Navigating the financial landscape of your business can be complex. Like a skilled explorer, you need the right tools and guidance to ensure you stay on track. That’s where double-entry bookkeeping comes in. Think of it as your comprehensive roadmap to financial clarity and success.

At XOA TAX, we’re dedicated to making this journey easier for you. We’ll break down the essentials of double-entry bookkeeping and show you how it can empower your business.

Key Takeaways

- The Foundation: The accounting equation (Assets = Liabilities + Equity) is the cornerstone of double-entry bookkeeping.

- Two Sides to Every Coin: Every financial transaction involves two entries – a debit and a credit – to maintain balance.

- Error Detection: Double-entry acts as a built-in system for catching mistakes and ensuring accuracy.

- Compliance: This method helps you organize your financial records and comply with regulations.

- Financial Insight: Double-entry bookkeeping provides a clear and comprehensive view of your business’s financial health.

What is Double-Entry Bookkeeping?

Imagine a perfectly balanced scale. To keep it level, you need equal weight on both sides. Double-entry bookkeeping operates on a similar principle. It’s a method of recording every financial transaction twice – once as a debit and once as a credit – to ensure your financial “books” remain balanced.

This time-tested system, with roots dating back to the 1400s, is the foundation of modern accounting. It all revolves around the fundamental accounting equation:

Assets = Liabilities + Equity

Let’s clarify these terms:

- Assets are what your business owns, including cash, equipment, inventory, and accounts receivable.

- Liabilities represent what your business owes to others, such as loans, accounts payable, and deferred revenue.

- Equity is the owner’s stake in the business.

With double-entry bookkeeping, every transaction affects at least two of these elements. For instance, if you purchase office supplies with cash, you increase your assets (office supplies) and decrease your assets (cash), maintaining the balance.

Who Needs Double-Entry Bookkeeping?

Maintaining accurate financial records is essential for all businesses, regardless of size or structure. Double-entry bookkeeping is particularly valuable for:

- Growing Businesses: As your business expands and transactions become more complex, double-entry helps you maintain organization and control.

- Corporations: It’s often a legal requirement for corporations to use double-entry bookkeeping for financial reporting.

- Freelancers and Entrepreneurs: Even for smaller businesses, double-entry provides a comprehensive view of your finances, which is crucial for tax preparation and informed decision-making.

- Non-Profits: Accurate record-keeping is essential for transparency and accountability in non-profit organizations.

The Benefits of Double-Entry Bookkeeping

- Accuracy: Recording each transaction twice minimizes errors and ensures your financial data is reliable.

- Error Detection: If your debits and credits don’t balance, it signals an error that needs to be investigated and corrected.

- Audit Trail: Double-entry creates a clear and traceable record of all financial activities, simplifying audits and ensuring compliance.

- Profitability Analysis: By accurately tracking income and expenses, you can analyze your profitability and identify areas for improvement.

- Financial Planning: Double-entry provides the foundation for effective budgeting, forecasting, and strategic financial planning.

- Scalability: This system can adapt to your business’s growth and handle increasing transaction volumes.

- Fraud Prevention: Maintaining a balanced ledger helps deter and detect fraudulent activity.

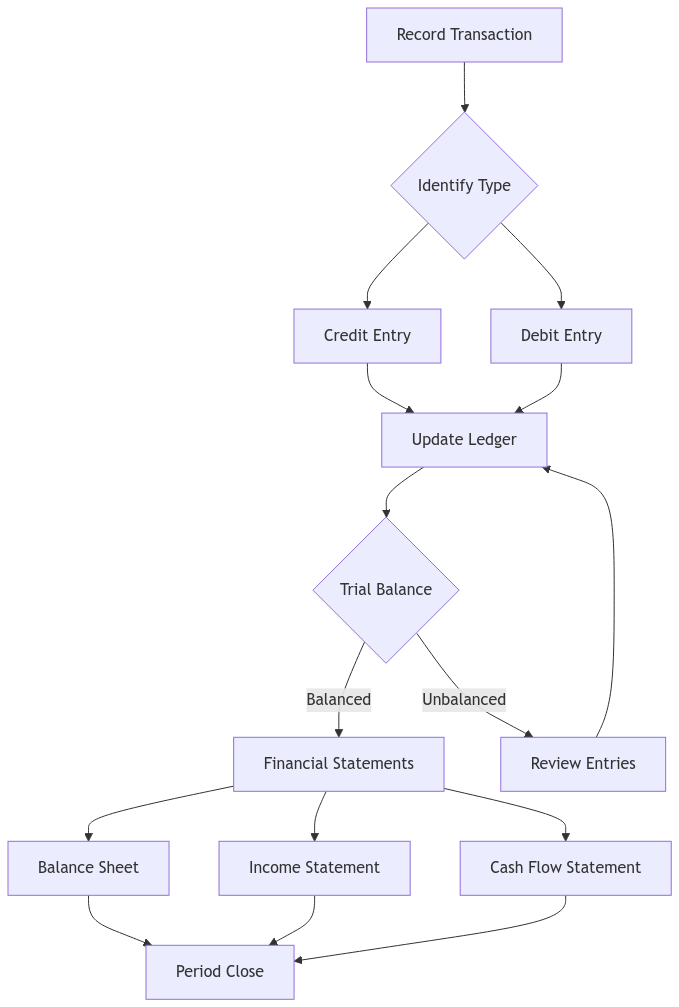

Getting Started with Double-Entry Bookkeeping

- Chart of Accounts: Develop a chart of accounts to categorize your financial transactions (e.g., “rent,” “utilities,” “sales revenue”).

- Accounting Software: Utilize accounting software like QuickBooks, Xero, or Zoho Books to streamline the process.

- Record Transactions: Ensure each transaction has corresponding debit and credit entries, maintaining the balance of the accounting equation.

- Trial Balance: Regularly reconcile your accounts to verify that your total debits equal your total credits.

- Financial Statements: Generate essential financial statements, including the balance sheet, income statement, and statement of cash flows.

- Regular Reviews: Conduct periodic reviews and audits to ensure accuracy and compliance.

Double-Entry Bookkeeping Setup Checklist

Initial Setup

Monthly Tasks

Quarterly Review

Double-Entry in Action

Here are a few examples to illustrate how double-entry bookkeeping works:

- Example 1: Purchasing Equipment: You buy a new piece of equipment for $5,000, paying with cash.

- Debit Equipment $5,000

- Credit Cash $5,000

- Example 2: Making a Sale: A customer purchases goods from you for $1,000 on credit.

- Debit Accounts Receivable $1,000

- Credit Sales Revenue $1,000

- Example 3: Paying Rent: You pay $2,000 for your monthly rent.

- Debit Rent Expense $2,000

- Credit Cash $2,000

- Example 4: Recording Depreciation: You depreciate a piece of equipment by $500 for the month.

- Debit Depreciation Expense $500

- Credit Accumulated Depreciation $500

Double-Entry vs. Single-Entry: A Comparison

While single-entry bookkeeping might seem simpler, it can lead to inaccuracies and doesn’t provide a complete financial picture. Double-entry bookkeeping offers:

| Feature | Double-Entry | Single-Entry |

|---|---|---|

| Accuracy | 👍 More accurate and reliable. | 👎 Prone to errors and omissions. |

| Financial View | 👍 Provides a complete and balanced picture. | 👎 Limited view, may not meet requirements. |

| Audit Trail | 👍 Creates a clear and traceable record. | 👎 Difficult to track transactions. |

| Compliance | 👍 Helps meet regulatory requirements. | 👎 May not be sufficient for compliance. |

Double-Entry and Financial Reporting

Double-entry bookkeeping is essential for creating accurate and reliable financial statements. These statements provide valuable insights into your business’s performance and financial health, and they’re often required for tax purposes and compliance with regulations.

Accounting Software: Your Bookkeeping Companion

Utilizing accounting software can significantly simplify the double-entry bookkeeping process. Here are some popular options:

- Quickbooks Online

- Xero

- Zoho Books

- Freshbooks

- Wave Accounting

- Sage Accounting

Understanding Materiality

In accounting, materiality refers to the significance of an amount or transaction. An item is considered material if its omission or misstatement could influence the decisions of users of financial statements. Understanding materiality is crucial for determining which transactions and events need to be recorded and disclosed in your financial reports.

Internal Controls: Safeguarding Your Assets

Internal controls are processes and procedures implemented to safeguard your assets, ensure the accuracy of your financial records, and promote operational efficiency. Examples of internal controls include segregation of duties, authorization procedures, and regular reconciliations.

Accrual vs. Cash Basis Accounting

- Accrual accounting: Records revenues when earned and expenses when incurred, regardless of when cash is received or paid. This method provides a more accurate picture of a company’s financial performance over time.

- Cash basis accounting: Records revenues when cash is received and expenses when cash is paid. This method is simpler but may not accurately reflect a company’s profitability.

The choice between accrual and cash basis accounting depends on various factors, including the size and complexity of your business and tax regulations. For example, businesses that sell on credit or carry inventory typically use accrual accounting.

Tax Implications of Accounting Methods

The accounting method you choose can have significant tax implications. For example, under accrual accounting, you may be able to defer taxes on revenue that has been earned but not yet collected. Conversely, under cash basis accounting, you may be able to deduct expenses in the year they are paid, even if they relate to a future period. It’s important to consult with a tax professional to determine the best accounting method for your business.

Bank Reconciliation: Ensuring Accuracy

Bank reconciliation is the process of comparing your bank statement with your internal records to identify any discrepancies. This is an important step in maintaining accurate financial records and detecting any errors or unauthorized transactions.

- Gather your records: You’ll need your bank statement and your cash account records.

- Compare the balances: Start by comparing the ending balance on your bank statement with the ending balance in your cash account.

- Identify differences: Look for transactions that appear on one statement but not the other. Common differences include outstanding checks, deposits in transit, bank fees, and interest earned.

- Make adjustments: Adjust your cash account balance for any items that haven’t yet cleared the bank (like outstanding checks) and adjust your bank statement balance for items that haven’t yet been recorded in your cash account (like deposits in transit).

- Reconcile the balances: Once you’ve made the necessary adjustments, your adjusted bank statement balance should match your adjusted cash account balance.

State-Specific Requirements and Regulations

It’s important to be aware of the specific bookkeeping and accounting requirements in your state. These requirements can vary, so it’s advisable to consult with a tax professional or legal expert to ensure compliance. For example, some states may have specific rules regarding sales tax collection and reporting, while others may have different requirements for record retention.

Digital Audit Trails: Ensuring Accountability

In today’s digital age, maintaining a clear and comprehensive audit trail is more important than ever. A digital audit trail provides a chronological record of all transactions and changes made to your financial data. This helps ensure accountability and transparency, making it easier to track errors, identify unauthorized activity, and comply with regulatory requirements.

Data Backup and Recovery: Protecting Your Financial Information

Regular data backups are crucial for protecting your financial information from loss or damage. Consider these best practices:

- Frequency: Back up your data regularly, ideally daily or weekly, depending on the volume of transactions.

- Storage: Store backups in a secure offsite location or cloud service to protect against physical damage or theft.

- Testing: Periodically test your backups to ensure they can be restored successfully.

Multi-Currency Transactions: Navigating Exchange Rates

If your business deals with transactions in multiple currencies, double-entry bookkeeping can help you manage the complexities of exchange rate fluctuations. Your accounting software should be able to handle different currencies and automatically calculate gains or losses due to exchange rate changes.

Non-Monetary Transactions: Recording Value Exchanges

Non-monetary transactions involve the exchange of goods or services without the use of cash. For example, if you barter your services for office supplies, this would be considered a non-monetary transaction. These transactions still need to be recorded in your books to accurately reflect the value exchanged.

Consolidated Financial Statements: Combining Multiple Entities

If your business has multiple entities or subsidiaries, consolidated financial statements provide a combined overview of the financial position and performance of the entire group. These statements are prepared by combining the financial data of all the individual entities, eliminating any intercompany transactions.

The Bottom Line: Double-Entry Bookkeeping for Financial Success

Double-entry bookkeeping is an essential tool for managing your business finances effectively. It provides accuracy, transparency, and compliance, setting the stage for informed decision-making and financial success.

Ready to embark on your journey toward financial clarity? Embrace the power of double-entry bookkeeping! And remember, XOA TAX is your trusted partner, ready to assist you every step of the way.

FAQs

Why is double-entry bookkeeping important for meeting financial reporting standards?

Double-entry bookkeeping ensures your financial records adhere to Generally Accepted Accounting Principles (GAAP) and the standards set by bodies like the Financial Accounting Standards Board (FASB). This promotes transparency and consistency in financial reporting.

What are contra accounts?

Contra accounts are used to reduce the value of a related account. For example, “Allowance for Doubtful Accounts” is a contra account that reduces the value of “Accounts Receivable” to reflect potential bad debts.

What is a trial balance?

A trial balance is a summary of all the accounts in your general ledger, listing their debit or credit balances. It helps ensure that your total debits equal your total credits.

How often should I reconcile my accounts?

Reconciliation involves comparing your internal records with external statements (like bank statements). It’s generally recommended to reconcile your accounts monthly.

What are the digital signature requirements for electronic bookkeeping?

Digital signature requirements vary. Consult with a tax professional for specific guidance.

How long do I need to keep my financial records?

Retention requirements vary, but it’s generally advisable to keep most records for at least six years.

What are the key differences between GAAP and IFRS?

GAAP (Generally Accepted Accounting Principles) is primarily used in the United States, while IFRS (International Financial Reporting Standards) is used in many other countries. While there are many similarities, there are also key differences in how certain transactions and events are treated. For example, GAAP uses Last-In, First-Out (LIFO) inventory costing, while IFRS prohibits it.

What are some best practices for electronic record-keeping?

Best practices include using secure accounting software, implementing strong password protection, regularly backing up your data, and ensuring compliance with digital signature requirements.

XOA TAX: Your Partner in Financial Success

We understand that managing your business finances can be challenging. At XOA TAX, our team of experienced CPAs is here to support you. We can help you:

- Set up your double-entry bookkeeping system.

- Ensure your financial records are accurate and compliant.

- Prepare and analyze your financial statements.

- Provide guidance on tax regulations and compliance.

Contact us today for a free consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime