Navigating the financial complexities of divorce can be a daunting task, especially when it comes to dividing assets like your family home. As a CPA, I’ve witnessed firsthand the stress and uncertainty surrounding these situations. That’s why I’ve prepared this comprehensive guide to help you understand the tax implications of a house buyout during divorce proceedings.

Understanding the Basics

A house buyout in a divorce typically involves one spouse retaining ownership of the marital home while compensating the other spouse for their share of the equity. This process can have significant tax implications, depending on how it’s structured. Let’s explore some key considerations:

Capital Gains Exclusion

Under Section 121 of the Internal Revenue Code, as explained in IRS Publication 523 (Selling Your Home), homeowners can exclude up to $250,000 of gain from the sale of their primary residence ($500,000 for joint filers). To qualify, the homeowner must have owned and used the property as their primary residence for at least two of the five years preceding the sale.

In a divorce scenario, if one spouse retains the home and later sells it, they may still qualify for this exclusion, even if the other spouse is no longer living there. However, it’s important to note that the exclusion applies only to the portion of the gain attributable to the period when the selling spouse owned the home after the divorce.

Example:

Let’s say a couple purchased their home for $300,000 in 2010 and divorced in 2018. The home was valued at $600,000 at the time of the divorce. One spouse bought out the other’s share for $300,000 and continued living in the house. In 2024, they sold the house for $800,000.

To calculate the taxable gain, we need to determine the adjusted basis. Since the spouse retained the home after the divorce, their adjusted basis would be $600,000 (the value at the time of the divorce). The total gain is $200,000 ($800,000 sale price – $600,000 basis). However, the exclusion would apply to the entire gain, as it’s less than the $250,000 limit for single filers.

Property Taxes

Property taxes can also be a significant factor in a house buyout. In some states, including California, a change in ownership due to divorce can trigger a reassessment of the property’s value, potentially leading to higher property taxes.

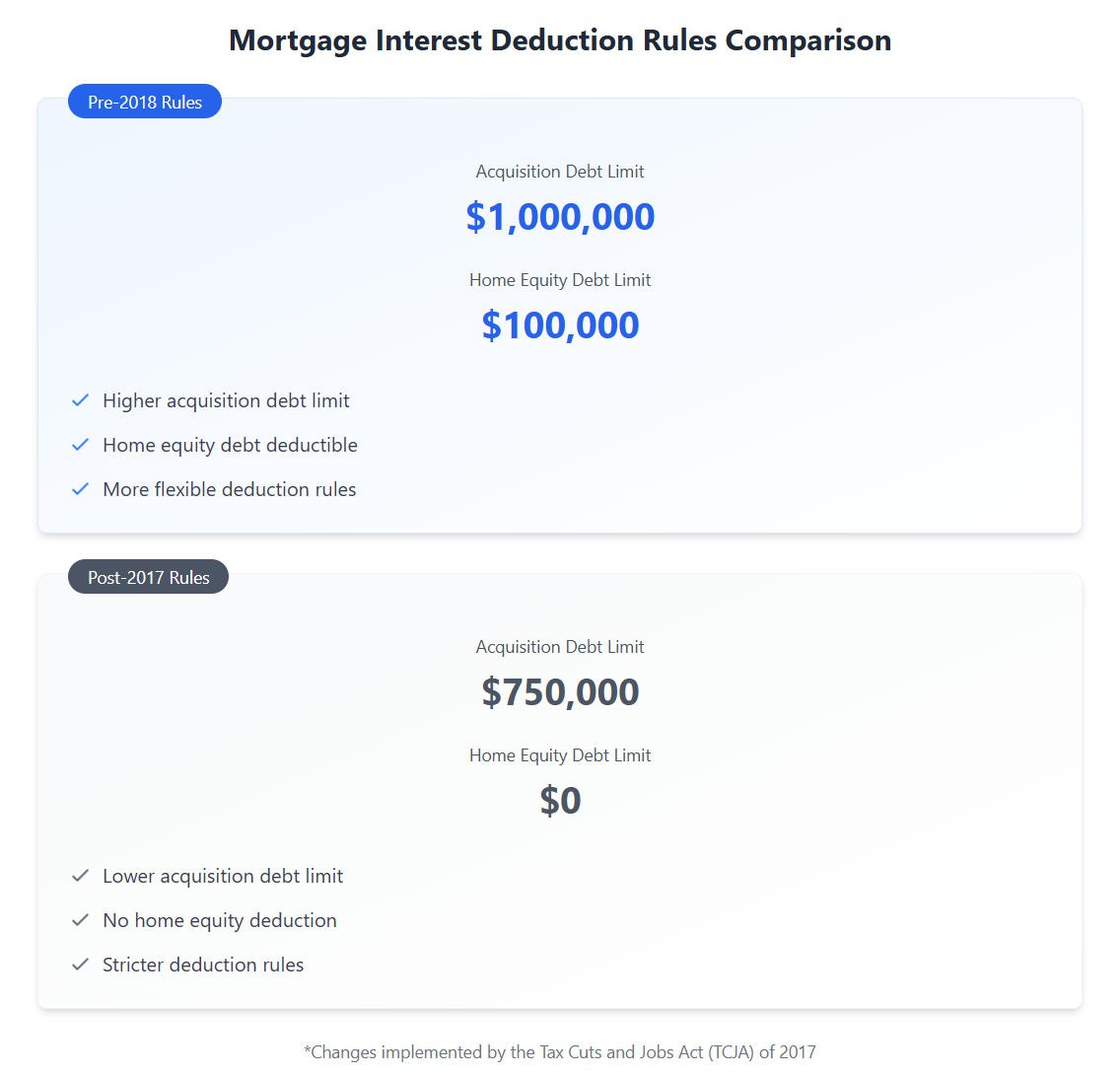

Mortgage Interest Deduction

For divorce buyouts finalized before 2018, the spouse who retains ownership of the house can generally deduct mortgage interest on up to $1 million of acquisition debt and $100,000 of home equity debt, subject to the alternative minimum tax (AMT).

However, for buyouts finalized after 2017, the federal deduction is limited to interest on the first $750,000 of acquisition debt, and the deduction for home equity debt is suspended.

Example:

If you have a $900,000 mortgage at 4% interest:

- Pre-2018: Interest on the full $900,000 is deductible.

- Post-2017: Interest only on the first $750,000 is deductible.

It’s important to note that these are federal rules. California, for example, does not impose these limitations.

State Tax Considerations

State tax laws can significantly impact the financial outcomes of a house buyout. Here’s what to consider based on your state:

- Community Property States: States like California, Arizona, Texas, Washington, Idaho, Louisiana, New Mexico, Nevada, and Wisconsin follow community property laws. In these states, most property acquired during the marriage is considered jointly owned, and the division of property may have different tax implications.

- Common Law Property States: In states that follow common law, property is typically divided based on ownership and contributions. Understanding your state’s specific rules is crucial for optimizing your buyout.

- State-Specific Property Tax Reassessment Rules: Some states reassess property taxes upon a change in ownership, which can affect your tax liabilities. For example, California may reassess property values, potentially increasing property taxes after a buyout.

Comparison: Community Property vs. Common Law Property

| Aspect | Community Property | Common Law |

|---|---|---|

| Ownership | 50/50 split presumed | Based on title/contribution |

| Basis Rules | Special rules apply | General rules apply |

| Tax Impact | Different treatment | Standard treatment |

Tax Calculator

Use this interactive calculator to estimate the tax implications of your house buyout:

House Buyout Tax Calculator

Strategies to Optimize Your Buyout

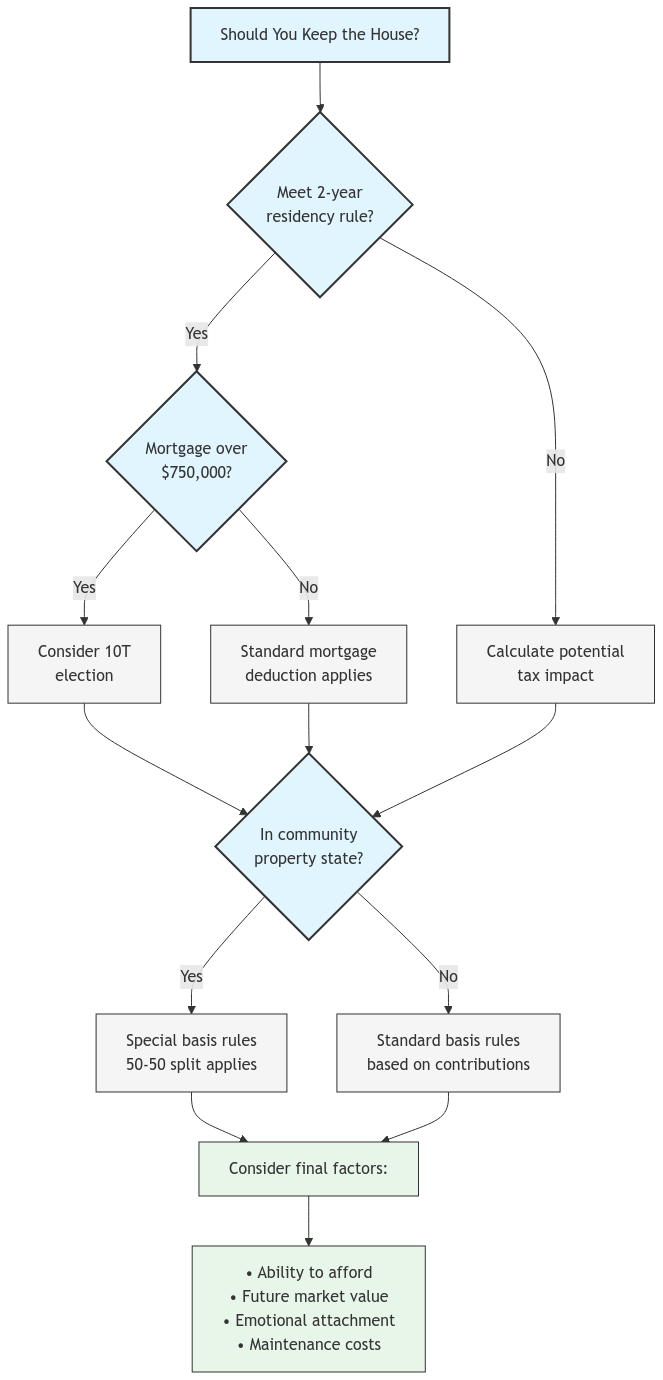

Before diving into specific strategies, use this decision tree to evaluate your situation:

- Timing is Key: If possible, finalize your divorce buyout before the end of 2025 to take advantage of certain federal tax benefits that are scheduled to expire due to the sunset provisions of the Tax Cuts and Jobs Act. These include the higher limits on mortgage interest deductions and the exclusion of up to $100,000 of home equity debt.

- Maximize the Section 121 Exclusion: If both spouses meet the ownership and use requirements, consider selling the home before finalizing the divorce to take advantage of the full $500,000 exclusion. If this isn’t feasible, the spouse retaining the home should aim to sell it within a few years of the divorce to minimize their taxable gain.

- Consider a 10T Election: For buyouts finalized after 2017, the spouse retaining the home may want to consider a 10T election, which allows them to treat any debt secured by the home as not secured by the home. This can be beneficial if the debt exceeds the $750,000 acquisition debt limit or if the taxpayer has significant home equity debt. However, it’s important to consult a tax professional, as this election can have complex ramifications.

- Negotiate Nontaxable Payments: Alimony payments made under a divorce or separation agreement finalized before 2018 are deductible by the payor and taxable to the recipient. However, for agreements finalized after 2018, alimony payments are neither deductible nor taxable. Consider negotiating higher nontaxable payments, such as child support or property settlements, to offset the loss of the alimony deduction.

- Understand Basis Adjustment: When one spouse buys out the other’s share of the home, the basis of the home is adjusted to reflect the new ownership structure. This can affect the taxable gain or loss when the home is eventually sold. Consult a tax professional to understand the specific basis adjustment rules applicable to your situation.

- Be Mindful of Gift Tax: In some cases, a house buyout can trigger gift tax if the value of the buyout is significantly less than the fair market value of the property. It’s important to ensure the buyout is structured at arm’s length to avoid any gift tax implications.

- Consult a Tax Professional: Tax laws are complex and constantly changing. A qualified tax professional can help you navigate the specific rules applicable to your situation and ensure you’re making informed decisions throughout the divorce process.

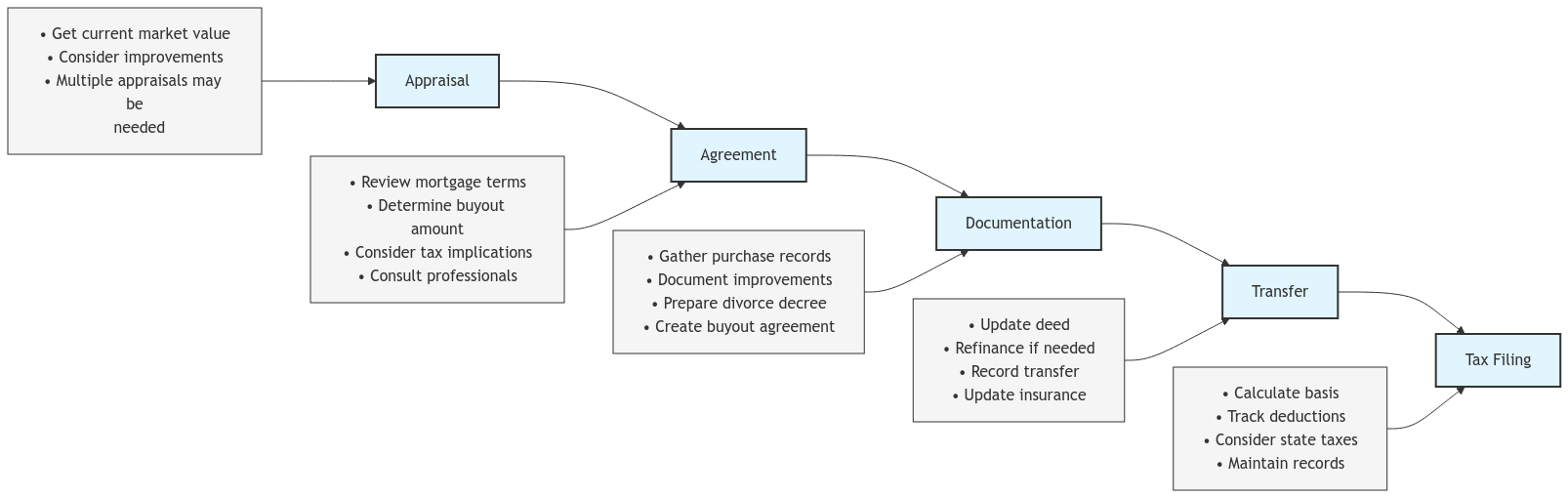

Required Documentation

Keeping thorough records is essential for managing the tax implications of a house buyout. Ensure you maintain the following documentation:

- Purchase Documents

- Improvement Costs

- Divorce Decree

- Buyout Agreement

- Property Appraisals

- Tax Returns

Document Retention Periods

- Tax Returns: 7 years minimum

- Property Records: Throughout ownership + 7 years

- Improvement Receipts: Throughout ownership + 7 years

Before You Proceed

Understanding the complete house buyout process is crucial for proper tax planning. Here’s an overview of the key steps:

Pre-Buyout Checklist

- □ Obtain a current appraisal of the property.

- □ Review and understand the existing mortgage terms.

- □ Check your state’s tax rules regarding property transfers.

- □ Document all costs related to property improvements.

- □ Verify ownership records to ensure clear title transfer.

- □ Review the divorce decree requirements related to the property.

Timeline Considerations

Key Dates to Consider

- 2025 TCJA Provisions Sunset

- Two-Year Ownership Requirement

- Five-Year Lookback Period

- Filing Deadlines

Related Considerations

Qualified Domestic Relations Orders (QDROs)

Note that Qualified Domestic Relations Orders (QDROs) may be relevant when dealing with retirement accounts alongside house buyouts. A QDRO is a legal order following a divorce that divides and changes ownership of a retirement plan to give the divorced spouse their share of the asset. Understanding how QDROs interact with property settlements can help ensure all financial aspects of the divorce are handled efficiently and in compliance with tax laws.

FAQs

Can I still deduct mortgage interest on a home I bought before December 16, 2017, if I refinance after that date?

Yes, but only up to the balance of the debt prior to refinancing. For example, if you had a $900,000 mortgage before December 16, 2017, and refinanced for $1 million in 2024, you can only deduct interest on $900,000.

How does equitable ownership affect the mortgage interest deduction?

If you’re the equitable owner of a property, you can still deduct mortgage interest, even if you don’t hold legal title or aren’t liable for the mortgage. This is because the IRS recognizes that interest paid on a mortgage, where the taxpayer is the legal or equitable owner, is deductible even if the taxpayer isn’t directly liable for the mortgage.

How do FSAs affect divorce settlements?

Flexible Spending Accounts (FSAs) allow employees to be reimbursed for medical, dependent care, or adoption assistance with pretax dollars. These contributions aren’t included in taxable wages, so they’re not required to be reported in divorce settlements.

Risk Warnings

- Document Retention Requirements

- State Compliance Issues

- Common Pitfalls

- Timing Considerations

We Can Help!

We understand that divorce is a challenging time, and we’re here to help you navigate the financial complexities. Our team of experienced CPAs can provide personalized guidance and support to ensure you’re making informed decisions that protect your financial future.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

Additional References

For detailed guidance, see:

anywhere

anywhere  anytime

anytime