Imagine this: You’re facing an unexpected expense—maybe a medical emergency, a much-needed home repair, or a sudden job loss. You’ve worked hard and saved diligently, and your IRA seems like a lifeline. But before you tap into those retirement funds, it’s essential to understand the tax implications of an early IRA withdrawal. Taking money out before age 59 ½ can trigger some hefty penalties, but don’t worry, we’ll break it all down for you.

Traditional vs. Roth IRA: A Quick Refresher

Let’s start with the basics. There are two main types of IRAs: Traditional and Roth.

- Traditional IRA: Contributions are often tax-deductible, meaning they reduce your taxable income in the year you make them. The money then grows tax-deferred, and you pay taxes on your withdrawals in retirement.

- Roth IRA: You contribute after-tax dollars, meaning you don’t get an upfront deduction. However, qualified withdrawals in retirement are completely tax-free!

For 2024, the annual contribution limit for both is $7,000 if you’re under 50, and $8,000 if you’re 50 or older (this includes a $1,000 “catch-up” contribution). These limits can be affected by your income level, so check the latest IRS guidelines (Publication 590-A).

The 10% Early Withdrawal Penalty: What You Need to Know

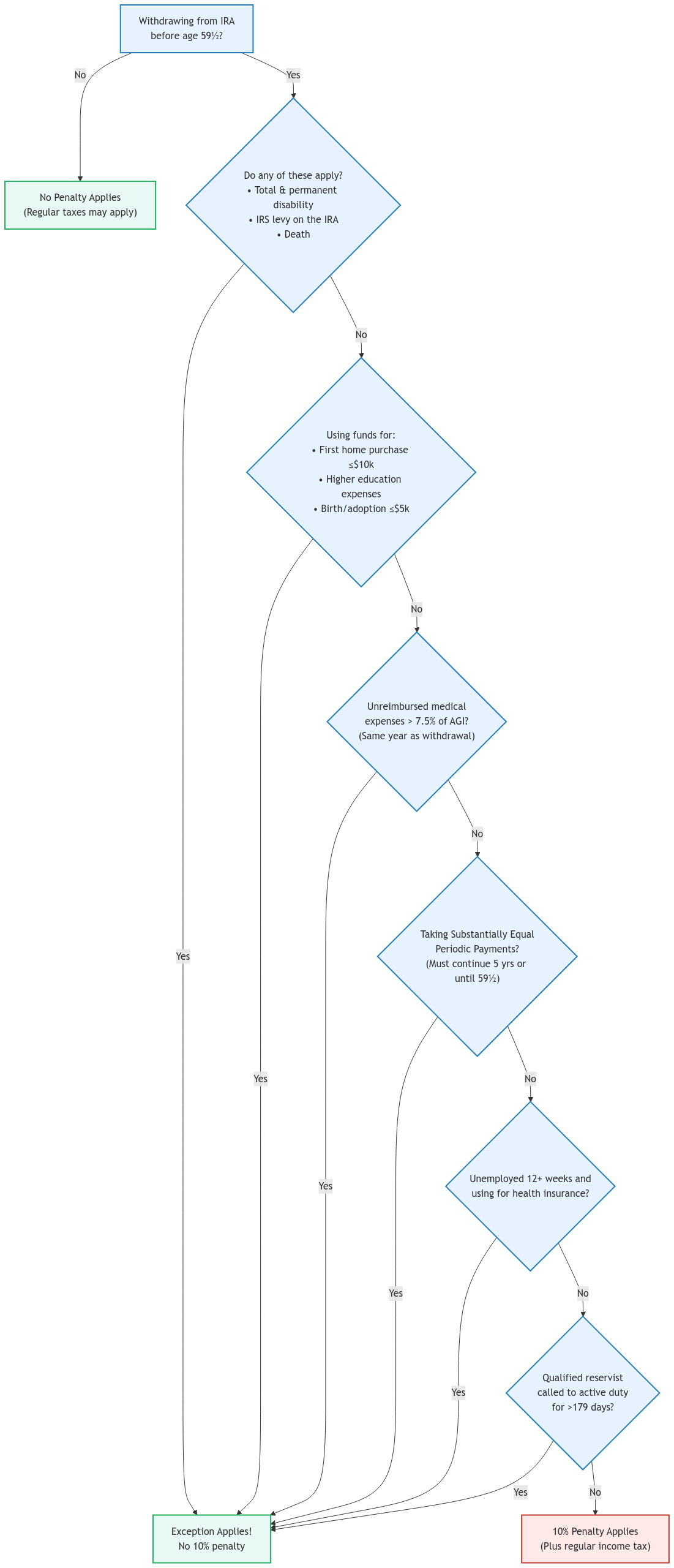

If you withdraw money from your IRA before reaching age 59 ½, you’ll generally face a 10% early withdrawal penalty on top of your regular income tax.

Example: Let’s say you’re in the 22% tax bracket and withdraw $10,000 from a Traditional IRA. You’ll owe $1,000 (10% of $10,000) as a penalty, plus $2,200 in income tax (22% of $10,000). That’s a total of $3,200 going to the IRS!

[Image Suggestion: A simple infographic illustrating the calculation of the 10% early withdrawal penalty on IRA distributions, with varying withdrawal amounts and corresponding penalty amounts.

Alt Text: “Infographic showing the calculation of the 10% early withdrawal penalty on IRA distributions.”]

Exceptions to the Rule: When Can You Avoid the Penalty?

There are some exceptions to the 10% penalty. Here are a few situations where you might be able to access your IRA funds early without penalty:

- First-Time Home Purchase: You can withdraw up to $10,000 to help buy your first home. This applies to qualified expenses like your down payment, closing costs, and certain building costs. To qualify as a first-time homebuyer, you generally cannot have owned a home in the previous two years.

- Higher Education Expenses: Need to pay for college tuition, fees, or books for yourself, your spouse, or your dependents? You can use your IRA funds penalty-free. Qualified expenses can also include room and board if the student is enrolled at least half-time.

- Unreimbursed Medical Expenses: If your medical expenses exceed 7.5% of your adjusted gross income (AGI), you can withdraw IRA funds to cover the excess without penalty. This applies only to medical expenses you paid in the same year you take the distribution.

- Disability: If you become totally and permanently disabled, you can take penalty-free withdrawals.

- Substantially Equal Periodic Payments (SEPPs): This option allows you to take regular distributions based on your life expectancy, avoiding the penalty even if you’re under 59 ½. However, these payments must continue for at least five years or until you reach age 59 ½, whichever is later.

- Health Insurance Premiums: If you’ve been unemployed for at least 12 consecutive weeks, you can use IRA funds to pay for health insurance premiums.

- Birth or Adoption: Thanks to the SECURE Act, you can withdraw up to $5,000 per child to cover expenses related to the birth or adoption of a child.

- IRS Levy: If the IRS levies your IRA, the distribution is not subject to the early withdrawal penalty.

- Qualified Reservist Distributions: Reservists called to active duty for more than 179 days can also take penalty-free withdrawals.

Important Note: The rules and regulations surrounding these exceptions can be complex. Always refer to the latest IRS guidelines (Publication 590-B) or consult with a tax professional to confirm your eligibility.

Minimizing the Tax Bite: Strategies for Early IRA Withdrawals

While the exceptions are helpful, it’s always best to avoid early withdrawals if possible. But if you absolutely need the funds, consider these strategies:

- Roth IRA Conversions: Converting your Traditional IRA to a Roth IRA can be a smart move, especially if you anticipate being in a higher tax bracket in retirement. You’ll pay taxes on the conversion amount now, but future qualified withdrawals will be tax-free.

- Withdraw Roth Contributions First: If you have a Roth IRA, remember that you can always withdraw your contributions tax-free and penalty-free, since they were made with after-tax dollars. However, any earnings you withdraw before age 59 ½ may be subject to taxes and penalties.

- Explore Other Options: Before tapping into your IRA, consider alternatives like borrowing from your 401(k) or taking out a personal loan. These options might have more favorable terms and help you preserve your retirement savings.

State Tax Considerations

In addition to federal taxes, you may also owe state taxes on your IRA withdrawals. State tax rules vary widely, so check the specific regulations in your state. Some states may follow the federal rules for early withdrawal penalties and exceptions, while others may have their own set of rules.

Example: In California, early withdrawals from an IRA are generally subject to the same 10% penalty as federal law. However, California does not conform to all of the federal exceptions. For instance, while the federal government allows penalty-free withdrawals for qualified higher education expenses, California does not.

The 60-Day Rollover Rule

You can avoid the early withdrawal penalty (but not the taxes) if you roll over the distribution back into an IRA or qualified retirement plan within 60 days. This rule can be helpful if you need temporary access to your retirement funds. However, you can only do this once per year.

SECURE 2.0 Act of 2022

The SECURE 2.0 Act of 2022 made significant changes to retirement plan rules, including some that affect IRAs. For example, it:

- Increased the age for required minimum distributions (RMDs) from 72 to 73.

- Expanded the penalty-free early withdrawal options for certain situations, such as terminal illness and victims of domestic abuse.

- Allowed for higher catch-up contributions for individuals nearing retirement age.

It’s essential to stay informed about these changes, as they may impact your retirement planning.

Frequently Asked Questions

What happens if I withdraw from my IRA after age 59 ½ but before the required minimum distribution (RMD) age?

You won’t face the 10% penalty, but you’ll still owe income tax on the withdrawal if it’s from a Traditional IRA. RMDs, which are mandatory withdrawals from your IRA, generally begin at age 73.

Are there any income limitations for the exceptions to the early withdrawal penalty?

Some exceptions, like the one for higher education expenses, may have income limitations. It’s best to check with the IRS or a tax advisor for the most up-to-date information.

Can I withdraw money from my IRA to help a family member?

Unfortunately, helping a family member is not one of the exceptions to the early withdrawal penalty. However, there might be other ways to assist them, such as gifting them money or exploring loan options.

Connecting with XOA TAX

Navigating the complexities of early IRA withdrawals can be challenging. At XOA TAX, our experienced CPAs can help you understand the rules, explore your options, and make informed decisions that align with your financial goals. Whether you’re considering an early IRA withdrawal or have other tax-related questions, feel free to reach out to us.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime