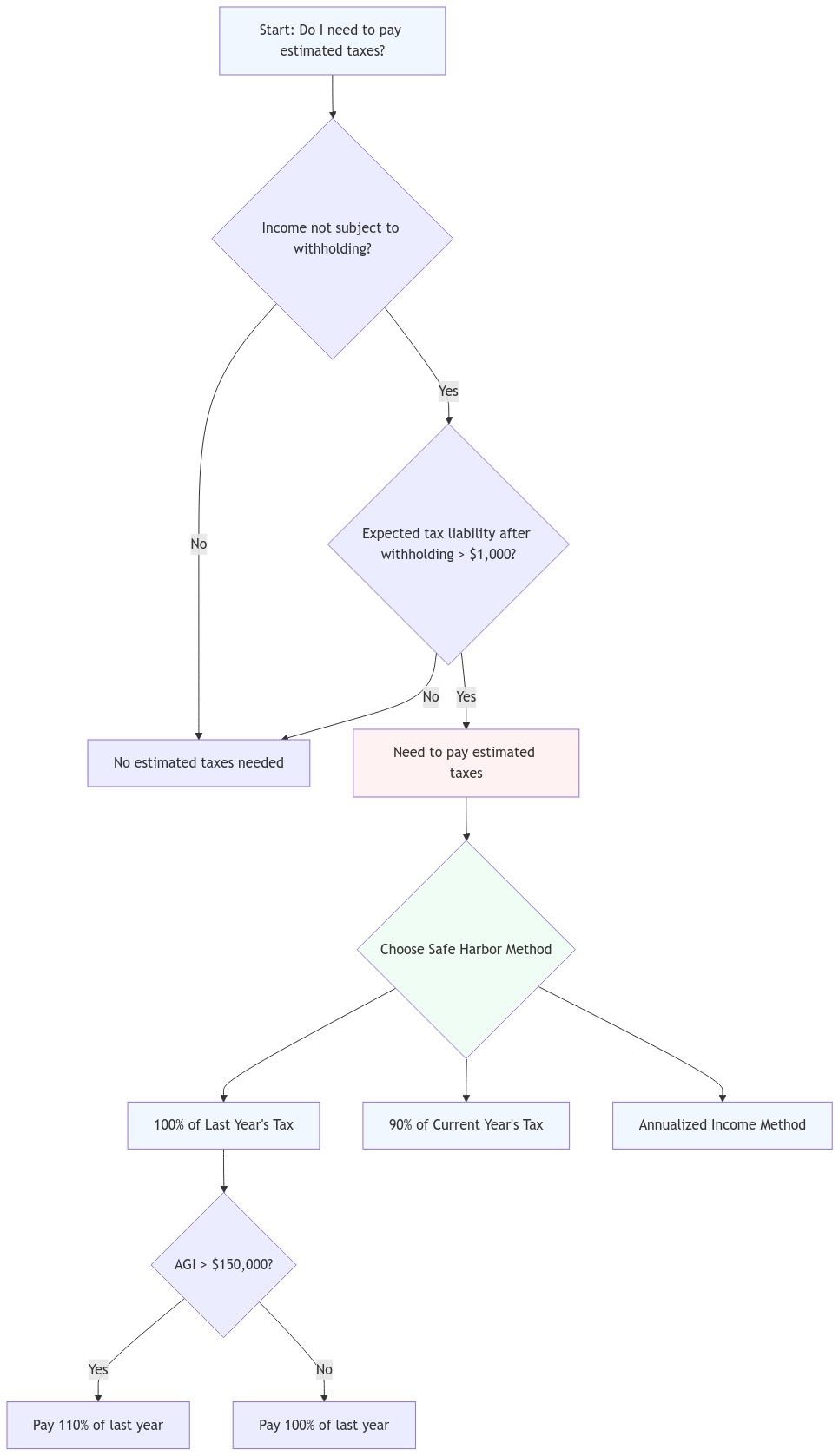

At XOA TAX, we know that dealing with estimated taxes can feel like walking a tightrope. Many people, especially those with income that doesn’t have taxes automatically withheld—like freelancers, investors, and small business owners—need to make these payments throughout the year. If you don’t, you could face penalties. But don’t worry, the safe harbor rule is here to help you avoid those! Let’s break down how it works, specifically for the 2024 tax year.

Key Takeaways

- Estimated taxes are payments made during the year to cover what you’ll owe that’s not already being taken out of your paychecks.

- The safe harbor rule helps you avoid penalties for underpayment of estimated taxes.

- There are a few ways to meet the safe harbor requirements for 2024.

- Having a good grasp of your income and potential tax liability is key for accurate estimated tax payments.

What is the Safe Harbor Rule?

Think of the safe harbor rule as your safety net when it comes to estimated taxes. It’s a set of IRS guidelines that protect you from penalties if you underpay your estimated taxes. Basically, if you meet certain conditions, the IRS won’t penalize you even if you end up owing taxes when you file your return.

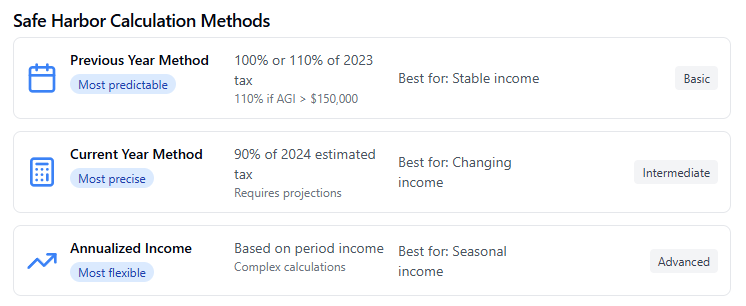

How to Meet the Safe Harbor Requirements in 2024

There are a few different ways to meet the safe harbor requirements. At XOA TAX, we help our clients determine the best approach for their individual needs. Here’s an overview:

- Pay 100% of Last Year’s Tax Liability: If your adjusted gross income (AGI) in 2023 was $150,000 or less ($75,000 for married filing separately), you need to pay at least 100% of your 2023 tax liability through withholding and estimated taxes. If your AGI was over this threshold, you’ll need to pay 110%. This is a common strategy for many taxpayers.

- Pay 90% of the Current Year’s Tax Liability: This involves estimating your 2024 tax liability and paying at least 90% of it throughout the year. This requires accurate income projections, which can be challenging for those with variable income.

- Meet the Annualized Income Installment Method: This method calculates your estimated tax payments based on your income throughout the year, making it ideal for those with fluctuating income. Think of individuals with seasonal businesses or commission-based earnings. We’ll explore this method in more detail later.

Who Needs to Pay Estimated Taxes?

You’ll likely need to pay estimated taxes if you receive income that doesn’t have taxes withheld, including:

- Self-employment income

- Interest and dividends

- Capital gains (including from digital assets)

- Rental income

- Alimony

- Prizes and awards

Consequences of Not Meeting the Safe Harbor

If you don’t meet the safe harbor requirements and underpay your estimated taxes, you may be subject to penalties. The penalty is calculated based on the underpayment amount and the IRS interest rate, which is adjusted quarterly. It’s important to note that these rates can vary, so it’s always best to check the latest IRS information. For example, the penalty rate for the first quarter of 2024 is 7%.

Tips for Avoiding Estimated Tax Penalties in 2024

- Keep Accurate Records: Meticulous records of your income and expenses are crucial for calculating estimated tax payments, especially with the evolving reporting requirements for digital assets like cryptocurrency. We’ve helped many clients at XOA TAX implement effective record-keeping systems.

- Use IRS Resources: The IRS provides helpful tools like Form 1040-ES and Publication 505 to help you calculate and pay your estimated taxes.

- Adjust Your Payments: Remember that changes in your income can affect your estimated tax calculations. For instance, if you increase your retirement contributions, you’ll reduce your taxable income and potentially lower your estimated tax payments. Speaking of retirement, don’t forget to maximize those contributions! For 2024, you can contribute up to $23,000 to your 401(k) ($30,500 if you’re 50 or older) and $7,000 to your IRA ($8,000 if you’re 50 or older).

- Pay Electronically: The IRS offers convenient electronic payment options:

- IRS Direct Pay: Schedule secure payments from your bank account (checking or savings) through the IRS website or the IRS2Go mobile app.

- EFTPS (Electronic Federal Tax Payment System): Make payments online or by phone, which is especially helpful for businesses and individuals making large payments.

- Credit/Debit Cards: Pay through a third-party provider (though keep in mind there might be processing fees).

- Consider State Estimated Taxes: While this post focuses on federal estimated taxes, don’t forget about your state requirements! Many states also impose estimated taxes, and their rules and deadlines may differ. Some states, like Alaska, Florida, Nevada, South Dakota, Texas, and Wyoming, don’t have any income tax.

Understanding the Annualized Income Installment Method

The annualized income installment method can be a lifesaver if your income fluctuates throughout the year. Instead of basing your estimated tax liability on your entire year’s income, it calculates it based on your income for each period. This is particularly useful for:

- Seasonal Businesses: Imagine a landscaping company that makes most of its money in the spring and summer. The annualized income method allows them to adjust their payments based on those higher-earning periods.

- Commission-Based Workers: Take a real estate agent, for example. Their income can change significantly depending on how many houses they sell each quarter. This method helps them align their tax payments with their earnings.

- Irregular Income: This applies to those with income from sources like royalties or investments that don’t follow a consistent pattern.

To calculate your estimated tax using this method, you’ll divide the year into four payment periods and determine your income, deductions, and credits for each period. You’ll then annualize your income for each period and calculate your estimated tax liability based on that annualized figure. This can be a bit complex, so feel free to reach out to us at XOA TAX if you need assistance with this method.

Form 2210: Underpayment of Estimated Tax

If you do happen to underpay your estimated taxes, you might need to file Form 2210. This form helps you figure out if you owe a penalty and if you qualify for any exceptions, such as in cases of casualty, disaster, or unusual circumstances.

Digital Assets and Estimated Taxes

The world of digital assets is constantly evolving, so it’s important to stay updated on the latest reporting requirements. If you’ve bought or sold cryptocurrency or other digital assets, you’ll likely receive Form 1099-B. This form reports your proceeds from these transactions, which can impact your tax liability and estimated tax payments. Always keep thorough records of all your digital asset transactions. You can find more information on digital asset reporting on the IRS website.

Example of Estimated Tax Calculation

Let’s imagine Sarah, a freelance graphic designer, expects to earn $80,000 in 2024. Based on her 2023 tax liability, she needs to pay $15,000 in estimated taxes throughout the year. To meet the safe harbor, she could make four equal payments of $3,750 by each quarterly deadline.

FAQs

When are estimated tax payments due for 2024?

For 2024, the deadlines are:

* Q1: April 15, 2024

* Q2: June 17, 2024 (June 15th falls on a weekend)

* Q3: September 16, 2024 (September 15th falls on a Sunday)

* Q4: January 15, 2025

Can I adjust my estimated tax payments throughout the year?

Yes, you can adjust your payments if your income or deductions change. Life throws curveballs, and your income situation may change unexpectedly. At XOA TAX, we help our clients adjust their estimated tax payments throughout the year to ensure they stay on track.

What happens if I overpay my estimated taxes?

You can apply the overpayment to your next year’s tax liability or request a refund.

Are there any exceptions to the safe harbor rule?

Yes, there are exceptions for those who retired or became disabled during the year, and taxpayers in federally declared disaster areas may have different deadlines.

Do I need to pay estimated taxes if I expect to owe less than $1,000?

No, if your tax liability after subtracting withholding and credits is less than $1,000, you generally don’t need to pay estimated taxes.

Are there special rules for farmers and fishermen?

Yes, special rules apply to farmers and fishermen who earn at least two-thirds of their gross income from farming or fishing. They may have different deadlines and requirements for estimated tax payments. You can find more information about these special rules in IRS Publication 225

How are penalties for underpayment calculated?

The penalty is calculated separately for each underpayment period, based on the amount of the underpayment and the IRS interest rate, which is adjusted quarterly. You can find the current penalty rates on the IRS website

Connecting with XOA TAX

We understand that estimated taxes and the safe harbor rule can be confusing. At XOA TAX, our experienced CPAs can guide you through these complexities and help you meet the necessary requirements to avoid penalties. We offer personalized advice tailored to your unique financial situation. Just like we helped Sarah optimize her estimated tax payments, we can do the same for you.

Contact us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime