Nobody enjoys getting a surprise tax bill, especially if it comes with penalties for underpayment. That’s where estimated taxes come in. While they might seem confusing at first, understanding this essential aspect of the US tax system can save you a lot of trouble (and money!) down the road.

At XOA TAX, we believe that knowledge is power when it comes to your finances. This guide will walk you through the ins and outs of estimated taxes, helping you navigate this often-misunderstood area with confidence.

What You’ll Learn:

- Determine if you need to pay estimated taxes

- Calculate your quarterly payments

- Understand payment deadlines and methods

- Avoid common pitfalls and penalties

Quick Reference

- Who needs to pay? Freelancers, investors, retirees, landlords, and anyone with significant income not subject to withholding.

- How much to pay? Generally, if you expect to owe $1,000 or more in taxes (See IRS Publication 505).

- When to pay? Quarterly – April 15th, June 15th, September 15th, and January 15th (subject to change if falling on a weekend or holiday).

- How to pay? Online, by mail, by phone, or through electronic funds withdrawal.

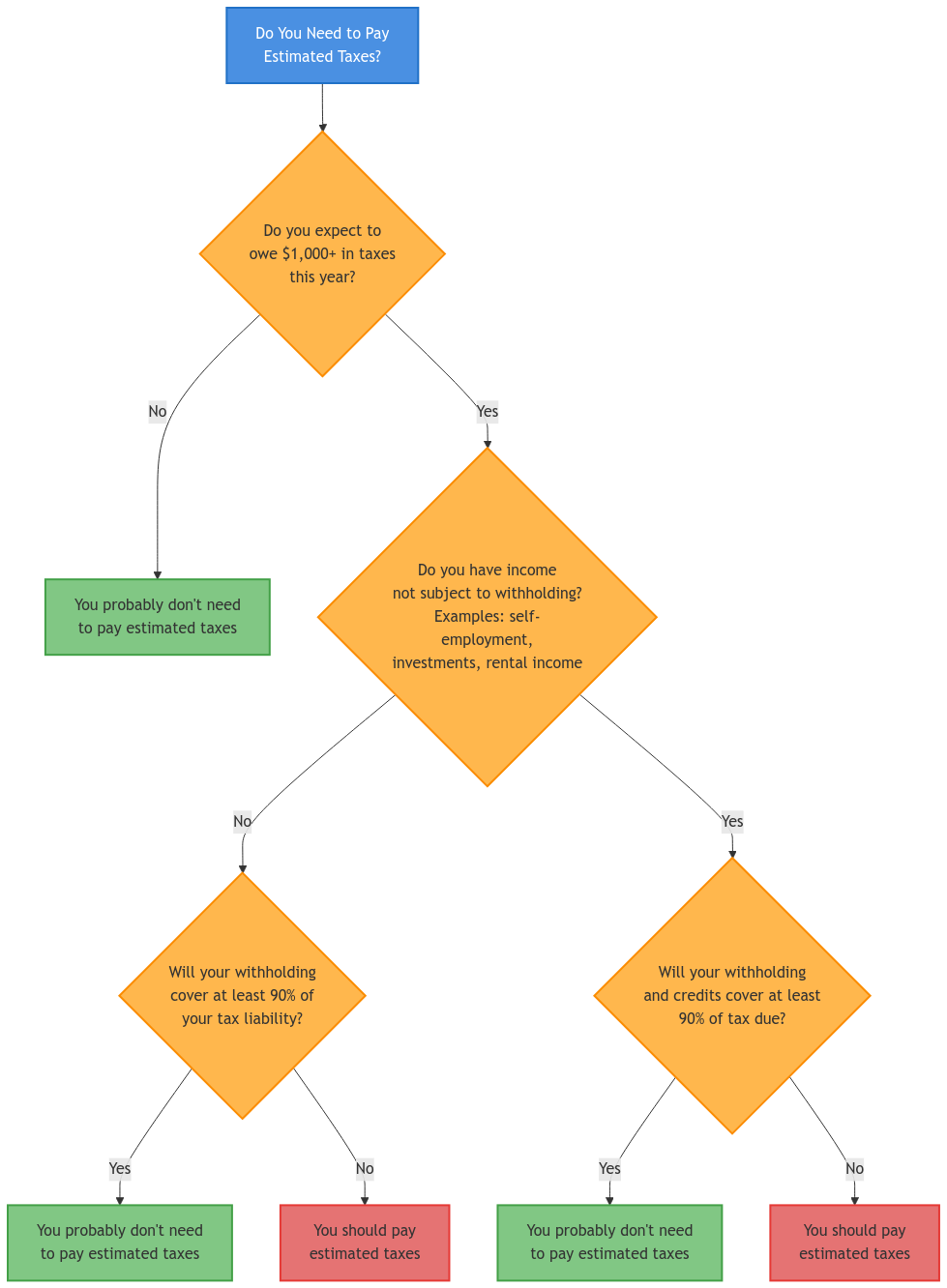

Need Help Deciding? Use Our Quick Decision Flowchart:

Who Needs to Pay Estimated Taxes?

Generally, you need to pay estimated taxes if you expect to owe at least $1,000 in federal taxes when you file your return (Form 1040), and you expect your withholding and refundable credits to be less than the smaller of:

- 90% of the tax shown on your current year’s tax return, or

- 100% of the tax shown on your prior year’s tax return (110% if your adjusted gross income was over $150,000 or $75,000 if married filing separately).

This typically applies to individuals who receive income that isn’t subject to traditional withholding. This can include:

- Self-employed individuals such as:

- Freelancers

- Independent contractors

- Small business owners

- Those working in the gig economy through platforms like Uber, DoorDash, or Etsy.

- Investors who earn significant income from:

- Stocks

- Bonds

- Cryptocurrency

- This includes income from interest, dividends, or capital gains.

- Retirees with substantial income from:

- Pensions

- Annuities

- Retirement accounts

- Landlords and real estate investors who receive rental income.

Calculating Your Estimated Taxes

Calculating estimated taxes involves estimating your income for the year and determining your tax liability. Here’s a step-by-step breakdown:

- Estimate your income: Consider all sources of income, including:

- Salary

- Wages

- Self-employment earnings

- Investment income

- Any other taxable income

- Example: A freelance graphic designer expects to earn $60,000 from their business and receive $10,000 in dividends from investments, for a total estimated income of $70,000.

- Calculate your tax liability:

- Use the current year’s tax brackets and deductions.

- Utilize Form 1040-ES, Estimated Tax for Individuals, and its accompanying worksheet.

- If self-employed, include self-employment tax (calculated on Schedule SE of Form 1040).

- Factor in withholding:

- Subtract any taxes withheld from your income sources from your total tax liability.

- Example: If $5,000 in federal taxes is withheld from dividends, subtract this from the total tax liability.

- Divide by four:

- Divide the remaining tax liability by four to determine your quarterly payment amount.

- Example: If the total tax liability after withholding is $12,000, the quarterly estimated tax payment would be $3,000.

Making Estimated Tax Payments

The IRS offers several convenient ways to pay your estimated taxes:

- IRS Direct Pay:

- Pay online directly from your bank account.

- Access through the IRS website or the IRS2Go mobile app.

- Electronic Funds Withdrawal:

- Pay through tax preparation software or when e-filing your return.

- Mail:

- Use the payment vouchers provided in Form 1040-ES.

- Mail your payment to the address listed in the form instructions.

- Phone:

- Pay by phone using a debit or credit card through a third-party provider.

Payment Deadlines

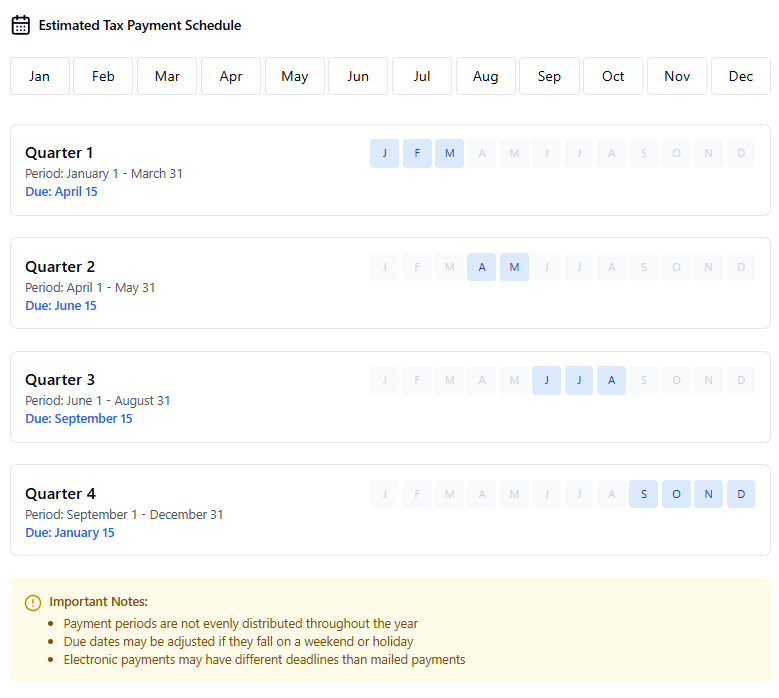

Estimated tax payments are due quarterly, with these general deadlines:

- April 15th: For income earned from January 1 to March 31

- June 15th: For income earned from April 1 to May 31

- September 15th: For income earned from June 1 to August 31

- January 15th of the following year: For income earned from September 1 to December 31

Important notes about payment deadlines:

- These dates may be adjusted if they fall on a weekend or holiday. Always refer to the official IRS website for the most accurate and up-to-date information.

- The payment periods are not evenly spaced throughout the year. For example, the second quarter payment covers only two months of income, while the fourth quarter payment covers four months.

State Estimated Taxes

- Many states also require estimated tax payments.

- Requirements and deadlines vary by state.

- Check with your state’s tax agency for specific guidelines.

Penalties for Underpayment

Failing to pay enough estimated tax can result in penalties. The penalty is calculated based on the amount of underpayment and the period it remained unpaid (See IRS instructions for Form 2210).

Safe Harbor Provisions: You may be able to avoid penalties if you meet certain conditions, such as:

- Your prior-year tax liability was $0.

- You had tax liability and U.S. citizenship/residency for the full prior year.

- Your withholding and estimated tax payments equal at least 90% of your current year’s tax liability OR 100% (or 110% if your AGI was over $150,000) of your prior year’s tax liability.

Common Pitfalls to Avoid:

- Inaccurate income estimation: Failing to accurately estimate your income can lead to underpayment. Consider all sources of income, including those that may fluctuate throughout the year.

- Missing deadlines: Late payments can result in penalties. Mark the deadlines on your calendar and set reminders.

- Ignoring state tax requirements: Many states have their own estimated tax requirements. Failing to comply with state regulations can lead to penalties.

Case Study: The Cost of Missing Deadlines

Jane, a freelance web developer, earned $80,000 in 2023 but missed two quarterly payments because she was busy with client work. Result: She owed $3,200 in penalties despite having the money to pay her taxes. Working with a CPA, she:

- Set up automatic payment reminders

- Created a separate tax savings account

- Implemented proper bookkeeping

Tips for Avoiding Estimated Tax Penalties

- Maintain thorough records: Keep records of all income and expenses throughout the year, including invoices, receipts, and bank statements. Consider using accounting software to organize your financial information.

- Regularly review your income: If your income changes significantly, adjust your estimated tax payments accordingly. Use Form 1040-ES to recalculate your payments.

- Utilize IRS resources: The IRS website offers helpful information, tools, and calculators.

- Seek professional advice: A qualified CPA can provide personalized guidance and ensure you meet all requirements.

FAQs

What happens if I overpay my estimated taxes?

You can choose to have the overpayment refunded to you or applied to your next year’s tax liability.

Can I adjust my estimated tax payments throughout the year?

Yes, if your income or deductions change, you can adjust your remaining payments to avoid underpayment or overpayment.

Are there any exceptions to the estimated tax rules?

Yes, there are some exceptions for farmers, fishermen, and certain higher-income taxpayers. You can find more information on these exceptions in IRS Publication 505.

Connecting with XOA TAX

Navigating estimated taxes can be complex, but you don’t have to do it alone. At XOA TAX, we have a team of experienced CPAs ready to assist you with all your tax needs. We can help you:

- Calculate your estimated tax liability accurately.

- Develop a payment plan that aligns with your income and financial goals.

- Ensure you meet all deadlines and avoid penalties.

- Provide ongoing support and guidance throughout the year.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime