Running an e-commerce business can feel like juggling flaming torches while riding a unicycle. There are so many moving parts, and one of the most critical is inventory management. Get it right, and you’ll be well on your way to happy customers and a healthy bottom line. Get it wrong, and you could be facing a pile of unsold products, frustrated customers, and a dwindling bank account.

At XOA TAX, we understand the challenges e-commerce businesses face in managing their inventory effectively and staying tax compliant. This guide will walk you through the essentials, from tracking methods and accounting to leveraging technology and forecasting demand.

Key Takeaways

- Accurate Tracking is Key: Knowing exactly what you have, where it is, and how much it costs is the foundation of good inventory management.

- Choose the Right Accounting Method: FIFO, LIFO, or Weighted Average – the method you choose impacts your COGS and, ultimately, your taxes.

- Mastering COGS: Understanding your Cost of Goods Sold is crucial for pricing, profitability, and accurate tax reporting.

- Returns are Part of the Equation: A smooth returns process is essential for both customer satisfaction and efficient inventory management.

- Technology is Your Friend: Inventory management software can automate tasks, provide valuable insights, and keep you tax compliant.

- Plan for the Future: Forecasting demand helps you avoid stockouts and overstocking, keeping your cash flow healthy and your customers happy.

Mastering the Basics of E-commerce Inventory

Think of your inventory as a constantly moving puzzle. Every sale, return, and new shipment changes the picture. To keep track of it all, you need a solid system in place.

SKU Management and Real-time Tracking

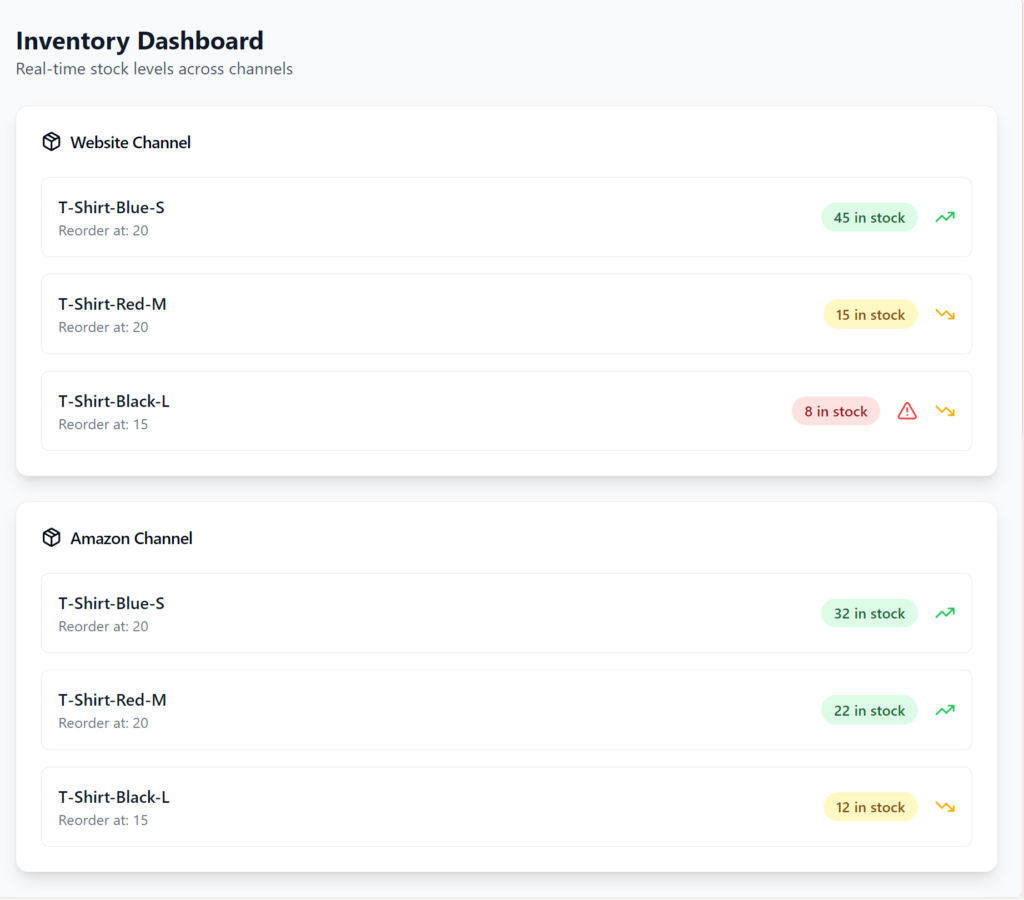

Imagine trying to find a specific book in a library without a cataloging system. Chaos, right? That’s what it’s like managing inventory without SKUs (Stock Keeping Units). Assign unique SKUs to each product variation to track your stock with precision.

Example: If you sell t-shirts, you might have separate SKUs for different colors, sizes, and styles (e.g., “T-Shirt-Blue-Small-Vneck”).

Pair your SKUs with a robust inventory management system that updates stock levels across all your sales channels in real-time. This prevents overselling and keeps your customers happy.

The Importance of Regular Stocktakes

Even with the best technology, periodic physical stocktakes are essential. Think of it as a reality check for your inventory data. It helps identify discrepancies, uncover potential issues like theft or damage, and ensure your records are accurate for tax purposes.

Inventory Accounting Methods and Tax Implications

Now, let’s talk taxes. The way you value your inventory directly impacts your Cost of Goods Sold (COGS) and, consequently, your taxable income. For more detailed information on accounting periods and methods, you can refer to IRS Publication 538.

FIFO vs. LIFO: Choosing the Right Method for Your Business

- FIFO (First-In, First-Out): Assumes the oldest inventory is sold first. This generally provides a more accurate reflection of current profitability and is the preferred method for most businesses.

- LIFO (Last-In, First-Out): Assumes the newest inventory is sold first. While this can offer tax advantages in times of rising prices, it’s important to note that LIFO is prohibited under International Financial Reporting Standards (IFRS).

Choosing the right method depends on various factors, including your industry, business goals, and whether you adhere to Generally Accepted Accounting Principles (GAAP) or IFRS.

Important Note: If you choose LIFO, you must consistently use it for all your inventory and follow the LIFO conformity rule, which requires you to use LIFO for tax reporting if you use it for financial reporting.

Weighted-Average Method: A Viable Alternative

The weighted-average method calculates the average cost of all your inventory items. This method is often simpler than FIFO or LIFO and can be a good option for businesses with products that are indistinguishable from each other.

Understanding and Calculating COGS

COGS represents the direct costs associated with producing or acquiring the goods you sell. It’s a crucial figure for determining your gross profit and taxable income.

Here’s the basic formula:

COGS = Beginning Inventory + Purchases – Ending Inventory

Example: Let’s say you started the year with $10,000 worth of inventory, purchased $5,000 more throughout the year, and ended the year with $8,000 worth of inventory. Your COGS would be $7,000 ($10,000 + $5,000 – $8,000).

Accurate COGS calculation is essential for:

- Setting profitable prices

- Analyzing your profitability

- Accurate tax reporting

Managing E-commerce Returns Efficiently

Returns are a fact of life in e-commerce. But don’t despair! A well-managed returns process can actually improve your inventory management and customer satisfaction.

Establishing a Clear Returns Policy

Start by creating a clear and concise returns policy that’s easy for your customers to understand. Make sure it’s prominently displayed on your website and includes information on:

- Eligible items

- Timeframes for returns

- Return shipping costs

- Refund methods

A well-defined returns policy not only manages customer expectations but also helps you stay compliant with consumer protection laws.

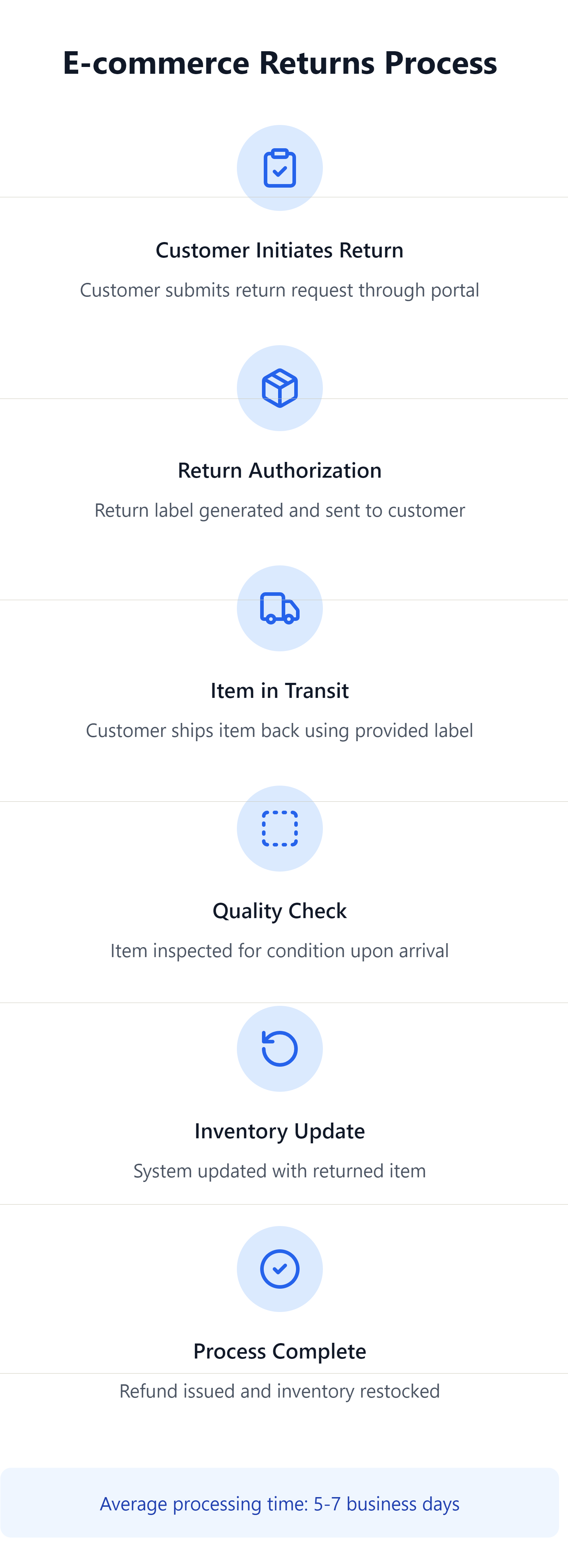

Streamlining the Returns Process for Inventory Optimization

When a customer returns an item, it’s crucial to inspect it promptly and update your inventory records accordingly. This ensures you have an accurate picture of your available stock and can avoid overselling.

Consider using technology to streamline your returns process. Automated systems can generate return labels, track shipments, and update inventory levels, saving you time and reducing errors.

Leveraging Technology for Inventory and Tax Management

In today’s digital world, technology is your greatest ally in managing inventory and staying tax compliant.

Inventory Management Software Solutions for E-commerce

Inventory management software can automate many of the tasks we’ve discussed, such as:

- Tracking stock levels

- Generating purchase orders

- Managing SKUs

- Forecasting demand

- Processing returns

Here are a few popular options:

- Shopify

- Skubana

- Zoho Inventory

- QuickBooks Commerce (TradeGecko)

When choosing software, consider your business size, sales volume, budget, and specific needs. Many solutions offer integrations with accounting software like QuickBooks Online, which can streamline your tax reporting.

Utilizing Technology for Tax Compliance

Technology can also help you stay on top of your sales tax obligations. E-commerce businesses often have to deal with sales tax nexus in multiple states, which can be a complex area.

Software solutions can automate sales tax calculations, generate reports, and even file returns in different jurisdictions. This can save you time, reduce errors, and minimize your risk of audits.

Forecasting Demand and Tax Planning

Predicting future demand is like having a crystal ball for your business. It allows you to proactively manage your inventory, optimize cash flow, and plan for your tax liabilities.

Strategies for Accurate Demand Forecasting

Analyzing historical data is a good starting point. Look at past sales trends, seasonality, and any external factors that might have influenced demand.

Example: If you sell swimwear, you can expect a surge in demand during the summer months.

You can also use tools and techniques like:

- Sales forecasting software

- Market research

- Customer surveys

Tax Planning Considerations for Inventory Management

Inventory management decisions can have significant tax implications. For instance:

Year-end inventory valuation: The value of your ending inventory directly affects your COGS and taxable income for the year.

- Tax credits and deductions

By carefully considering the tax implications of your inventory management decisions, you can minimize your tax liability and improve your overall profitability.

Industry-Specific Considerations

While the principles of inventory management are universal, there are nuances depending on your industry. For example:

- Perishable goods

- Durable goods

- Regulated industries

Understanding the specific needs of your industry can help you tailor your inventory management strategy for maximum efficiency and compliance.

Depreciation Considerations for Inventory-Related Assets

Don’t forget about depreciation! If you own assets used in the production of your inventory (like manufacturing equipment or warehouse facilities), you can depreciate these assets over time. This depreciation expense reduces your taxable income.

It’s important to choose the appropriate depreciation method and track your asset values accurately to ensure compliance with tax laws. Refer to IRS Publication 946, for detailed guidance on depreciation.

State-Specific Inventory Tax Considerations

It’s important to be aware that states may have different rules regarding inventory taxation. Some states may impose property taxes on business inventory, while others might have specific sales tax rules for inventory depending on whether it’s stored, used, or sold within the state.

For example, some states offer sales tax exemptions for inventory used in manufacturing or for resale. Be sure to research the specific inventory tax laws in your state or consult with a tax professional to ensure compliance.

Frequently Asked Questions (FAQ)

What is the best inventory valuation method for my e-commerce business?

There’s no one-size-fits-all answer. The best method depends on factors like your industry, business goals, and accounting standards (GAAP or IFRS). We recommend consulting with a tax professional like those at XOA TAX to determine the most appropriate method for your specific circumstances.

How often should I conduct physical stocktakes?

The frequency of stocktakes depends on the nature of your business and the size of your inventory. While some businesses may conduct stocktakes monthly or quarterly, others may only need to do them annually. It’s also a good idea to perform a stocktake after any significant event, such as a major sale or a suspected inventory discrepancy.

What are some common mistakes businesses make with inventory management?

Some common mistakes include:

- Poor record-keeping

- Lack of forecasting

- Manual processes

- Ignoring returns

- Overlooking tax implications

How XOA TAX Can Help

At XOA TAX, we offer a range of services to help e-commerce businesses like yours navigate the complexities of inventory management and tax compliance. Our services include:

- Guidance on inventory accounting methods

- Accurate COGS calculation

- Assistance with inventory management software

- Tax planning and compliance

Important Note: While we provide expert guidance on the accounting and tax aspects of inventory management, we recommend consulting with specialized inventory management or legal professionals for advice on areas such as supply chain optimization, warehouse management, or specific state regulations.

Connecting with XOA TAX

Ready to take control of your e-commerce inventory and optimize your tax strategy? Contact XOA TAX today for a consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime