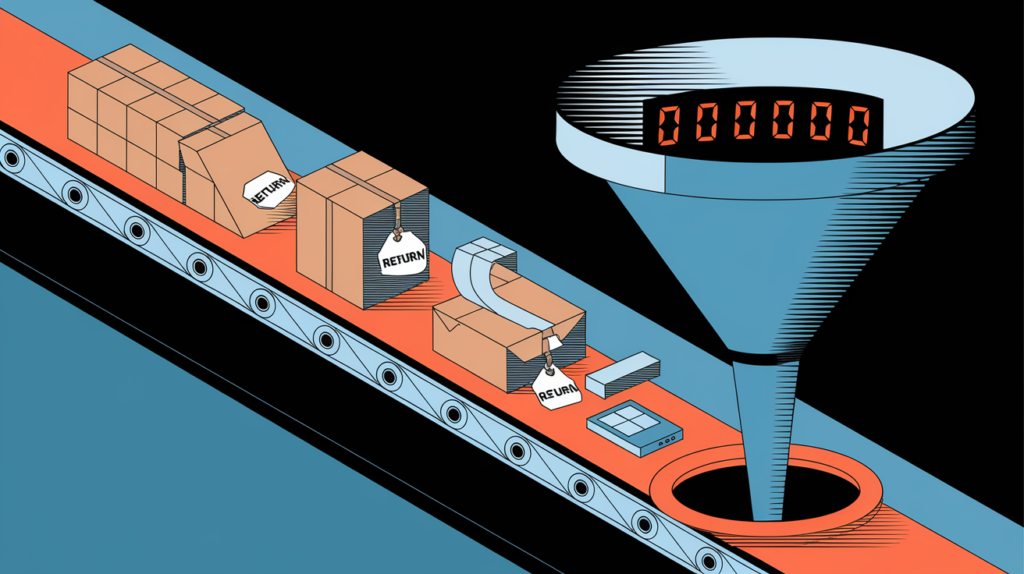

The e-commerce boom has transformed the retail landscape, offering unprecedented opportunities for businesses of all sizes. However, this digital shift comes with unique challenges, particularly when it comes to managing returns and refunds. For e-commerce businesses, understanding the financial implications of these transactions and accurately accounting for them is paramount for maintaining a healthy bottom line and making informed decisions. This revised blog post delves deeper into the intricacies of managing returns and refunds in the e-commerce world, equipping you with the knowledge and strategies to navigate this complex aspect of online retail.

Key Takeaways

- E-commerce returns and refunds significantly impact revenue, inventory, and profitability.

- Accurate accounting for these transactions is vital for informed decision-making and financial health.

- Properly managing returns and refunds enhances customer satisfaction and fosters loyalty.

- Utilizing technology and implementing clear policies can streamline the returns and refunds process.

The Financial Impact of Returns and Refunds

Returns and refunds are an unavoidable part of the e-commerce landscape. They can significantly impact your business’s financial health in several ways:

- Reduced Revenue: Each return directly reduces your revenue, as you must refund the purchase price. For example, if you sell 100 items at $50 each and experience a 10% return rate, your revenue will be reduced by $500 (10 returns x $50).

- Inventory Management: Returned items disrupt inventory levels, requiring careful tracking and potentially leading to storage challenges. Imagine selling out of a popular item, only to have several units returned unexpectedly, potentially leading to lost sales opportunities if not properly managed.

- Increased Costs: Processing returns involves costs like shipping, handling, and restocking, which can eat into your profit margins. These costs can vary significantly depending on the product, shipping distance, and your return policy.

- Potential for Fraud: E-commerce businesses are susceptible to fraudulent return attempts, further impacting profitability. This can include wardrobing (buying an item with the intent to return it after use) or returning counterfeit goods.

Accounting for Returns and Refunds

Accurate accounting for returns and refunds is essential for maintaining clear financial records and making informed business decisions. Here are some key considerations:

- Sales Returns and Allowances: Create a separate account in your accounting system to track sales returns and allowances. This allows you to monitor the volume and financial impact of returns. This account is a contra-revenue account, meaning it reduces your overall revenue.

- Inventory Adjustments: When a product is returned, ensure your inventory records are updated accordingly. This helps prevent stockouts and ensures accurate reporting. This might involve using inventory management software to automatically adjust stock levels upon return processing.

- Refund Processing: Establish a clear process for issuing refunds, whether through the original payment method or store credit. Maintain detailed records of all refunds issued. This includes the date, amount, reason for return, and payment method used.

- Cost of Goods Sold (COGS): Adjust your COGS to reflect returned merchandise. This ensures your profit calculations are accurate. For instance, if a returned item cost you $20 to acquire, you would decrease your COGS by $20.

Illustrative Example: Journal Entries for a Return

Let’s say a customer returns a $100 item that cost you $60 to acquire. Here’s how the journal entries would look:

| Account | Debit | Credit |

|---|---|---|

| Sales Returns and Allowances | $100 | |

| Accounts Receivable | $100 | |

| Inventory | $60 | |

| Cost of Goods Sold | $60 |

Best Practices for Managing Returns and Refunds

Efficiently managing returns and refunds can not only mitigate their financial impact but also improve customer satisfaction. Here are some best practices to consider:

- Clear Return Policy: Establish a clear and concise return policy that is easily accessible to customers. This helps manage expectations and reduces confusion. Clearly state the return window, conditions for return, and any associated fees.

- Streamlined Process: Implement a straightforward return process that is easy for customers to follow. This can include pre-printed return labels and online return portals. Consider offering multiple return shipping options to cater to different customer preferences.

- Timely Refunds: Process refunds promptly to enhance customer satisfaction and build trust. Aim to process refunds within a few business days of receiving the returned item.

- Customer Communication: Keep customers informed throughout the return process with regular updates and notifications. This can include email or SMS notifications about the return status and refund processing.

- Data Analysis: Track your return rates and reasons for returns to identify trends and areas for improvement. This data can inform decisions related to product quality, customer service, and return policies. For example, if a particular product has a high return rate, you might investigate its quality or description.

Technology Solutions

Several technology solutions can help streamline the returns and refunds process and improve accuracy:

- E-commerce Platforms: Most e-commerce platforms, such as Shopify and WooCommerce, offer built-in tools for managing returns and refunds. These tools often include features for generating return labels, tracking return shipments, and processing refunds.

- Inventory Management Software: Inventory management software, like Zoho Inventory and Fishbowl, can automate inventory adjustments when returns are processed. This helps maintain accurate inventory records and prevents stock discrepancies.

- Accounting Software: Integrate your accounting software, such as QuickBooks Online or Xero, with your e-commerce platform to automate the accounting entries related to returns and refunds. This integration can save time and reduce errors by automatically recording transactions in your accounting system.

Expanding Your Horizons: International Returns and Cross-Border Tax Implications

As your e-commerce business grows, you might venture into international markets. This introduces additional complexities in managing returns and refunds, particularly regarding cross-border tax implications.

- Tax Regulations: Different countries have varying tax regulations regarding returns and refunds. It’s crucial to understand these regulations to ensure compliance and avoid penalties. For example, you might need to adjust VAT or GST calculations for international returns.

- Logistics: International returns can be more challenging logistically, involving longer shipping times and potentially higher costs. Consider partnering with international shipping providers and clearly communicating shipping expectations to international customers.

- Currency Fluctuations: Currency exchange rate fluctuations can impact the refund amount for international returns. Establish a clear policy for handling currency fluctuations to ensure fair and transparent refund processing.

FAQ Section

How do I account for damaged goods that are returned?

If a returned item is damaged, you may need to account for it differently. You might issue a partial refund, offer store credit, or write off the item as a loss, depending on the extent of the damage, your return policy, and the reason for the damage.

What are the tax implications of returns and refunds?

Sales tax generally needs to be adjusted when a refund is issued. The specific rules vary by state and locality, so it’s important to understand the regulations in your jurisdiction. For example, some states require you to refund the sales tax collected, while others allow you to retain a portion of the tax.

How can I prevent fraudulent returns?

Implement measures to deter fraudulent returns, such as:

- Requiring proof of purchase: Requesting an order number or receipt can help verify the legitimacy of the return.

- Setting return time limits: Establish a reasonable time frame for returns to discourage wardrobing and ensure that returned items are still in resalable condition.

- Carefully inspecting returned items: Thoroughly inspect returned items for signs of wear and tear, damage, or missing parts.

- Implementing a restocking fee: Charging a restocking fee for certain returns can deter fraudulent attempts and help offset the cost of processing returns.

What are some common pitfalls in returns accounting?

Common pitfalls include:

- Not updating inventory records: Failing to update inventory records can lead to inaccurate stock levels and potential stockouts.

- Incorrectly accounting for COGS: Inaccurate COGS adjustments can distort your profit calculations and lead to misinformed business decisions.

- Not reconciling returns with sales data: Regularly reconcile your returns data with your sales data to ensure accuracy and identify any discrepancies.

How can accounting software integration help with returns management?

Accounting software integration can automate various tasks, such as:

- Generating invoices and credit memos: Automatically generate invoices for original sales and credit memos for returns, ensuring accurate record-keeping.

- Recording journal entries: Automatically record the necessary journal entries for returns and refunds, reducing manual data entry and minimizing errors.

- Reconciling bank transactions: Reconcile your bank transactions with your returns data to track refunds and identify any inconsistencies.

Connecting with XOA TAX

Managing returns and refunds in e-commerce accounting can be complex. If you have further questions or need assistance navigating these challenges, don’t hesitate to contact the experts at XOA TAX. We can help you develop effective strategies for managing returns and refunds, ensuring accurate accounting, and optimizing your e-commerce business for financial success.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime