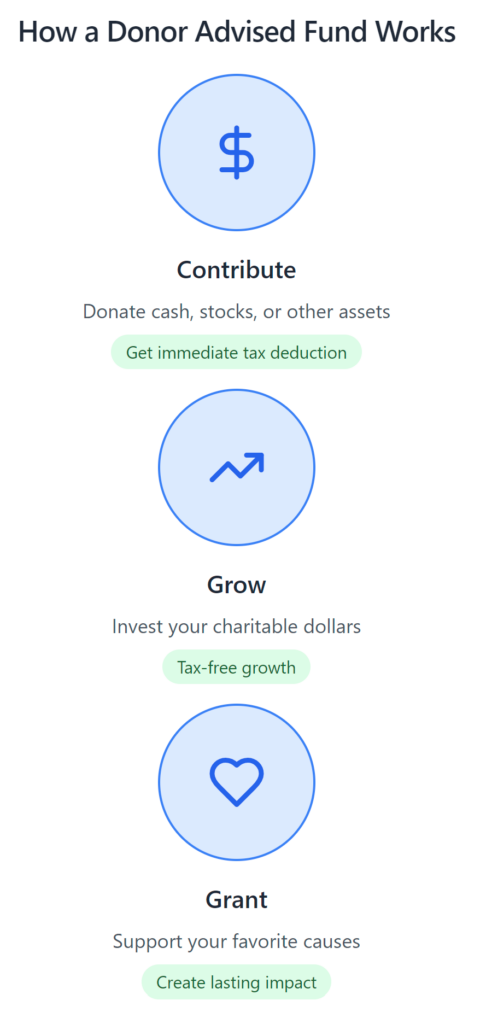

At XOA TAX, we believe in the power of giving back. But did you know that charitable giving can also be a smart financial move? Donor Advised Funds (DAFs) offer a fantastic way to support your favorite causes while maximizing your tax benefits. Think of a DAF like a charitable savings account: you contribute money or assets, get an immediate tax break, and then decide later how you want to distribute those funds to charities.

Why Choose a DAF in 2024?

Boost Your Deductions: For 2024, you can deduct cash donations up to 60% of your Adjusted Gross Income (AGI). For assets like stocks or real estate that you’ve held for over a year, the limit is 30% of your AGI. The best part? If you’re feeling extra generous and exceed these limits, you can carry forward the extra deduction for up to five years!

Flexibility is Key: With a DAF, you’re in the driver’s seat. You decide when and how to distribute funds to your chosen charities. This means you can respond to immediate needs or support long-term projects, all while enjoying the tax benefits upfront.

Say Goodbye to Capital Gains: Donating appreciated assets to a DAF lets you avoid capital gains taxes on the increased value. For example, if you bought stock for $1,000 that is now worth $5,000, you can donate the stock to your DAF and avoid paying capital gains tax on the $4,000 increase in value. It’s a win-win for both your portfolio and your favorite causes.

Smart Tax Strategies with DAFs

Smart Tax Strategies with DAFs

Bunching Strategy

$10,000

$10,000

$20,000

$0

Optimal Timing

Key Deadlines

- December 31: Year-end tax deduction deadline

- Securities: Allow 5-7 business days

- Real Estate: Start 60-90 days before year-end

Tax Savings Example

Bunch Your Donations: The standard deduction for 2024 is $14,600 for single filers and $29,200 for married couples filing jointly. By “bunching” a few years’ worth of donations into a single year and contributing to a DAF, you can exceed the standard deduction and itemize. This could lead to significant tax savings! For example, let’s say a married couple typically donates $10,000 to charity each year. By bunching two years of donations into a single year, they could contribute $20,000 to their DAF, exceeding the standard deduction and potentially lowering their taxable income.

Time it Right: If you expect a higher income in 2024 (maybe from a bonus or stock options), a DAF becomes even more attractive. You’ll receive an immediate tax deduction for your entire contribution, even if you distribute the funds to charities later. This can be especially helpful in managing your tax liability during high-income years.

DAF Year-End Planning Checklist

- Review current year income and tax situation

- Identify appreciated securities held > 1 year

- Calculate potential tax savings

- Review grant history and plans

- Consider bunching strategy

- Schedule contribution timing

- Explore Other Options: If you’re 73 or older, consider Qualified Charitable Distributions (QCDs) directly from your IRA to eligible charities. QCDs can satisfy your Required Minimum Distributions (RMDs) and are excluded from your taxable income. However, remember that DAFs are not eligible recipients for QCDs.

Making the Most of Your DAF

Investment Choices: Most DAFs offer a variety of investment options to help your contributions grow. These typically include mutual funds with various investment strategies, index funds that track the market, exchange-traded funds (ETFs), and even bonds. Some DAFs also offer Environmental, Social, and Governance (ESG) focused investment options. This allows your contributions to potentially grow tax-free over time, but remember that investment growth is not guaranteed and will fluctuate with market conditions. Be sure to inquire about investment minimums for different options.

Fees Matter: Be mindful of potential fees, such as administrative fees to cover the DAF’s operating costs and investment management fees for managing the investment options. These fees can vary by DAF sponsor.

Typical Fee Ranges: Administrative fees often range from 0.5% to 1.5% annually, while investment management fees vary based on the investment options chosen. Some sponsors offer fee breakpoints for larger accounts, so be sure to ask about potential cost savings.

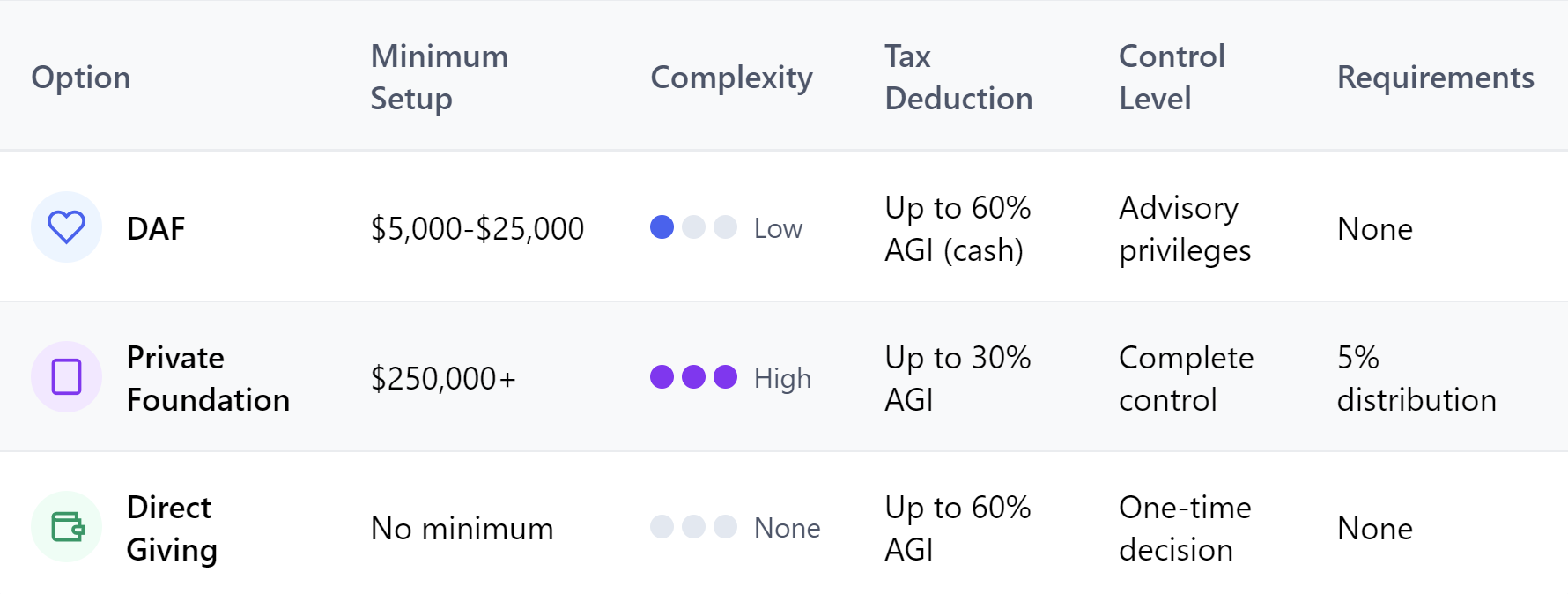

DAFs vs. Private Foundations: DAFs are generally less complex and less expensive to administer than private foundations. They also offer less control over how the funds are ultimately used.

Charitable Giving Options Comparison

Important Considerations

Minimum Contributions: DAF sponsors often have minimum initial contribution requirements, which can vary significantly. Be sure to inquire about these minimums when selecting a sponsor.

Grant Minimums: Most DAFs have minimum amounts for grants to charities, typically ranging from $50 to $250.

Timelines: While DAFs offer flexibility, some sponsors may have timelines for distributing funds. It’s important to understand any deadlines or requirements for grantmaking.

Typical Timelines: DAF setup can take a few weeks, asset contributions may take a few days to process, and grant requests are usually processed within a few business days.

State Tax Benefits: In addition to federal tax benefits, many states offer tax advantages for DAF contributions. Consult with us or a tax professional in your state to understand the specific rules in your area.

Planning for the Future: You can designate successor advisors to manage your DAF, ensuring your charitable legacy continues according to your wishes. This is an important part of estate planning and ensures that your philanthropic goals are carried out even after you’re gone.

FAQs

What types of assets can I donate to a DAF?

Most DAFs accept a variety of assets, including cash, stocks, bonds, and even real estate. However, there can be restrictions on certain complex assets. It’s best to check with your DAF sponsor and tax advisor to determine what’s eligible.

What happens if I change my mind about which charity to support?

That’s the beauty of a DAF! While the contribution itself is irrevocable, you retain advisory privileges over how the funds are granted. You can change your mind about which charities to support at any time.

Are there any downsides to using a DAF?

It’s important to be aware of potential administrative and investment management fees, which can vary by sponsoring organization. Also, once you contribute assets to a DAF, they cannot be returned to you.

How do I choose the right DAF sponsor?

Consider factors such as investment options, fees, minimum contribution requirements, and grantmaking flexibility. Community foundations, financial institutions, and national charities all offer DAFs, each with its own nuances.

Can I donate to international charities through a DAF?

The ability to donate to international charities can depend on the DAF sponsor. Some sponsors may have restrictions or require additional documentation. Check with your sponsor to understand their policies. Generally, international charities must be “equivalency determined” (meaning they meet similar standards to U.S. charities) or “expenditure responsibility” tracked (meaning the DAF sponsor monitors how the funds are used). Many DAF sponsors prefer working with U.S.-based 501(c)(3) organizations.

Getting Started with Your DAF

Important Deadlines

- December 31: Deadline for current-year tax deduction

- Securities transfers: Allow 5-7 business days

- Real estate donations: Start process 60-90 days before year-end

- Gather Your Documents: You’ll typically need to provide documentation of the assets you’re contributing, such as account statements or property appraisals.

- Establish Your DAF: The process for setting up a DAF can vary depending on the sponsor. It usually involves completing an application and providing the necessary documentation.

- Make Grant Recommendations: Once your DAF is established, you can recommend grants to your chosen charities. This typically involves submitting a simple request to your DAF sponsor, either online or in writing.

XOA TAX: Your Partner in Charitable Giving

We know that taxes and charitable planning can feel overwhelming. That’s where we come in. At XOA TAX, our experienced CPAs can help you:

- Determine if a DAF is the right fit for your circumstances.

- Develop a comprehensive charitable giving plan that aligns with your financial goals and philanthropic vision.

- Explore alternative strategies, such as QCDs, if applicable.

We’re dedicated to helping you make the most of your charitable giving while optimizing your tax benefits. Have questions about Donor Advised Funds or need help with your charitable giving strategy? We’re here to guide you! Contact XOA TAX today for personalized advice.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime