Revenue Code Section 1041, transfers of property between spouses during a divorce, or former spouses incident to a divorce, are generally treated as non-taxable events. This means that the receiving spouse often takes on the carryover basis of the transferring spouse. In simpler terms, they inherit the original cost basis of the property.

Example:

If a couple bought a house for $200,000 and one spouse receives the house in the divorce settlement without a buyout, their cost basis might remain $200,000.

Important Note: Whether a transfer qualifies under Section 1041 can depend on various factors and state laws. It’s crucial to consult with a tax professional to determine how this applies to your specific situation, especially regarding timing requirements. Generally, the transfer should occur within one year after the marriage ceases or is related to the cessation of the marriage.

Common Misconceptions

- Keeping the original cost basis: It’s a common mistake to assume you can retain the original cost basis after a buyout. However, as explained earlier, the buyout is considered a new purchase, requiring a recalculation of the cost basis. (See IRS Publication 551 for more details.)

- Ignoring significant improvements: If you made significant improvements to the property during the marriage, these costs should be factored into the cost basis calculation. Be sure to keep records of these expenses. Examples of significant improvements include room additions, new roofs, HVAC system replacements, and major kitchen or bathroom renovations.

Tax Implications of Selling the House Later

Your adjusted cost basis after a divorce buyout will determine your capital gains or losses when you sell the house in the future. Capital gains are the profits you make from selling an asset for more than its cost basis.

Example:

Using our earlier example, if the spouse who kept the house (with the $250,000 adjusted basis) later sells it for $300,000, their capital gain would be $50,000 ($300,000 selling price – $250,000 adjusted cost basis).

Capital Gains Exclusion: It’s important to remember that you may qualify for a capital gains exclusion if you’ve used the house as your primary residence for at least two of the five years before the sale. This exclusion allows you to exclude up to $250,000 of capital gains from your taxable income if you’re single, or up to $500,000 if you’re married filing jointly.

State-Specific Considerations

Remember that state laws can significantly impact property division and tax treatment in a divorce. Some states are community property states, which have unique rules regarding property ownership and basis. Be sure to consult state-specific guidelines or seek advice from a tax professional familiar with your state’s laws.

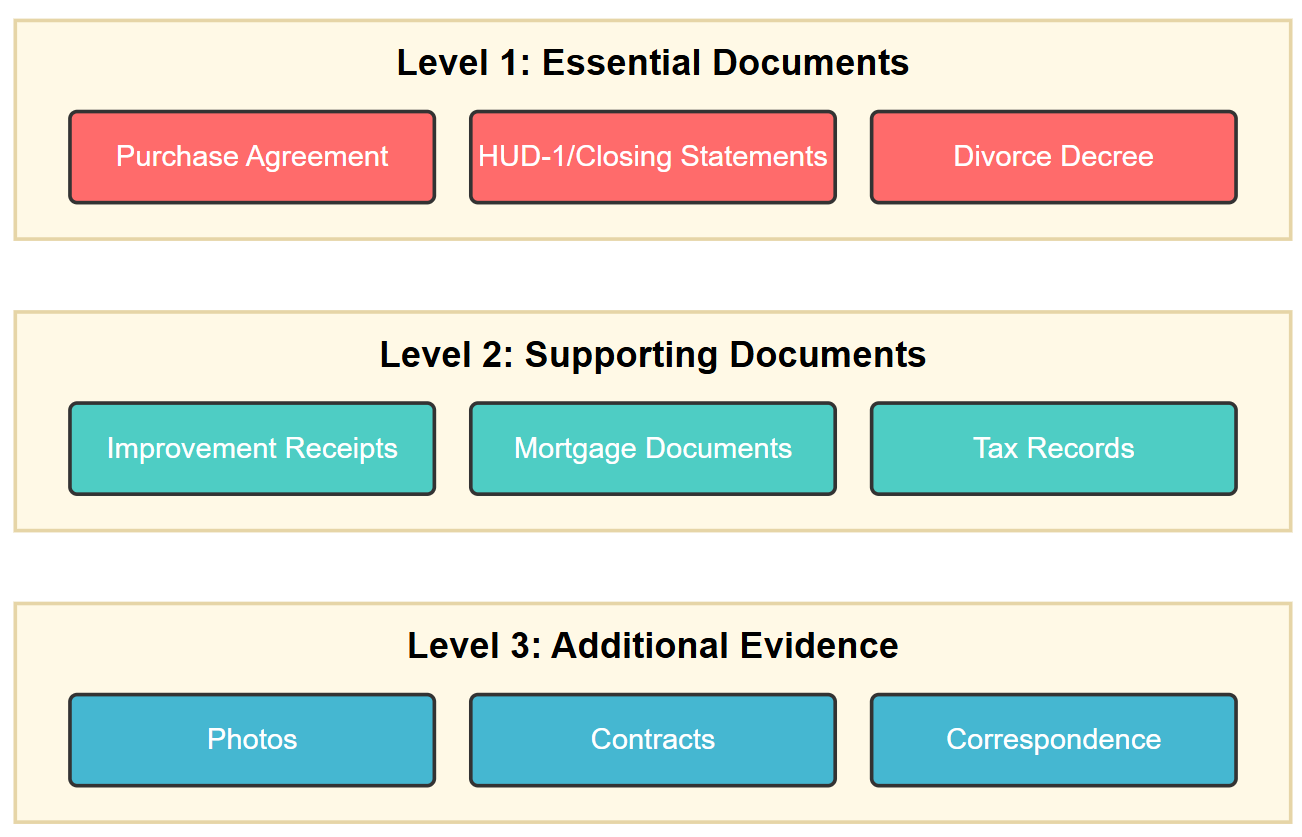

Documentation Requirements

To prove your cost basis to the IRS, maintain meticulous records of all relevant documents, including:

- Purchase Documents: The original purchase agreement, closing documents (Form HUD-1), and any records related to the initial purchase of the house.

- Closing Costs: Statements and receipts for expenses incurred during the closing process, such as title insurance, appraisal fees, and legal fees.

- Improvement Records: Receipts, invoices, and contracts for any significant improvements made to the property, including remodeling, additions, and major repairs.

Timeline for Gathering Documentation

- During the Divorce Process: Start gathering all relevant documents as soon as the divorce process begins. This includes obtaining copies of all financial records related to the house.

- Before the Divorce is Finalized: Ensure you have all necessary documentation before the divorce is finalized, especially if a buyout is involved.

- Throughout Homeownership: Continue to keep thorough records of any improvements or expenses related to the house.

Mortgage Considerations

If you assume your spouse’s mortgage as part of the divorce settlement, the amount of the mortgage assumed is generally added to your cost basis. It’s essential to keep clear records of the mortgage assumption agreement and any associated documentation.

Record-Keeping Best Practices

- Digital Copies: Scan important documents and store them securely in a cloud-based service or on an external hard drive.

- Physical Copies: Keep original documents in a safe place, such as a fireproof safe or a safe deposit box.

- Organized System: Maintain a well-organized filing system for easy access to your records.

Tax Forms and Reporting

When you eventually sell the house, you’ll need to report the sale and any capital gains or losses on your tax return. The primary form used for this purpose is Form 8949, “Sales and Other Dispositions of Capital Assets.” You’ll also need to report the sale on Schedule D of Form 1040, “Capital Gains and Losses.” For sales that occurred before 1997, you may need to use Form 2119, “Sale of Your Home.” Keep all your documentation readily available to support the information reported on these forms. Remember that if you e-file your tax return, you should still retain all supporting documentation in case of an audit.

Special Considerations for Partial Business Use of Home

If you use part of your home for business purposes, you’ll need to allocate the basis between personal and business use. This can affect both depreciation calculations and eventual gain/loss calculations when you sell. Keep detailed records of business use percentages and any depreciation taken. It’s advisable to consult with a tax professional for guidance on properly allocating the basis and calculating depreciation for the business use of your home.

Seeking Professional Advice

Navigating the complexities of property division and tax implications during a divorce can be challenging. We strongly recommend seeking guidance from a qualified tax professional or CPA. They can provide personalized advice based on your unique circumstances and help you make informed decisions.

Quick Reference Timeline:

- Before Divorce: Gather all relevant financial documents related to the house.

- During Divorce: If there’s a buyout, ensure the terms are clearly documented.

- After Divorce: Continue to keep thorough records of any home improvements or expenses.

- Sale Preparation: Compile all evidence of your cost basis, including purchase documents, improvement records, and divorce settlement papers.

Pre-Sale Checklist:

- ☐ Original purchase documents

- ☐ Improvement records

- ☐ Divorce settlement papers

- ☐ Business use documentation (if applicable)

- ☐ Capital gains exclusion qualification evidence

FAQs

What if I received the house in the divorce settlement without a buyout?

Your cost basis may be the original purchase price plus any significant improvements, or it may be a carryover basis from your spouse, depending on whether the transfer falls under IRC Section 1041. It’s best to consult with a tax professional to confirm the specifics of your situation.

How can I prove the cost basis of my house to the IRS?

Keep thorough records of all purchase documents, closing costs, and receipts for significant improvements. These documents will serve as evidence of your cost basis when you file your taxes.

What happens to my cost basis if I refinance the house after the divorce?

Refinancing typically doesn’t affect your cost basis. However, if you take cash out and use it for home improvements, those improvement costs can be added to your basis. Keep detailed records of how refinancing proceeds are used.

If I live in a community property state, how does that affect my cost basis?

In community property states, both spouses generally receive a full step-up in basis on community property when one spouse dies. This can significantly impact your tax situation. The rules can be complex, so consult with a tax professional familiar with your state’s community property laws.

How do I calculate my cost basis if I inherited part of the house before the divorce?

Inherited property typically receives a step-up in basis to fair market value at the date of death. If you inherited a portion of the house and then received the remaining portion in a divorce, your cost basis would be a combination of the stepped-up value and any additional basis from the divorce transfer.

What if I can’t find all my improvement receipts from during the marriage?

While having receipts is ideal, you can also prove improvements through:

- Before and after photos

- Building permits

- Home improvement loan documentation

- Contractor contracts and communications

- Insurance records showing home upgrades

Do repairs count toward my cost basis?

General maintenance and repairs typically don’t increase your cost basis. However, major renovations or improvements that add value to the home, prolong its life, or adapt it to new uses can be added to your basis. For example, fixing a broken window is a repair, but replacing all windows with energy-efficient ones is an improvement.

How does the timing of the divorce settlement affect Section 1041 treatment?

Transfers within one year after the divorce is final automatically qualify under Section 1041. Transfers between one and six years after may qualify if they are pursuant to the divorce instrument. After six years, you’ll need strong evidence that the transfer was divorce-related.

How does using part of the home for business affect my cost basis and eventual sale?

If you use part of your home for business purposes, you’ll need to allocate the basis between personal and business use. This can affect both depreciation calculations and eventual gain/loss calculations when you sell. Keep detailed records of business use percentages and any depreciation taken.

Connecting with XOA TAX

If you’re facing a divorce and need assistance understanding the tax implications related to your property, don’t hesitate to contact XOA TAX. Our team of experienced professionals can provide personalized guidance and support to help you navigate this challenging time.

Contact Information:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime